Since Larry Fink, BlackRock’s CEO, did a complete 180 and started heaping praise on Bitcoin last year, optimism has returned to the crypto space, especially for those focused on Bitcoin.

This, alongside Grayscale’s win against the US Securities and Exchange Commission (US SEC), which forces the regulator to review the company’s plans to convert its Bitcoin Trust to a spot Bitcoin ETF, has generated much hype for the real possibility of these ETFs seeing the light of day in the USA.

There hasn’t been a single day over the past nine months where we haven’t heard about a media outlet or crypto commentator discussing a spot Bitcoin ETF.

It’s a big deal for Americans (particularly institutional investors) and anyone eligible to trade US stocks. I get it. There is the significant convenience of having a commodity readily traded on a stock exchange without the entire rigmarole of creating an additional account, doing KYC AML checks, etc.

On top of this, firms behind spot Bitcoin ETFs have to follow strict rules to guarantee more transparency and consumer protection. This is why so many amendments have been made to the SEC filings, as the regulator needs to be fully satisfied with the submissions.

With BTC returning to $47,000, the anticipation of an approval has only intensified in recent weeks. There’s a high (reportedly a 95%) probability of the US SEC green-lighting the ETFs by tomorrow (10 January), the final day for the US SEC to respond to ARK 21 Shares’ application.

Despite all the benefits listed above, I will play devil’s advocate and explain why — as a retail investor — I would still prefer self-custody and, to a lesser extent, a regulated crypto exchange over a spot Bitcoin ETF.

Straight up, the biggest difference is having an asset I can trade 24/7/365 and not be limited to market hours.

I’d readily pick 168 hours per week available for trading BTC, ETH or any crypto asset instead of the regular 32.5 hours for the stock markets.

Even when accounting for pre- and post-market orders, these options are still unavailable in the evening, the early morning, and weekends.

It is widely believed that the regulator will approve all ETFs simultaneously to avoid first-mover advantage, which is a plausible assumption.

Institutions, retirement funds and other fund managers can seamlessly grant their clients exposure to BTC.

Even though onboarding new clients has become easier over the years, Spot Bitcoin ETFs simplify it even further.

The most compelling argument for having direct ownership of Bitcoin is that we, as individuals, have full control of the private keys to access the coins.

I can already see many people rolling their eyes. Most people involved in BTC no longer care about this, but it serves a key purpose: You know that you hold 100% of the assets and can trade them anytime on any exchange.

There’s no BS about fractional reserves or worries about companies co-mingling funds.

I am aware that many crypto exchanges still lack proof of reserves and transparency to reassure their clients. However, this can be resolved by forcing exchanges to do regular independent audits by government-approved firms on top of these proof-of-reserves declarations.

You’re not relying on a third party being available to access your Bitcoin. Yes, I have some of my BTC, ETH and altcoins on various exchanges, as I believe in distributing assets.

So, I am not against exchanges. In fact, from a retail investor’s perspective, I would still pick going through an exchange that I can access 24/7/365 (at least 99.9% of the time) rather than going via the NASDAQ or NYSE.

This is also for practicality. As I am based in Australia, there’s even less of an incentive to have BTC exposure to a market’s hours that barely align with my local time zone. If I were based in the USA, then spot Bitcoin ETFs would make more sense.

Even though various countries have local spot Bitcoin ETFs, it’s still comparing chalk and cheese with directly holding BTC.

If you can’t handle the heat, get out of the kitchen

There is another factor at play. Stock markets such as the NASDAQ or the NYSE can impose “circuit breakers” that lead to short trading halts, depending on how steep the drop is from the previous day.

In extreme cases, i.e., a Level 3 circuit breaker (involving a 20% loss from the day before) is triggered, leading to trades being suspended for the rest of the day.

Will the same rules apply to spot Bitcoin ETFs?

Even though circuit breakers are generally used for drops in market indices (e.g. the S&P 500), this could apply to individual stocks.

This can also be activated in rare cases when the stock gets too hot. The most famous example of this recently is the controversial GameStop trading halt when it rose by 69% in just one day in January 2021.

In my opinion, spot Bitcoin ETFs should not be subjected to trading halts because of volatile periods.

If this were to happen, the next question should be, what about Bitcoin-mining stocks? Will they be subjected to circuit-breaker rules? FYI, they have been far more volatile than BTC, and no one has complained.

After all, this is all that is expected of BTC, crypto assets at large, and their related stocks.

If you can’t handle the heat, get out of the kitchen.

In other words, if you don’t like rollercoasters, then don’t choose to ride them in the first place.

https://cryptowithlorenzo.medium.com/subscribe

Old habits die hard

Suppose I were to survey 10,000 people at random across a broad demographic 12 months after the approval of a spot Bitcoin ETF (or several of them simultaneously). In that case, I strongly feel that many will say they began to get enthusiastic about Bitcoin after BlackRock, Fidelity, or another fund manager launched their product.

If it’s not one of these entities, it was most likely because of a friend or relative. Mind you, there is also a cohort of early BTC adopters that got into the market courtesy of a friend or family member, so this can go both ways.

Nonetheless, it is likely because of them or a large, centralised financial institution.

Bitcoin’s a “scam”…until the big end of town gives the asset a thumbs up, it’s legit.

The inconvenient truth is that a lot of ordinary people (a.k.a. plebs, as I like to call them) refuse to analyse things and question people’s motives critically. I.e., some naïvely believe that these institutions are acting in the best interests of these individuals.

News flash: They’re not; many couldn’t give a flying f&#k about their customers. Their priority is making money for themselves; lining their clients’ pockets is a secondary, not a primary, function.

The biggest issue for the average person is that they struggle to defy convention. If you get excited about Bitcoin, Ethereum or any crypto asset, you’re considered weird…at best.

“Some politicians say criminals use Bitcoin.”

“Warren Buffett said it’s ‘rat-poison squared’, Charlie Munger said it’s stupid,” and so on.

I don’t care. Just because they and many others made a ton of money through their investments does not mean they are (rather, were, in the case of Charlie Munger) the best people to ask about Bitcoin, crypto, and blockchain technology.

I speak from my experience investing in this asset class since 2017, so I know a thing or two about people’s perceptions of this nascent space.

This is slowly changing, but we’re still far from mainstream adoption. Alas.

Additional thoughts

Disregard what the (uninformed) masses are doing and judge Bitcoin on its merits.

No risk = no reward, but never bet the house on it, unlike this Dutch family who literally did that; talk about having cojones.

In some ways, we’re heading in the right direction in terms of mainstream adoption.

However, I am not fond of institutional investors gaining further control of what was initially designed to be a peer-to-peer electronic payments system that could bypass financial institutions, as per Satoshi Nakamoto’s original vision.

It is already disheartening for many everyday investors aiming to get their hands on just a million satoshis (i.e., 0.01 BTC) when there are whales who own thousands of BTC.

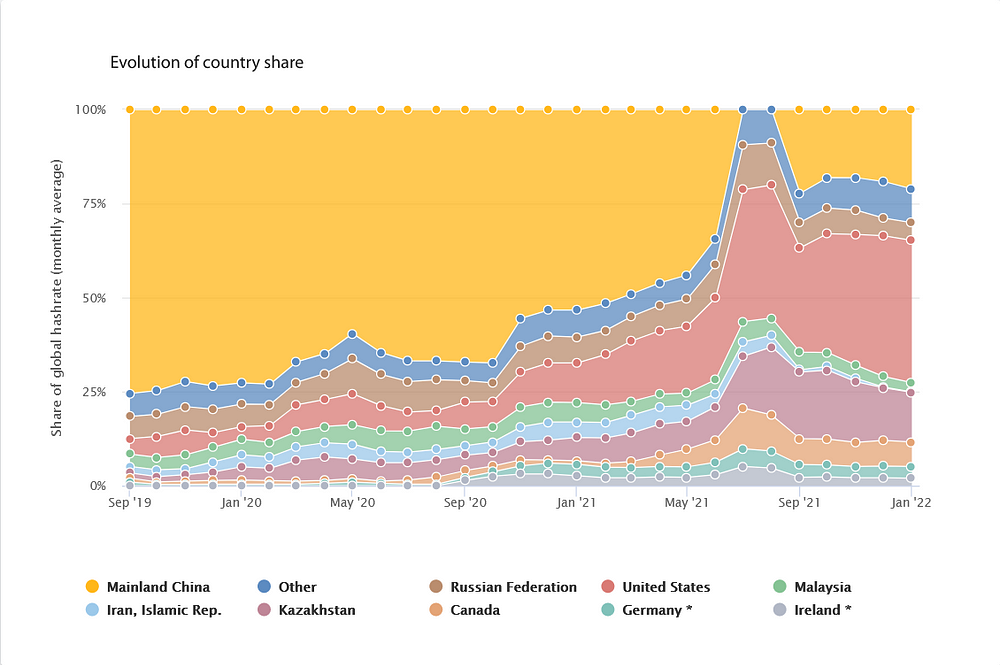

There’s also the issue with mining centralisation, mostly from a geographical perspective. Historically, China called the shots regarding BTC mining dominance, but now it plays second-fiddle to the United States.

* (Taken verbatim from the CBECI website) To our knowledge, there is little evidence of large mining operations in Germany or Ireland that would justify these figures. Their share is likely significantly inflated due to redirected IP addresses via the use of VPN or proxy services.

While it sounds great that the US now has the largest share of Bitcoin hash rate, no country should have this dominance. Bitcoin is a distributed system, and this should also apply to its hash rate, both geographically and the number of companies involved in mining BTC.

The fact that India — the world’s most populous country — is not even listed here is astonishing (to put it politely). Yes, I know that its government has been antagonistic towards Bitcoin — let alone other digital assets — which is a major reason for its absence on this chart.

As an alternative to spot Bitcoin ETFs and the consumer safeguards they offer, I believe there will inevitably be a system whereby centralised exchanges will offer a form of insurance to retail (and institutional) clients, akin to FDIC coverage for the USD.

I covered this in a separate article, so I will refrain from repeating too much info. It would (initially) involve one or two entities offering coverage for BTC, ETH and XRP holdings, up to certain amounts.

I envisage a two-tier insurance system covering these assets as a complimentary service up to a certain USD value. For greater coverage, there would be a monthly or annual insurance fee.

I am all for giving people options, and listing spot Bitcoin ETFs will (eventually) add liquidity to this market. It will most likely contribute to higher BTC prices if it were to replicate trends after spot gold ETFs went live in the early 2000s. So, I am not complaining.

In summary, the eventual listing of spot Bitcoin ETFs — whenever it’s official — will be a major milestone for the foundation cryptocurrency, which marked its 15th birthday last week.

I expect trillions of extra dollars flowing into the space by the end of next year, onboarding tens of millions of investors who prefer the simplest way to get BTC exposure. I say “extra” as this is on top of the money going into the market via exchanges.

With the imminent ETF approvals, Bitcoin’s 2024 Block Reward Halving and interest rates likely to go down this year, brace yourselves for some overwhelming price action over the next 12–18 months.

Disclaimers

• N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

• The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

• Please do your research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

• For transparency, Bitcoin (BTC) accounts for roughly 25% of my crypto portfolio. Way too little for some and too much for others.