Debunking the claims being spread on social media and mainstream outlets.

“2% of wallets control 95% of Bitcoin”.

“0.01% of bitcoin holders control 27%”.

These headlines were prominent in the last bull run between 2020 and 2021. Recently, I have seen people on social media posting these or similar stats. I have also been guilty of this, as I didn’t analyse these claims.

Thus, it is time for me to set the record straight and provide you all with important context before circulating this (somewhat) misleading information.

This will become an increasingly popular topic of discussion as we return to another BTC and crypto-wide bull market….and crypto millionaires/billionaires will be minted (once again).

Before I begin, I am aware there is also the matter of a handful of companies dominating Bitcoin mining. I will cover this in future, as today’s focus is on the distribution of BTC across different addresses and how many coins the largest wallets own.

What information is being used to determine this (i.e., indicators)?

One of the key metrics used to measure this is the number of wallets holding a given range of BTC and as a percentage of total BTC holdings.

The key metric to determine the distribution of BTC wealth is the “Bitcoin Rich List”.

Source: BitInfoCharts. Snapshot taken on 3 November 2023.

However, it is important to note that Satoshi Nakamoto most likely has hundreds of Bitcoin addresses, each with substantial (USD-equivalent) holdings. For context, the genesis block address –linked to the first block mined on Bitcoin’s blockchain – reportedly has a 72.6 BTC balance.

Any reference to “Satoshi’s wallet” or any early Bitcoin adopter is a misnomer – they most likely have several wallets, which they should if they believe in decentralisation.

Who controls and/or owns the wallets?

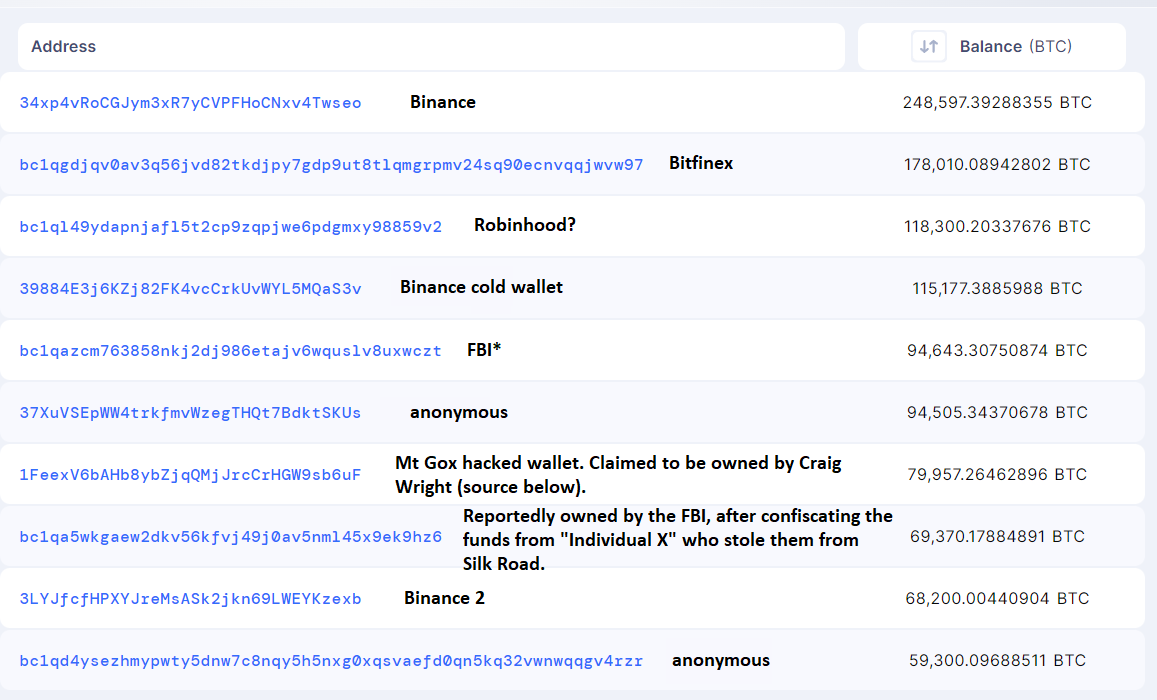

I found the entire list of Bitcoin addresses via Blockchair. Here is the top-10 list based on BTC holdings.

I obtained most of the information about account ownership through the Blockchain.com Explorer feature. Just copy and paste an address in the search bar, and you can see (for many BTC, BCH and ETH addresses) who controls them.

Sources for the following addresses:

* bc1qazcm763858nkj2dj986etajv6wquslv8uxwczt – FBI

1FeexV6bAHb8ybZjqQMjJrcCrHGW9sb6uF – Mt Gox and Craig Wright claimed ownership

Bc1qa5wkgaew2dkv56kfvj49j0av5nml45x9ek9hz6 – “Individual X” and Silk Road

It is important to make the distinction between control and ownership.

Strictly speaking, whoever controls the private keys – such as centralised exchanges that custody funds on behalf of retail and institutional clients – could theoretically run away with the funds. In reality, it is more difficult nowadays to get away with this and not face major repercussions (albeit still possible) due to greater regulatory oversight and more transparency on public blockchains (e.g., Bitcoin, Ethereum, Cardano, etc.). CHECK THIS

How do other coins and tokens compare to BTC when considering the top 0.1, 1 and 10% of wallet holders?

Despite a small number of BTC whales (relative to the billions of people who could hold some satoshis in a wallet), Bitcoin still has a far greater % distribution of coins across more wallets (and most likely more individuals) than other Proof-of-Work (PoW) assets such as Litecoin (LTC), Bitcoin Cash (BCH) and the people’s favourite, Dogecoin (DOGE).

Network and coin stats for BTC, LTC, BCH and DOGE. Snapshot taken on 2 November 2023. Source: BitInfoCharts.

Using the abovementioned data, the level of wealth concentration across various blockchains is concerning. This is not just from an inequality perspective but more for market manipulation.

If ten addresses control ~46% of DOGE’s circulating supply (most likely more by the time you’re reading this), then it is easier to have a coordinated pump-and-dump than for Bitcoin, even though whales still influence BTC prices.

To clarify, I am not saying that major DOGE holders – let alone any blockchain with a small number of dominant wallets – will carry out such a market move, nor am I making accusations about past actions. Rather, people who purchase these coins should always be mindful of this wealth concentration before purchasing and holding these digital assets.

What about Ethereum (ETH), Cardano (ADA) and other major blockchains? As expected, these also have their share of whales. It is important to remember that these blockchains run on Proof-of-Stake (PoS), unlike Bitcoin, Litecoin, Dogecoin, etc.

Why does this matter? ETH and ADA holders have delegated vast coins to certain wallet addresses (i.e., validators) to earn staking rewards.

When you see stats about wallet holdings for PoS assets and the wealth concentration of these coins, it is hard to tell (at face value) whether this data accounts for the number of wallets (and their individual balances) that have delegated ETH or ADA to a validator, or they have disregarded this; I assume the latter.

Ever wondered about the distribution of wealth in different cryptocurrencies? Here's a snapshot: 💰

👉#Bitcoin: ~80% owned by 0.32% of addresses, including Satoshi's wallets.

👉#Dogecoin: ~80% held by a mere 0.014% of addresses.

👉#Ethereum: ~80% in the hands of just over 0.01%,…— IntoTheBlock (@intotheblock) August 7, 2023

Source: IntoTheBlock on X (Twitter)

How has this trend changed over time?

Using information from various on-chain data analysis entities – Glassnode, Look Into Bitcoin, Macro Micro – the number of addresses, each containing over 1,000 BTC, peaked in February 2021 amid the previous bull run.

According to an article published on CoinGecko Analysis, we saw an increase in wallets holding more than 0.1 BTC and 1 ETH in 2022.

Here are three theories I have about this:

1) More people are moving their funds from exchange wallets (Binance, Coinbase, Kraken, etc.) to non-custodial wallets (desktop, Ledger, Trezor, etc.).

This is plausible as the number of BTC in dormant addresses has continuously increased over the past nine years, doubling from 8.8M in February 2021 to 17.92M as of last month. For context, approximately 19.53M BTC have been minted, with a 21M max supply.

Why is this relevant? This, in tandem with BTC supply on exchanges (see also ‘Bitcoin exchange reserves’), which is at a five-year low, indicates a greater tendency to hold Bitcoin for long-term storage. In other words, there is no intention to sell it anytime soon.

Additionally, we know that crypto exchanges manage some of the largest BTC wallets. As people withdraw their coins from these to personal wallets, it is expected to see more BTC wallets increase in size, including those between 0.1 and 1 BTC.

2) Unwillingness to store large amounts of BTC/crypto on an exchange since 2021.

As Bitcoin’s price hit a new all-time high of ~$69,000 in 2021, this translates to more money sitting on exchanges.

Having several Bitcoins on an exchange for most of its history wasn’t as risky as having even one BTC during the 2021 bull run, so people would start seeking safer alternatives.

Many crypto experts and commentators will strongly recommend that people keep most of their crypto off a centralised exchange, particularly with high-profile hacks and collapses in recent years.

There is an increasing range of hardware wallets, each of which is becoming easier to use and incorporates more features so that their users have a one-stop shop to manage their favourite crypto assets.

Moreover, as we return to a bull market, there’s a greater chance that even more hackers will try to compromise these exchanges.

3) (This one to a lesser extent) Tighter daily or weekly withdrawal limits in USD

Another incentive to get a significant amount of crypto off an exchange is when you plan to cash it out quickly.

In a bull run, prices can go wild in less than 24 hours, especially if this happens with small-cap altcoins.

If you plan on cashing it all out, be wary of the daily (and sometimes) weekly withdrawal limits that most crypto exchanges impose. Having said this, this can be easily circumvented by maxing out the fiat withdrawal limit and then withdrawing the rest in crypto to another exchange (subject to KYL AML regulations).

Alternatively, you can convert that crypto to a stablecoin and wait until the 24 hours have passed (or the next calendar day, whichever one is applicable) before continuing your fiat withdrawals.

Comparison to overall wealth

I prefer to put things into perspective, and our life doesn’t revolve solely around crypto…well, at least not for most of us, which would probably be real estate, at least in my city.

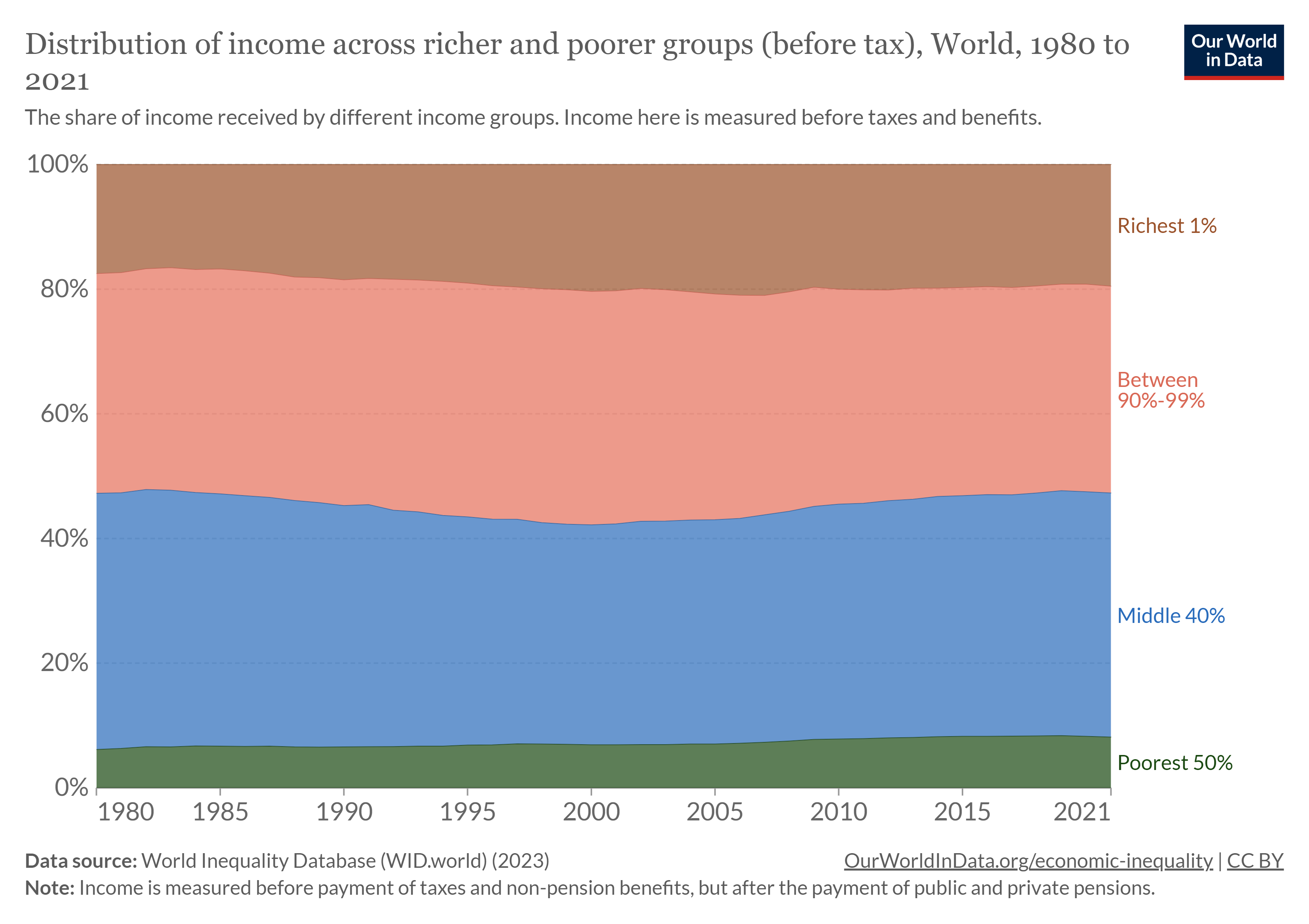

I’ll let the chart do most of the talking.

N.B. When accounting for massive tax deductions wealthy people can get — in part due to access to some of the best accounts in the world — I imagine that the top 10% will have an even share of wealth under their belt.

Source: Our World In Data | CC BY 4.0 DEED

Yes, there will be a small section of the “middle-class”/ middle rung that’s displayed above – and possibly a handful of people from the poorest 50% – that will move their way up the wealth ladder, but most of us will predict the rich to line their pockets even more courtesy of crypto, not to mention real estate.

To clarify, I am saying this from a neutral perspective: I am neither criticising nor praising what elites do when investing in digital assets.

There’s a lot I could say about the rich vs poor debate, but this is not the place for that, as the focus here is on BTC and crypto.

Additional thoughts

To answer the question in the title, it is very difficult to correctly determine how much the top 1% earns in crypto, rather than simply using the data from the Bitcoin Rich List.

Whilst there are individuals with significant crypto holdings – particularly early adopters such as Barry Silbert (Digital Currency Group), Cameron and Tyler Winklevoss, Michael Saylor (MicroStrategy), Jack Dorsey, Mike Novogratz, etc. – the claims that 92% of all Bitcoin addresses are controlled by 1% of wallets are misleading.

Nonetheless, this skewed distribution of a relatively small number of wallets controlling most BTC in circulation is still disappointing for the masses, as more of the world should have given Bitcoin a chance when owning even just 0.1 BTC was within reach of at least 25% of the world’s population up until a few years ago.

The longer people wait on the sidelines, the harder it will become even to own 0.03 BTC (to pick an arbitrary number).

Whilst many rich people have benefited from privileged upbringings and have received extensive and well-informed financial advice compared to many others in society, I would say getting involved in crypto has been an exception to the rule (and still is, albeit to a lesser extent).

Hear me out.

The extremely volatile nature of BTC and other digital assets has led to wild price gains and losses.

Many average people with modest upbringings have taken a chance (and still do) by investing* in BTC, or even ETH, XRP, MATIC, ADA and other crypto assets. Many of these threw money into these assets years ago and have reaped the rewards.

*In many cases, it would be considered speculating more than investing, particularly with memecoins and s&!tcoins in general, but I digress…

If you’re gonna find a rags-to-riches story in recent years, there’s a good chance that BTC or altcoins were involved in this.

Even though a handful of stocks – mostly tech-related ones – have helped average people become rich fairly quickly, crypto’s lower barrier of entry (anyone can purchase a fraction of crypto) and insane ROIs for these assets (including BTC, as shown below), has led to life-changing returns for early adopters, particularly pre-2017, even up till early 2020 if you took profits accordingly.

Asset Class Returns since 2011… pic.twitter.com/zZowZcAsTH

— Charlie Bilello (@charliebilello) July 15, 2023

Source: Charlie Bilello on X (Twitter)

On that note, the silver lining of the pandemic was the massive market-wide sell-off of crypto assets in March 2020; a very late Xmas present or delayed Valentine’s Day gift for oneself, you be the judge.

This was a golden opportunity for people to snap up BTC, ETH, XRP, etc., for a bargain, but how dare you even consider going against a market and doing a lump-sum purchase when everyone is panicking?

Sarcasm aside, the average (i.e., retail) investor has squandered many opportunities to boost their bags/stack their sats, particularly when the great opportunities were staring you right in the eyes.

It doesn’t help that Bitcoin has been declared “dead” over 470 times, mostly thanks to mainstream media and delusional/narrow-minded influencers.

A key statistic to derive from the BitInfoCharts mentioned earlier: Less than 12 million addresses hold more than 0.01 BTC (~$350 using today’s price).

Consider these points as well:

– 6.8% of the world population lives in a high-income country (>$50 per day), with another 14.7% in the upper-middle bracket ($20.01 – $50 daily).

Just taking the 6.8% = ~550 million people, it gives you an idea of how much more BTC relatively wealthy individuals) could have purchased to date…and can still add to their wallets.

– I haven’t even factored in over a billion people in the middle-upper bracket who could still purchase minuscule amounts of BTC over time.

– On top of this, let’s not forget the estimated six million BTC lost forever, with roughly four million – and possibly up to six million – BTC lost forever due to misplaced, forgotten or destroyed recovery seeds.

– Exchanges, other companies and government departments also hold vast sums of BTC.

You get the gist of what I am saying.

I know this is a lot to unpack, but it all boils down to this:

Certain individuals have taken their chances and bought as much Bitcoin as possible/willing to hold, whether this be for themselves or on behalf of institutions, e.g., Michael Saylor for MicroStrategy, Jack Dorsey for Block Inc., Mike Novogratz for Galaxy Digital Holdings, and so on.

You can call them – and everyone else who made vast sums from Bitcoin and crypto in general – greedy rich F&#ks, or whatever you want, but they took a risk and seized the opportunity years ago when everyone else disregarded this asset class.

Fortune favours the brave.

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your research before investing in any crypto assets, staking, NFTs and other products affiliated with this space.

- For transparency, Bitcoin (BTC) and Ethereum (ETH) each account for roughly 25% of my crypto portfolio.

© Crypto with Lorenzo 2023. All rights reserved unless specified otherwise.

Featured image by Extarz on Shutterstock.