“Bitcoin is too expensive now at $36,000.”

“I missed the boat on Bitcoin. It’s too late now.”

“The bubble has burst. What’s it at now, 15K?”

“Bitcoin is BS; crypto overall is a scam and a get-rich-quick scheme.”

Over the years, I have spoken to many people through work and leisure, and these are some of the most common excuses I’ve heard about Bitcoin and altcoins.

There is some truth regarding scams in crypto. Still, it is just as foolish to paint the entire space with the same brush as it is to fall for a rug-pull altcoin/token.

Oh, and the one about Bitcoin mining being bad for the environment because of its electricity demands. How could I forget this one?

I’ll call BS on that one. If you beg to differ, I have written articles about this FYRP.

To cut to the chase and put it bluntly for you:

– Price and value are two different things (I will expand on these later);

– As per its setup, THERE. WILL. ONLY. BE. 21. MILLION. BITCOINS.

– There are two multinational companies priced at over $60,000 per share. Examples?

– Berkshire Hathaway Inc. (BRK-A) @ $547,800 per share;

– Lindt & Sprüngli AG (LISN.SW) @ ~$122,260 (108,000 CHF)

Have people stopped buying these because they’re too expensive? No. These are still appealing to shareholders seeking more consistent yet modest returns.

Investors in the legacy financial system don’t seem to bat an eyelid regarding these high prices.

I acknowledge that most of these debuted with high stock prices (over $1,000). However, these are still growing year-over-year (YoY).

What does this indicate? Despite the sky-high stock prices, people still hold their shares, and institutional investors and funds are still buying these assets.

Let’s not forget gold, valued at $1992 per ounce (~$64,000 per kilogram).

Has this stopped people from continuing to purchase the precious metal? No.

On the other hand, what about Bitcoin? Don’t be ridiculous. This “digital gold” is way too expensive despite clearly defined inflation rates and capped supply.

————————————————————————————————————————–

Let’s touch on market caps.

Bitcoin’s circulating market cap is ~$544 billion versus gold’s $12.504 trillion, 23 times larger than the former.

Apple, Amazon, Microsoft and Google (Alphabet) have market caps beyond $1.5 trillion, with Apple and Microsoft boasting an enviable $2.97 trillion and $2.8T valuation, respectively.

Yes, you could argue that these companies generate value through their products and services offered worldwide, not to mention ongoing R&D for continuous innovation.

As per Bitcoin (BTC), more people will appreciate its value as it gradually becomes more integrated into our daily lives.

To paraphrase Elon Musk, let that (all) sink in.

On the topic of Musk, who often speaks about the following matter: global population.

8 billion people….21 million BTC.

Please do me a favour, and remember this number: 0.002625.

WTF is this? It represents the amount of Bitcoin each person would have if it were evenly distributed, assuming a global population of 8 billion.

0.002625 BTC.

Let’s break this down even further.

The global population is set to grow to 9.7 billion in 2050, possibly more than 2100.

Source? Here you go.

Bring this down even further….0.0021 BTC per capita for about 10 billion people.

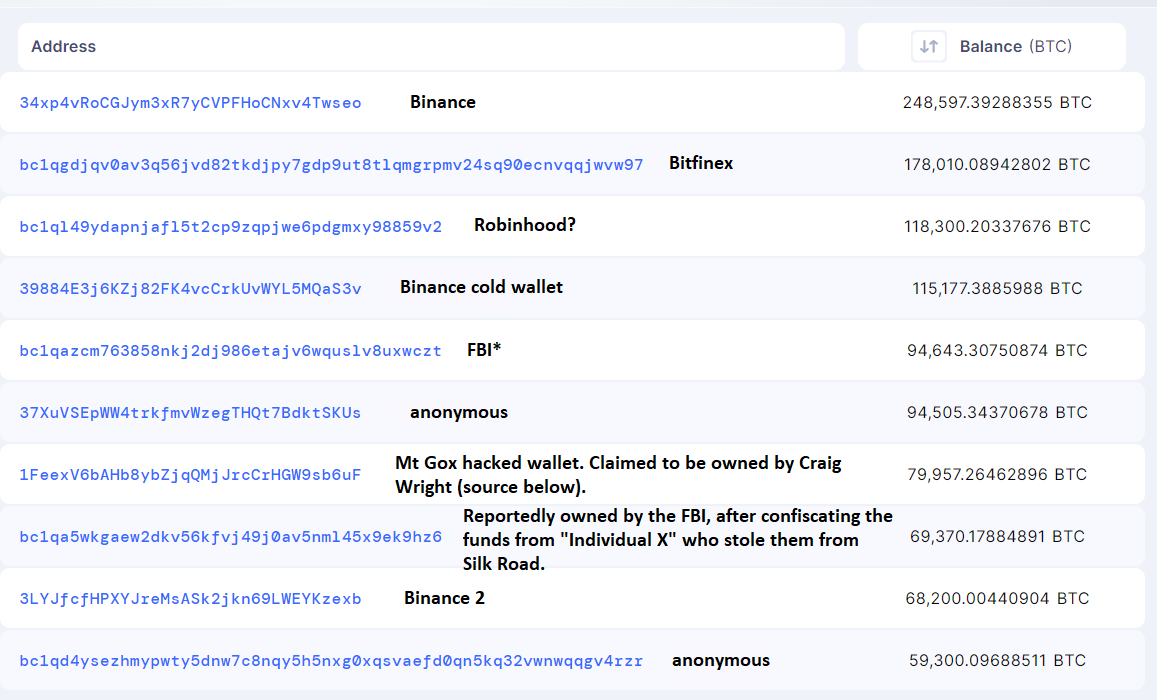

To avoid bombarding you with calculations, the point here is that there is far less BTC available per capita when you include the Bitcoin Rich List, whales that control vast amounts of coins (both individuals and companies) and over four million BTC lost forever.

Addresses and balances table obtained from Blockchair. Balances correct as of October 30, 2023. Wallet ownership details added by the author.

Addresses and balances table obtained from Blockchair. Balances correct as of October 30, 2023. Wallet ownership details added by the author.

Sources for the following addresses:

* bc1qazcm763858nkj2dj986etajv6wquslv8uxwczt— FBI

1FeexV6bAHb8ybZjqQMjJrcCrHGW9sb6uF — Mt Gox and Craig Wright claimed ownership

Bc1qa5wkgaew2dkv56kfvj49j0av5nml45x9ek9hz6 — “Individual X” and Silk Road

The scarcity just keeps on rising…and rapidly.

The 2024 Bitcoin Block Reward Halving will halve the amount of Bitcoin entering circulation daily.

Currently at 900 BTC, a meagre 450 coins per day will enter circulation from April 2024…for the entire world, until the last BTC is mined, estimated to occur by 2040. In 2028, this will halve again to 225 BTC, and so on.

What really brings this all home is Bitcoin’s illiquid supply, i.e., not readily available for trading through an exchange, with little to no intention of selling it in the short term.

This figure is 15.4 million BTC (as of November 8), roughly 78% of its circulating supply. The so-called supply crunch has only intensified recently, as the same metric reportedly hit a record high of 72% in June.

Both of these linked sources used data from Glassnode, a leading company in on-chain market intelligence, which is frequently quoted by Bitcoin/crypto market analysts.

This is a bullish sign for BTC as we begin to move out of an accumulation phase into the beginning of a major bull market for the entire asset class, forecast for 2024 and 2025.

All of this boils down to supply and demand. Provided that Bitcoin’s network strength continues to grow (as per its hash rate) and it remains decentralised (with over 16,000 reachable nodes to help verify Bitcoin transactions and maintain a secure network), it is likely to see increased popularity.

Never underestimate BTC’s price growth

Bitcoin is returning to its fifth bull market since hitting the scene in 2009.

Price gains have happened like clockwork by meeting and or exceeding expectations based on technical analysis or, most famously, using PlanB’s Stock-to-flow (S2F) Model.

Stock-to-Flow model (grey) is prediction, because we know future S2F-ratio. Market Cycle model (color) is detection, because it's based on counting specific onchain txs, and we only know current (and past) utxo set.

IMO:

🔵 slow rise towards April 2024 halving

🟢 after halving pic.twitter.com/xKJ1qHwcpO— PlanB (@100trillionUSD) November 3, 2023

Source: PlanB on X (Twitter)

These factors will further accelerate Bitcoin demand:

– Impending spot Bitcoin ETFs, with over 12 companies waiting for application approvals from the US Securities and Exchange Commission (SEC).

– Massive growth in Bitcoin inscriptions (Ordinals, a.k.a. “Bitcoin NFTs”) since they hit the scene in January.

– El Salvador and the Central African Republic (CAF) adopting BTC as legal tender. Moreover, Argentina’s President-elect, Javier Milei, has a more favourable view of Bitcoin than most leaders worldwide. Other countries will eventually follow suit.

If Argentina – the second-largest economy in South America – were to adopt BTC as legal tender in the coming years, this would inject even more liquidity into the asset.

– Layer-2 improvements (whether this primarily involves Lightning Network or not, it is still TBC) and smart-contract functionality through protocols such as Stacks will further boost use cases on Bitcoin’s blockchain and more predictable transaction fees. ss

Considering that many of these things were not present in 2021 when BTC hit its all-time high of approximately $69,000, it is a cop-out to say the digital asset is overpriced and “I’ve missed the boat”.

How high could it get in the upcoming bull market? This is anyone’s guess, and no one knows.

At the very least, I’d expect it to double its all-time high, i.e., ~$138K, which is a plausible assumption when accounting for all the points I’ve made about supply and demand.

With BTC at about $36K, this is roughly a 4x. It’s not life-changing for anyone with BTC holdings, but it would still outperform most other assets.

Additional thoughts

“Gold has value, unlike Bitcoin.”

BS once again. BTC’s supply, demand, fundamentals, institutional adoption and investor sentiment (spot ETF hype anyone?) influence the digital asset’s value. Traits of money represent another point that’s often mentioned. Investopedia has written pieces about Bitcoin’s price and (intrinsic) value.

If you’re looking for compelling reasons why Bitcoin is better than gold and many other investments, Michael Saylor has ten.

Here’s one relating to gold:

“The problem with gold coins is that the gold coins will only be worth one-tenth as much in 100 years or in 50 years as it is today. And the other problem is I can’t easily move them around. I want to move $1 billion of gold from here to Tokyo, it takes three months and $5 million.

I can’t decompose it, and recompose it.”

What about fiat currencies, namely, the USD? Satoshi Nakamoto shared his/their two cents about the flaws in the legacy financial system:

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.

Satoshi Nakamoto, February 11, 2009.

___________________________________________________________________________

I am happy for you if you’re here and have some skin in the game. You are one of the “lucky” ones.

“Lucky”? I look at this from two different perspectives.

1) Fortunate to have the opportunity to have the disposable income in 2023 to buy and accumulate one of the most revolutionary forms of property in the 21st Century, unlike billions of people around the world who are struggling to get by.

2) On the other hand, you created your luck by giving this an opportunity when friends, family, acquaintances and the mainstream media belittled (and still mock) you for doing so.

People laughed at you, and now you’re having the last laugh. A toast to that. 🍷

__________________________________________________________________________________________

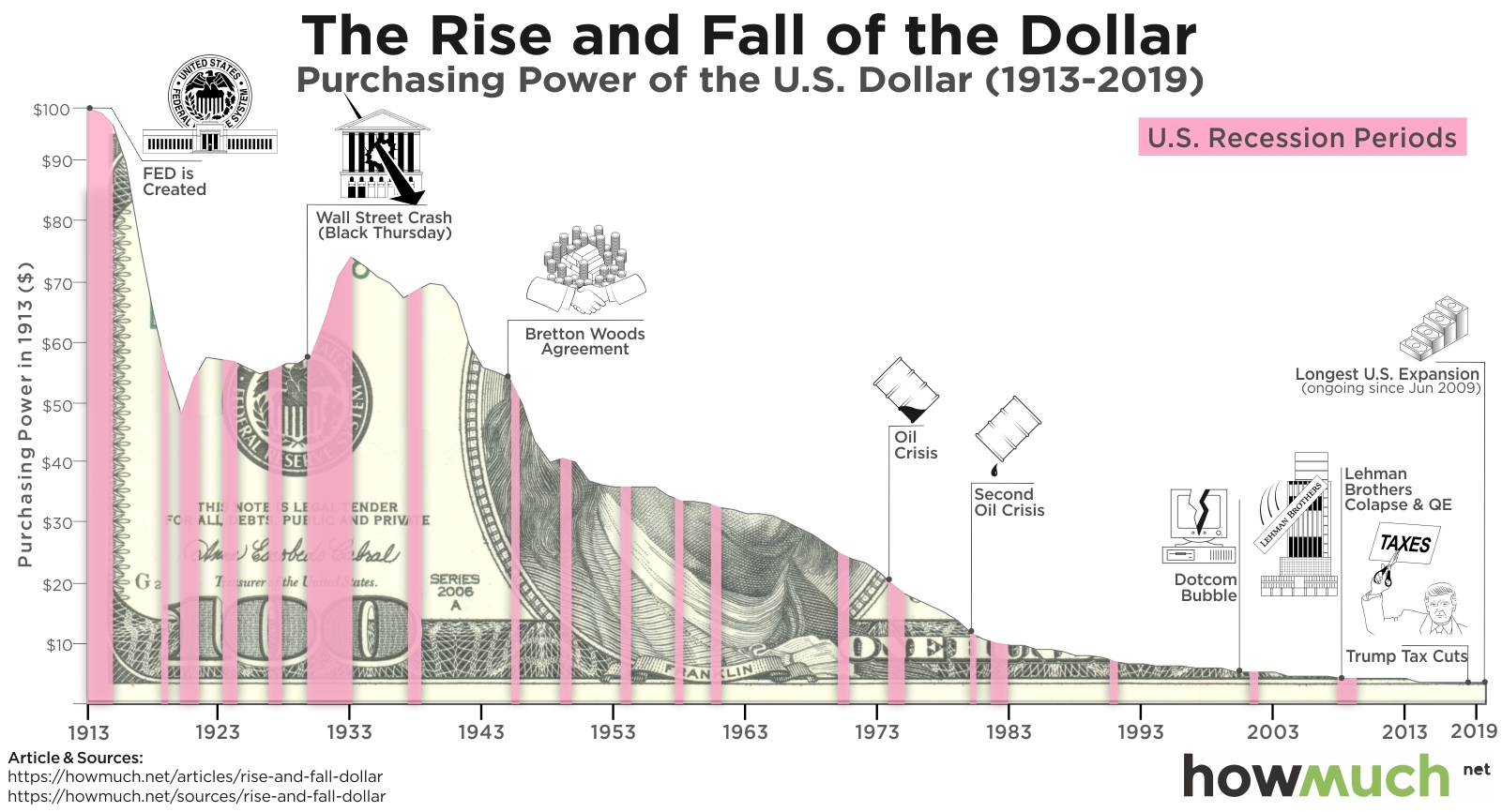

If Bitcoin is a scam, so is fiat currency, especially with (hyper) inflation swindling people YoY, particularly in recent times.

When your domestic currency is inflating over 50% in less than a year, quit telling us that the current system is working.

No, the US Dollar is no saint either. Its inflation rate – coupled with the gargantuan amount of public debt to GDP – leaves much to be desired, significantly eroding the USD value since The Fed’s creation in 1913.

I’ll give credit to gold where it’s due. It’s done a better job than fiat currencies in terms of holding value…but still has nothing on BTC. Alas.

Source: HowMuch.net, a financial literacy website. Click the image for a full-screen view.

As I wrap up, I am deeply disappointed in many people around me who still hold such an antagonistic view towards Bitcoin.

As a worst-case scenario, they could be mildly sceptical to neutral whilst still being respectful towards those willing to embrace a new form of property, technology, store-of-value or monetary system, however you perceive BTC’s role in society.

When BTC hit $1, most would have doubted it would ever hit $100, let alone come close.

When it hit $100, who imagined it would have reached $10,000?

It hit $69K, mostly with a lot of hype, partially attributed to the Elon Effect, which was mostly for Dogecoin (DOGE), but I digress.

Consider Bitcoin’s insane rise as a top-20 global asset in less than 15 years.

In conclusion, when you think about everything discussed here, never rule out $500,000, let alone the elusive $1,000,000/BTC.

Maybe I’m delusional, but these targets are not beyond the realm of possibility. After all, this space never ceases to amaze us, for better or worse.

Enjoy the ride.

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your research before investing in any crypto assets, staking, NFTs and other products affiliated with this space.

- For transparency, Bitcoin (BTC) accounts for roughly 25% of my crypto portfolio. Way too little for some and too much for others.

Featured image by phanurak rubpol via Shutterstock