What to buy if you’re playing the long game.

Unfortunately, you missed the early days of BTC, ETH and various altcoins where you could bank on your digital asset of choice, doing a 50 or even 100x in just months.

Yet, that doesn’t stop you from investing in the big end of town, despite “missing the boat”.

You’re in it for the long term; the journey will matter as much, if not more than the destination.

Here is a list of my favourite cryptos (in order of investing preference) with solid prospects in the coming years, many of which have stood the test of time.

For perspective, no single digital asset accounts for more than 30% of my overall crypto portfolio; shock horror to maximalist, I know.

1) Ethereum (ETH)

You know many others think this is the bee’s knees when several rivals, i.e., the (in)famous “Ethereum killers”, start working on or incorporating an Ethereum Virtual Machine/EVM-compatible aspect to their own network.

If these competitors (rather, some hardcore enthusiasts behind these that think Ethereum is s&*t), why bother with EVM compatibility?

Me thinks that Ethereum is here to stay.

For starters, let’s not forget the thousands of ERC-20 tokens built on its blockchain.

Shortly after launching in 2014, Ethereum gradually made its way up the ranks and has consistently remained in the top-3 by market cap since February 2016.

Developers behind the leading smart contracts platform continue to build on and improve the ecosystem (see Ethereum Improvement Proposals/EIPs), and major upgrades over the past 12 months, including The Merge and Shapella, coupled with bullish sentiment gradually returning to the market once again, I expect big things ahead for Ethereum.

Regarding institutional interest, let’s not forget the Enterprise Ethereum Alliance, a consortium of various stakeholders aiming to speed up the business adoption of this ecosystem and its native coin. Various EEA board members include representatives from J.P. Morgan, Ernst & Young, Microsoft, Accenture, Santander and other firms.

Thus, strong interest from retail and institutional investors, coupled with ongoing network upgrades, reinforces the argument that Ethereum is a safe bet for the long term.

Image by Trichaiwat on Shutterstock

EIP-1559 and the ETH burn mechanism have helped stabilise the coin’s circulating supply, peaking at roughly 120.5 million ETH; even better, this rate has been gradually decreasing, particularly since The Merge last year.

Some detractors question its long-term viability by moving from proof-of-work (PoW) to the more energy-efficient proof-of-stake (PoS) system. However, as prospective investors, you be the judge on this one, and, pardon the cliché, but time will tell.

2) Bitcoin (BTC)

The fact that the foundation crypto — launched in 2009 — has stood the test of time to remain relevant as a top-20 crypto and hold the top spot unrivalled is nothing short of remarkable.

Yes, Ethereum has come close to usurping Bitcoin, per the on-and-off discussion of the BTC-ETH Flippening. However, Bitcoin still retains the lead.

Widely regarded as one of the most decentralised blockchains, Bitcoin continues to survive and pick up steam again, rising from $19K to ~$29K year-to-date.

Moreover, the haters are still waiting for this thing to die/ F off and (dare I say) vanish into the ether; it has been declared “dead” over 470 times to date (you be the judge of the veracity of these sources).

In spite of such “wishful” thinking by Bitcoin/crypto critics, two countries to date — El Salvador and the Central African Republic — have even accepted the use of the original cryptocurrency as a form of legal tender. Yes, these are small economies, but it is still an impressive move, considering that Bitcoin is less than 15 years old.

Despite it being slow and having limited utility versus Ethereum and other chains, sooner or later, many expect Bitcoin to adopt the Lightning Network, it’s

“The Lightning Network is a decentralized system for instant, high-volume micropayments that removes the risk of delegating custody of funds to trusted third parties.”

QUOTE: The Bitcoin Lightning Network (summary paper)

The debate continues whether Bitcoin should be primarily used as a digital store-of-value (i.e., digital gold) or a global payment system — micropayments and otherwise.

Nonetheless, its growing hash rate correlates to its overall network security with ~17,000 reachable Bitcoin nodes (node operators) across 90 countries. With more countries contemplating its use as legal tender, the network continues to grow by the day.

Vires in numeris, as they say in Latin.

Image by Phongphan on Shutterstock

3) Cardano (ADA)

One of the leading alternatives to Ethereum, Cardano’s “slow and steady” approach to developing its blockchain and incorporating various features as outlined in the project’s roadmap (across five eras) has won over a legion of fans and developers since its inception in 2017.

With three main entities behind the ecosystem — Cardano Foundation, Emurgo and Input Output Global —and an average of 151 daily developers in 2022, the blockchain had one of its most significant upgrades to date, back in 2021, the Alonzo Hard Fork. This finally allowed developers to run smart contracts on Cardano, which can be deployed to run decentralised apps (dapps).

Further details about this hard fork and other key Cardano upgrades are available here from Cardano Docs.

Why am I optimistic about Cardano’s long-term prospects? In spite of (the expected) slow progress on improving its blockchain—expanded functionality, cheaper and faster transactions without compromising network security, cross-chain interoperability, etc. — it continues to be a dominant player in the space.

This prominent position goes beyond its status as a top-10 crypto by market cap. Assessing other metrics (number of active followers across multiple online communities, developer activity, quantity and scope of partnerships, range of Cardano dapps and the number of active users (daily, weekly, monthly, and so on), this helps gauge both the amount of existing and upcoming support for the protocol and its native coin, ADA.

https://twitter.com/Cardano_CF/status/1653101715657220111/photo/1

The latter’s CEO and de-facto key Cardano spokesperson, Charles Hoskinson, is one of the most outspoken personalities across the crypto industry.

Love him or loathe him; he’s a polarising and eccentric character. I think he will go down as one of the most influential people in this space, at least by the end of this decade.

Here is a neat visual summary of some on-chain metrics for April 2023. I also came across additional, real-time and updated OCM data via Messari.

Source: Cardano Foundation (@Cardano_CF) on Twitter.

One of the most exciting developments on this blockchain is gradually overhauling the key programming language and toolkit for building and executing smart contracts* on Cardano.

This would replace the current option, Haskell.

*Haskell acts as the blockchain’s virtual machine and converts the code into Plutus, the ecosystem’s native smart contract language.

Enter Aiken, touted as ‘A Modern Smart Contract Platform for Cardano’.

“Aiken is not intended as a general-purpose language. Rather, it focuses on Cardano and aims for a high-quality toolkit for developing reliable smart contracts with confidence.”

Aiken homepage

Why this major change? I have seen mixed opinions about Haskell, notably that it is difficult to learn and become proficient in this programming language, as opposed to something much easier for beginners, like Python.

Speaking of programming languages, Aiken, whilst written in Rust, is different from the latter, as explicitly mentioned in the Aiken ecosystem overview.

Regardless of what you think, the Cardano developers working on Aiken acknowledge that Haskell wasn’t the suitable option to offer a great developer experience and instead provide an alternative that is safe, easy to use, modular and with minimal configuration required.

This smart move will quash much criticism about Haskell to date. This industry is hyper-competitive, so if Cardano stakeholders and enthusiasts want the ecosystem to maintain a strong presence in this space (and not lose talented engineers and developers to rival blockchains), it must adapt accordingly.

4) BNB

Previously Binance Coin, BNB (“Build n Build”) is the native coin of the BNB Chain network, another major smart-contracts platform positioned to remain a dominant alternative to Ethereum in the coming years and possibly exceed it one day.

Earlier this month, BNB recently experienced its 23rd Coin Burn, a quarterly event that will continue until the BNB maximum supply reaches 100 million coins (from the 200 million coins at launch).

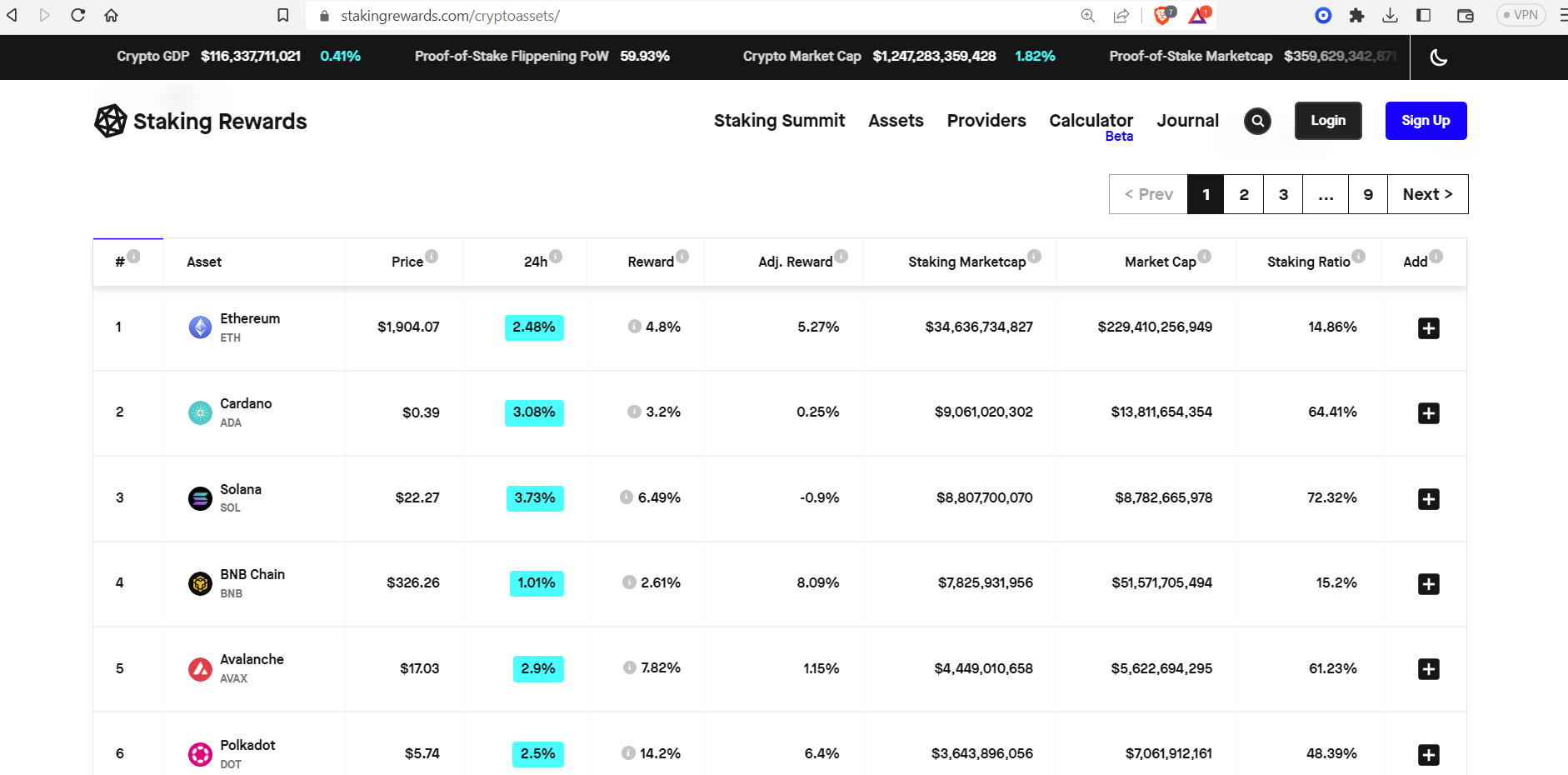

Like ETH, there is an added incentive for BNB holders to contribute to the network by staking their coins. At present, BNB is the fourth-most staked crypto by staking market cap.

BNB’s continually deflationary supply (until 100M) makes it even more advantageous for people staking the coin, as the adjusted annual reward (after inflation/deflation) more than triples from 2.61% to roughly 8%, as shown in the image below; visit the Staking Rewards website for updated info.

Source: Staking Rewards

Moreover, there are other opportunities for BNB holders to earn passive income with their coins, notably through lending via a crypto exchange (e.g. KuCoin) or an open-source liquidity protocol, such as Aave, with a Ledger hardware wallet.

A concern about network decentralisation is the relatively small number of network validators (50) as part of the BNB Smart Chain consensus mechanism (Proof of Staked Authority). In contrast, Ethereum has over 650,000 validators for its Beacon Chain (although this figure has been contested).

Regardless, there should be a continuous push to further decentralise a network as much as possible.

Binance affiliate link. I receive a small commission from each successful referral.

Here is the link if you are on a laptop or desktop:

https://www.binance.com/en/activity/referral-entry/CPA?fromActivityPage=true&ref=CPA_002PKBO6IF

5) Polygon (MATIC)

As the most renown chain-agnostic scaling solution for other blockchains (which also functions as a side chain), Polygon will retain an integral role in aiding other blockchains to accommodate massive throughout on their blockchain.

Sidechains and layer-2 networks (L2s) will play a pivotal role in helping Ethereum and other base (layer-1) chains scale whilst maintaining security and processing transactions affordably; there is still much room for improvement in terms of scalability and cheap transaction fees, especially on Ethereum.

One of the biggest Polygon partnerships in recent times is with Google Cloud, with the latter deploying its node-hosting product, the Blockchain Node Engine, to the Polygon ecosystem.

Despite improvements involving L2s and having more predictable Ethereum gas fees (gwei) as per the London Hard Fork, remember that all networks will need consistently robust and extensive infrastructure to cope with mass adoption in the future.

Thus, Polygon, other sidechains and L2s will remain important for the foreseeable future. Even if the scalability were no longer required on Ethereum, Polygon can still play an important role in aiding other blockchains or even continue expanding its utility and partnerships as a standalone, independent blockchain.

Polygon boasts over 19,000 DApps at present and roughly $1 billion of TVL in its network relating to DeFi.

6) XRP

Image by BT Side on Shutterstock

Many crypto commentators will agree that the ongoing Ripple vs SEC lawsuit has dragged on for way too long; for context, it began in May 2018.

As frustrating as this is for Ripple, the XRP community and general crypto enthusiasts awaiting the official decision from US District Court Judge Analisa Torres, John E. Deaton, a US attorney that regularly informs the crypto community about this lawsuit and general legal matters in this space, providing a useful video (in early April) covering why Torres has delayed making a decision about this saga.

If you would like further insights about this matter, check out these related articles.

A verdict will likely be handed sometime in the coming months, hopefully by the end of this year. Otherwise, many will start mocking the process and how long it has dragged out.

Whenever this judgement this made, and assuming that it is favourable for Ripple (and, broadly speaking, various altcoins), XRP’s price will probably go ballistic, if not straight after, then a couple of months after the decision.

Despite the massive clout the USA has on the world stage (financially and otherwise), Ripple has been expanding its partnerships across other significant regions—South Asia, Latin America, the Middle East and North Africa (MENA), amongst others.

These should be major areas of interest as there is enormous potential for gross-payment settlement systems/remittance networks to have the greatest benefit to most individuals and enterprises in regions ripe for strong economic growth in the coming years and decades.

7) Algorand (ALGO)

Touted as one of the greenest blockchains around (i.e., a “carbon-negative” blockchain — offsetting more emissions than the network produces. This is achieved through its collaboration with ClimateTrade; more details about Algorand’s approach towards sustainability are available here.

Its ultra-low fees and fast finality provide even more incentives for companies, particularly emerging ones, seeking an alternative to Ethereum and opting to utilise the Algorand blockchain for efficient operations.

Image by ARTEMENKO VALENTYN on Shutterstock

Earlier this month, Algorand teamed up with the American Red Cross and St. Vincent de Paul USA to launch the Kare Survivor Wallet, aiding people and communities impacted by natural and artificial disasters.

Besides usage for enterprises, I imagine Algorand playing a notable role in aiding other NGOs and multiple entities (commercial and otherwise) seeking a blockchain/crypto partner with excellent environmental/”green” credentials, like those I alluded to earlier.

Last November, the Algorand Foundation introduced Algorand Ventures, a new initiative to foster greater development and support for anyone building on and generally supporting the Algorand network.

From the related communique, this initiative will aim to attract more talent and funding through accelerator programs and seed projects, aiming to aid VC connections as well. Moreover, this post also states a specific goal of accelerating at least 50 projects per year.

If/When the Algorand Foundation manages to secure massive partnerships with leading multinational companies, expect an enormous increase in ALGO’s price, most likely propelling it into the top-10 list of assets by circulating market cap.

For perspective, it currently sits at #40 on this list, with a CMC of roughly $1.26 billion, with ETH at $227.8 billion.

8) Chainlink (LINK)

A leading player in the decentralised oracle space, the chain-agnostic protocol has come a long way in forging various partnerships and blockchain integrations since its mainnet launch in 2019.

One of Chainlink‘s main purposes is to connect external data, such as real-time weather or price data, automation services, decentralised medical data, and much more, all with smart contracts. This is achieved through the use of decentralised oracles.

These oracles can play a pivotal role in numerous use cases, including decentralised finance (DeFi), Insurance, Enterprise, NFTs and Gaming, and for non-profits/NGOs.

Key metrics and milestones for Chainlink up to December 2022. Source, Sergey Nazarov (Chainlink Blog). Click here for a full-screen view.

With over 1700 projects affiliated with Chainlink and major partnerships with Google Cloud, Amazon Web Services (AWS), AccuWeather, Swisscom and other enterprises, there are plenty of exciting developments about this project.

For brevity and to avoid repeating content from other excellent sources analysing Chainlink, I encourage you to watch this recent video about Chainlink and its medium to long-term prospects, courtesy of Altcoin Daily.

9) Polkadot (DOT)

Founded by Gavin Wood, an instrumental member behind the creation of Ethereum, Polkadot promotes itself as “a scalable, interoperable & secure network protocol for the next web (Web 3)”.

To achieve this, there are three core components of its main blockchain architecture: the relay chain (the network’s core chain), parachains (Polkadot-native chains) and bridges (ideal for interacting with different networks such as Bitcoin and Ethereum). I recommend exploring the lightpaper for a succinct overview of the blockchain and organisation.

Despite mixed investor opinions about Polkadot as of late, one collab to watch is that with Deloitte Switzerland. The accounting firm has recently integrated KILT Protocol, a “blockchain identity protocol for issuing self-sovereign, verifiable credentials”, which runs on Polkadot.

This setup offers reusable digital credentials for its clients as per KYC or Know Your Business (KYB) checks for uses in e-commerce, private logins and fundraising, to name a few.

This aims to overhaul inefficient and costly systems, often requiring clients to verify their identities repeatedly – full details about this partnership through the KILT Protocol Medium blog and an associated news article.

Besides Polkadot, it is also worth paying attention to Kusama, the former’s test net, similar to Ropsten or Goerli for Ethereum.

This open-source interoperability platform is positioning itself as a one-stop shop for seamless interoperability across different blockchain ecosystems.

For a useful and concise overview of Polkadot, its key features and benefits, check out its lightpaper.

Because Polkadot allows any type of data to be sent between any type of blockchain, it unlocks a wide range of real-world use cases.

Polkadot lightpaper

Image by David Sandron on Shutterstock

Another promising aspect of Polkadot is the high number of full-time and total developers on this blockchain – 750 and 2,000, respectively. This represents a 16-fold increase since 2018.

It’s no surprise that many of the crypto assets featured here are some of the popular staking cryptos around. Polkadot has a generous double-digit staking APY, which is still enticing when accounting for inflation (as per the adjusted rewards below).

As a result, pay closer attention to the adjusted rewards when finding the best PoS cryptos, alongside other considerations about network security, developer activity, community, etc.

FYI I included Polkadot (and Algorand) in a related article about promising mid-cap crypto assets to watch in the coming months and years, covering further details I have not included here.

10) Solana (SOL)

It’s no surprise that these blockchain features last here in my primary list. Put simply, I am in two minds about this network.

If you asked me a year ago about this project, I would have been more reluctant than now to add it here.

The main reason for this? I was put off by the frequent network outages throughout 2021 and 2022.

You know the situation was ridiculous when regular jokes about Solana’s “opening hours” were made.

To their defence, over the past six months, they seemed to have gotten their s&%t together; hopefully, these don’t become famous last words shortly are publishing this piece.

Image by pakie via Shutterstock

Jokes aside, Solana has backing from 22 listed venture-capital firms (39 listed on Crunchbase, including individuals). Thus, there is a strong economic incentive to see this project continue unless these related companies make a coordinated exit from Solana into another blockchain, which I do not see occurring shortly.

Moreover, there is a variety of dapps built on this blockchain and proposed VC funding for more protocols being built on it.

As per DeFi, one of the major dapp categories across the crypto space, Solana still lags well behind Ethereum across several metrics – number of protocols, daily active users, TVL, volume and value of stablecoins running on their respective blockchains.

As a result, I remain ambivalent about its long-term success but acknowledge its colossal number of Twitter followers – over 2.2 million – more than many of the other crypto projects featured here.

WILDCARDS

These are the crypto asset that, whilst I am in two minds about their long-term prospects (>10 years, as an arbitrary number), I still believe they will do well for at least a couple of major bull cycles in the near future (i.e., for the rest of the 2020s).

11) Cosmos Hub (ATOM)

Another great crypto project, but one that I have not paid as much attention to as the others; nonetheless, it is worthy of a mention.

The Cosmos SDK is an innovative blockchain framework underpinning Cosmos Hub, allowing for the creation of new, custom blockchains and connectivity with existing ones also built on the Cosmos Network via the Inter-Blockchain Communication Protocol (IBC).

Like Algorand, Cosmos boasts ultra-low transaction fees and a very energy-efficient system.

For a recent, extensive overview of the project and coin, I advise you to watch a recent video from Ivan on Tech.

For regular Cosmos-related content on YouTube, I recommend following Cryptocito and various videos from Coin Bureau about the project and its native crypto, ATOM.

Above all, the best information sources for this protocol are the official Cosmos Network blog and website.

Image by Cosmos press kit.

Image by Cosmos press kit.

12) Litecoin (LTC)

Another legacy coin that has also stood the test of time, although it has slipped down the ranks in terms of market cap.

I am featuring this last on my list of blue-chip cryptos because I am in two minds about its presence in the long term. Whilst it will continue to exist and remain in the top 50 for the foreseeable future, it needs to establish more partnerships (prolific ones, too, if it were to dominate once again), attract and retain devs, and continue building its online community.

One of the most anticipated integrations on its blockchain was the privacy-enabled Mimblewimble upgrade, with talks about this dating back to 2019.

As one would imagine, this did not bode well with different centralised exchanges, many of which require upholding know-your-customer, anti-money-laundering (KYC AML) laws stipulated by law-enforcement agencies (not to mention that some exchanges would be keen on obtaining user data for their own purposes).

LTC, like BTC, has a capped supply and a block reward, halving roughly every four years. The altcoin is less than 100 days from the next iteration, with the inflation rate falling from 3.68% to 1.8%, on par with its older sibling.

Others such as Fantom (FTM), Avalanche (AVAX), Tezos (XTZ) and Aptos (APT) are also on my radar and worth investing in as well. I will expand on these projects in future. However, I did not want to make this longer than what it is.

Image by Wit Olszewski on Shutterstock

Additional thoughts

Whilst I envisage a future whereby multiple blockchain protocols will co-exist with varying degrees of influence, certain ecosystems will likely find and focus on a particular niche to cater for certain sectors.

Still, competition will be rife when factoring in how much money will flow through the space, not to mention the rush to dominate the space.

In regards to this, it is worth keeping an eye on how other blockchains in this space are faring, particularly from a developer activity perspective, amongst other metrics (dapp usage; the number of people using these dapps; total value locked for something like DeFi, social-media activity, and so on).

To reiterate, I have prioritised the well-established cryptos that have stood the test of time so far, and I believe that they will still be dominant players (top-30) digital assets in the future.

With over 23,700 registered crypto assets (98%* of those are s&*thouse, straight-up scams, obsolete, various stablecoins, etc.), there is only so much room to accommodate x number of blockchain protocols worth investing in from a longevity perspective.

As part of this list, I aimed to incorporate some diversity here in terms of structure (i.e., degree of (de)centralisation, benefits, use cases, and so on), consensus algorithm (both PoW and PoS example, mostly the latter), and, above all, focusing on those that have not only survived to date but are thriving, notwithstanding regulatory attacks, mainstream-media bias and public perceptions of this entire space.

When selecting your preferred digital asset(s) for long-term held, some more food for thought is factoring in the role of L2s and sidechains in the coming years and how significant these will be. This is an entirely different topic of discussion, and I have covered L2s in detail in recent pieces.

Elaborating on developer activity across the crypto sphere, here are a couple of key takeaways from the latest (2022) Electric Capital Developer Report:

- 72% of monthly active devs work outside the Bitcoin and Ethereum ecosystems.

- Solana, NEAR, and Polygon grew 40% YoY and have 500+ total monthly active developers.

I recommend reading other aspects of this report, as mentioned earlier, including the geographical distribution of blockchain developers; the USA is losing its dominance in this regard (2017-22 data), with strong growth across Asia (including India) and Europe remaining in the second spot.

Above all, it is worth remembering that no crypto is guaranteed to be a winner/safe bet in the long term; anyone who aims to convince you otherwise is full of s&*t.

Technology, in general, is evolving at an accelerating pace; we’re living in increasingly uncertain times (if recent years are anything to go by); draconian governments and influential people intent on destroying (semi-)decentralised crypto assets remain a looming threat; quantum computing (especially for the long-term), so on and so forth.

At the same time, I remain optimistic about the survival of this space in its current form (i.e., Bitcoin and genuinely decentralised money); at least, it is supported by a large enough cohort of our society.

Yet, the points listed above should remain in the back of our minds; if we’re complacent, we could see excessive regulations hijacking the system and simply making it something heavily-controlled, not far from what is being proposed with central bank digital currencies.

*Purely subjective, but you get the gist.

Disclaimers

N.B. None of this is financial or legal advice, and I am neither a financial advisor nor a lawyer. You are solely responsible for crypto investments and how you interpret the information provided in this piece.

The opinions expressed within this piece are my own and might not reflect those behind any company, organisation or person listed here.

Please do your research before investing in any crypto assets, staking, NFTs and other product affiliated with this space.

For transparency, I acknowledge that these assets featured herein account for the vast majority of my overall crypto portfolio, particularly ADA, BTC and ETH.

I received no incentive from any person or entity listed throughout this article to discuss their product.

If you enjoyed this article, I recommend following my Medium page for regular reports about crypto assets, blockchain technology, and more. Feel free to check out my publication as well, Crypto Insights AU.

Thanks for your support.

Featured image by zimmytws on Shutterstock

Нi! I know this is kinda off topic but I was wonderіng if you knew where I couⅼd

find a captcha plugin for my comment form? I’m using the same blog platfоrm as

yours and I’m haᴠing difficulty finding one?

Thanks a lot!

I’m planning to start my blog soon, but I’m a little lost on everything. Would you suggest starting with a free platform like WordPress or go for a paid option? There are so many choices out there that I’m completely confused. Any suggestions? Thanks a lot.