Major improvements to help boost global adoption of the foundation blockchain and leading crypto asset worldwide.

Ordinals and inscriptions (“Bitcoin NFTs”)

One of the biggest talking points across the Bitcoin community was the launch of inscriptions on Bitcoin’s blockchains, informally known as Bitcoin NFTs, which led to a flurry of network activity in recent months.

This term is also used interchangeably with ‘ordinals’ – using numbers to represent and track individual satoshis (i.e., 1/100,000,000th of a BTC), now valued at 0.000306 USD.

A satoshi can be inscribed with metadata, covering any transaction data and other information about the digital entries linked to that satoshi, NFT, security tokens (BRC-20 tokens that utilise the Ordinals protocol on Bitcoin) and more.

These ordinals can also be categorised differently – numbers, decimals, percentages, and even names. Additionally, each ordinal has a degree of rarity, much like physical and digital collectibles. The Ordinal Theory Handbook will give you a comprehensive run-down of all of this.

You can also monitor Ordinals inscriptions by block via the official website.

Zooming out, I see this as a major positive for Bitcoin’s ecosystem. It defies the (once) widespread belief that Bitcoin lacked smart-contract functionality (unlike Ethereum, the leading smart-contracts blockchain) and that the former should focus on being a digital store of value.

In simple terms, it adds to Bitcoin’s growing range of use cases.

This has also benefited certain altcoins. For example, Stacks functions as an additional layer for Bitcoin smart contracts and dapps; its related crypto, STX, has achieved over 200% growth YTD, outperforming ~95% of digital assets so far in 2023 across the top 200, 500 and even 1000 cryptos.

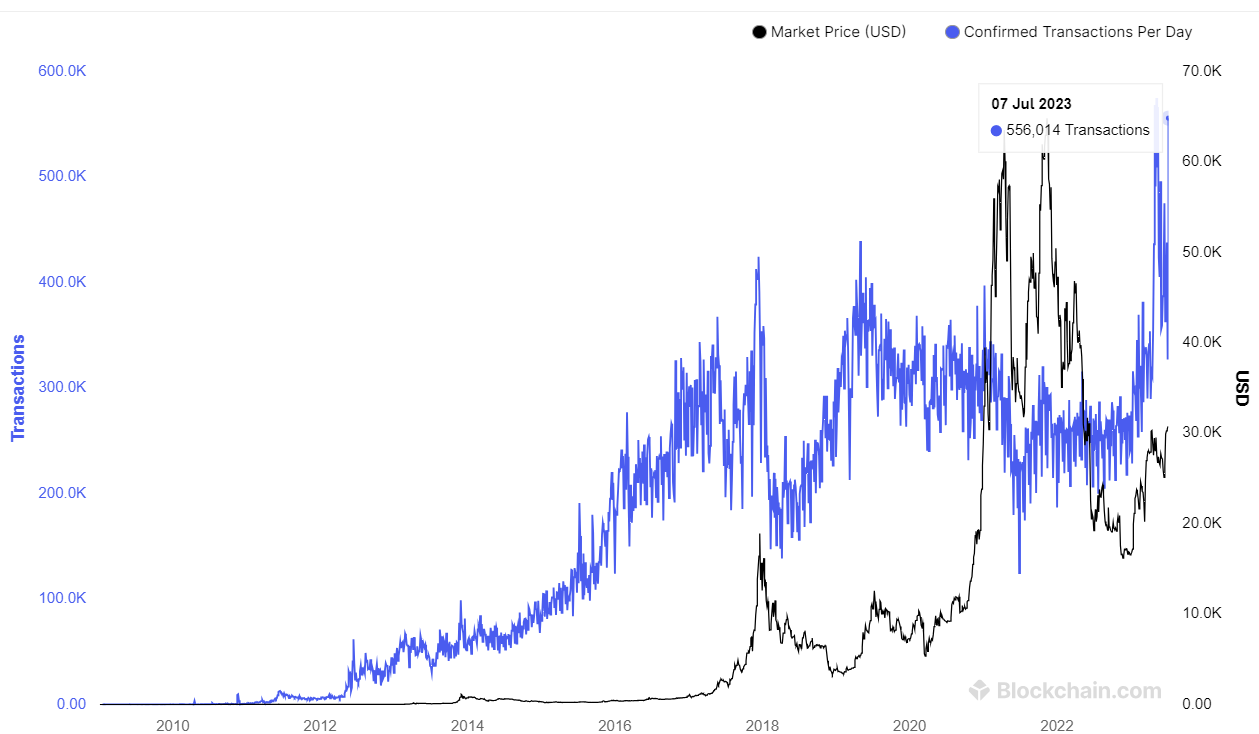

This rapid growth in Bitcoin inscriptions – over 16.8 million Bitcoin Ordinals inscriptions as per Dune Analytics data – is a bittersweet achievement overall. While this surge in Bitcoin’s blockchain is promising, it has also increased BTC transaction fees, spiking to a daily average of ~$31 on 8 May.

Source: Blockchain.com

Whilst this has dropped since then, average fees over the past 2-3 months are still higher than the typical $1 or so paid for sending and receiving BTC. I will be expanding on BTC fees later in this piece.

Taproot and Schnorr Signatures

Even though this was released in November 2021, this combo of upgrades has been one of Bitcoin’s biggest over the past five years.

Taproot’s main purpose is to improve privacy and efficiency for Bitcoin’s network, including cheaper transaction fees.

I’m excited for Taproot activation!

What this brings? Reduces size of some complex transactions and improves privacy for these complex transactions.

What it does not bring? Fully expressive smart contracts. You are still limited by Bitcoin Script, i.e, limited contracts.

— muneeb.btc (@muneeb) November 14, 2021

Tweet from Muneeb Ali, co-creator of Stacks (Bitcoin L2),

This upgrade relates to three different Bitcoin Improvement Proposals (BIPs) — Schnorr Signatures (BIP 340), Taproot (BIP341), and Validation of Taproot Scripts (BIP342).

As Schnorr signatures also permit batch validation, allowing multiple signatures to be validated together more efficiently than validating each one independently, we make sure all parts of the design are compatible with this.

BIP 341 (Taproot: SegWit version 1 spending rules) via GitHub

Combining several transactions and approving them all at once will help contribute towards greater speeds and cheaper fees. This is reflected by the average costs returning to around a dollar even when accounting for climbing daily transactions, not to mention BTC’s price generally trending upwards (at least every 3-4 years).

$1 is still better than dozens of dollars being forked out for moving or exchanging satoshis, but this is far from a panacea; Bitcoin will require much more work before it can effectively scale and handle thousands of transactions per second (including off-chain) if it were to ever compete with established payment systems.

Additionally, the rapid growth of Bitcoin ordinals emphasises the need for the blockchain’s developers to successfully and consistently deploy major scalability upgrades.

This ties into the next point.

Lightning Network

Many people involved in Bitcoin or those who have transacted with BTC acknowledge its network is slow; those requesting faster transactions must accept higher payment fees, rendering micropayments unfeasible.

Bitcoin developers and other stakeholders could agree to increase block sizes (the cash for Bitcoin Cash), reduce block times (about 10 minutes per block for Bitcoin) to accommodate more transactions, or even allow cheaper transaction fees. However, this will cause security trade-offs here, notably with security; check out Coin Bureau’s video for an overview of this dilemma.

So, what is the solution? The Lightning Network (LN) has been touted as a practical way to increase scalability (transactions per second) and reduce costs without compromising decentralisation or security. The LN function as a type of off-chain scaling solution, with similarities to layer-2s (L2s) and sidechains for other networks, notably Ethereum.

A concept that pre-dates most crypto assets, the LN has been touted as a holy grail/ “game changer” for the foundational crypto.

What is it? It is Bitcoin’s leading off-chain scaling solution, i.e., a “layer-2” for the foundation blockchain. Strictly speaking, this is not exclusive to just one chain; Litecoin recently incorporated LN into its network, according to a Twitter post in May.

It works through a series of two-way off-chain payment channels, with both parties approving any funds moving between them, with a ledger entry on Bitcoin’s blockchain.

Even though transactions are not broadcast on the blockchain in real time, the LN can overcome issues with limited timestamping information due to this delay. As mentioned in the ‘Bitcoin Lightning Network’ whitepaper:

“In the case of micropayment channels, only two states are required: the current correct balance and any old deprecated balances. There would only be a single correct current balance, and possibly many old balances which are deprecated…Therefore, it is possible in bitcoin to devise a bitcoin script whereby all old transactions are invalidated, and only the new transaction is valid.”

Joseph Poon and Thaddeus Dryja, Lightning Network whitepaper, 2016 (CC BY 4.0).

Simply Explained’s short video provides an excellent visual summary of what this all entails.

Major benefits that LN offers to Bitcoin include:

– Speed: A conventional BTC transaction will take between 10 and 20 minutes, although this is highly variable – it can range from 1 minute up to several hours, or even more than a day in extreme cases.

Some major influences on transaction times include overall network activity, hash rate and transaction costs.

– Scalability: Significantly increasing the number of transactions per second (throughput), currently around 7 TPS on Bitcoin’s base layer (i.e., layer 1).

Even though the LN exists and has been used since its inception in 2016, it is far from mainstream usage across Bitcoin’s network. Having said this, Binance announced yesterday that they have fully integrated the Bitcoin LN for deposits and withdrawals on their exchange; I expect other exchanges to follow suit.

The highly challenging task of successfully taking Bitcoin transactions off its main chain (i.e., base layer) without affecting security and network distribution has been a key focus of developers advancing the LN.

“To achieve much higher than 47,000 transactions per second using Bitcoin requires conducting transactions off the Bitcoin blockchain itself.”

Poon & Dryja 2016. CC BY 4.0

This 47K figure refers to a 2014 press release about Visa’s processing network, VisaNet, handling that many transactions per second.

Image by Zapp2Photo via Shutterstock

LN or a similar system will successfully deploy a rapid off-chain scaling solution for Bitcoin, costing a fraction of a cent instead of several dollars.

Why am I adamant about this? Competition is the main factor, with Ethereum leading the charge here, particularly with the vast range of L2s and sidechains working on successfully scaling its blockchain.

Don’t just take my word for it. Michael Saylor, who is the CEO of MicroStrategy, Inc. — the company with the largest BTC holdings worldwide (>152,000 BTC under management) — in an interview with Lex Fridman, mentioned:

“The truth is there are a lot of open protocols; Lightning probably won’t be the only one. There’s an open-market competition of other permissionless, open-source protocols to do this work.”

Ethereum co-founder and leading spokesperson Vitalik Buterin had this to say last week about Bitcoin:

“I think if we want Bitcoin to be more than payments, it needs more scaling solutions.”

A quantum-resistant blockchain

Even though this is not an imminent threat to Bitcoin and other blockchains, it must be properly addressed before quantum computing can decipher the cryptographic code behind crypto assets and their respective networks.

A quantum computer with 4,000 quantum bits (qubits) is the number I have seen frequently mentioned that could theoretically crack public key cryptography on Bitcoin. Based on IBM’s Quantum Development Roadmap, its Kookaburra modular QC system aims to achieve 4,158+ qubits by 2025.

However, before you start panicking, this is very wishful thinking. Dr Mark Webber, formerly of the University of Sussex, UK, conducted studies with fellow researchers into how many qubits would be needed to compromise Bitcoin’s network.

The figures? Based on data from Webber’s team, as reported in NewScientist:

– 1.9 billion qubits for a 10-minute timeframe (roughly when miners confirm each block of recent Bitcoin transactions);

– 317 million qubits to break the encryption code within 1 hour;

– 13 million qubits to achieve this within a day.

So taking the most conservative estimate of 13 million qubits, this is >3,000 times more than the 4,000 qubits reported in various sources needed to crack Bitcoin.

Despite these figures, Bitcoin developers and other prominent people in its community, particularly large BTC holders with a lot at stake, should start working towards incorporating quantum-resistant algorithms for Bitcoin’s network, both for hashing and digital signatures.

This is not a new topic of discussion in the Bitcoin – let alone the overall crypto–community. Considerations surrounding quantum computing and its potential impact on Bitcoin have existed for years, with independent Bitcoin and open-blockchain expert Andreas Antonopoulos weighing in on all of this. Here is a quote from a 2018 video:

“We will know when quantum computing exists when Satoshi’s coins move.”

For context, Antonopoulos referred to lost wallets or ones inaccessible due to the person holding private keys having passed away, and a quantum attack would thus compromise their wallet.

I initially thought this related to Hal Finney, who received the first BTC transaction from Satoshi Nakamoto. He was one of the possible identities to be the actual creator of Bitcoin, even though he constantly denied being Nakamoto.

I explore this idea in further detail in a separate story.

Atomic swaps

Atomic swaps involve switching from one crypto asset to another on a separate blockchain.

Whilst we haven’t yet achieved this, the crypto space has made massive strides in recent years through decentralised exchanges (DEXes), with Uniswap being a pioneering example of one that lets you readily switch from one ERC-20 (Ethereum-linked) token to another in a matter of seconds; let’s put the once exorbitant (yet still high) ETH gas fees on Uniswap aside and appreciate that such a service exists.

Strictly speaking, this is not an atomic swap, as these trades occur on the Ethereum blockchain and cannot readily trade assets from one blockchain to another.

In due course, atomic swaps will become a reality. To get there, we must first solve the issues surrounding scalability and transaction fees on Bitcoin, Ethereum and other blockchains while maintaining network security and sufficient decentralisation.

Of course, if you’re a Bitcoin maxi, this is a stupid idea because why would you even consider getting involved in a crypto asset other than BTC?

All jokes aside, seeing something like atomic swaps available for use would be wonderful. To play devil’s advocate, I believe centralised exchanges will resist such a movement, particularly if they lose money from trading fees associated with this service.

On the contrary, this might be a major threat to them as there would still be a cohort of crypto holders that prefer the convenience of using a centralised custodian to manage their digital assets.

Additional thoughts

Currently the 12th largest asset worldwide based on market cap, not to mention the 20th largest currency compared to fiat, Bitcoin has already made so much progress since its inception in 2009, much more than many fiat currencies that have existed for longer than BTC and have ended up hyperinflating to embarrassing levels and (literally) becoming worthless.

Nonetheless, it still has a long way to go, just like every other crypto asset.

I expect the LN and Ordinals to be two of the biggest developments in Bitcoin in the coming months and years.

With two countries officially adopting Bitcoin as legal tender – El Salvador and the Central African Republic (CAR) – not to mention BlackRock, Fidelity and other financial juggernauts all awaiting approval for a Bitcoin Spot ETF in the USA, expect massive things ahead for BTC, let alone crypto assets in general.

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are solely responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your research before investing in any crypto assets, staking, NFTs and other product affiliated with this space.

- For transparency, Bitcoin (BTC) represents about 25% of my crypto portfolio.

Featured image by Thongden Studio on Shutterstock.

All rights reserved, except for the Lightning Network whitepaper (CC BY 4.0).

Useful article, thank you. Top article, very helpful.