How do you stay on top of your Bitcoin/crypto taxes and lower them?

Before continuing, I am more knowledgeable about the tax implications for crypto trading in Australia than in the United States. So, for the latter – which would apply to most of you reading this – I am relying on researched information instead of speaking from experience.

Despite this, these are all important considerations to make before executing trades. Why is this? There are similarities between capital gains tax (CGT) schemes in Australia, the USA and other developed Anglophone countries regarding short-term and long-term profits and losses.

Generally speaking, short-term gains are those made from assets that you held for less than one year, and these tend to attract a much higher CGT (often taxed as ordinary income) than long-term holds of more than a year.

So, what’s one set of trades that has thrown many people off guard?

Swapping from a native coin (e.g., BTC, ETH, BNB) to a wrapped token – one that is typically pegged to the coin’s price and is created to be readily traded on a DEX or to be used for liquid staking – is subject to capital gains tax (CGT).

To play devil’s advocate and to step into the government’s shoes, they could justify it as a taxable event as this is essentially earning passive income via liquid staking as opposed to obtaining rewards in the native coin, i.e., for certain ETH holders, ADA, BNB, and other proof-of-stake cryptos.

When Uncle Sam comes knocking at the door in need of your moolah, he’ll find a way to get it…and they need every dollar they can get to pay off over $33.7 trillion of national public debt.

Fortunately, there are always ways to reduce your tax obligations. More on these shortly.

How much will I have to pay in CGT for crypto?

For US residents, this is what you need to know:

You’ll pay up to 37% tax on short-term capital gains and crypto income and between 0% to 20% tax on long-term capital gains – although NFTs deemed collectibles may be taxed at 28%. The amount of tax you’ll pay on crypto in the USA depends on how much you earn, the specific transaction, and how long you’ve held the asset.

Danny Talwar, Head of Tax @ Koinly

You should always double-check information directly from government sources to verify claims made by tax advisors and similar third parties. For everything you need to know, consult the US IRS FAQ Guide on Virtual Currency Transactions and Digital Assets pages.

Koinly provides similar guides to those paying crypto taxes in Canada and the UK.

For Aussie taxpayers, this is when you have to pay crypto taxes:

In general, a CGT event happens when you dispose of a CGT asset. For the purposes of crypto assets, that may be when you:

-

sell a crypto asset

-

gift a crypto asset

-

trade, exchange, or swap one crypto asset for another

-

convert a crypto asset to Australian or foreign currency

-

buy goods or services with a crypto asset.

Australian Taxation Office (ATO), Australian Government

Another point the ATO left out is receiving “free” crypto – rather, earning it by holding it – in the form of airdrops, forks and staking (more on this shortly). These earnings also need to be declared. Airdrops and forks are not as common anymore but should still be declared where applicable.

Australia offers a 50% CGT discount for anyone holding crypto as an investment for more than 12 months.

Swyftx’s ‘Crypto Australia Tax Guide 2023’ provides a comprehensive overview of managing crypto taxes here.

As of November 2023, most countries worldwide will have at least one service to help you navigate crypto taxes. Find what works best for you.

For those of you residing in another country I have not yet listed, I have included a list of resources for other nations, as shown towards the end.

Image by fabrikasimf on Freepik

Airdrops, forks, staking and lending

The growing number of staking and lending services available throughout the sector across multiple assets provides us with additional opportunities to boost our portfolios further.

However, when calculating % gains or losses, you should also factor in tax.

This is inevitable if you’re going through a centralised exchange, as they would almost certainly be sharing this data with relevant tax authorities as part of their KYC AML obligations.

Fortunately, you can easily feed the information into crypto accounting software as transactions related to staking, airdrops, or lending should be included in the end-of-financial-year transaction list. Alternatively, you can connect to the accounting software via a read-only API.

CoinLedger and Koinly have guides about crypto taxes associated with lending and borrowing crypto, including going via DeFi.

Can you avoid paying crypto taxes?

It is difficult to avoid paying them outright legally, especially in 2023. However, one can take several legitimate measures to significantly reduce the tax paid on crypto earnings.

As a bare minimum, everyone should be exploiting the massive CGT tax concessions from long-term CGT gains, as covered earlier, not just for crypto but multiple asset classes. An exception here would be for experienced and successful day traders who can easily justify paying higher taxes for their generous short-term gains.

This illustrates the additional benefits of purchasing BTC/crypto during bear markets. Not only are you snapping it up for a discount, but you will also (most likely) benefit from CGT concessions by waiting to sell amid a massive bull run, often more than 12 months after a bear market.

Syla, a financial services company based in Australia, published this article about ways to legally avoid crypto tax Down Under.

N.B. I am neither promoting nor discouraging you from adopting these tax reduction measures. I am merely informing you about what is publicly available. You and your accountant are ultimately responsible for managing your (crypto) taxes within your jurisdiction(s).

Before continuing, I want to emphasise that going through a licenced, professional accountant is strongly recommended to manage any crypto taxes. This could be using your regular accountant or even a designated crypto accounting firm.

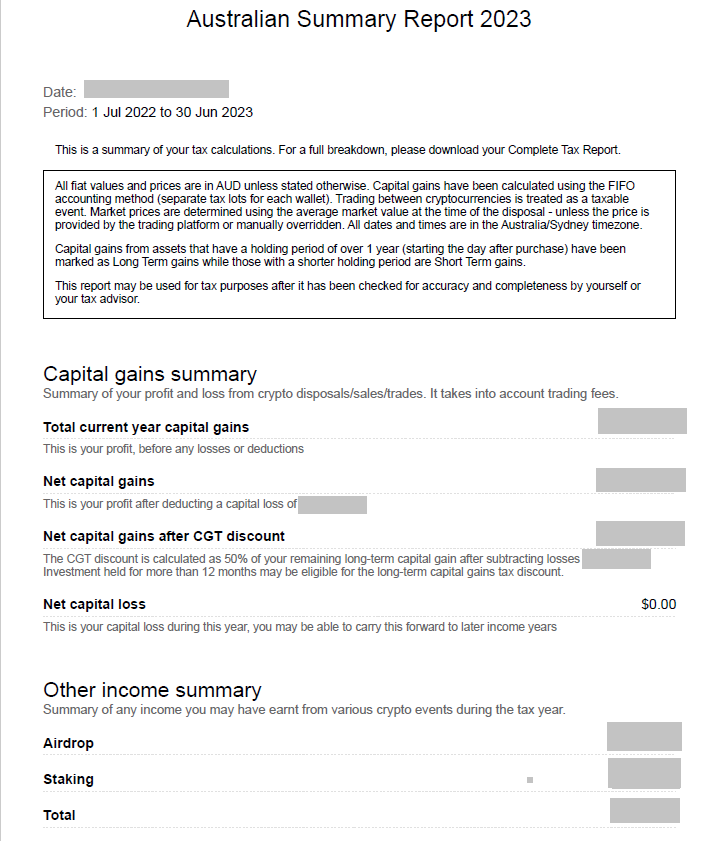

I have used Koinly to manage my crypto affairs for three years. They provide a neat summary (see below) showing all my gains and losses for the financial year, which I then pass on to my regular accountant.

For anyone with over 1,000 transactions per year (FYI, each staking reward counts as a transaction), using a designated crypto accounting service will save several hours of hassle doing your calculations.

A screenshot of my latest Koinly crypto tax report. This is the most basic report, but any licenced crypto accounting service will allow you to download comprehensive reports, including all transactions for a financial year. Source: Author.

With the comprehensive range of blockchain-tracing tools and the integration of personal data linked to transactions on various blockchains, good luck trying to avoid paying any crypto taxes nowadays.

In many cases, the fines for not declaring crypto income – at least doing so intentionally – are not worth the risk. As always, you do you, and you can simply ignore what I mentioned and tell me to F off; that’s also fine with me.

Final thoughts

During a crypto bull run, you need to weigh up whether it is worthwhile waiting until the 12-month period elapses to be eligible for major tax concessions on BTC/crypto trades or whether you cash out whilst the market is in an overbought phase (which is often a signal to take profits), even if this incurs higher taxes.

If you’re a country/region with a volatile local currency, consider the exchange rates when converting from BTC to your domestic currency via major fiat options such as USD, EUR, GBP, etc.

In summary, consider tax implications and market conditions before buying, selling, or converting BTC/crypto. This includes dealing with stablecoins or swapping BTC and ETH with their wrapped equivalents or, for the latter, liquid staking tokens.

Crypto-tax resources for other countries

– Ireland

– Germany

– France (French Government resource)

– Dubai – UAE

– Italy (a bilingual resource)

– South Africa

– Switzerland

– India (I also came across this Indian Government resource)

– Japan (resources in Japanese)

– South Korea (and Coindesk article)

– Brazil

– Nigeria

– Philippines

– Indonesia

– Vietnam

If your country wasn’t included, rest assured, I have no hard feelings towards it. 👍🏻

Affiliate link: Click this link to get $40 off your first order with Koinly. This is not paid advertising, but I receive commission from each successful referral.

Disclaimers

- N.B. None of this is financial or tax advice; I am neither a financial advisor nor an accountant. You are ultimately responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your research before investing in any crypto assets, staking, NFTs, or other products affiliated with this space.

- I received no incentive to discuss any entities listed throughout this article.

Hello, thanks for your feedback.

I use DreamHost. This is my affiliate link if you’re interested in supporting my writing.

http://click.dreamhost.com/aff_c?offer_id=8&aff_id=12056

Don’t forget to check out this piece to get free BTC/crypto when using the featured crypto services:

https://www.cryptowithlorenzo.com/2023/09/20/ways-to-support-my-crypto-writing-promotions-and-affiliate-links/

All the best to you!

Lorenzo