A “partial” victory for Ripple, depending on whom you ask.

After nearly three years, we finally got the verdict many of us were hoping for:

XRP is not a security.

US District Judge Analisa Torres concluded that XRP tokens sold on exchanges and algorithms (e.g., decentralised exchanges) did not violate federal securities laws. In contrast, sales to institutional investors were classified as securities.

Various crypto and mainstream media sources have labelled this a partial victory, with some playing devil’s advocate indicating that this decision complicates matters for other crypto assets, notably Ethereum.

Nonetheless, the decision has been made. Stuart Alderoty, Chief Legal Officer at Ripple, tweeted a summary of this legally-binding decision.

A huge win today – as a matter of law – XRP is not a security. Also a matter of law – sales on exchanges are not securities. Sales by executives are not securities. Other XRP distributions – to developers, to charities, to employees are not securities.

— Stuart Alderoty (@s_alderoty) July 13, 2023

Source: Stuart Alderoty on Twitter

Unsurprisingly, The SEC will challenge the part of the verdict favouring Ripple.

We know that the US SEC Chair, Gary Gensler, is determined to take down much (perhaps most) of the crypto industry, particularly anything that negatively affects the status quo in the traditional finance (TradFi) realm.

As per challenging this decision, I struggle to understand how much more new and relevant information the SEC can supply to the U.S. District Court of the Southern District of New York to challenge Judge Torres’ verdict about XRP listings on exchanges not being securities.

Only “direct XRP sales to institutional clients” were classified as securities, based on another tweet from Alderoty.

Determining if a product is a security relates to the Howey Test: whether or not a deal represents an “investment contract”. An excellent summary of this — with a reference to the Ripple case — is available here.

Other winners across the space

Another company to significantly benefit from this scenario is Coinbase (NASDAQ: COIN), whereby its shares increased by over 20% on the same day of Judge Torres’ decision. Hours after the decision, Coinbase informed its Twitter community that it would be relisting XRP for trading.

Regarding other crypto assets, Stellar (XLM) – a similar blockchain and digital asset also co-created by Jed McCaleb – rallied by about 80% in a matter of hours following the Ripple vs SEC announcement.

Cardano (ADA), Polygon (MATIC) and Solana (SOL) also recorded double-digit % gains the same day. For context, these projects and their respective assets are considered to be securities (i.e., “Crypto Asset Securities”) in the eyes of the US SEC against Binance Holdings Limited (see Section 352 of the lawsuit for the full list of assets).

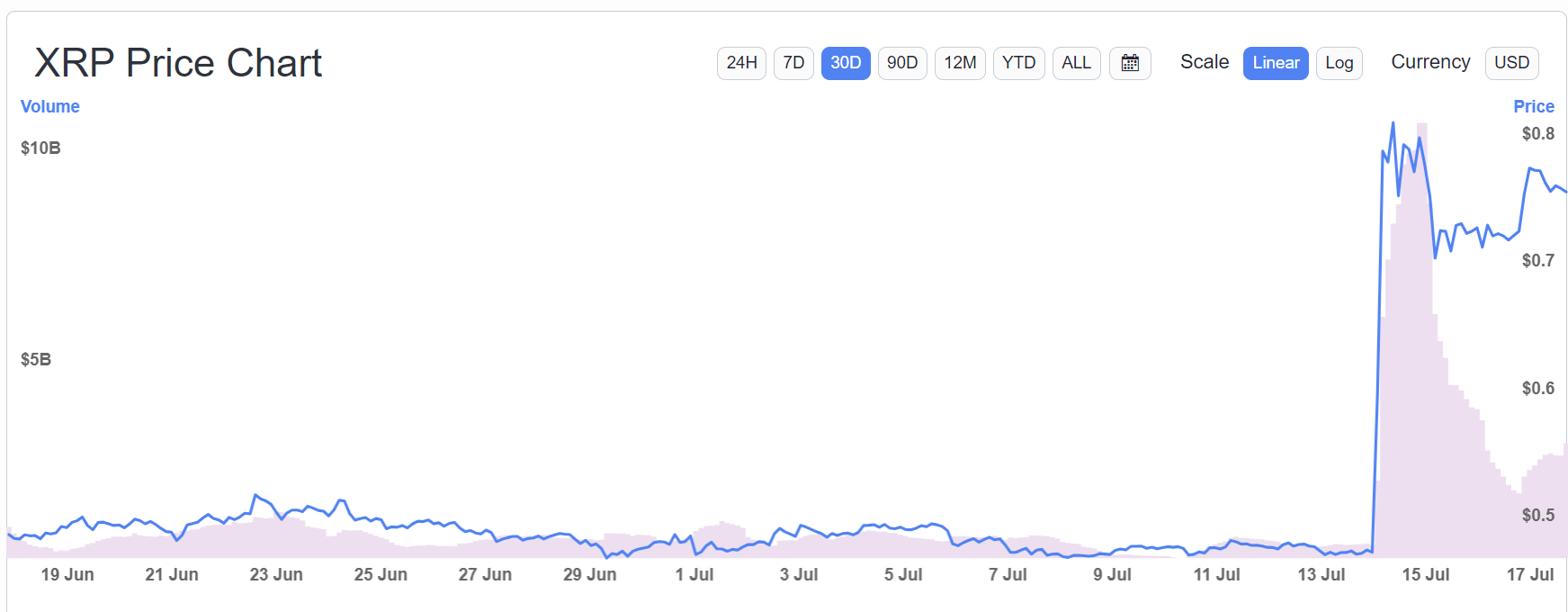

XRP/USD price 30-day price and trading volume (pinkish-purple area). Source: LiveCoinWatch.

Additional thoughts

You would think the SEC would eventually raise the white flag and try to save some face. Adding to the list of vocal opponents of Gary Gensler is his predecessor, Jay Clayton.

The former US SEC Chairman was critical of the current set of leaders at the organisation, particularly with their approach towards creating lawsuits against certain businesses; Ripple, Binance, Coinbase, Gemini and Kraken are some of the major crypto-related entities that have been in the regulator’s crosshairs.

“When you have the power of the state, you’re supposed to only bring cases and only make rules that you think are gonna (sic) pass judicial muster.”

Jay Clayton

Despite his criticisms, Clayton is no saint; the Ripple lawsuit began in December 2020, towards the end of his tenure at the regulatory body. Whether he would have been “less harsh” than Gensler towards Ripple is difficult to tell.

Moving ahead, it is best not to get ahead of ourselves as I expect even more resistance from the US regulator to try and stifle these crypto projects. Besides this, I envisage the court case against Binance as a drawn-out process, similar to Ripple vs The SEC.

I know that the US is still the world’s largest economy, and its two largest stock changes – the NYSE and NASDAQ – collectively manage over $40 trillion of domestic market cap. However, many forget there are emerging markets and business collaborations with crypto projects beyond US borders.

Beyond the US, how many people believe that international bodies such as The World Bank and the World Economic Forum can shut down crypto? Regrettably, I would say a significant percentage of people, but I won’t speculate what %.

The point of the story is that it is too late to dismantle this entire asset class and all related (mid-to-large) entities; continuous efforts to stifle crypto innovation in the US will send money and talent elsewhere, i.e., a brain drain.

With Gensler still at the helm, not to mention prominent US politicians such as Elizabeth Warren, Brad Sherman and (to a lesser extent) Janet Yellen calling some shots, crypto assets and their affiliated companies will be in for a rough time, notably those aiming to take on TradFi.

A federal election is fast approaching, so Americans might opt for more pro-crypto representatives on both sides of politics to help boost the US position on crypto and blockchain tech; let’s see how things pan out.

I remain optimistic overall for this space, especially in the medium- to long-term. You can interpret the Ripple vs SEC verdict as you please, but I consider this a victory, which will set an important precedent for judgements on other crypto projects and their native coins/tokens.

Addendum

I know this occurred last Thursday (or Friday morning, depending on your location), and I have just posted about this now. This delay was due to urgent family matters, and I could not post earlier.

Nonetheless, this massive decision will have ramifications for other altcoins, at least in the USA. Moreover, this outcome will most likely give the green light to Ripple for their anticipated IPO shortly; more about this in an upcoming piece.

Disclaimers

N.B. None of this is financial or legal advice, and I am neither a financial advisor nor a lawyer. You are solely responsible for crypto investments and how you interpret the information provided in this piece.

The opinions expressed within this piece are my own and might not reflect those behind any company, organisation or person listed here.

Please do your research before investing in any crypto assets (including stablecoins), hardware wallets, NFTs and other products affiliated with this space.

To reiterate, I received no incentive from any person or body listed throughout this article to discuss their product.

If you enjoyed this article, I recommend following my Medium page for regular reports about crypto assets, blockchain technology, and more. Feel free to check out my publication as well, Crypto Insights AU.

Thanks for your support.

Featured image by INelson on Shutterstock.