It’s an age-old debate for anyone in crypto, for both veterans and noobs:

Which is more profitable — Bitcoin (BTC) or Ethereum (ETH)?

Specifically for this piece, which one performed better in dollar-cost averaging (DCA)?

What is DCA, and why is it appealing to many?

DCA involves investing the same amount of money at frequent intervals (e.g., $200/month) over a given period, irrespective of an asset’s price.

It is preferred by people seeking a simplified approach to digital assets, let alone investing. This can be useful for beginners or risk-averse investors jumping into a market and understanding technical analysis and macroeconomic trends.

Methodology and assumptions

— I took the closing price of BTC on the 15th day of each month, based on statistics provided by CoinMarketCap, and stuck with this date for consistency.

– I opted for a plausible figure of US$200 per month in each asset = $2,400 per year.

The DCA investment intervals range from January 2018 to June 2023, including 66 $200-per-month investments, totalling $13,200.

– Returns on investment (ROIs) do not account for inflation or trading fees.

Why 2018? The data provided here were originally displayed in various YouTube videos on my channel between 2018 and 2020. In this, I primarily focus on a Bitcoin vs Ethereum DCA analysis and which was more lucrative. As a result, I have decided to continue adding data to the original BTC vs ETH DCA analysis in January 2020.

I have included read-only spreadsheets for Bitcoin (BTC) and Ethereum (ETH) for your viewing pleasure for every table showing the annual DCA calculations.

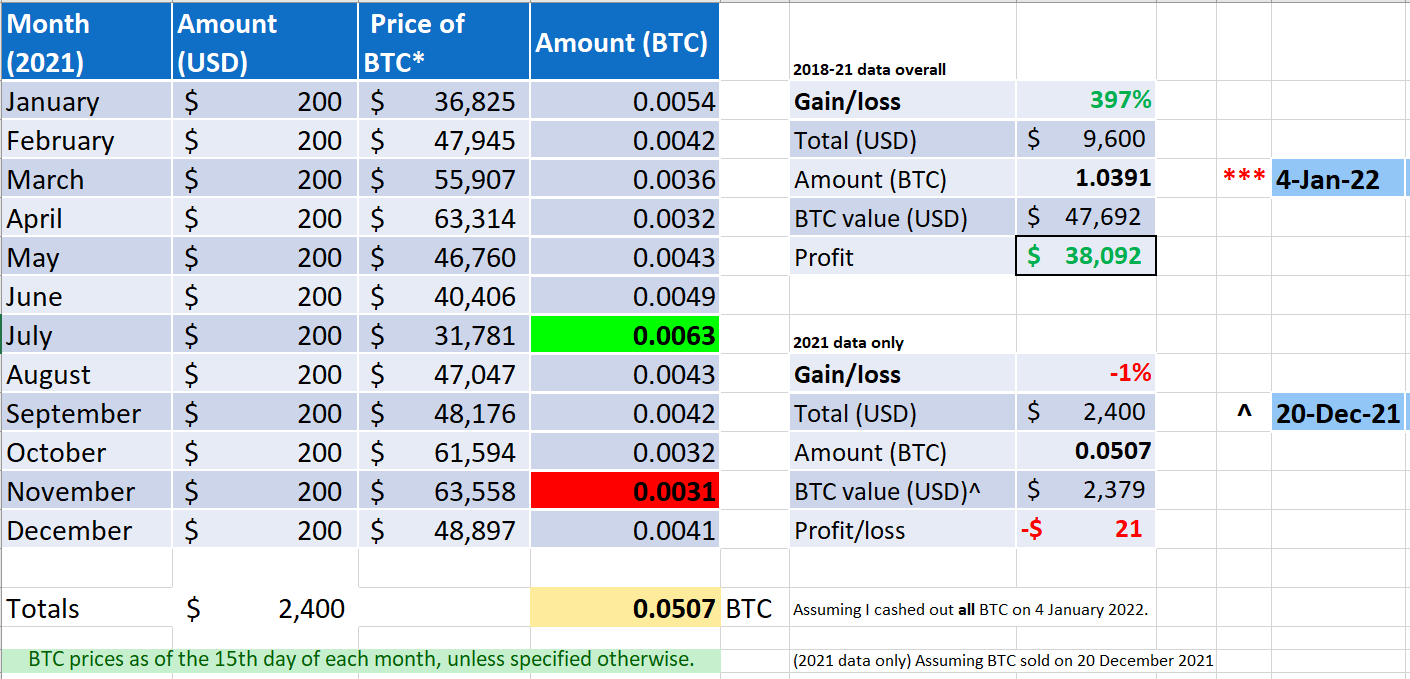

Table 1: Screenshot from my original 2018-21 Bitcoin DCA calculations @ $200/month.

BTC vs ETH DCA – The Verdict

Without bombarding this article with multiple screenshots (and to avoid repetition), Table 1 is a reflection on how DCA % gains can vary substantially depending on the length of time involved when you began the process and, most importantly, for various crypto assets, the exact date when you chose to sell your assets.

So who won this one?

Since 2018, Ethereum, and by a convincing margin. However, so far in 2023, Bitcoin is up, albeit slightly.

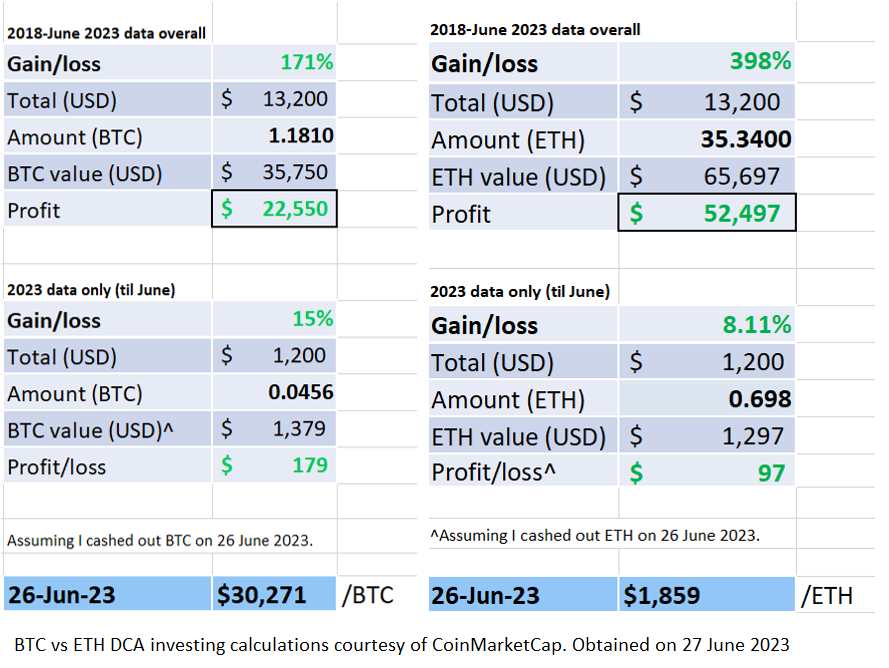

Table 2: BTC vs ETH DCA summary @$200/month: January 2018 to June 2023 (inclusive).

The table above indicates a ‘comparatively’ strong ROI for Bitcoin and Ethereum using DCA investing between 2018 and June 2023. I say this as it could be interpreted in two different ways:

– In relation to the performances of BTC and ETH in their first few years, these ROIs are mediocre. Having said this, still ‘not bad’ for many crypto investors.

– Zooming out and looking at the bigger picture, BTC has performed phenomenally well, as demonstrated by Charlie Bilello; ETH, LTC, XRP and other well-established crypto assets have also outperformed many other financial sectors.

The data provided here were originally displayed in various YouTube videos on my channel.

Alternative strategies

Let’s face it, DCA doesn’t work for everyone and is far from the most profitable strategy.

However, it is a simple, set-and-forget scheme, assuming that you set up automated payments at regular intervals, which is very common nowadays through multiple cryptos. As we saw in the summary above, DCA is still lucrative in the medium to long term.

For those seeking a more profitable approach, I would recommend lump-sum investing — a large amount all at once or even split across two crypto purchases per year — specifically during market downturns.

Buying the dips, having an exit strategy when prices pick up again and re-entering when they drop again is an excellent way to build your crypto portfolio faster than normal.

Pick various points throughout the year to invest $2400 during the dips or any combination to allocate $x to BTC, ETH, XRP, etc.

Of course, this is easier said than done as it involves good timing (particularly important in a highly volatile asset class).

Besides this, you can also bypass the plan to time the peaks and troughs by continuously accumulating using a mixture of DCA + buying-the-dip.

For those of you seeking faster gains and wanting to pursue day trading, understanding technical analysis is essential or, at the very least, highly advantageous.

I acknowledge that I do not know much about this, so I recommend that you follow experienced chart analyst and TA researcher Alessio Rastani. His crypto content focuses primarily on Bitcoin, and he also covers other commodities, popular stocks and macroeconomic trends.

Image by Wit Olszewski on Shutterstock

Final thoughts

Ethereum’s deflationary supply and staking rewards since the London Hard Fork (EIP-1559) and The Merge, respectively, have also changed the BTC and ETH comparison over the past 12-15 months.

Adjusted staking rewards (i.e., when accounting for ETH deflation) are at approximately 6% p.a. As per Bitcoin, its declining inflation rate as part of the scheduled Bitcoin Block Reward Halving — which, for perspective, is already lower than most countries worldwide — and its capped supply will be two major drawcards to invest in Bitcoin and, in turn, increase prices.

As a result, we need to consider staking rewards generated from ETH and its deflationary supply to obtain a more accurate result.

Which one will be the best to invest in long-term under DCA? No one knows, as this market is highly volatile, and major upgrades on either blockchain could significantly swing the pendulum to BTC or ETH.

In reality, I expect both to continue doing well, provided that:

- Devs behind the respective protocols continue to create and implement upgrades/general improvements;

- Bitcoin maintains its strong decentralisation, and ETH continues to follow suit;

- Greater retail and institutional adoption of both crypto assets. Plenty of excitement in recent times with BlackRock and other major financial players lodging applications for a Bitcoin Spot ETF, which would most likely lead to Ethereum being next in line for a similar product.

Useful tools for crypto DCA

- Deltabadger – DCA tool for all crypto assets

- Dollar Cost Averaging Bitcoin (dcaBTC)

- Uphold’s DCA calculator

- Crypto Head DCA Calculator for BTC, ETH and LTC

- DefiAdda – DCA calculator for various crypto assets displaying ROI in several fiat currencies

Disclaimers

B. None of this is financial advice; I am neither a financial advisor. You are solely responsible for crypto investments and how you interpret the information provided in this piece.

The opinions expressed within this piece are my own and might not reflect those behind any company, organisation or person listed here.

Please do your research before investing in any crypto assets (including stablecoins), hardware wallets, NFTs and other products affiliated with this space.

BTC and ETH collectively represent about half of my crypto portfolio at present.

I received no incentive from any person or entity listed throughout this article to discuss their product.

If you enjoyed this article, I recommend following my Medium page for regular reports about crypto assets, blockchain technology, and more. Feel free to check out my publication as well, Crypto Insights AU.

Thanks for your support.

Featured image by Dragon Claws on Shutterstock.

Affiliate link is included below. I receive a small commission per referred sale at no extra cost to you.

BitBox is an increasingly popular alternative to Ledger and Trezor hardware wallets.