YouTube needs to crack down on this and assign more resources to stamp this out.

The evolution of AI in recent years has led to more convincing videos being distributed on various social media platforms to entice people into certain traps.

Today’s scam in focus involves AI-generated voice and video to convince people to send X amount of BTC, ETH or another digital asset to a wallet and “you will receive double the amount”.

The common denominator is to “maximise your profits” and generate X% of returns on your initial investment, often at regular intervals. Some of these involve you sending x amount to a wallet, and you will “receive double in return.”

I admit most of you here would identify this scam in a heartbeat. No rational-minded person would fall victim to this.

It often involves using a (co-) founder’s voice and, with the power of AI, replacing what was actually said in front of an audience with something bogus.

Unfortunately, many people still do. In some cases, there are people in a vulnerable financial position who naively or desperately want to believe in what they see and hear.

If others have made a quick fortune — often by investing in meme coins or, as a more relevant example, receiving airdrops — who’s to say it’s too late for them?

I will refrain from naming specific projects or people, as the general nature of the scam is more or less identical, regardless of the coin or token involved.

For those who don’t get it, who the f#$k would straight-up give you double the amount you’re sending them?

There are exceptions with generous people on social media, but these are rare in the grand scheme of things.

On top of this, remember that these philanthropic individuals are public figures who can be easily identified and rarely hide behind a façade.

With the increasing prevalence of deepfakes and AI-generated voices, not to mention more sophisticated schemes nowadays, you need to be extra vigilant, particularly regarding crypto.

The other popular one doing the rounds is using famous, ultra-wealthy individuals to promote trading bots to give the average Joe or Jane the allure of “legitimacy” to said product.

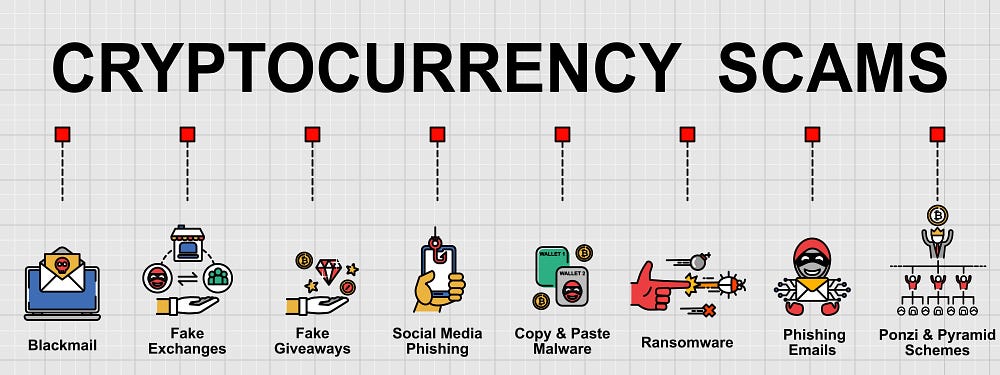

Beware of phishing emails

You will likely receive fraudulent crypto-related emails if you’ve been a data breach victim, especially if it involved a crypto company that got hacked at some point.

Most of these emails usually feature at least one of the following topics:

- “Your wallet has been hacked/compromised. Action is required.”

- A prompt to carry out a software update

- Someone claiming to be from an exchange and that you must verify details, or your account will be suspended. Note the urgency in their message.

- Free airdrops

More often than not, you can easily check to see if an email is from a legitimate source by noting the sender’s email address.

While it is not a foolproof method to remain safe, it gives you a good idea upfront if it is from a reputable sender, as many fraudsters resort to using an email address that bears no resemblance to an official email from a trustworthy crypto service.

On this note, as a crypto PSA, never, under any circumstances, share your recovery seed with any unknown people requesting it. Only you or, if you’ve made arrangements in advance, a trusted custodian (i.e., an individual) you know in person should have access to this.

Bots, left, right and centre

Bots have been flooding the comments section, bypassing YouTube restrictions or spam filters for several years.

I understand it is difficult to keep up with all of these, but YouTube is not doing enough to clamp down on this issue and is relying too much on individuals to report these bogus comments.

Regarding Medium, this platform has done a good job stamping out bogus comments and removing fake accounts, at least from my experience. Yes, I expect this to be difficult to manage during a bull market, as it often relates to a surge in spam comments.

It remains miles ahead of YouTube because it does not have ads and has stricter rules surrounding affiliate links/promotions, thus significantly reducing the risk of falling victim to bogus schemes. Yet, there’s always room for improvement.

I used to report comments as spam on YouTube, but I quickly realised my efforts were futile, and I imagine many others feel the same way, thus allowing the bots to flood the comments section.

on

.

Solutions

Let’s end this on a positive note by noting the ways to identify and thus avoid any bogus schemes and fraudulent crypto assets.

The simplest way to approach this is to ask yourself, “Is this too good to be true?”

More often than not, it is.

I acknowledge that many distributions in the space (e.g., airdrops, staking rewards, yields from lending assets, etc.) are usually legit. However, it would be best to be careful with the former, as there are also garbage airdrops out there).

However, here are some of the biggest red flags to look out for when dealing with any of these:

— The idea of guaranteed returns: “You can double your investment in one month”, or “20% guaranteed each month”, etc.

This is straight-up BS, as there are no guaranteed returns in crypto. Yes, you get exchanges that offer stablecoin and crypto lending APYs, but they never “guarantee” that returns at X%. Rather, you will often see “up to” a specified rate, and the realised return will likely be less than that.

— Pressuring you into buying a product: There are a few occasions where desperation leads to good outcomes.

If someone’s really in your face about convincing you to buy something, the product or service is probably terrible, or they’re giving me the impression that they’re on the cusp of losing their position because of insufficient sales.

If you want to see multiple examples of desperate scammers, I highly recommend watching Kitboga’s videos.

— Overly enthusiastic content creators eagerly promoting some random crypto without sufficient research across multiple (reputable) sources.

You’ve seen the clickbaity thumbnails, laser eyes, gaping mouths and other cringy measures people use to get your attention.

I get it. Good and bad content creators often resort to this to appease the algorithm and stay ahead of the game.

Just be careful with anyone pushing just one or two micro (dare I say, nano?) caps with less than $2M in circulating market cap. These will often be (at least in the early days) extremely volatile and controlled by a handful of people who can easily manipulate the price.

In other words, it is mostly a pump-and-dump scheme, and it will take time to determine whether the said asset has longevity and a reliable, knowledgeable and (preferably) experienced team behind it.

Fortunately, there are resources to help us ascertain whether a protocol and its corresponding coin/token are genuine or not. DEX Tools, Moralis Money and Dapp Radar are examples that constantly track on-chain metrics such as the number of unique wallets, buy/sell volume ratios over different intervals, buy/sell number of transactions, trust scores derived from third-party audits, etc.

If in doubt, always seek an additional opinion (on top of your research) to verify whether something is legitimate.

This updated piece from Investopedia provides good insight into how to spot popular crypto scams out there.

How to report scams and related resources for your country/region

United States

- Department of Justice (Criminal Division) > Crypto Enforcement

- USA.gov portal on finding the right place to report a scam. This is also available in español.

- Federal Trade Commission (U.S. FTC) > Report fraud

- Commodities and Futures Trading Commission (CFTC) > Investor Alert: Watch Out for Fraudulent Digital Asset and “Crypto” Trading Websites

Canada

- Canadian Anti-Fraud Centre > Recent scams and fraud

- Canadian Centre for Cyber Security > Report a cyber incident

Australia

- ScamWatch > Report a scam

- Moneysmart > Crypto scams article

United Kingdom

- UK Financial Conduct Authority (FCA) > Crypto investment scams article

- UK FCA > Report a scam

- UK Government > Avoid and report internet scams and phishing

Republic of Ireland

- Banc Ceannais na hÉireann (Central Bank of Ireland) > Avoiding Scams and Unauthorised Activity

- An Garda Síochána (Ireland’s National Police and Security Service) > Cyber crime and Fraud Advice — Cryptocurrency

In Europe

- Europol > Report cybercrime online (covers all of the EU countries and the UK)

- National Cyber Security Centre (NCSC) for Switzerland

- Politiet (National Cybercrime Centre) for Norway

Further reading

Disclaimers

• N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

• The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

• Please do your own research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.