What is a stablecoin? | Why are they useful? | Types | Stables vs CBDCs | “Proof of Reserves” | Tether’s reserves | Future of stablecoins

Stablecoins (“Stables”) are digital assets that are designed to maintain a steady value relative to another asset, particularly those pegged to fiat currencies (e.g., the USD). However, others are tied to tradable commodities, such as Tether Gold (XAUT) and Pax Gold (PAXG).

How many exist? This significantly varies, depending on your source of info — 142 are displayed on CoinMarketCap; 310 on Live Coin Watch; BitPay reported (in October 2022) roughly 200 stablecoins globally.

You be the judge, but somewhere between 150 and 200 are around, though many are barely utilised (at least at present) versus the top dogs.

On this note, the five most popular stablecoins at present — based on their circulating market caps — are Tether (USDT), USD Coin (USDC), Binance USD (BUSD), Dai (DAI) and True USD (TUSD); these five digital assets account for more than 90% of the total market cap for stablecoins.

Why are they useful?

Trading options (i.e., pairs) were very limited in the early days of buying Bitcoin and altcoins. Whenever you wanted to trade with another crypto, BTC was usually paired with other major digital assets, namely Litecoin (LTC) and XRP, and almost all others were paired with Bitcoin.

However, let’s say you wanted to take some profit (or cut your losses) and purchase again after X hours or days. You could cash out in USD, but this was not as straightforward as now.

In a market with insane price swings — bearing in mind cryptos were even more volatile then than now — the last thing you’d want is not to be able to readily take profit at highs or buy Bitcoin at major (intraday) dips.

Besides this, what if you didn’t want to trade into BTC or ETH, or your favourite altcoin was not paired with USD?

Enter stablecoins.

They have played a pivotal role in adding significant liquidity to the crypto market. Moreover, they have been particularly useful for day traders, whether trading high amounts or carrying out several trades quickly.

Their presence has also helped add another set of trading pairs, notably for small and micro-cap crypto assets typically paired with BTC or ETH, with multiple DEXes also contributing to this.

Above all, they add stability to one of, it not, the most highly volatile asset classes out there.

One of the earliest examples of stablecoins was BitUSD. It was established in July 2014 and ran on the BitShares blockchain.

NuBits was another choice in the early days, with its whitepaper available for download.

However, these two have come and gone, and many useful alternatives have sprung up as the crypto market has grown. I expect this list to grow in the coming years, particularly with stablecoins pegged to some lesser-known fiat currencies.

Consider the user experience for buying and selling crypto back on regulated exchanges in 2017 compared to today via stables or direct coin/token swaps.

Types of stablecoins

Most of these can be classified into two broad categories, collateralised (mostly backed by cash or other tangible assets) and algorithmic (controlled by smart contracts). From here, we have more specific classifications, some of which include:

– Collateralised (fiat-backed) stablecoins

The most popular type, at least by market cap.

These are predominantly backed 1:1 in cash, cash reserves (e.g., US Treasury Bills) or other assets such as real estate, bonds, etc. However, the vast majority should be covered by a fiat currency, such as the USD or EUR.

– Collateralised (crypto-backed) stablecoins:

Similar to the first example, but instead uses a digital asset as collateral to balance its related stablecoin’s price rather than fiat.

One of the most popular examples is MakerDAO, a decentralised autonomous organisation (DAO) tied to the DAI stablecoin, which has operated on the Ethereum blockchain since 2014.

How does this work? DAI is minted by locking up not just ETH as a surety but (as of November 2019) any Ethereum-based token approved by those holding MKR — the protocol’s governance token (see ‘Multi-Collateral DAI’ for further details.

The ETH (or approved token) being leveraged as a guarantee is done through exclusive smart contracts called Collateralized Debt Positions (CDPs).

To account for wild price swings in the crypto market, these systems usually work best when crypto is over-collateralised to stabilise DAI — at least 150% of the DAI amount borrowed.

Logo courtesy of MakerDAO brand assets.

Logo courtesy of MakerDAO brand assets.

As a quick side note, DAI, let alone various stablecoins, including those throughout this piece, can also be used for lending to earn passive income, with AAVE being a popular decentralised, non-custodial liquidity market operating across multiple chains. I will expand on crypto lending in a future piece.

In addition to stables such as DAI, similar ones are backed by an established crypto asset and a reserve coin, collectively requesting much higher amounts of (crypto collateral) to sustain the stablecoin.

A recent example is DJED, an algorithmic stablecoin backed by Cardano (ADA) and utilises the Shen reserve coin. This all runs on the layer-1 platform (L1), COTI.

Whilst these involve smart contracts — like the next example — there is still a requirement to use a well-established and adequately trusted crypto asset to back the stablecoin.

– Algorithmic stablecoins

These are supported by reserves in both a stablecoin and its affiliated crypto asset, and rely on algorithms (e.g., smart contracts) to work.

This relationship is set up so that you can burn the US$1 equivalent of its crypto asset to swap into its related stablecoin and vice-versa. The incentive to balance an algorithmic stablecoin’s price is offered courtesy of arbitrage.

Sounds familiar? An example that comes to mind is the (in)famous Terra Luna and TerraUSD pair, with the spectacular rapid collapse of LUNA and UST, which have now been rebranded to LUNC and USTC following its downfall in May 2022.

Quick shout-out to Coinsider for calling out Terra Luna in March 2022, two months before s&$t hit the fan. Check out his video about this here.

Since then, many people, within and outside the crypto community remain sceptical of this model and would instead prioritise another that involves adequate and reliable reserve assets, as I discussed earlier.

As this one is more complex to manage than collateralised stablecoins, many (both within the crypto sphere and generally) are sceptical of their reliability. As such, I recommend this excellent explainer video from Whiteboard Crypto.

These resources will be highly useful for further details about this type of digital asset.

– Collateralised (commodity-backed) stablecoins

As mentioned, these are stablecoins pegged to commodities, with gold-related options being the most popular in this category.

Like fiat-pegged stablecoins that are (rather, should be) predominantly backed by treasury bills, their gold equivalents are backed by tangible gold ingots.

Here is the official confirmation from the Pax Gold website:

“Each Pax Gold (PAXG) token is backed by one fine troy ounce of gold, stored in LBMA vaults in London. If you own PAXG, you own the underlying physical gold, held in custody by Paxos Trust Company.”

Photo by Zlaťáky.cz on Unsplash

For silver and platinum, I came across SilverToken and PlatinumCoin.

N.B. I just came across these two digital assets, and I do not have any experience dealing with them, and strongly recommend doing your due diligence before even considering buying or trading these.

Crypto, stablecoins and central bank digital currencies (CBDCs)

Over the past 12-18 months, you would have most likely heard something about multiple governments planning to introduce their own CBDC, a digital version of banknotes and coins.

Before continuing, let’s clarify that CBDCs are not cryptocurrencies/crypto assets.

Whilst they are similar to stablecoins, the fundamental difference is that, unlike stablecoins, CBDCs are directly controlled and issued by a central bank, thus, controlled by a state.

You know it’s a big deal when the UK Prime Minister, Rishi Sunak, enthusiastically announced a plan amongst G7 countries to establish a set of policy ideas to roll out retail CBDCs.

“Unlike most of the digital money people use daily today, it would be issued by a central bank, like the Bank of England in the UK. And governments and central banks across the world are working together; looking into what a digital currency might mean in practice.”

Rishi Sunak, UK Prime Minister

Considering that a large cohort of society in developed economies is already cashless (this trend has accelerated in recent years, courtesy of the pandemic), and well-established crypto assets already exist, not to mention plenty of routine surveillance (voluntary or involuntary), proposed CBDCs leave much to be desired.

The current system of crypto assets and stables, coupled with the gradually increasing amount of Know Your Customer Anti Money-laundering (KYC AML) requirements to appease regulators, mean that CBDCs have few benefits to offer versus the trade-offs, particularly in the developed world.

To clarify, two major factors still holding back the widespread adoption of crypto worldwide are ultra-low transaction fees with high throughput (transactions per second) whilst maintaining robust network security.

As I see this being resolved within the next three years (based on progress so far with L2s and sidechains), it will make CBDCs less appealing.

I have previously covered my thoughts about CBDCs and will make an updated piece later this year or early next year as these are gradually rolled out.

Stablecoins and ‘Proof of Reserve’

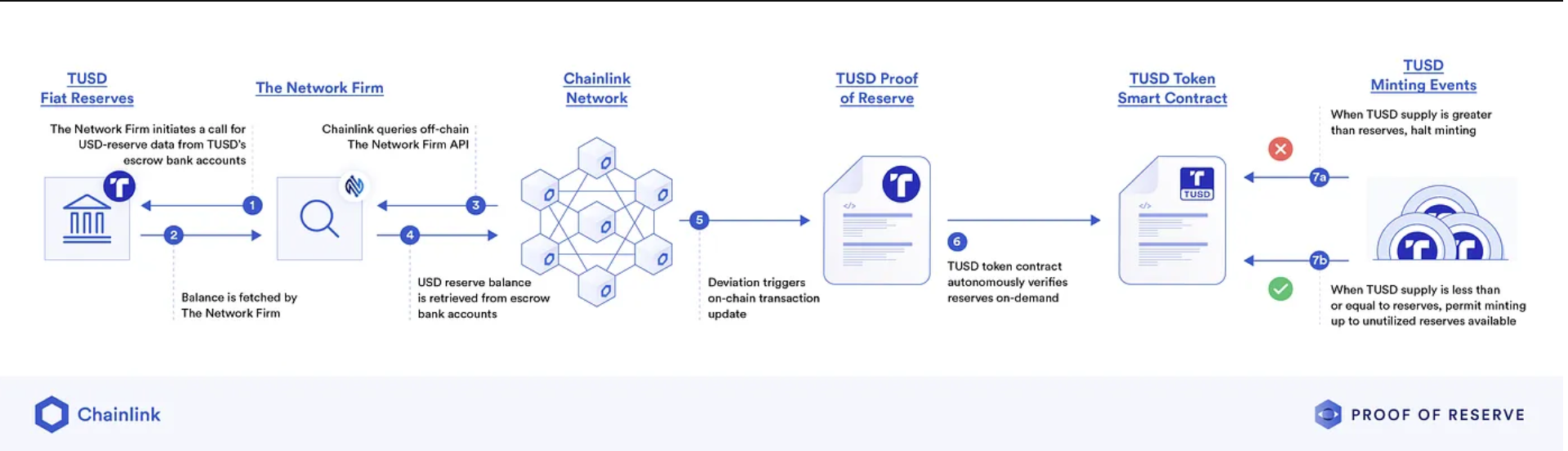

One of the most promising features involving both stablecoins and crypto projects is a collaboration between TrueUSD (TUSD) and Chainlink.

The former uses the latter’s blockchain to verify proof of USD reserves for TUSD. Through smart contracts on Chainlink, the system is set up to ensure that the total TUSD supply does not exceed the total amount of USD held in the company’s (True USD) reserves.

“With this ‘Proof of Reserve’ data feed, the TUSD smart contract will automatically check whether the total supply of TUSD would exceed the total amount of US dollars held in reserve before any new stablecoin is minted.”

TrueUSD post, January 2023

A visual summary of how the TrueUSD and Chainlink Proof-of-Reserve functions.

Source: TrueUSD, Chainlink Today. Click here for the enlarged (original) image.

This is an adaptation of an earlier partnership announced in January 2021 involving the decentralised-oracle blockchain and Paxos, the company behind stablecoins such as Pax Dollar (USDP) and PAXG, which is also responsible for managing Binance USD (BUSD).

Tether’s Reserves

On and off over the years, Tether has constantly been thrust into the spotlight by various media outlets – crypto, mainstream and otherwise – primarily about the issue of official audits for its USD reserves.

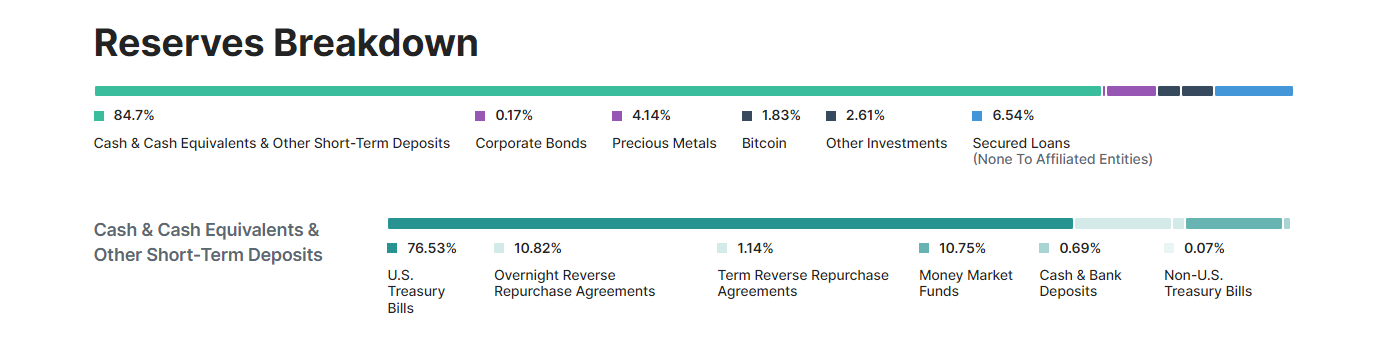

To quell concerns about this, Tether Holdings Limited, owned by iFinex, a Hong Kong-based company, opts for quarterly independent auditing of its overall reserves via BDO Italia, a part of the multinational accounting/professional services firm BDO.

According to Tether’s ‘Transparency’ page, it provides this information:

All Tether tokens are pegged at 1-to-1 with a matching fiat currency and are backed 100% by Tether’s reserves.

The value of our reserves is published daily and updated at least once per day.

Composition of USDT reserves (viewed on 16 May 2023). Source: Tether

Despite these efforts and purported “transparency”, renowned news sources such as the Wall Street Journal and Forbes are still sceptical about the integrity of Tether’s practices.

The latter’s article on this matter made the following (alleged) discovery about Tether:

“Now, Forbes has learned that Tether moved $37 billion of its reserves to an offshore bank called Capital Union in 2021, according to internal documents.”

David Jeans and Sarah Emerson, Forbes (Feb 10, 2023)

The quarterly reports about Tether’s reserves appear to lack specific information about the financial institutions or related third parties that manage the ~$81.8 billion of Tether’s assets, including approximately $53 billion of U.S. Treasury bills.

I find this surprising as we’re dealing with significant sums of money.

Having said this, I am unsure whether they are obligated to disclose this information (even to identify the relevant entities). Still, more specific details about this would instil further confidence in anyone reading these audits.

Additionally, perhaps this information is publicly available; if so, please let us all know in the comments section.

Moreover, let’s not forget that U.S. Treasury Bills back three-quarters of Tether’s cash and cash equivalents, so we would need to keep a close eye on how things pan out with the USA’s financial situation/economy, inflation levels and mounting levels of public debt, as this would also impact Tether.

I am not here to attack Tether, and I am not saying there’s something fishy either. Rather, I want to see enough stability and regulatory clarity for this entire space so that various blockchain/crypto companies can move on and continue to advance their products and services.

I am sick and tired of so much noise and rumours about this asset class which is holding back much money entering the space; sooner or later, we will see this extra liquidity coming through.

Affiliate link from Binance.

Future of stablecoins

I remain in two minds about the long-term prospects of various fiat-backed stablecoins, particularly those outside the top 10 (i.e., stablecoins only, not including regular crypto assets).

Here are some factors to consider when thinking about the viability of stablecoins outside of their top-10 list:

1) An increase in the overall crypto market cap, at least six-fold from where we are today ($1.19 trillion, including stables).

2) Non-USD stablecoins that use other major currencies (EUR, GBP, JPY or CNY/RMB*) rising the ranks or being created. At the moment, the largest non-USD stablecoins to date are Stasis Euro (EURS) and Euro Coin (EUROC), which are both a drop in the ocean versus Tether and USD Coin; to be fair, Stasis’ market cap has continuously grown since 2018.

There should be a push in the general crypto community to support the growth of emerging and mid-sized stablecoins to reduce the dominance of both Tether and USD Coin, akin to encouraging decentralisation of stake pools related to various cryptos.

I recognise that these major stablecoins are integral in offering stability across the crypto market. However, it is ironic to have just one or two massive assets (both of which are governed by centralised authorities, Tether Holdings Limited (“Tether”) and Circle, respectively) representing an asset class that has “decentralisation” as a major buzzword.

Of course, I know many of you will tell me to F off and stop being alarmist. However, just remember how much TerraUSD’s collapse affected the crypto market, which, even at its peak in May 2022, was still a fraction of USDT’s market cap (back then).

Point of the story: We will eventually need suitable alternatives to USDT and USDC. Ideally, more decentralised options (e.g., using DAOs) as a robust backup in case unexpected issues such as regulatory crackdowns, mismanagement, a scandal, hack, etc., were to arise one day, which would have significant consequences for the entire crypto space.

I see significant potential in terms of commodity-pegged stables, especially gold. It is uber-convenient to have the option to readily switch from decentralised crypto – one such as Bitcoin, often regarded as “digital gold” – to any major stablecoin, whether pegged to fiat or a commodity such as gold.

The beauty of this system is that it allows people to switch directly from BTC (or some altcoins) to a gold-pegged stablecoin and bypass the need to go via a digital greenback/dollarydoo.

PAXG to BTC historical price and 24-hour trading volume, September 2019 – May 2023. Source: CoinMarketCap. Minor adaptation by author.

I will provide a comprehensive analysis of commodity-related stables shortly, especially with our economy’s (gradually) growth in tokenising physical assets.

*Good luck with having stablecoins backed by the Chinese Yuan in the foreseeable future, particularly with the Chinese Government’s stance on cryptocurrencies.

Disclaimers

- N.B. None of this is financial or legal advice, and I am neither a financial advisor nor a lawyer. You are solely responsible for crypto investments and how you interpret the information provided in this piece.

- The opinions expressed within this piece are my own and might not reflect those behind any company, organisation or person listed here.

- Please do your research before investing in any crypto assets (including stablecoins), staking, NFTs and other product affiliated with this space.

- I received no incentive from any person or entity listed throughout this article to discuss their product.

If you enjoyed this article, I recommend following my Medium page for regular reports about crypto assets, blockchain technology, and more. Feel free to check out my publication as well, Crypto Insights AU.

Thanks for your support.

P.S. I know I write using (predominantly) British English, as in Australia (where I was born, raised and still live), this is how people write. If you’re from the USA, rest assured, I have not deliberately misspelt words. I also realise that I have also incorporated terms written in American English, which I did intentionally in cases of specific titles (e.g., Collateralized Debt Positions).

(Featured image) Left to right: DAI, USDC, USDT, BUSD, TUSD. Source: David Sandron on Shutterstock.

Affiliate link: BitBox02 is a increasingly popular alternative to Ledger and Trezor. This is not paid advertising. However, if you were to buy one of their products via my affiliate link, I receive a small commission at no extra cost to you. Their website also has an excellent side-by-side comparison with the above-mentioned alternatives.