Let’s not forget about the vast swathe of competitors looking to emulate their movements.

Last week, BlackRock, Inc. announced its intention to launch its Bitcoin Spot ETF through the United States Security and Exchange Commission (US SEC).

Why is this a big deal?

First and foremost, this is the largest asset manager in the world – a whopping ~$9.5 trillion of assets under management (AUM).

Like Apple in the tech scene, anyone interested in financial services will be observing the top dog and what it does in terms of Bitcoin and other crypto assets.

Irrespective of the decision made in the US SEC, it will be a major talking point. Why?

– BlackRock getting the green light for a Bitcoin Spot ETF means that they’ll need to buy and hold actual BTC, which will massively reduce the available amount of Bitcoin (i.e., for purchase on exchanges); this currently sits at roughly 10% of all BTC in circulation à 1.87M available out of 19.4M mined to date.

This tweet from a crypto veteran, Lark Davis, says it all:

Blackrock manages about 10 trillion in assets.

Only about 10% of all Bitcoin is sitting on exchanges.

So, about 50 billion dollars worth of BTC.

0.5% of Blackrock money movings to BTC would buy every single coin available.Let that sink in!

— Lark Davis (@TheCryptoLark) June 16, 2023

Let me remind you, this is just one company. Do not forget about other major entities and notable individuals buying up plenty of BTC— MicroStrategy, Galaxy Digital Holdings, Tesla, Block, Inc. (including Jack Dorsey’s Bitcoin holdings) and many others.

– If BlackRock were to be the first company approved in the US to offer this type of ETF (me thinks that the US SEC will support it), it would provoke the ire of every other business to date that has applied for a similar spot ETF, only for all of them to be rejected.

In short, it would be a massive F U to them.

With the way the SEC has dragged out its infamous lawsuit with Ripple, not to mention its recent actions against Binance and Coinbase, it is no wonder why the vast majority of the crypto space is fed up with its activities.

I would not be surprised if the SEC were to reject BlackRock’s first application (to give the general public the illusion that they’re not giving preferential treatment, only to then give the thumbs up to a “slightly tweaked” proposal the second time around.

This differs from a Bitcoin Futures ETF, which has options available in the US.

Image by Sittipong Phokawattana on Shutterstock

Bitcoin Spot vs Futures ETFs

A Bitcoin Spot ETF would allow everyday traders to have exposure to the investment in real-time without directly holding BTC in their wallets. This would also involve the fund manager owning the digital coins.

On the other hand, a Bitcoin Futures ETF contract would involve buying the asset at a set price at a pre-determined date. The latter’s set of contracts expires monthly and occurs on the last Friday of each month.

Each type comes with its own pros and cons, which are explained in these resources.

I am all for people having options to gain exposure to this (relatively) new asset class, which still has enormous room for growth despite many feeling as though they “missed the boat”.

A similar ETF for Ethereum (and other altcoins) on the horizon?

If, rather, when BlackRock’s Bitcoin Spot ETF goes ahead, this will set a precedent, and ETH-related ETFs will be next in line to help boost crypto exposure to the masses.

To clarify, I am referring to no (crypto) spot ETFs yet being available in the USA and focusing on this market for this article. However, spot ETFs for Bitcoin and Ethereum exist in other countries/regions: Australia, Europe, Asia, Brazil, etc.

Of course, you can directly hold ETH by keeping it secure in your own (non-custodial) offline or even choosing to buy and hold the coin in an exchange wallet. On this note, I recommend sending as much as possible in a non-custodial wallet instead of a centralised crypto exchange, but you do you.

I expect the emphasis to remain on Bitcoin and Ethereum ETFs for the next time until we get clear US regulations for other digital assets. XRP will be the next logical option to launch an ETF, followed by Cardano (ADA) and Polygon (MATIC).

However, ADA and MATIC are two of the 12 assets listed allegedly “offered and sold as securities” on crypto exchanges, so there will be a waiting game for anyone to trade these on a stock market.

Otherwise, use an exchange, as the vast majority of the space has done since the advent of crypto.

Additional thoughts

Whether it is BlackRock or another major TradFi institutional investor, sooner or later, one, perhaps several of these, will get the all-clear to offer a Bitcoin spot ETF.

Earlier today, crypto news sources covered Fidelity’s intentions to reportedly launch its own Bitcoin Spot ETF or even make a bid on behalf of notable digital-asset fund manager Grayscale, which unsuccessfully attempted to convert its Bitcoin Trust (GBTC) to a spot ETF last year.

Back to BlackRock. Due to the company’s leading position in the financial realm, I remain optimistic about its chances to get the Bitcoin spot ETF, which, FYI, offers dozens of ETFs under the iShares name alongside its range of managed funds.

Any injection of institutional funds for the entire crypto asset class would be a neat boost for the foundation crypto in the lead-up to its 2024 Block Reward Halving. Yet, it is unfortunate that many have become so reliant on institutional money to boost crypto prices; there should be enough understanding amongst the general public about the merits of Bitcoin and a small number of altcoins to put more money behind these digital assets. Alas.

The fact that the US is finally pulling its finger out and giving regulations means that they think crypto is here to stay, a bullish sign for the space in the medium-to-long term.

This is the beauty of competition: Other nations and regions have gotten their s&*t together to provide clear(er) regulations for individuals and firms delving into this nascent industry, whereas US reps, particularly Gensler and Co. @ the SEC, have been pussyfooting around, notably with the dragged-out lawsuit with Ripple.

For anyone who has been here for at least four years, you will most likely be desensitised to all of Bitcoin’s wild price action, let alone for the rest of the crypto space.

Despite multiple crypto scandals, bankruptcies, regulatory crackdowns (i.e., mostly in the USA), etc., over the past 15-18 months, not to mention common misconceptions about crypto, BTC’s price is still above where it’s been for most of its history (dating back to its inception in 2009).

Moreover, looking at the chart below, did you notice how the crypto’s price is at least $10K higher than where it was in 2019-20, even though the 24-hour trading volume (greyish bars) in recent weeks is lower than the 24H volume back in 2019-20? I included the little green arrow to help you understand what I mean.

BTCUSD price chart (Dec 2018 – present) by CoinGecko

Why is this significant? It is a bullish factor (one of many) as it shows that more people are willing to buy and hold BTC than before, reflected by the small % of BTC on exchanges I alluded to earlier.

In an upcoming piece, I will also cover Bitcoin’s stock-to-flow model (S2F), one of the most promising price models predicting reasonable Bitcoin prices in future.

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are solely responsible for crypto investments and how you interpret the information provided in this piece.

- The opinions expressed within this piece are my own and might not reflect those behind any company, organisation or person listed here.

- Please do your research before investing in any crypto assets (including stablecoins), hardware wallets, NFTs and other products affiliated with this space.

- BTC and ETH collectively represent about half of my crypto portfolio at present.

- I received no incentive from any person or entity listed throughout this article to discuss their product.

If you enjoyed this article, I recommend following my Medium page for regular reports about crypto assets, blockchain technology, and more. Feel free to check out my publication as well, Crypto Insights AU.

Thanks for your support.

Featured image by ioda on Shutterstock.

Affiliate links included below. I receive a small commission per referred sale at no extra cost to you.

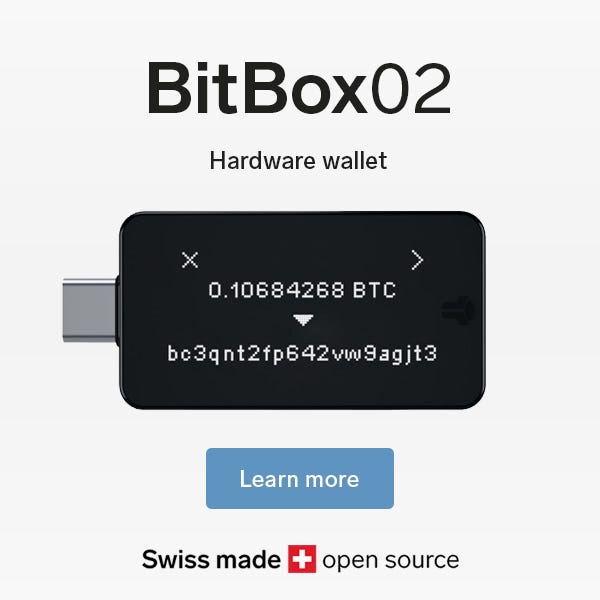

This is in increasingly popular alternative to Ledger and Trezor hardware wallets.