Could the “most trusted crypto exchange” become as big as the e-commerce/tech giant?

Various crypto news sources have recently drawn parallels between Coinbase and Amazon.

Devin Ryan, Citizens JMP Director of Financial Tech Research, also made this comparison in a Yahoo Finance interview last month.

As the crypto market continues to pick up and its overall market cap will likely hit a new all-time high in the next 6-9 months, more outlets will discuss Coinbase’s rise and its chances of eventually becoming a trillion-dollar crypto company.

Let’s explore what the crypto exchange is doing to reinforce its dominance in this highly competitive industry.

Crypto exchange and stablecoin wars

Binance’s massive global growth — regarding countries that serviced and supported crypto assets — caught Coinbase off-guard. Much of the latter’s focus was on BTC, ETH, LTC, a handful of ERC-20 tokens, and (eventually) XRP until about 2018. It has finally caught up but still lags behind competitors regarding supported crypto assets.

Binance, on the other hand, took a gung-ho approach, went heard early on and listed a vast swathe of trading pairs, which has led to it being the largest crypto exchange by 24-hour trading volume since about 2018.

However, the latter has been embroiled in a range of regulatory and legal issues over the past 12–18 months, including the delisting of its stablecoin, Binance USD (BUSD), a $4.3 billion fine for the exchange, and (former CEO) Changpeng Zhao pleading guilty to inadequate anti-money laundering (AML) checks.

Following its previous market dominance, BUSD, which peaked at ~$23B in market cap, has vanished into the ether.

This was much to the delight of Tether and Circle, the top two stablecoin issuers that manage USDT and USDC, respectively.

Where does Coinbase fit into this? Brian Armstrong and Jeremy Allaire, the Coinbase and Circle CEOs, announced that the crypto exchange will invest in the stablecoin issuer (by taking an equity share), further reinforcing its partnership.

“The nature of the investment means that Coinbase and Circle will now have even greater strategic and economic alignment on the future of the financial system. Coinbase is committed to the long term success of the stablecoin ecosystem and USDC, specifically.”

Coinbase Blog, 21 August 2023

Moreover, as noted in its latest (February 2024) shareholder letter, it is doubling down on promoting USDC and Base for payments as one of the three priorities this year.

For the record, I am not insinuating that they played a role in the demise of BUSD. Rather, I acknowledge the commercial and strategic benefit to the top two stablecoin issuers in further solidifying their dominance.

Despite the scandals mentioned above, Binance is still the most dominant exchange worldwide per 24-hour trading volume (and still by a long shot), according to data from CoinGecko and CoinMarketCap. The latter has been owned by Binance since 2020.

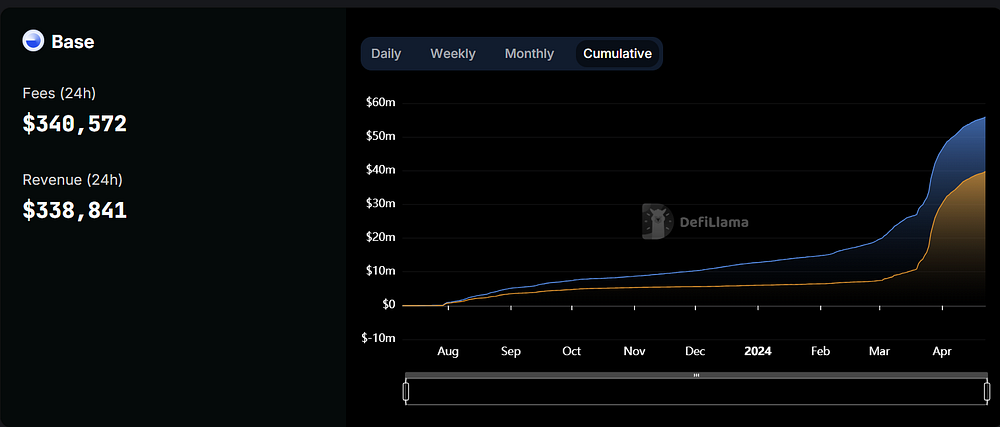

An in-house L2 rapidly rising through the ranks

Coinbase announced its foray into the layer-2 (L2) space last year with the launch of Base, providing an additional scaling solution to other established options on the market, such as Optimism, Arbitrum, Loopring and Linea, to name a few.

It holds a strategic advantage in readily incorporating USDC and Base into its exchange and incentivising its clients to use these products instead of USDT and other L2s. They can achieve this by offering ultra-low fees for transacting via Base and USDC, as well as promotional rates for lending the stablecoin via its platform, amongst other measures.

This is also a way for the exchange to boost its volume (and revenue) to help it reclaim the top spot following Binance’s aggressive worldwide expansion since 2017.

Whilst Base has been on the up — based on handling so many transactions per second (TPS) — other L2s will most likely maintain significant roles in helping Ethereum scale, both in the lead-up to and following the complete deployment of Danksharding.

As part of decentralisation, we shouldn’t be too reliant on just one or two L2s, particularly one influenced by a centralised entity. On the contrary, having way too many L2s starts to become redundant and overkill, much like the thousands of cryptos that try to copy Bitcoin, Ethereum and, to a lesser extent, Solana and Cardano.

Onboarding the next billion users

The company is often recommended as a useful exchange for beginners looking to get into Bitcoin and a handful of altcoins. For example, Investopedia and Business Insider listed Coinbase as being best for beginners (these were published last month, so they’re still relevant).

Having said this, Binance, Kraken, and the most popular exchanges nowadays have clean and user-friendly interfaces, with desktop and mobile app options and increasing deposit options for various fiat currencies.

The part of crypto with huge untapped potential is an exchange that seamlessly interacts with thousands of decentralised applications (dapps). This will be key to accommodating more than a billion new crypto users in the next 10–15 years.

In February, Coinbase published a blog post outlining its intention to simplify onboarding. Some of these include:

— Smart wallets that work alongside the Coinbase Wallet SDK that enable users to create a wallet within a dapp with a passkey (involving biometrics, a PIN, a pattern, or, the best option, a security key) without needing to download apps, install extensions or deal with seed phrases. These would be useful for EVM-compatible dapps across multiple chains.

—Embedded wallets that permit developers to create white-labelled wallets that eliminate the challenges involved in crypto, i.e., setting up private keys, keeping them secure, checking the exact wallet address per transaction, etc. These wallets will instead offer the chance to log in using an email or social media.

This ties in with account abstraction, some Vitalik Buterin wrote about two years ago. I recommend learning more about this as it becomes more of a talking point in the coming years, particularly with improved account recovery.

I acknowledge that there might be trade-offs between security and ease of use, particularly if using some social media logins. However, the benefits might still outweigh the risks, particularly for casual users with small balances and a relatively small digital footprint (e.g., some older people) who don’t want to play around with seed phrases and wallet addresses.

Tying it back into Coinbase, I look forward to seeing these features deployed shortly. I’m all for giving people choices and presenting individuals with easy-to-understand alternatives, provided they understand the risks involved.

Ultimately, it’s in our best interests to make this simple while remaining secure and accessible, i.e., without exorbitant fees. The more people interact with Bitcoin, Ethereum, and other networks, the more likely we’ll see price increases and greater activity for Bitcoin miners and Ethereum delegators, not to mention ETH burned to help make the latter deflationary.

Coinbase public listing

In April 2021, the US Securities and Exchange Commission (SEC) gave it the all-clear to go public, making it the first crypto exchange to be listed on a US stock exchange under the

COIN ticker symbol on the NASDAQ.

Ironically, the same regulator — spearheaded by Gary Gensler, who has developed a reputation for being rather hostile to crypto companies operating in The States — took it to court shortly after approving the IPO. In one of the recent cases, The SEC claims the exchange operated as an “unregistered broker, exchange, and clearing agency.”

Even though its price sharply declined shortly after launch, it has made a nice recovery since plummeting to about $35 per share in December 2022, coinciding with the bottom of the bear-market cycle. It now sits at $263 and will most likely eclipse its all-time high of $357.09 (November 2021) in the coming months.

An improved diversification strategy

Until a couple of years ago, Coinbase relied heavily on trading fees to sustain company revenue.

In Q1 2021, the company earned $56.4 million in subscriptions and services revenue and $1,540.6 billion in total transaction revenue.

While this wasn’t much of an issue during the euphoria in the lead-up to and throughout bull runs, it was a grim picture once the bear market came around, leading to job losses and issues with a high dependence on a sole source of revenue.

Fast forward to Q4 2023, these figures were $1,519.7 billion and $1,406.9 billion, respectively.

Due to its diversification strategy, Coinbase’s prospects have been more promising in recent years.

— The company was elected as the custodian for nine out of 12 spot Bitcoin ETFs, as shown below

— It allows the trading for listed derivatives via its subsidiary, Coinbase Financial Markets

— The company offers Coinbase One, a monthly subscription service that provides various perks to its users. This is currently limited to the US, the UK, and most of the EU.

Custody services are a vital part of #bitcoinETF applications.

So far, @coinbase has dominated. Nine out of the 12 prospective issuers have chosen the crypto exchange for their custodian business.

Can anyone else join the race? https://t.co/lEhNBaRjKa pic.twitter.com/lss6c7uX8f

— CoinDesk (@CoinDesk) December 3, 2023

Source: CoinDesk (@CoinDesk) on X (formerly Twitter)

Still, these multi-trillion-dollar fund managers are sending a strong message by entrusting Coinbase with the security of their clients’ Bitcoin and crypto funds.

Final thoughts

Part of me wants to play devil’s advocate and say it is a stretch to dub Coinbase the “Amazon of crypto,” particularly when there’s a vast amount of competition. The e-commerce (now overall tech) titan is leaps and bounds ahead of its rivals, at least when looking at US consumer data.

As alluded to earlier, Coinbase faces stiff competition, particularly globally. Binance still exists in the US via BAM Trading Services (operating as Binance.us), Kraken has retained its spot as a major alternative, and Gemini still maintains a solid presence there.

Across the rest of the world, many local exchanges offering trading for dozens or even over 100 crypto assets often provide lower fees, particularly for withdrawals.

Thinking of my home country, Australia, Coinbase took a while to introduce fee-free instant deposits and even AUD withdrawals. It still has higher fees than other options, albeit a convenient, beginner-friendly exchange. Having said this, most people are tech-savvy enough to easily navigate alternatives that are still user-friendly.

Thus, it will struggle to regain the market dominance it once had before Binance and the multiple options that emerged around 2017 and 2018. However, despite the competition, it still has room for growth.

Like other crypto companies operating in the USA, it is still seeking regulatory clarity from the SEC. Until this occurs, many retail (and even some institutional) investors will remain reluctant to dabble in altcoins.

I mention alts because we know that Bitcoin (BTC) is not a security; instead, it is classified as a commodity like gold and other precious metals. It has received a boost from major investors via spot ETFs getting the green light earlier this year.

Sooner or later, the regulator will need to provide this clarity, much of it revolving around which digital assets are classified as securities and which ones are commodities. This will be necessary, considering many other countries are getting (or have gotten) their act together.

Otherwise, the leading economy risks losing more talent and money, which it needs in tax revenue, if it were to chip away at its colossal public debt, which is a different topic of discussion.

To reiterate, I doubt it will become as superior as Amazon in its respective sectors. Continued improvements to other exchanges, coupled with the availability of non-custodial (hardware) wallets — which are becoming increasingly convenient and affordable across a wider range of models and brands — will provide tough competition for Coinbase.

Yet, it has a bright future ahead as many expect crypto assets and blockchain tech to flourish, albeit with hiccups along the way. If it were to ever reach Amazon’s market cap, currently at $1.81 trillion versus Coinbase’s $51 billion, the exchange would need to offer the lowest trading fees and commission (for staking), not to mention increase its range of supported crypto assets akin to Binance and even KuCoin.

P.S. I understand some Bitcoin and crypto investors are not pleased with the idea of a large centralised exchange managing vast amounts of digital assets and having lots of sway in this industry. I get it. However, Coinbase has a company to run and shareholders to satisfy, so many want it to succeed, even if it goes against decentralisation.

Further reading and additional resources

Ways to support my work

• Check out this post for various affiliate links and promotions you can use to top up (or kick start) your crypto portfolio. By using these, I earn a small commission at no extra cost.

• All of my articles (including previous ones) are now published on Medium for anyone to read, including non-members. I welcome any crypto donations to support my work. Please use the following addresses to do so.

BTC — bc1qny59y95g4narcf4a7d3k9g7h54kc8jakj9t87a

ETH — 0xF4D51542Ed8bb769F87692e220Ea31932f184887

ADA —

addr1q9dkkzs8sfevxve72ttmtgthsdcddut86ssttlhn25t9qczmdv9q0qnjcvenu5khkksh0qms6mck04pqkhl0x4gk2psq5c5gqz

XRP — rLDThKVeMCZQCZcT4uzBU6NTSPHxwmRifE

DOT — 15Gn8DZeZY3pmLczjwx7WGUc7TXXme8y2nrxuC6o4hBxn7jX

Disclaimers

• N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

• The opinions expressed in this piece are my own and might not reflect those behind any news outlet, person, organisation, or other items listed here.

• Please do your own research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

• I am a Coinbase client. I also hold less than 10 COIN shares.

• Information is correct at the time of writing.

Originally published at https://www.cryptowithlorenzo.com.