Which crypto assets are closely linked to this?

Imagine a system where you can easily access multiple decentralised apps (dApps) across different networks with an email address or social media profile.

There’s something big happening behind the scenes in the blockchain and crypto asset space to revolutionise how we interact with our own and other accounts.

Enter account and chain abstraction.

These are sometimes used interchangeably, but strictly speaking:

Account abstraction involves programming a blockchain account to operate as a smart contract, i.e., computer code automatically executed once pre-determined conditions are met.

Chain abstraction allows you to interact with dApps found across different blockchains, all with the same user interface (UI). In other words, the average person can easily carry out several actions across multiple blockchains without realising they’ve done so.

As pointed out in a NEAR Protocol blog post, many dApps are, strictly speaking, frontends. This is when you consider the manual onboarding process involved with many of them, coupled with navigating different blockchains and their corresponding types of gas to cover transaction fees. Thus, chain abstraction will resolve these inconveniences.

I will focus on the former in this piece, but I will occasionally allude to chain abstraction.

The current system: Externally owned accounts (EOAs)

Since the advent of Bitcoin (BTC) in 2009, the typical way to interact with digital assets is via wallets controlled by a public and private key pair.

So far, this has been achieved by using non-custodial (e.g., desktop, mobile, and hardware) wallets and custodial options — the latter involving a centralised exchange or similar entity to manage your crypto — which have worked reasonably well for most BTC/crypto holders.

Despite ongoing improvements, the system is still not as convenient as it could be, i.e., compared to other ways of sending money.

While most of us in the space are fairly tech-savvy, and it’s easy to send and receive digital assets, there’s a large cohort of society that struggles with using crypto and might find the EOA process daunting, particularly those who would ultimately like to have full control of their funds and convenience.

A newer system: Account abstraction

This setup involves using smart contract accounts (SCAs) rather than relying solely on EOAs to interact with dApps.

It provides alternatives to relying exclusively on private keys and seed phrases, copying and pasting long wallet addresses (and double-checking the info), ensuring you’re using the right network, having enough ETH to cover gas fees, etc.

To clarify, users still need to keep keys safe. AA minimises the likelihood of losing one’s account when connecting with different dApps.

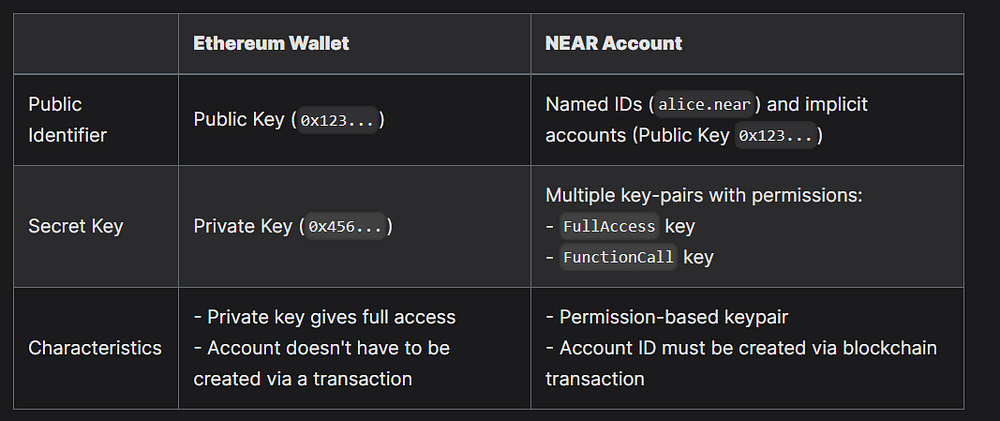

This table by QuickNode provides an excellent side-by-side comparison of EOAs and SCAs.

Account abstraction proposes a unified model that blends the flexibility of contract accounts with the direct control of EOAs, thereby enhancing the blockchain user experience.

Pavlo Horbonos, Blaize Tech

Why is AA significant?

As I mentioned earlier, the combination of security and convenience is paramount.

If we are serious about onboarding the next billion users, we must explore and deploy the best tools that improve UX while maintaining ample security and sufficient decentralisation.

Moreover, we need to incorporate more account recovery options to increase the likelihood of retrieving lost funds.

Seeing stories about people losing their devices with private keys to a wallet doesn’t instil much confidence in newcomers. Case in point: The Welsh man who lost £165 million (~$206 million) of Bitcoin when his ex-partner threw out a hard drive with 8,000 BTC in 2013.

Even though there’s better education and options to keep backup seed phrases safe, many people still lose keys, which are difficult to recover when a device fails and seed phrases are lost.

Eventually, quantum computing will most likely break the robust encryption used in cryptography and decipher the private keys linked to certain wallets that haven’t migrated to a quantum-resistant chain, as Bitcoin and open-blockchain expert Andreas Antonopoulos explains.

Back to account abstraction. Some will argue, “Why not just use a crypto exchange to avoid the rigmarole?”

Not everyone wants to rely on centralised custodians, which goes against the whole point of Bitcoin and crypto: having a practical way to control your digital assets and bypass intermediaries fully.

Even then, AA makes a huge difference compared to the status quo. Most exchanges still require users to use wallet addresses and check they’re using the right blockchain instead of a social-media login, email address, phone number, or similar identifier.

Which crypto projects are involved in AA and CA?

NEAR Protocol (NEAR)

.

This major crypto project is at the forefront of chain abstraction, which claims to be a “user-friendly and carbon-neutral blockchain, built to be fast, safe, and able to grow without limit.”

Both chain and account abstraction will help create a seamless user experience with this interoperability (with Ethereum and EVM-compatible chains) and greater flexibility overall for users.

> Comparison to Ethereum

Click here to learn how NEAR’s access (Full-Access and Function-Call) keys work and their benefits, particularly for an improved UX and simpler onboarding.

Ethereum (ETH)

If there’s one blockchain that will benefit the most from account abstraction (AA), it will be Ethereum.

Over the years, the developers behind the world’s largest smart contracts platform have explored various ways to enhance UX and safety.

AA for this network relates to the Ethereum Improvement Proposal (EIP) 2938, which was presented to the Ethereum community in September 2020.

Since then, Ethereum devs have provided an updated proposal in EIP-7562: Account Abstraction Validation Scope Rules. This is alongside a new token standard, ERC-4337: Account Abstraction Using Alt Mempool, a proposal that “completely avoids the need for consensus-layer protocol changes”.

Even though Ethereum (and its token) holders and traders have benefited from the successful release of EIP-4844: Shard Blob Transactions, a.k.a. Proto-Danksharding, leading to significantly cheaper fees on Ethereum’s base chain and L2s (especially the latter), there’s still a lack of interoperability and overall inconvenience when readily navigating between dApps on different chains.

by

at Shutterstock

Polkadot (DOT)

Founded by Gavin Wood, Polkadot promotes itself as “a scalable, interoperable and secure network protocol for the next web (Web 3)”.

To achieve this, the network’s main blockchain architecture has three core components: the relay chain (the network’s core chain), parachains (Polkadot-native chains), and bridges (ideal for interacting with different networks such as Bitcoin and Ethereum). I recommend exploring the lightpaper for a concise overview of the blockchain and organisation.

Its emphasis on improving interoperability between chains makes it useful in helping promote chain abstraction. Polkadot Wiki outlines what the network is doing to improve the UX for the average user regarding protocol-level and smart-contract-level AA.

Because Polkadot allows any type of data to be sent between any type of blockchain, it unlocks a wide range of real-world use cases.

at

Final thoughts

Bitcoin and crypto assets have evolved from being primarily used as a peer-to-peer system for transferring digital money. In 2024, we have a plethora of use cases that have exploded since smart contracts came onto the scene, courtesy of Ethereum. Some of these include:

— DeFi

— NFTs

— blockchain-based gaming (and play-to-earn)

— decentralised media

— ‘’ video streaming services

— ‘’ physical infrastructure networks (a.k.a. dePIN), and so on.

It’s a balancing act between adequate security, control of one’s wallet — as opposed to reliance on a centralised exchange — and ease of use.

Not everyone wants to learn how blockchains work, which network to use when sending or receiving funds, wallet addresses, etc. Some do, but only to a certain extent.

Let’s be honest. Many people involved in Bitcoin/crypto don’t care about distributed ledger technology and its benefits. They just want to make money from this volatile asset class and I don’t blame them.

AA will become the norm in the next 5–7 years, perhaps sooner. Once we’ve established a setup for crypto wallets similar to an email account recovery system, then we should see an accelerated interest.

Further reading and additional resources

CoinDesk article: The Rise of Chain Abstraction and the End of Blockchain Factionalism

This is a…cryptowithlorenzo.medium.com

You think Bitcoin’s price is too high? Read this.

“Bitcoin is too expensive now at $37,000.”

“I missed the boat on Bitcoin. It’s too late now.”

“The bubble has…cryptowithlorenzo.medium.com

Ways to support my work

Disclaimers

• N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

• The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

• Please do your own research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

• Information is correct at the time of writing.

Originally published at https://www.cryptowithlorenzo.com.