One of the most controversial aspects of Bitcoin is no fad.

The advent of ordinals and inscriptions, a.k.a. “Bitcoin NFTs”, has added utility to the chain previously mocked for lacking smart-contract functionality.

It’s a concept that has divided the Bitcoin community — hardcore maximalists dislike the idea and believe it deviates from Satoshi’s original vision in the Bitcoin whitepaper, which is for BTC to be used as a “peer-to-peer (P2P) electronic cash system” in Satoshi’s words.

Others with more open views towards Bitcoin see its positive side: extra use cases on its blockchain that could help it “compete” with Ethereum.

Before you beat me to it, Bitcoin doesn’t have to compete with Ethereum because it has different objectives and will most likely exist for different purposes, i.e., Bitcoin being used for P2P payments and as a digital store-of-value rather than for dApps on Ethereum.

What are ordinals and inscriptions?

Ordinals refers to the numbering system for satoshis (i.e., 1/100,000,000th of a BTC) to track them in real time. The name relates to ordinal numbers (1st, 2nd, 3rd, etc.).

The term is sometimes used interchangeably with inscriptions: satoshis inscribed with metadata, such as transaction data and other information about the digital entries linked to that satoshi, NFT, security tokens (BRC-20 tokens that utilise the Ordinals protocol on Bitcoin) and more.

These ordinals can also be categorised differently — numbers, decimals, percentages, and names. Additionally, each ordinal has a degree of rarity, much like physical and digital collectibles.

This is influenced by blocks (every 10 minutes), difficulty adjustments (every 2016 blocks), halvings (every 210,000 blocks, with the next halving scheduled in April @ Block 840,000) and cycles.

You have an interesting mix of unique satoshis with these variables at play.

The Ordinal Theory Handbook will give you a thorough explanation of this.

Before continuing, I have lumped rare satoshis into this category, even though (strictly speaking) they differ from Bitcoin NFTs. However, both relate to ordinals.

Expensive transaction fees on Bitcoin

Much like the NFT craze in 2021, which contributed to Ethereum’s sky-high transaction fees, ordinals on Bitcoin’s blockchain have clogged up its network. This resulted in a backlog of unsettled transactions on both networks and, as a result, significantly pushed up fees.

At present, we have over 231,000 unconfirmed transactions on Bitcoin. As its blockchain processes roughly five per second, many will be left hanging unless they fork out more money.

Whilst this is more profitable for miners, it has frustrated a cohort of Bitcoin devs opposed to ordinals and Bitcoin (BRC-20) tokens; more on this shortly.

Last August, ordinals developer @LeonidasNFT disputed claims about Ordinals “being dead” by claiming 84.9% of Bitcoin activity is attributed to these inscriptions.

.

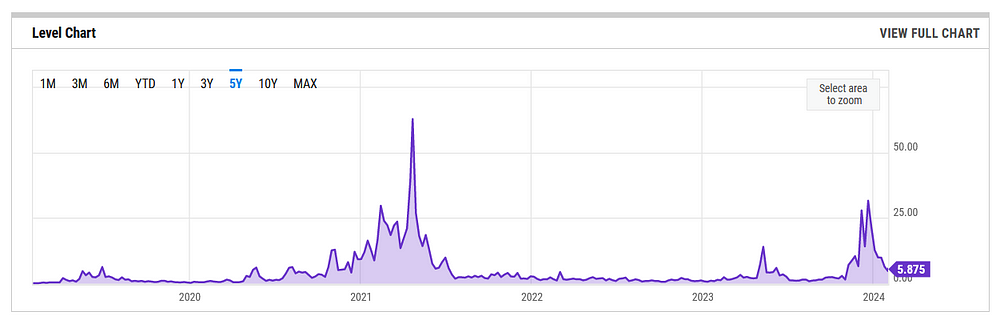

Except for price spikes in Tx fees in late 2020 and 2021, higher fees since 2023 have mostly been attributed to Ordinals.

“Ordinals, inscriptions, and BRC-20 tokens can take up more of this (block) space. Therefore, they’re competing against financial transactions. What that does is it bids up the transaction fees.”

Fred Thiel, Chairman & CEO of Marathon Digital Holdings, in conversation with Anthony Pompliano (The Pomp Podcast #1299, 5’17”).

While a few dollars per transaction doesn’t sound like much for more well-off individuals in the developed world, it excludes many people who cannot afford (or cannot justify) spending around six dollars per transaction, particularly for microtransactions.

I am worried this will get worse — at least during peak activity in the next bull cycle — with even higher average fees than the 2021 bull run unless Bitcoin layer-2 scaling solutions such as Stacks and The Liquid Network step up. Even then, these pose their challenges for Bitcoin’s network.

I recognise that you can sacrifice speed to get cheaper fees, but this doesn’t work for everyone, and it’s naïve to expect most people to wait several hours, or even days, to settle a transaction.

This issue must be resolved if we want to make Bitcoin more inclusive. I don’t know how much longer it will take for Lightning Network to be deployed at scale, but I am not holding my breath for anything in the next year or two.

Fortunately, many can circumvent this by going through an exchange, but the system should be set up so that you can avoid relying on centralised entities for transactions in Bitcoin.

This is not just a dig at Bitcoin; I have repeatedly remarked about Ethereum’s high fees. However, solutions currently exist to circumvent these fees when dealing with ERC-20 tokens, albeit with some extra (inconvenient) steps.

Striking similarities with coins

Whether you see Bitcoin primarily used for P2P payments, as a store of value or as an Ethereum competitor, I see parallels between ordinals and certain types of cash, specifically coins.

Even though we’re moving to a cashless society, banknotes and coins are still ubiquitous and will be used as legal tender for several years, possibly decades.

Thinking of Australian coins in particular (as I am based Down Under), I’ve noticed that there’s been a higher demand for certain coins — particularly $1 and $2 gold coins — with a special design on the reverse (tails) side since the passing of HM Queen Elizabeth II.

Each coin (used as legal tender) in circulation is worth its listed amount, i.e., every $1 coin is worth $1.

However, we know that not all coins are equal. There are $1 coins that are valued at well above $1. Any coin collector will know this.

You’ll see how this relates to satoshis in a second; stay with me.

Like digital art, there’s also the artistic element with creative designs minted onto coins, including coloured options for special-edition, circulated coins that can be used as legal tender.

Using these coins for payments would not be very smart, as there’s a near certainty that these can easily fetch a higher price (20, 30, 50 or even >100x the generally perceived value), even after just a few years.

I see this remaining the case for certain Ordinals. Certain satoshis could be worth a lot more, in some cases, based on when they were minted, especially for “milestone” blocks.

Considering how much money is flowing through this space, not to mention millions of dollars spent on various NFTs to date (mostly on Ethereum), someone will happily pay tens of thousands of dollars for a sat with a high perceived value.

Sotheby’s — a renowned international auction house — listed inscription artworks and rare satoshis for auction on their platform last month; see ‘Natively Digital: An Ordinals Curated Sale’ for further details.

Presenting our Natively Digital: An Ordinals Curated Sale: https://t.co/nd4QoRWLOH

A special curation of Bitcoin Ordinals featuring pioneering Artists and Rare Sats is now open for Bidding until 22 January 📢 pic.twitter.com/2XRi37TQ7c

— Sotheby's Metaverse (@Sothebysverse) January 12, 2024

Like coins with a unique design, some of these “milestone” sats could fetch a higher price than a regular one.

Arguments against ordinals and inscriptions

Those with strong opinions against Bitcoin inscriptions (Beautyon’s tweet is a notable example) argue that ordinal enthusiasts should create a new altcoin (for the record, this does exist, and it’s called ORDI) and not interfere with Bitcoin’s mining (let alone the network at large).

OCEAN — a Bitcoin mining company backed by Jack Dorsey and co-founded by prominent Bitcoin (Core) developer Luke Dashjr — initially refused to mine Bitcoin blocks that contained Ordinals in them by implementing the Ordisrespector, a “spam patch filter” that rejects transactions containing the inscriptions.

A few weeks later, the firm came to a compromise, allowing those who mine through their system to choose whether or not to filter spam in the transactions.

A decentralized #Bitcoin is a Bitcoin where miners decide what goes in blocks, not pools.

OCEAN's ultimate goal is to make this a reality, and today we take one step closer to our vision of decentralized block template construction.

Available immediately, OCEAN is offering… pic.twitter.com/IWcZcDFsqh

— OCEAN (@ocean_mining) December 21, 2023

on

Additional thoughts

For anyone feeling a bit adventurous and wanting to look into your sats’ metadata and whether you own any with unique properties that could be valued at a higher price than what they’re worth (based on market rates).

Many people will remain sceptical about the value of Ordinals and these specific sats, let alone Bitcoin. For this reason, I expect a lot of pushback against this idea to remain for years to come.

I think that if there’s a market for something — regardless of how bizarre it is — the value of certain goods can skyrocket, even temporarily.

Trading cards, digital and physical art, comic books…you name it, there are highly sought-after items out there that can fetch incredible amounts of money.

In terms of whether Ordinals will adversely impact Bitcoin’s blockchain overall, I remain neutral on this.

I can see where certain devs are coming from. Bitcoin has gone through a lot over the years. This network has had to overcome various challenges to gain enough trust worldwide and prove itself a robust alternative to other commodities and systems.

However, if there’s enough community support (among devs, miners and users), I don’t see this being an issue, provided these do not compromise Bitcoin’s security, which should remain the priority, especially with trillions* of dollars of vested interests here.

*This arbitrary figure includes the BTC market cap, the combined value of ASIC miners (and related mining equipment), and companies that have invested a vast sum of time and effort into understanding Bitcoin.

Ordinals, inscriptions and BRC-20 tokens are here to stay. Miners who dislike them will most likely be outnumbered by those with a neutral to positive view of them.

As I referred to in the OCEAN mining example, it took a diplomatic approach and allowed its clients to filter out blocks containing such metadata.

What do you think about ordinals, inscriptions, and BRC-20 tokens? Should Bitcoin devs ban this activity on the blockchain or is it time to embrace the idea on this network?

Further reading and additional resources

“Bitcoin is too expensive now at $37,000.”

“I missed the boat on Bitcoin. It’s too late now.”

“The bubble has…cryptowithlorenzo.medium.com

Disclaimers

• N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

• The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

• Please do your own research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

• For transparency, Bitcoin (BTC) accounts for roughly 25% of my crypto portfolio.