And my strategy for Ethereum as the bull run heats up.

It’s been a long time coming – nearly four years in the making – but we’re on the cusp of having ETH set a new all-time high of $4,890.

Just like XRP, the doubters and haters are being proven wrong.

Yes, altcoins are still far from their peaks relative to Bitcoin, but they’re still pumping in USD terms, some of which have also outperformed BTC over the past 12 months.

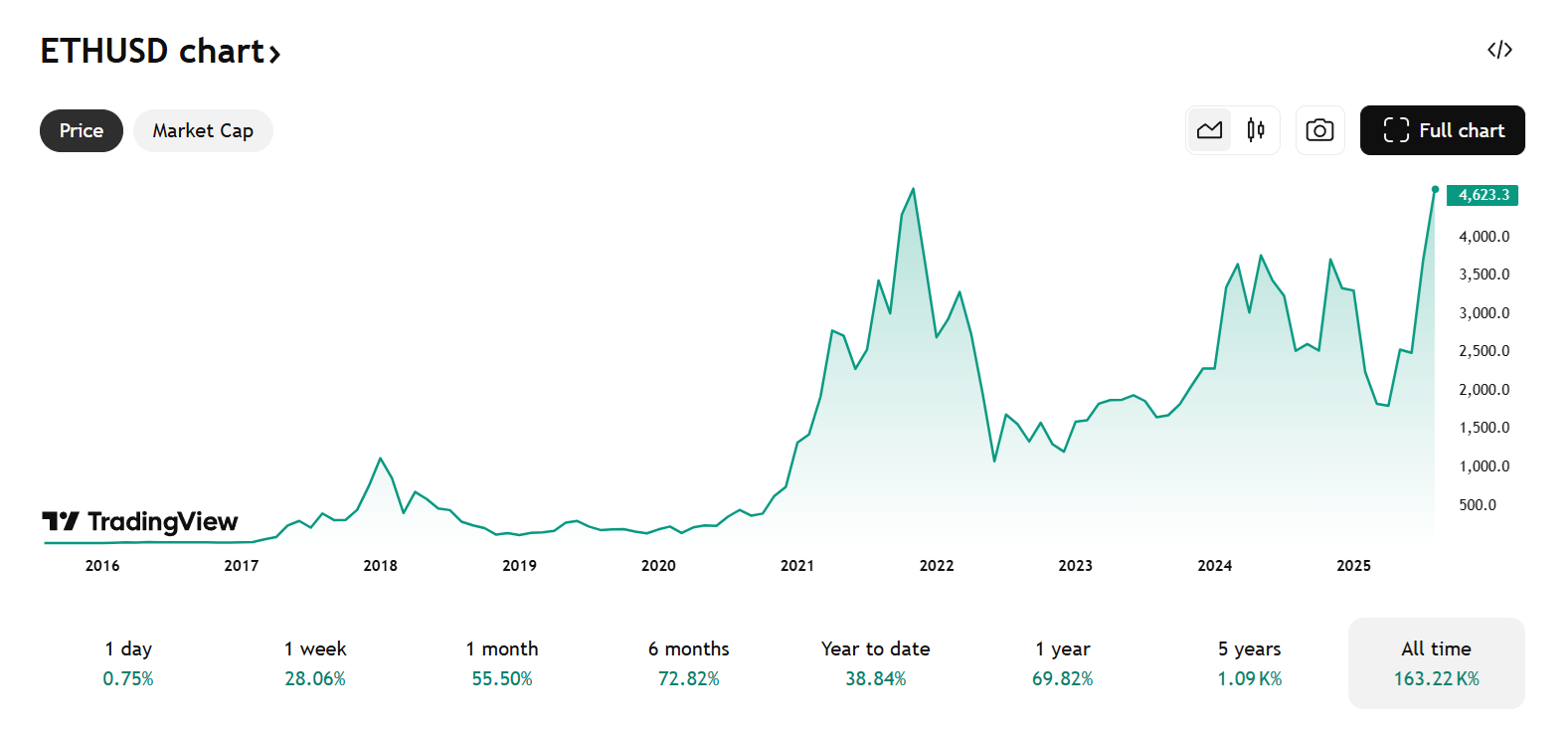

ETH/USD historical price chart, up to August 13, 2025. Source: Bitstamp via TradingView.

While Bitcoin’s performance has contributed to altcoins beginning to take off, much of ETH’s price increase as of late boils down to the surge in institutional interest snapping up ETH and, to a lesser extent, the change of guard at the Ethereum Foundation.

Over the past few months, there has been an aggressive accumulation by various entities, especially by Bitmine Immersion Technologies (NYSE: BMNR), GameSquare Holdings (NASDAQ: GAME), and SharpLink Gaming (NASDAQ: SBET), over the past 30 days.

Bitcoin Treasuries and Strategic ETH Reserve (SΞR) provide the most comprehensive, updated data about the largest publicly-owned companies’ ownership of these two digital assets.

SΞR firms and (spot) ETF providers currently manage just under 9 million Ether, about 7.4% of the coin’s circulating supply.

Not only is this lower than the combined institutional holdings of Bitcoin, between public Bitcoin treasury companies and spot ETF providers, of around 2.6 million ₿ (~12% of the max supply), but ETH’s ownership is relatively more distributed, unlike MicroStrategy and BlackRock’s gargantuan BTC holdings.

————————————————————————————————————————-

Earlier this year, the Ethereum Foundation underwent a major leadership overhaul. Aya Miyaguchi went from Executive Director to President, while Hsiao-Wei Wang and Tomasz Stańczak became co-Executive Directors, separating the long-term vision from daily operations.

This move appears to have paid off, as ETH’s up by 76% over the past three months, one of the best-performing top-100 assets during this period.

Had you stocked up on ETH during trade tariff concerns around April, you would have tripled your money.

How I’m taking profits in ETH

At some point, we’ll witness the end of this bull run, so we should all be prepared for this moment whenever it arrives.

To what extent BTC, ETH and others will drop is impossible to tell. Still, there will eventually be a (major) correction, i.e., a good buying opportunity, possibly to a lesser extent than in previous cycles.

What’s my plan of attack?

At $8,000 per coin, I’d convert 7% of my holdings to Solana. If history repeats itself, then we’ll see capital rotating from ETH to other altcoins. I believe Solana will be one of the beneficiaries of this move.

I’d cash out another 10% and invest it in other assets or pay off some debt.

5% I will convert to Bitcoin (or distribute into another 3-4 altcoins, still TBC.

At an $12,000 Ξ, I would double the abovementioned percentages and explore less-volatile investments (possibly stocks) that can be readily liquidated and used to buy BTC or ETH when the bull run ends or cools off.

These are my initial price targets, which I may adjust slightly based on market sentiments or macroeconomic factors, such as profit-taking at a $10.5K target instead of $12K.

Remember, we’re all in different financial positions, and there are many variables to consider: your entry price, how much crypto you’ve bought, spot vs leverage trading, crypto % of one’s overall portfolio, personal circumstances, etc.

As a result, make plans that are best suited to your needs.

Additional thoughts

Following the rollout of some Pectra upgrades earlier this year, the anticipated Fusaka Hard Fork is another set of network improvements aimed at enhancing scalability, boosting efficiency, and strengthening node resilience.

Sidenote: This was named after “Fulu”, a star in Cassiopeia, and “Osaka”, a past Devcon host city, in line with Ethereum’s tradition of naming upgrades after stars and cities, e.g. Dencun, Shapella, Pectra and Glamsterdam (tacky AF, I know).

Assuming all eventually goes well with these upgrades – there will likely be delays and bugs, but Ethereum still gets things done, albeit slowly – I believe an $8K ETH should be a shoo-in for this cycle.

Some are saying it will exceed $10K, but I’ll go by one target at a time.

As retail starts pouring back in, which is gradually happening, based on Google Trends statistics, the entire market will pump even harder and faster than many expect, similar to 2017 and 2021.

Bitmine Immersion Technologies Chairman Tom Lee, who still serves as the CIO and Head of Research at Fundstrat, believes that Ethereum could reach $15,000 by the end of this year, translating to $1.81 trillion.

“There is a significant probability that Ethereum could flip Bitcoin as well, in terms of network value.”

Tom Lee, interview on Bankless podcast, August 6, 2025.

For context, if BTC were to take the #1 spot, it would need a circulating market cap of $19,222 using Bitcoin’s current price.

For context, Bitcoin’s circulating market cap is currently $2.36 trillion, so Lee’s expectations are plausible.

Considering Ethereum’s longstanding position as the largest smart contracts platform, I wouldn’t be surprised if it manages to reach and remain above a $2 trillion market cap by 2030.

However, let’s not get ahead of ourselves, at least not for this cycle. The tech still has a long way to go.

Will ETH continue its excellent run as of late, or is it overblown hype? If so, how many of you believe we should focus on Solana instead? Comment below.

Affiliate links

If you’d like to purchase a Ledger or Trezor product, please use the following link to help support my channel. I receive a small commission per sale at no additional cost.

https://shop.ledger.com/?r=a1b3ac23d773

https://affil.trezor.io/aff_c?offer_id=169&aff_id=35611

You might also be interested in these stories:

https://medium.com/@cryptowithlorenzo/bitcoin-is-going-to-zero-5562122f5481

Disclaimers

• N.B. None of this is financial advice; I am not a financial advisor. This information is for educational purposes only. You are ultimately responsible for your investments.

- My opinions in this piece might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

Featured image by Alexandru Nika at Shutterstock.