…even though I still prefer ETH, at least for now.

With Solana’s massive 900% growth in 2023 comes the discussion of whether it can continue to catch up to Ethereum and present itself as a better investment than the leading smart contracts platform.

Here are five reasons I believe Solana can continue closing this gap and take away more of Ethereum’s market share across multiple crypto sectors.

1) Many projects are migrating to Solana

Render Network, Helium, Audius and Circle (behind the USDC and EURC stablecoins) have moved away from Ethereum (or from their own network) and have instead decided to use Solana, whether in part or as a full move to the newer protocol.

This trend is becoming more popular across the space due to a push for greater decentralisation by having a project/asset operating on several blockchains simultaneously.

For example, I will note that stablecoin issuers are doing this to decentralise their operations by having their products run on multiple systems simultaneously, e.g., Tether (USDT) and its rival, Paxos (USDP).

Aave, a popular automated market maker (AMM), will soon add Solana as a compatible chain, per an Aave community vote. This will further boost SOL liquidity going through DeFi platforms.

These represent small yet important wins for Solana, which has pulled off an amazing turnaround in 12 months, where it collapsed down to the single digits (i.e., < $10). We hadn’t seen it since February 2021, the first time it exceeded this price point.

To put things into perspective, SOL has been on a rollercoaster ride since launching in April 2020.

— 11 April 2020: ~$0.95

— 1 January 2021: ~$1.70

— 6 November 2021: $260 (its all-time high)

— 1 January 2022: $170

— 1 January 2023: $10

— 1 January 2024: $101

Source: CoinMarketCap

Hats off to anyone who has held on the entire time, and a special mention to those who loaded your SOL bags while people were panic selling in December 2022.

SOL generated 900% ROI last year instead of ETH’s modest 80%. The former’s significantly lower market cap still makes it plausible to see it outperforming the second-largest digital asset for a consecutive year.

at

2) A push for greater decentralisation

Today, Solana’s ecosystem boasts over 1,960 block-producing validators (according to its Validator Health Report — October 2023) with a Nakamoto Coefficient 31. For comparison, it is 25 on Ethereum but has over 4,000 block-producing validators.

This coefficient represents the minimum number of validators that could have 51% ownership of the entire network’s stake.

Balaji S. Srinivasan and Leland Lee proposed this concept in July 2017 in the Medium post Quantifying Decentralization.

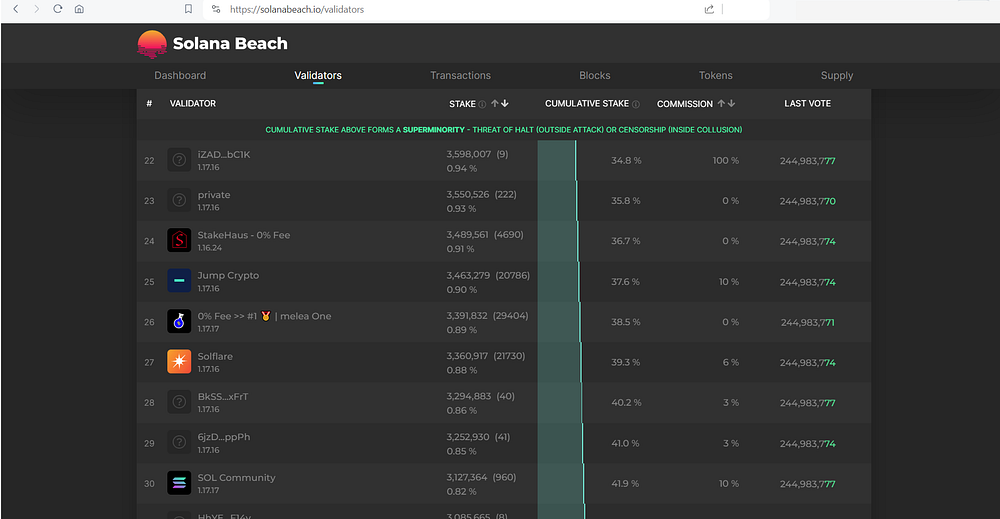

It can sometimes be problematic when cumulative ownership (amongst a small number of participants, i.e., ~20) gets above 33%, as shown in the screenshot below.

This has been an ongoing issue and has intensified in recent years as institutional investors further reinforce their position as major coin/token holders of various digital assets.

The problem presented here is that decentralised, or lack thereof.

As I’ve explored in a previous piece, some of this vast ownership is attributed to large exchanges (Binance, Coinbase, Kraken, etc.) managed funds on behalf of their clients. I expect this to become more prominent once more institutions snap up ETH and SOL as their customers show more interest.

People will have differing views on how much control individuals should relinquish to an exchange in managing their assets, and I won’t expand on this here for brevity.

Besides ownership and control of private keys to access ETH and SOL, there’s another issue of (de)centralisation of stake pools.

Fortunately, block explorers such as Solana Beach warn people seeking a suitable validator about this before staking their SOL. This encourages individuals to use a pool with relatively lower staked amounts to promote network decentralisation.

This matter relates to all blockchains with varying degrees of miner or validator dominance, including a highly decentralised network such as Bitcoin.

Per Ethereum, the issue relates more to liquid staking derivatives (LSDs), notably Lido DAO, which solely accounts for 31.9% of staked ETH (through its liquid token, stETH). This matter has been an ongoing topic of discussion as ETH staking becomes more popular.

However, Lido DAO is quelling doubts by claiming it wants to keep “Ethereum decentralised, accessible to all, and resistant to censorship” through the Lido on Ethereum Scorecard.

Moreover, even though it reportedly has over one million unique addresses (per Glassnode statistics) that have deposited 32 ETH to the ETH 2.0. contract, it is important to note that an individual can control multiple addresses, which is most likely the case in many instances.

3) Improvements to network stability

Solana’s come a long way over the past couple of years after an atrocious spell during 2021 with frequent network outages.

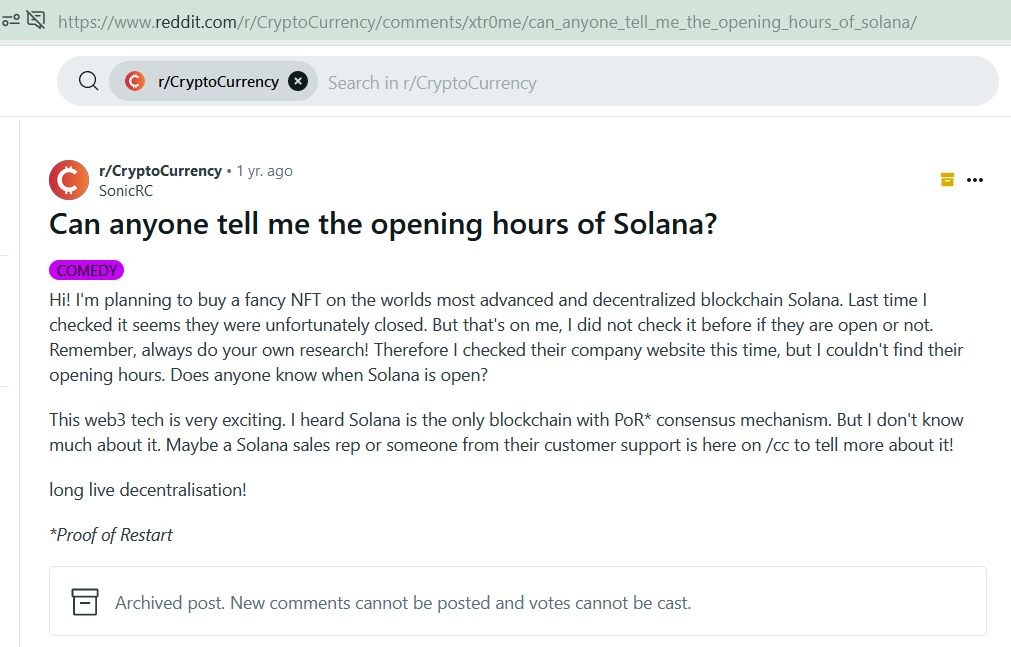

It became the butt of jokes for a while on crypto social media, the best ones being questions about Solana’s “opening hours”, “Proof-of-Restart”, and “I wish (insert name) went down as much as SOL”.

You have to laugh; otherwise, you’d cry about how pathetic the situation was at the time.

on

It has done a fantastic job restoring its reputation by maintaining an excellent network uptime.

4) NFT trading volumes and creator royalties

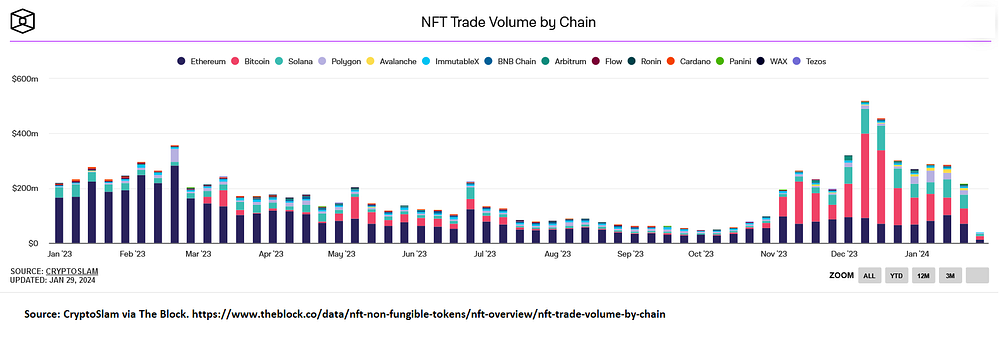

Bitcoin and Solana have made significant strides in the NFT realm/digital collectibles, with the pioneering blockchain exploding in popularity since the advent of Ordinals, a.k.a. Bitcoin NFTs/inscriptions.

These two have broken Ethereum’s near monopoly in NFT trading volumes, with other networks now collectively accounting for the majority of $ transactions, as shown in the chart below.

via

. Snapshot taken on 30 January 2024.

Per Solana, trading volume on its protocol has grown much faster than Ethereum. The latter has lost ground, dropping significantly since early 2023, and, over the past two months, has generated less activity (in $ amounts) than Solana.

Of course, this is just one metric, but a notable one nonetheless, particularly as NFTs are forecast to pick up once again. The above volumes are tiny compared to over $2 billion in weekly NFT trading volumes generated in 2022.

All things considered, Solana presents good opportunities for its coin holders as its network continues to grow, perhaps better ones than for those looking to buy ETH.

OpenSea, a major NFT marketplace, decided to make creator fees optional on its platform. As a result, many creators have sought alternate platforms that provide them with a better deal.

Even though it is multi-chain, it remains a popular option for digital collectibles minted on Ethereum.

Where does Solana tie into this?

“Solana has something that many EVM chains struggle with, and that’s NFT royalties baked in on the smart contract level of the NFT.”

Ivan on Tech (29 January 2024)

Solana-based fine-art platform Exchange Art adopts the Exchange Royalty Protection Standard, permitting creators to opt into this system whereby they are guaranteed royalties forever for secondary sales.

Before continuing, I admit I haven’t covered another growing crypto component: blockchain-based gaming.

This will also do well (across multiple blockchains), and I expect Solana’s fast, well-established network and cheap fees to attract gaming devs looking to build on its ecosystem. The play-to-earn side of crypto gaming was massive in 2021, and I anticipate a repeat of this later this year and in 2025.

5) Airdropping like it’s 2018

If you thought airdrops were a relic of the past, you’re mistaken. Don’t worry; I was guilty of this as well.

There was a period when they faded from the spotlight post-2018, but things have changed in recent months.

Enter BONK.

The Solana-based meme coin took the space by storm last year. No, I am not exaggerating; it was the best-performing top-100 crypto asset in 2023, generating a whopping 5,250% from 1 January to 31 December, over 10,000% from its all-time low on 31 December 2022.

Part of the mania that peaked in mid-December (2023) was the ability to earn free BONK by purchasing Saga — an Android-based Web-3 Solana smartphone — and using dApps via dApp Rewards on the phone.

At one point, the airdropped BONK tokens were worth several times more than the cost of a Saga.

As we go into an explosive bull run (most likely after the upcoming Bitcoin Block Reward Halving, if history repeats), I expect a carbon copy of this to occur with new meme coins being airdropped, whether through Saga or another device.

Love them or loathe them, meme coins have been a recurring theme throughout bull markets ever since DOGE hit the scene. As much as I find them ridiculous, many degens go wild for them, hoping to find a 100, 200 or even 500x token.

Why Ethereum will remain dominant

Despite all the praise I’ve heaped on Solana, I remain a big Ethereum fan and believe it will also have enormous success.

As such, I will continue holding 4–5 times as much ETH as SOL. However, I plan to narrow this gap in the coming months, provided that it takes some market share from the leading smart contracts platform, remains secure and pushes for further decentralisation.

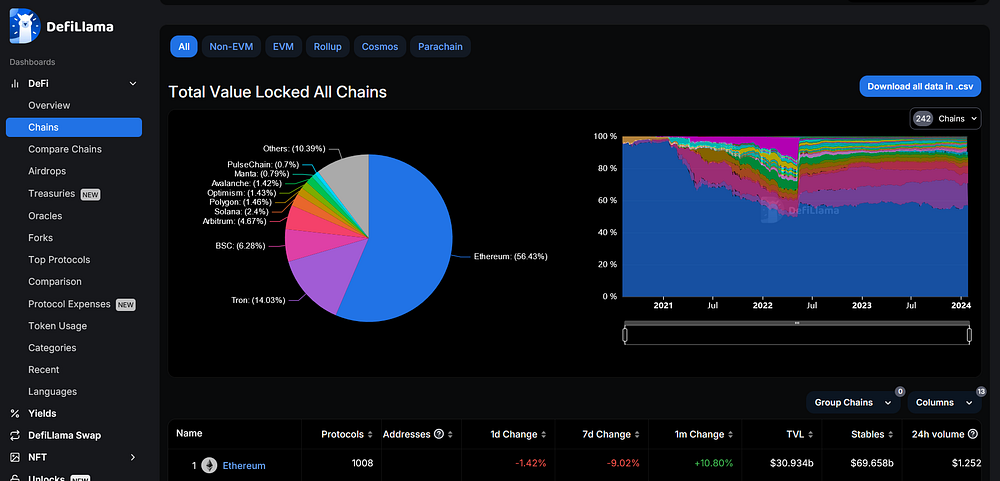

Ethereum still accounts for the vast majority (54%) of TVL, even though other networks have been gradually taking away its market share of DeFi TVL, which peaked at ~97% in January 2021.

Solana’s share will not only benefit from a relative increase in TVL market share (i.e., in % terms) but also from more money pouring into DeFi in the coming years, with a surge expected later this year or early 2025 to coincide with a market-wide bull run.

Scalability improvements set to help it compete with Solana’s ultra-low gas fees and a faster throughput (transactions per second) are part of the missing piece of the puzzle to ensure that the leading smart contract platform can handle 100,000 TPS*

*This also accounts for batched transactions on Ethereum (grouping multiple addresses into one transaction to avoid separate ones), some L2s and sidechains to further enhance scalability. This concept has been discussed in the Ethereum community since 2018 (and possibly before then).

Most of the activity to accommodate many more (and significantly cheaper) transactions will be achieved by layer-2 scaling solutions (L2s), with Arbitrum (ARB) and Optimism (OP) being two notable examples. I covered both of these projects in a recent post.

Moreover, Proto-Danksharding, a precursor to Danksharding (a long-term solution), will also improve throughput on the Ethereum network.

Danksharding is how Ethereum becomes a truly scalable blockchain, but there are several protocol upgrades required to get there. Proto-Danksharding is an intermediate step along the way. Both aim to make transactions on Layer 2 as cheap as possible for users and should scale Ethereum to >100,000 transactions per second.

Ethereum > Danksharding

In the interim, L2s will continue doing the heavy lifting for Ethereum, handling six times as many transactions as Ethereum alone (i.e., the base chain/L1).

There is also block finality — where a transaction has been verified, and a block has been added to the network, thus making it irreversible (immutable).

CoinDesk provides an excellent summary of block finality and the most popular forms used by various blockchains, applicable to Proof-of-Work and Proof-of-Stake systems.

Why do I prefer Ethereum, at least for now?

Ethereum is more established than Solana and remains more dominant than the latter regarding market cap, transaction volume and the number of dapps.

This will most likely change in the future, and, at the very least, I expect Solana to narrow this gap with its rival.

However, this will be a challenge from a business perspective. One of the biggest drawcards for Ethereum in this regard is the Enterprise Ethereum Alliance — an international consortium of “blockchain leaders, adopters, innovators, developers and businesses.”

Launched in February 2017, the EEA now has over 60 members, with renowned companies such as Accenture, Banco Santander, BlockApps, BNY Mellon, CME Group, ConsenSys, Intel, J.P. Morgan, and Microsoft sitting on its rotating board.

Hence, Ethereum will remain dominant in this space for years (probably decades).

Remember that retail and institutional investors still use Ethereum despite its high fees and relatively slower throughput and finality than Solana. Wait until the former resolves these issues and see it grow even faster.

at

Additional thoughts

When I say Solana will be more profitable, I mean from this point onwards, not from each coin’s inception.

The “Ethereum killer” narrative has faded as many believe it is here to stay. The fact that most chains have incorporated EVM-compatible features is a testament to this.

On the other hand, Solana has its share of competitors aiming to wrestle some market share and its growing user base.

I hope both networks — let alone multiple blockchains — thrive in future, mostly due to competition and having a decentralised setup to combat any long-term duopoly/oligopoly.

However, this might be wishful thinking as I still expect a handful of dominant players in this industry. Having a few options is still better than relying on just one.

The increased competition should also benefit consumers by (eventually) forcing blockchains to lower their costs or provide a better dApp experience for consumers.

Yes, there will be people who will still fork out vast sums for priority transactions, e.g., mostly cashed-up users that can easily absorb the costs or for when a highly sought-after NFT is available through an auction.

However, more people will likely turn to Solana, Polygon, Arbitrum or other chains that can settle transactions quicker and cheaper than Ethereum until it solves its scalability issues.

Further reading

Disclaimers

• N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

• The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

• Please do your research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

• For transparency, ETH accounts for roughly 25% of my crypto portfolio, whereas SOL makes up about 5% of it.

Featured image credits

— Background by abdularis at Freepik

— Solana logo by CzBchs at Shutterstock

— Ethereum logo by Jacart at Shutterstock