Founded by Gavin Wood, Polkadot is promoted as “a scalable, interoperable and secure network protocol for the next web (Web 3)”.

To achieve this, there are three core components of its main blockchain architecture: the relay chain (the network’s core chain), parachains (Polkadot-native chains) and bridges (ideal for interacting with different networks such as Bitcoin and Ethereum). I recommend exploring the lightpaper for a concise overview of the blockchain and organisation.

Because Polkadot allows any type of data to be sent between any type of blockchain, it unlocks a wide range of real-world use cases.

High network decentralisation

Unlike many blockchain networks that claim to be decentralised when they’re more like semi-centralised networks, Polkadot is one of the few that has a bona fide distributed setup.

It is the third-most decentralised blockchain, Bitcoin and Mina Protocol, with the foundation blockchain well ahead of its competitors. This is based on Polkadot’s Nakamoto Coefficient of 92.

This coefficient represents the minimum number of validators that could have 51% ownership of the entire network’s stake. This is according to Balaji S. Srinivasan and Leland Lee, who proposed this concept in July 2017 in the Medium post Quantifying Decentralization.

However, note that 92 refers to controlling 33% of the network. Thus, if accounting for majority (51%) control, this would be even higher. See Polkadot in Numbers — Annual Report 2023 for comprehensive information.

Ethereum and Solana have an NC of 25 and 31, respectively.

Why is this important? Maintaining sufficient decentralisation should remain one of the core aspects of a network, perhaps the most important one. This ensures it runs trustless (without an intermediary) and is set up to prevent an individual or small group from gaining majority control over a blockchain.

“Polkadot 2.0”

This term covers a range of proposed network improvements, as covered by Wood at Polkadot Decoded 2023. It is one of the most anticipated developments for this ecosystem, scheduled for release sometime this year.

From my understanding, this would consist of various upgrades being released at different times throughout the year and most likely going into 2025.

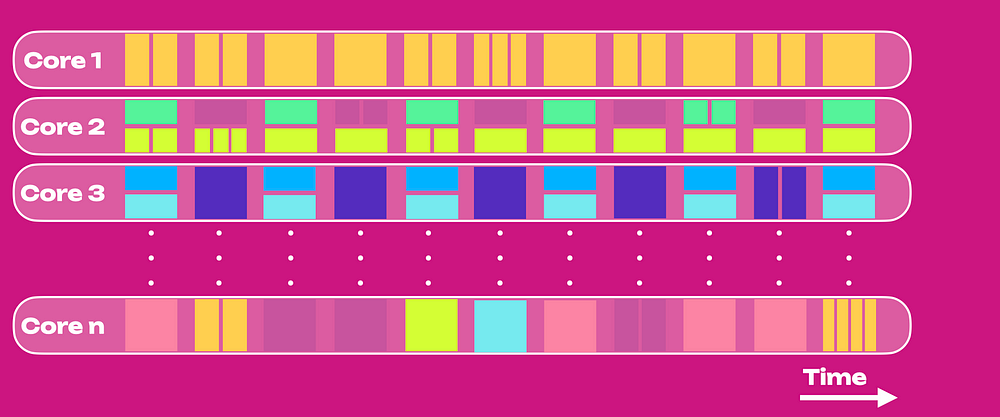

One of the examples put forward by Wood is to overhaul the current parachain auction system, with available slots released every few months as determined by on-chain governance.

We depart from the classic lease auctions and propose an agile marketplace for coretime, where essentially coretime becomes a commodity that can be tokenized, sold, and traded.

Polkadot Docs > Polkadot Direction

I recommended checking out Polkadot Docs for in-depth explanations of this and related topics, which cover some of the information put forward by Wood at Polkadot Decoded 2023.

Besides better utilisation of cores and an overhauled parachain setup, what other benefits does Polkadot 2.0 bring?

Cris Pap, a Polkadot ambassador, provided this neat summary on X (Twitter).

Asynchronous Backing is a key component of #Polkadot 2.0 as it optimises the performance of the network & enables faster & more autonomous executions!

Benefits:

▫️High speeds

▫️Better transactions flow

▫️Increases flexibility

▫️More throughput

▫️Boosts scalability

▫️Improves… pic.twitter.com/rri3wX5VJA— Cris Pap | 🐂⭕ (@Cris_Pap8) January 8, 2024

on

Opting to deploy this shortly is a smart move, and it is no coincidence that other projects (notably, other major layer-one chains) will be launching significant upgrades this year, e.g., Dencun and Proto-Danksharding for Ethereum; the Chang Hard Fork for Cardano; (another example), etc.

Like “Ethereum 2.0” (which became The Merge), I expect Polkadot 2.0 to excite many Polkadot enthusiasts and bring back many people who were once involved in the project or its native token.

Two key reasons for this:

1) It would help the network and the DOT token gain much more traction by releasing this amid a bull market than throughout a bear market. Based on history, bullish sentiment returns to this space in the lead-up to each Bitcoin Block Reward Halving, with the impending one less than 90 days away.

2) This is a narrative-driven asset class and industry. The most prolific example was the hype surrounding the launch of Spot Bitcoin ETFs. Now that has occurred, many investors and crypto enthusiasts are banking on the approval of Ethereum or possibly spot XRP ETFs sometime this year.

It’s the idea of looking forward to something that keeps people interested, which (unfortunately) is considered essential, at least in the short term.

Yes, how these upgrades impact the project in the long term will be more important than daily or weekly movements. Nonetheless, there is strong competition for attention in this space, let alone across most industries in modern society.

Staking DOT

This is a massive improvement to DOT staking for retail investors. For a long time, you would have needed at least 120 tokens for self-custodial staking, currently worth $815.

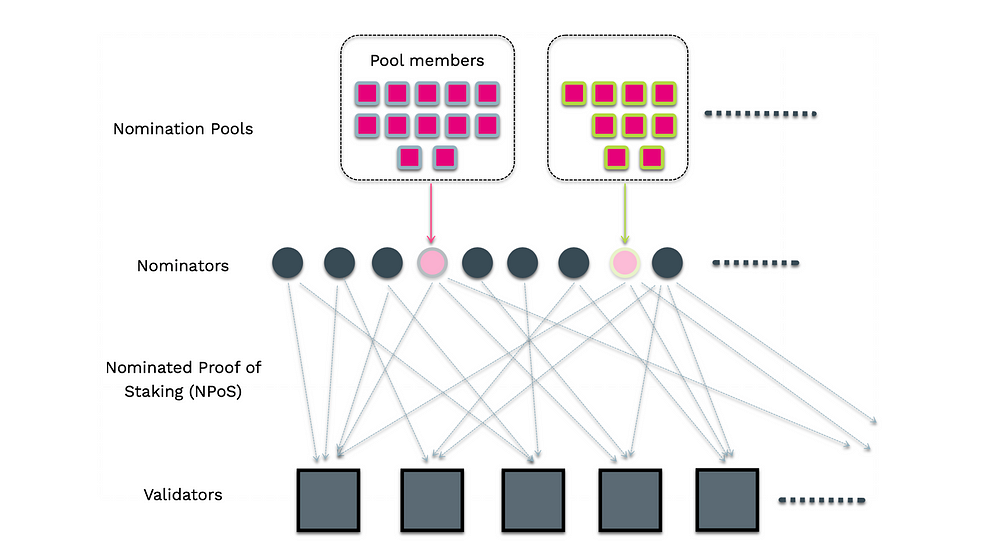

The minimum amount eventually went down to 10 DOT, but with its revamped setup, individuals can stake with as little as 1 DOT (~$7) in a non-custodial wallet. This is possible through nomination pools, whereby users combine funds to nominate validators.

Rewards are paid out as native DOT tokens, even in a pooled setup, as opposed to people involved in Ethereum staking (of less than 32 ETH) who earn their rewards in a liquid staking token pegged to the native asset, e.g., stETH, rETH.

By participating in a Polkadot pool, you are relying on its operator to act in everyone’s best interests (including their own) to avoid slashing, i.e., getting penalised for any actions that adversely affect the network. If this happens, validators can use a portion of the staked tokens.

)

You can also get involved as a standalone nominator by staking at least 561* DOT.

In either case, the 28-day unbonding period has provoked some community members’ ire. As frustrating as it is, this withholding period minimises the risk of destabilising Polkadot’s ecosystem by preventing an abrupt mass exodus of validators.

To Polkadot’s defence, it is not the only distributed ledger technology system with this setup — 2–5 days for Ethereum (ETH); for Fantom (FTM), it is seven days; 21 days for Cosmos (ATOM), ~3–4 days (80 checkpoints) for Polygon (MATIC), and so on.

*This figure is dynamic and relevant at the time of writing. According to the related table, the minimum is 250 DOT.

There is a way to bypass this waiting period through the use of liquid staking protocols, e.g., Ankr, Equilibrium, Acala, etc., which provides its participants with liquid staking derivatives (LSDs), a.k.a. liquid staking tokens that are ± pegged to the native coin/token, in return for staking DOT.

Despite the convenience and instant liquidity, you rely on the (third-party) protocol’s security instead of staking directly on Polkadot.

N.B. I do not endorse using these protocols as I prefer to stake directly through Polkadot. Do your due diligence before proceeding.

The only hardware wallet brand that currently supports DOT staking is Ledger.

Suppose you don’t have a hardware wallet or prefer an alternative to Ledger. In that case, you have also set up your mobile device as a non-custodial DOT wallet via the Polkadot Vault app, available on the App Store and Google Play.

Go to the Polkadot Staking page for the list of compatible wallets.

Crypto PSA: Never share your recovery seed with anyone, even if someone claims to represent Polkadot or Parity Technologies (a blockchain infrastructure company working on Polkadot).

News and partnerships

Supply chain and logistics

Polkadot announced a collaboration between Telecom Vodafone and Aventus — a blockchain-as-a-service provider — for better security and reliability of the aviation supply chain through Heathrow Airport.

Vodafone’s Digital Asset Broker (DAB) platform will work with Aventus to develop cargo-tracking pods via blockchain-enabled SIM cards. This aims to reduce the associated losses that cost the industry roughly $400 million annually.

“As a first step, the two companies will establish a bridge between Vodafone DAB and the Aventus Network, which connects to the wider blockchain ecosystem via the Polkadot platform.”

Aventus press release

Check out Aventus’ press release and a corresponding Polkadot news post for further information.

Polkadot x Cardano

Polkadot announced that it’ll be using Substrate, the basis of Polkadot’s software development kit (SDK), for creating unique blockchains, enhanced cross-chain interoperability, and access to various Polkadot platforms and applications.

1/ Cardano will use Substrate, the foundation of the Polkadot SDK, to build out its “partner chain” project — showcasing Substrate's potential to expand across Web3, and its ease of use for other chains and ecosystems 🛠️

— Polkadot (@Polkadot) November 6, 2023

on

Charles Hoskinson, founder of Cardano, has spoken positively about Wood and Polkadot, including this quote:

“Polkadot is what Ethereum 2 should have been.”

Charles Hoskinson, 7 March 2021 AMA, 16’01”

It’s unsurprising these two would consider a collaboration Charles Hoskinson is another Ethereum co-founder and is still on good terms with Wood, unlike Vitalik Buterin and Hoskinson.

Other partnerships

Another collaboration to watch is with Deloitte Switzerland, as announced in a news release. The accounting firm has recently integrated KILT Protocol, a “blockchain identity protocol for issuing self-sovereign, verifiable credentials”, which runs on Polkadot.

In December, an announcement was made about a collaboration between Parity Technologies and Unity Games, whereby the latter powers renowned titles such as Pokémon Go and Call of Duty Mobile.

Despite this being reported across multiple web media sources, which have a screenshot of the original tweet posted on Polkadot’s account, it no longer exists whenever you click on the post.

Thus, it is possible that the deal has been called off or that something planned between these entities will be released later this year; we’ll see what happens.

Additional thoughts

Polkadot has promising prospects with its significant network improvements– more-inclusive staking, a revamped governance system OpenGov (a.k.a., Gov2) and the impending Polkadot 2.0.

These will provide added versatility, bringing about additional use cases and attracting more people to Polkadot.

However, it was a long way to go if it were touted as a “global supercomputer”, particularly with Ethereum’s dominance and the rise of Solana, Chainlink, Polygon, Avalanche and other ecosystems in recent years.

I expect to be a major player and focus on a niche in the crypto space (most likely as a prominent chain for interoperability). Its major drawcard is its consistently high decentralisation, often lacking across most projects across this space.

This also shows promising signs from a developer-activity standpoint. As of 31 December 2023, Polkadot has over 790 and 2,100 full-time and monthly active devs, respectively, per data from Electric Capital.

To help maintain decentralisation, I am glad that the devs behind Polkadot drastically lowered the minimum amount of self-custodial staking to just 1 DOT. This will encourage more individuals to follow this rather than opt for a centralised exchange to stake on their behalf.

One thing I’d like to see is featuring DOT on all crypto (i.e., non-BTC-exclusive) hardware wallets within the next two years. Ledger, Ellipal and the Keystone 3 Pro are notable options that allow you to store the tokens on their devices.

Yes, you can use your mobile/cell phone or tablet to store the private keys, but Polkadot has been around long enough to be accessible across more hardware wallets, particularly Trezor, Keepkey and BitBox02.

Is Polkadot still worth investing in this year? I believe so, but it’s just outside of my top-5 crypto assets to invest in; FYI, these are Chainlink (LINK), Bitcoin (BTC), Ethereum (ETH), Arbitrum (ARB) and XRP.

From a risk-reward perspective, DOT could pay off more than other altcoins as it is about 85% from its all-time high of ~$55 per token; it currently sits at $7.53.

Even though past performance does not guarantee future results, I remain optimistic about this protocol.

Ways to stay in the loop with Polkadot (DOT)

– Official website and the DOT token

– Whitepaper (EN) and lightpaper (available in six languages)

– Telegram

– Matrix (decentralised communication protocol)

– Discord

– Web3 Foundation (includes info about Kusama Network)

Further reading and additional resources

You think Bitcoin’s price is too high? Read this.

“Bitcoin is too expensive now at $37,000.”

“I missed the boat on Bitcoin. It’s too late now.”

“The bubble has…cryptowithlorenzo.medium.com

Gavin Wood Sees Polkadot as a Global Supercomputer | Polkadot Decoded 2023

Polkadot in Numbers: Annual Report 2023

Messari Developer Report 2023: State of Polkadot Q4 2023

Ways to support my work

• Check out this post for various affiliate links and promotions you can use to top up (or kick start) your crypto portfolio. By using these, I earn a small commission at no extra cost to you.

• All of my articles (including previous ones) are now published for anyone to read on Medium, including non-members. I welcome any crypto donations if you’d like to support my work. Please use the following addresses to do so.

DOT — 15Gn8DZeZY3pmLczjwx7WGUc7TXXme8y2nrxuC6o4hBxn7jX

BTC — bc1qny59y95g4narcf4a7d3k9g7h54kc8jakj9t87a

ETH — 0xF4D51542Ed8bb769F87692e220Ea31932f184887

ADA —

addr1q9dkkzs8sfevxve72ttmtgthsdcddut86ssttlhn25t9qczmdv9q0qnjcvenu5khkksh0qms6mck04pqkhl0x4gk2psq5c5gqz

XRP — rLDThKVeMCZQCZcT4uzBU6NTSPHxwmRifE

Disclaimers

• N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

• The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

• Please do your own research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

• For transparency, DOT accounts for roughly 1% of my crypto portfolio. However, I plan to increase this soon, especially with the hype surrounding Polkadot 2.0.

• Information is correct at the time of writing.

Featured image by dRender at Shutterstock.

Originally published at https://www.cryptowithlorenzo.com.