This group of investments closely related to Bitcoin is generating ROIs well beyond BTC’s price gains.

With bullish activity returning to the market in 2023 and much hype surrounding Bitcoin Spot-ETF requests from BlackRock, Fidelity, and other colossal fund managers in the USA (see image below), Bitcoin (BTC)’s price has returned to its highest level since June 2022; it currently sits at roughly $31,000.

As a result, the savvy investors amongst you will be looking to boost your holdings and prep yourselves for a significant price growth forecast for 2024 – which will include Bitcoin’s upcoming Block Reward Halving – with the strong possibility of >$100K Bitcoin later that year or in early 2025.

With the foundation crypto yielding a modest return of ~86% year-to-date (YTD), even outdoing most altcoins so far, today I want to share what is a great way to profit from Bitcoin’s gains beyond this 86% figure.

How? The obvious assumption would be using leverage/margin, which could work and often does for experienced traders. However, this is not what I am referring to today.

1/ last week's @BlackRock spot Bitcoin ETF filing was big news!

but, it's not the only story. many of the largest financial institutions in the US are actively working to provide access to Bitcoin and more.

a quick glance – $27 trillion of client assets here! pic.twitter.com/azmHZmUL2a

— Meltem Demirors (@Melt_Dem) June 26, 2023

A shortlist of major institutional investors offering or planning to provide Bitcoin and general crypto services.

Source: Meltem Demirors (@Melt_Dem) on Twitter on 27 June 2023.

Rather, I am talking about undervalued stocks of Bitcoin-mining companies, prioritising those sourcing over 90% of their electricity needs from “sustainable” sources, notably a mix of renewables and nuclear power.

Some of these, notably CleanSpark (NASDAQ: CLSK) and Iris Energy Limited (NASDAQ: IREN), have been the most profitable assets for me so far in 2023, generating roughly 140% & 210% for me, respectively, in just six months.

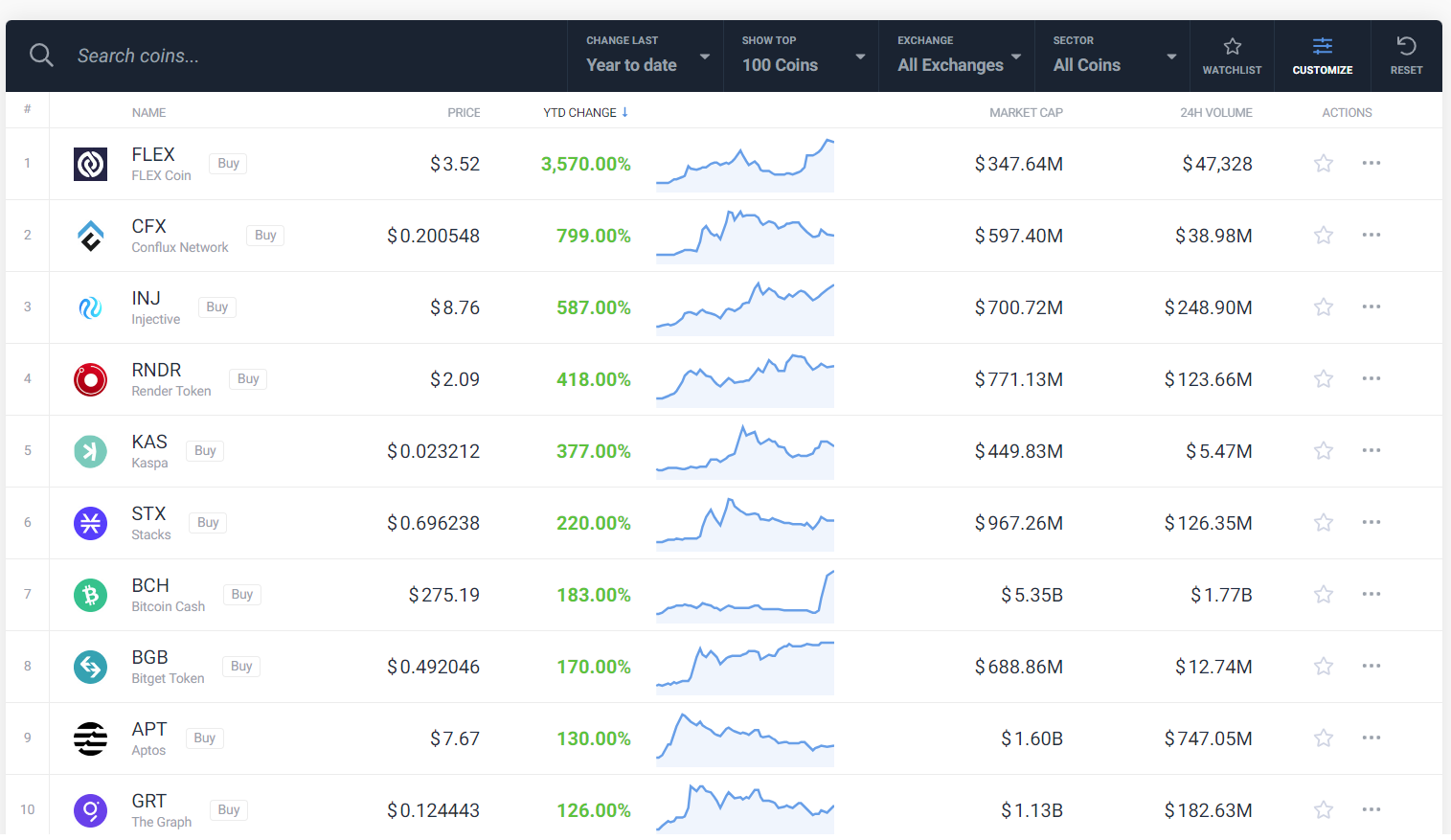

What’s more impressive is that IREN and another Bitcoin miner, Marathon Digital Holdings (NASDAQ: MARA), have produced over 350% ROI in 2023. Moreover, compared with the top 100 crypto assets (by market cap), if CLSK, IREN and MARA were all crypto assets, these would all be in the top-10 list of most profitable YTD assets.

I have included this screenshot obtained from CoinCodex to put this into perspective.

Whilst this screenshot is a shortlist of the top 100 crypto assets, IREN, CLSK, HIVE and RIOT (more on RIOT shortly) have outperformed 95% of the top 500 altcoins. See ‘Show Top 500 Coins’ and ‘YTD Change’ and see for yourself.

Source: CoinCodex. Screenshot taken on 5 July 2023.

Why do I anticipate even stronger price growth in the next 15-18 months?

Some major reasons for this:

1) Low market caps for most of these companies (each less than a billion dollars, mostly around the $500M mark) indicate major room for growth, particularly due to the strong correlation between Bitcoin’s price and share prices.

– IREN is currently at $5.86 and was at an ATH of ~$18 on 1 November 2021, around its launch date.

– CLSK is currently at $5.29 and reached an ATH of $59 on 4 September 2018. However, it is worth noting that CleanSpark shifted its focus to Bitcoin mining from clean-energy sources in 2020, having previously concentrated on software solutions for modern energy requirements. See their full history of press releases for further details.

These stocks are down by 75-80% from their ATHs, lower than Bitcoin, which is 55% from its ATH.

2) Bitcoin mining companies have been boosting their hash rate (in exahashes per second) — and BTC mined per month — with the order of new ASIC miners this year, as per monthly reports or similar announcements.

Any official reports surrounding increased production and affordable ways to source clean energy to power their mining facilities will boost investor confidence for the medium- to long-term.

Various BTC mining companies have profited significantly since the start of this year, passing on these benefits to their shareholders.

“We’re still able to mine at sub-$10,000 per Bitcoin.”

Daniel Roberts, Iris Energy Co-Founder and Co-CEO, interview in February 2023.

While I know that electricity costs have most likely increased since then (relying on 97% renewable energy, mostly hydro), do bear in mind that BTC’s price has also increased by about $7,000 per BTC since Roberts’ interview.

Moreover, a bullish sign in the space is the neutral-to-greedy sentiment in recent weeks, according to the Bitcoin Fear and Greed Index. This is ideal as it indicates enough buying interest and a lower probability of a major price correction, as opposed to excessive greed and a higher risk of bearish sentiment coming back.

3) These miners are planning accordingly for the 2024 Bitcoin Block Reward Halving. Even though their reward will halve, using newer, more efficient Bitcoin miners, sourcing the cleanest clean energy available and other efficiency measures, such as liquid immersion cooling for enhanced ASIC miner operations.

4) Last but not least, BTC and market-wide bull runs have begun shortly after each Bitcoin halving event, based on the three previous ones to date.

Chart courtesy of TradingView. Snapshot taken on 11 June 2023 at ~01:00 EDT.

What about other crypto-related stocks?

These are also suitable options and can help offer some further exposure to the crypto and blockchain technology space via publicly-listed companies.

Popular examples that come to mind are global crypto exchange Coinbase (COIN); another BTC miner called Riot Platforms (RIOT); various ETFs from Ark Invest — a global asset manager headed by crypto and blockchain-tech enthusiast Cathie Wood — particularly those relating to fintech and automation; and MicroStrategy (MSTR) — an American technology firm focusing on business intelligence and cloud-based services — which has Michael Saylor at the helm, whom I would consider to be one of the most enthusiastic institutional investors in Bitcoin.

RIOT, IREN, MSTR and COIN have also been some of the most profitable this year, each with >150% YTD growth; RIOT and IREN have over 300% gains in 2023.

Do some of these entities sound familiar to you? Earlier this year, I listed these stocks and other products that allow investors to invest indirectly in Bitcoin and crypto assets. You can access the related article here.

Final thoughts

I understand this is far from a 20, 50 or even 100x that many people have experienced. However, the profits obtained from stocks in general, including gains on certain altcoins, could still go significantly further when finding crypto-to-crypto trading opportunities.

As a hypothetical (yet plausible) scenario, if you were to take profits (in fiat) at 10x your initial investment in one of the BTC mining stocks, put the money into an altcoin such as ADA, XRP, MATIC, etc., triple or quadruple it, convert it into BTC, wait for that to appreciate after The Halving, and then cash out, I would not rule out doing a 50x overall.

Alternatively, you can take your profits from crypto stocks and use the proceeds to purchase small groups of digital assets relating to particular crypto categories, e.g., liquid staking derivatives (LSDs), decentralised finance (DeFi), zero-knowledge (ZK), layer 2s (L2s), NFTs, and so on.

There is no one-size-fits-all approach to (crypto) investing. Exploring various ways to maximise your ROI realistically; factoring in macroeconomic trends (e.g., crypto regulations abroad, BlackRock, Fidelity and others filing for Bitcoin Spot ETFs, etc.); researching emerging companies or trends; and having an exit strategy will all help you become better equipped to deal with any major bull run in the coming months and years.

Disclaimers

N.B. None of this is financial advice; I am not a financial advisor. You are solely responsible for crypto investments and how you interpret the information provided in this piece.

The opinions expressed within this piece are my own and might not reflect those behind any company, organisation or person listed here.

For transparency, I acknowledge that I hold CLSK, IREN, COIN and HIVE stocks in order of $ value.

Please do your research before investing in any crypto assets (including stablecoins), hardware wallets, NFTs and other products affiliated with this space.

To reiterate, I received no incentive from any person or entity listed throughout this article to discuss their product.

If you enjoyed this article, I recommend following my Medium page for regular reports about crypto assets, blockchain technology, and more. Feel free to check out my publication as well, Crypto Insights AU.

Thanks for your support.

Featured image by Zakharchuk on Shutterstock.

Affiliate link: BitBox02 is an increasingly popular alternative to Ledger and Trezor hardware wallets.

By using the affiliate link when you click the image below, I receive a small commission for any sales at no extra cost. Cheers.