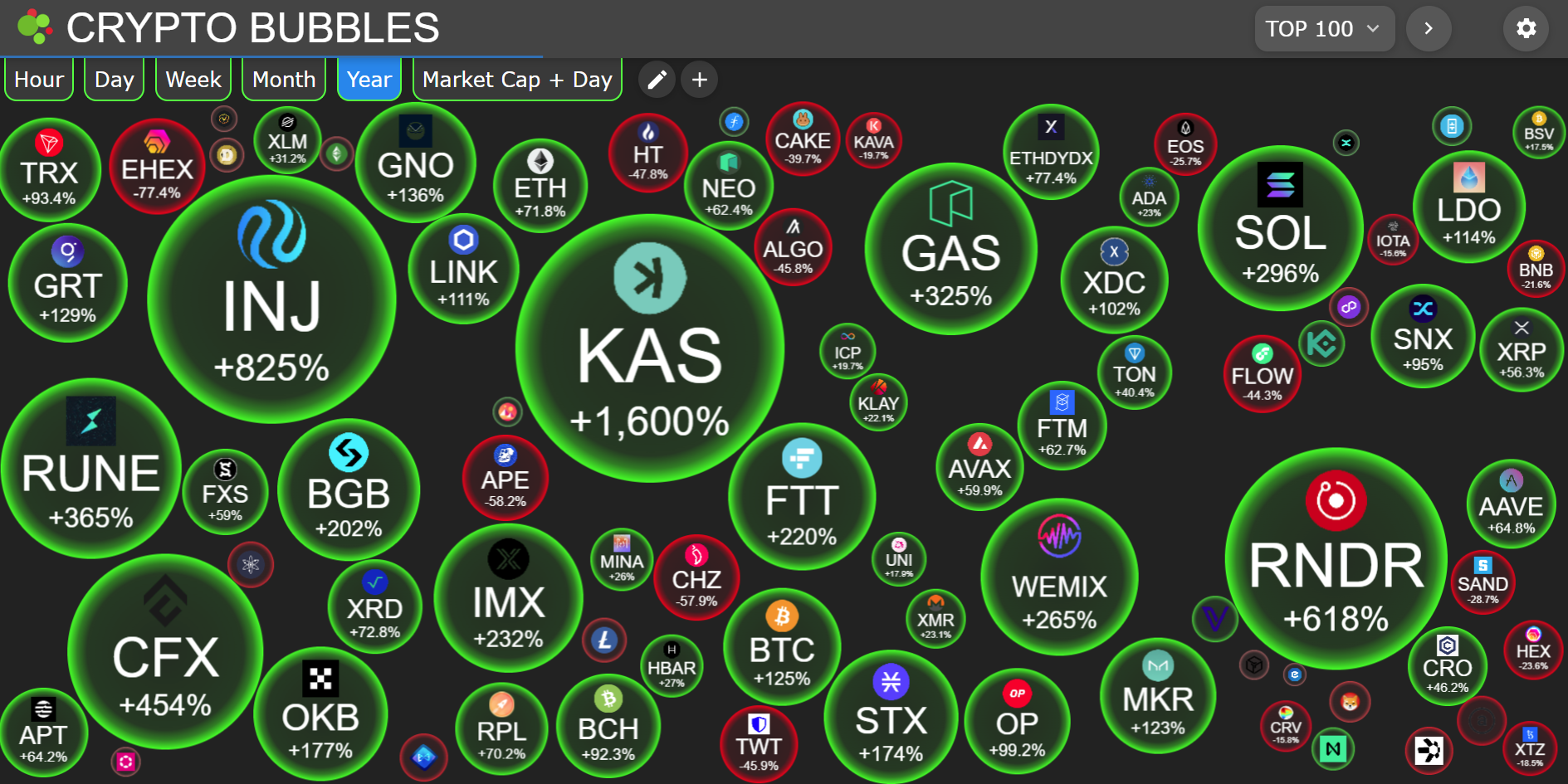

The best-performing top-100 crypto asset shows little sign of stopping.

As we start gearing up for what many consider a massive 2024 for Bitcoin and the entire crypto space, some altcoins and tokens have already delivered solid returns for their asset holders since the start of this year.

The one leading the pack is Kaspa (KAS), which has generated a whopping 1,600% ROI (17x) over the past 12 months. Even more impressive is its 77,000% growth since launching in June 2022 during a bear market.

Before we get ahead of ourselves and begin throwing around price predictions and targets, let’s backtrack and gain an understanding of this project.

What is Kaspa?

Those behind this protocol claim it to be “the fastest, open-source, decentralized & fully scalable Layer-1 in the world.”

Unlike Bitcoin – which relies on the Nakamoto Consensus (NC) algorithm (a type of proof-of-work [i.e., mining] consensus system) – Kaspa adopts another mining-related setup, the GHOSTDAG (Phantom 2.0) mechanism.

Imagine all of the benefits listed above, coupled with the robust security of Bitcoin and ultra-cheap (0.001 KAS) fees.

This differs from a conventional blockchain – a sequential chain of records that cannot be altered (immutable) – using a blockDAG instead. The latter involves a system of connected transactions linked to others, like a web.

For a good overview of blockDAG, I recommend this post from TheCryptoLord on Binance Square.

I have included a snippet of the visualiser displaying Kaspa’s GHOSTDAG.

Here's a snippet of Kaspa's GHOSTDAG (blockDAG) visualiser.

Check it out in real-time at https://t.co/BXPibZKbzt#Kaspa pic.twitter.com/KxOCdRcrTE

— Crypto With Lorenzo (@CryptoLorenzoAU) November 28, 2023

What is the benefit of this over Bitcoin’s NC? The first advantage here is speed. Kaspa can boast faster transactions without compromising security, according to its website.

“Kaspa is unique in its ability to support high block rates while maintaining the level of security offered by the most secure proof-of-work environments. Kaspa’s current mainnet operates with one block per second.”

Meanwhile, Bitcoin’s block generation time is approximately 10 minutes, handling about four transactions per second (TPS) on average. Despite this, it has strong network security and has maintained a 99.988% uptime since launching in 2009.

Besides GHOSTDAG, Michael Sutton and Yonatan Sompolinsky – leading developers and researchers for Kaspa, of which the latter is also the project’s founder – are working on DAGKNIGHT. This new ordering system can adopt transaction confirmation times based on Internet speeds, thus improving network conditions for miners.

Check out this post for a useful rundown of GHOSTDAG and DAGKNIGHT.

For your reference, DAG stands for directed acyclic graph, representing another form of distributed ledger technology, with blockchain tech being the most renowned type of DLT. Some notable projects that use DAG include Hedera, Fantom and IOTA.

While blockchain’s Proof of Work mechanism has flaws like high fees and slow processing, DAG benefits enable parallel and stream processing, the elimination of middlemen, and the involvement of all users in consensus. IOTA blog

Very regularly, I hear around that $KAS is good, but it doesn't have ''SMART CONTRACTS''.

First of all, smart contracts are BOOST to a project, not a necessity. Some people need to reconsider why they are in the crypto space.

The goal of #Bitcoin was to create a fair monetary…

— Crypto Chrys 𐤊 (@CryptoChrys17) November 11, 2023

Source: Crypto Chrys on X (Twitter)

Much of this is warranted, especially with the high network fees on both blockchains when they’re heavily congested.

If Bitcoin and Ethereum (let alone any blockchain) want to be the top dog, then they have to successfully overcome the trilemma, particularly with the major uptick in network activity (once again) forecast for 2024 and 2025, as we gradually re-enter a fully-fledged bull market.

These chains’ L2s will need to step up and compensate for the slow L1s when another iteration of the NFT craze comes around, let alone a tonne of DEX trades, DeFi activity, play-to-earn, etc.

This short video (apparently recorded in 2015) features this Ethereum dev speaking about GHOSTDAG and its benefits over Bitcoin’s NC. Vitalik Buterin also referenced Sompolinsky – one of the creators of (PHANTOM) GHOSTDAG – and GHOST in the Ethereum whitepaper well before Kaspa existed.

The undisputed top-100 altcoin king of 2023, unless it tanks or another altcoin/token does ballistic in the coming weeks. Source: Crypto Bubbles. Screenshot taken on 24 November 2023.

KAS tokenomics and price history

The token (rather, coin, as it is the native asset of Kaspa, an L1) has a circulating and total supply of 21.647 billion, with a max supply of 28.5 billion coins.

Even when accounting for the fully diluted market cap of approximately $3.63 billion, KAS still has plenty of growth potential. This figure is a fraction of nearly $3 trillion of money injected into the overall crypto market at its peak in November 2021.

This is set to grow much more (even when accounting for inflation), and I imagine KAS will benefit from these additional cash flows.

It is trading at 13 cents per coin and close to its all-time high of 15 cents set last week. As I alluded to earlier, this has experienced a meteoric rise since launching at a fraction of a cent ($0.0001838, to be exact)—hats off to anyone who got in early and is still holding.

KAS/USD historical prices and 24-hour volume (column graph). Snapshot taken on 24 November 2023. Source: CoinGecko.

Similar to BTC, it has a pre-programmed reduction in inflation over time, with a specific maximum supply. Every month (except for the first six), the inflation rate has dropped steadily and will continue declining until we hit the maximum in 2037.

For context, 1.314 billion KAS were released monthly for the first six months. This will dwindle to a meagre 37,412 coins by April 2037.

As a result, this will incentivise people to hold their KAS and (like BTC) will force miners to be as efficient as possible in light of lower mining rewards and an increasing hash rate, all of which can be monitored in real-time at the KAS FYI Explorer.

For further details about KAS, see the Kaspa Emission Schedule table. For more information about its Tokenomics, go to the related tab via the official Kaspa website.

___________________________________________________________________________

Another 17x in 2024?

How likely will KAS replicate its 2023 success going into 2024? I am 50/50 about this. While I believe it is still destined to succeed and outperform most crypto assets, I doubt we will get another 17x in 2024, possibly by the end of 2025, but by December 2024, that’s a stretch.

Why? Its circulating market cap would have to reach roughly $47.45 billion, assuming another 17x from now.

It’s not that KAS doesn’t deserve to hit this amount; I believe it does. Rather, it will face resistance from those strongly in favour of BTC, ETH or another blockchain.

However, to see it from the bright side, we could have more people switching from BTC, ETH or another asset to KAS, but the lack of support from crypto exchanges and hardware wallets will temporarily stifle its rise.

If people are given more options to buy KAS (I will expand on exchange and wallets later), coupled with an explosive market-wide bull run in the latter part of 2024, I believe KAS could approach that MC.

Is it worth investing in? Absolutely. Some skin in the game is better than nothing.

Then again, anything could happen in a bull run—case in point, Shiba Inu (SHIB). In 2021, it went from $3.4 billion on 3 October to $36.9 billion on 31 October, whilst the entire crypto market was pumping.

Never underestimate pumpamentals in crypto.

As greed usually gets the better of us, people will be more inclined to take profits in mid-cap cryptos and put some of them into other micro- and small-caps.

A portion of altcoin (including KAS) holders would prefer to cash out or even take profits in BTC, ETH or another large-cap as a bull run begins to lose steam.

So, factor in all of this before throwing money into KAS. Timing is crucial here, notably amid a bull run. Fortunately, we’re still in an accumulation phase, or at best, the early stages of a bull market.

Partnerships and news

Last week, Kaspa announced its bridge with Polygon and BNB Chain, utilising the Wrapped Kaspa (wKAS) token, whose value is pegged to the original coin.

This builds on a major collaboration forged earlier this year, when wKAS was created to act as a custodial bridge with Ethereum, allowing you to exchange with the plethora of ERC-20 tokens around.

This will give the ecosystem access to an increasingly popular and growing DeFi system across other coins and tie in with the broader need for cross-chain interoperability. This improved connectivity will facilitate the flow of liquidity between these different ecosystems, thus boosting KAS’ usage.

————————————————————————————————————————–

Kaspa x Topper

Earlier this month, Topper (owned by the popular US-based Web3 platform Uphold) announced a partnership with Kaspa.

The payment widget acts as a fiat on-ramp for its users, simplifying the process of buying, holding and trading crypto, precious metals and other commodities, all in one app.

🔥The @UpholdInc news keeps flowing today! Thanks to #Topper by #Uphold, you can now buy $KAS directly via the website, https://t.co/G8dXFqAePB.

• Set your purchase amount

• Select $KAS

• Select fiat currency

• Enter your wallet address

• Click Get Started

• Finalize on… pic.twitter.com/qBog8rvKio— Kaspa (@KaspaCurrency) November 15, 2023

In a more recent post, Uphold tweeted Topper’s latest integration into Apple Pay, making it even easier to interact with over 200 cryptocurrencies on the widget, including KAS.

As Kaspa continues to forge alliances and KAS is supported on more crypto exchanges, it will pump even more liquidity into its ecosystem.

Regarding major exchanges, it is surprising to see KAS still not available for trading on Coinbase, Kraken and Binance, per CoinMarketCap’s KAS Markets tab. None of these supports the coin, which is a big surprise.

On a positive note, this presents even more opportunities and should boost KAS’ price even more. When announcements are made about its eventual listing on these platforms (I believe it’s a matter of when not if), this should lead to price pumps, at least in the short term.

Besides centralised exchanges, Kaspa listings on decentralised exchanges (DEXes) will also be major news whenever the time comes. One, in particular, will be KAS’ listing on THORChain, a useful DEX that allows for fast cross-chain coin and token swaps.

Two exchange platforms featured by Kaspa to purchase its coin are changeNOW and SimpleSwap.

Ongoing improvements on Kaspa

Per the project’s developments page, here are a few improvements to look forward to that are currently in the development and testing phase:

– Integrating the DAGKNIGHT protocol into its consensus layer (as a hard fork).

– Rewriting Kaspa’s programming language from GoLang to Rust. Adopting the latter will reportedly help the chain process more blocks per second to eventually hit 100 BPS.

– Plans to launch smart contracts on Kaspa, as covered in this article.

– General measures to increase BPS and TPS.

– Making Kaspa (KAS) compatible with Ledger wallets.

Having this available for storage on Ledger devices is a good start regarding hardware wallets. Still, I hope Kaspa also works with Trezor and other manufacturers/wallet providers to include a broad range of users, particularly those seeking alternatives to Ledger devices.

For more comprehensive information about this chain, I recommend reading various publications by the experts behind this project, alongside following Kaspa’s blog and social media pages (details below).

Additional thoughts

Full credit to the developers and other stakeholders behind Kaspa. What they’re working on appears to be a viable alternative to Bitcoin in terms of processing ultra-fast transactions whilst still using a mining mechanism.

With how BTC has panned out in recent years, there is the ongoing debate of whether the Bitcoin community should push to have it as a store of value or opt for vast improvements to transaction speeds and fees as a viable form of payment globally, even for micropayments.

I am aware of the push for Lightning Network on Bitcoin. However, there’s been slow progress on this off-chain scaling solution since it was first proposed in January 2016. LN or a similar layer-2 (L2) will eventually take off.

There is room to accommodate both Kaspa and Bitcoin moving forward. Each may focus on a niche or readily coexist as distributed ledger technology (blockchain, DAGs, etc.) becomes mainstream. It will be good to see interoperability between the two networks.

Considering KAS’ minuscule market cap compared to BTC, its potential upside is enormous, with plenty of promise for BTC’s price as well.

In terms of KAS being a top-10 crypto, it is worthy of it. Several crypto assets in the top 20 (based on circulating market cap) don’t deserve the money and recognition they get.

With ongoing partnerships, wider coin adoption, a growing community and protocol improvements, Kaspa will become a mainstay in this space.

Ways to stay in the loop with Kaspa (KAS)

– Official website

– Whitepapers

– X (Twitter)

– News and blog

– Kaspa Foundation

– Discord

– Reddit

– Telegram

– Kaspa Developments page – updates for new features and improvements

– Kaspa WIKI knowledge base

– Kaspa GitHub repositories

– Block explorer

Additional resources

– N.R. Crowningshield is a Medium writer who has covered Kaspa comprehensively across more than 100 articles related to this crypto project. Two pieces that stand out are ‘Kaspa: The Best of Bitcoin and Ethereum’ and ‘Chapter 2: Bitcoin and Ethereum: Creating Solutions and Unveiling Problems.

– Crowningshield also released The Book of Kaspa: Realizing the Nakamoto Dream as an audiobook via Audible.

– Check out the ‘This Is HUGE For Kaspa!’ YouTube video by Tactical Investing for a great protocol overview, including KAS mining information.

– Who accepts KAS payments? This is the official list of merchants accepting the coin.

Important PSA

For anyone new to crypto, please beware of any tokens (besides wKAS) that are variants of KAS or anything bearing the Kaspa name. These are likely scams, as with several spin-offs of popular coins and tokens across the crypto market. Always double-check what you’re investing in and (as a bare minimum) do some basic research.

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your research before investing in any crypto assets, staking, NFTs, or other products affiliated with this space.

- For transparency, Kaspa (KAS) accounts for a tiny portion (<0.1%) of my crypto portfolio. However, I will gradually increase this. Bitcoin (BTC) and Ethereum (ETH) still account for half (25% each) of my overall crypto holdings.

Featured image courtesy of Kaspa media kit.