Many are searching for 100, 200, or even an elusive 1000x gem, banking on a few killer partnerships, listing on major exchanges or mass adoption of these little-known cryptos.

Whilst some go parabolic, most fade away and never return to their initial price or all-time high.

At the opposite end of the spectrum, BTC, ETH, and large-cap altcoins are unlikely to do more than 15x soon; we missed the boat, but they will remain solid crypto investments.

So what’s the sweet spot? Enter small- to mid-cap crypto assets. These have a good balance between risk and reward (at least in this market), many of which have been around long enough to become well-established after a few years.

I will feature four small-cap and seven mid-cap crypto assets alongside a few other wildcards/notable mentions for this piece.

What exactly are these, you may ask? According to Coinbase, small-caps have a (circulating) market cap of less than $1 billion, whereas mid-caps fall into the $1B — $10B range.

That’s quite a range for the latter, but you get the gist.

I am going for a max of $5B circulating MC to find mid-caps that can lead to higher ROIs.

Enough talk; let’s begin.

1) Arbitrum (ARB) — Market cap: ~$2.73B, currently $2.13, ATH $2.39

As many are banking on a fully-fledged bull market akin to what we saw in late 2020 and most of 2021, layer-2 scaling solutions (L2s) will be essential in helping Ethereum manage overwhelming network activity.

Before continuing, an L2 system runs transactions off the main chain (layer-1) to reduce congestion and help it scale.

With all of the different L2 options, why am I focusing on Arbitrum? Its network, Arbitrum One, accounts for roughly half ($9.63B) Using total value locked per L2 protocol. Additionally, it is one of the more established options at present.

However, I envisage this to change in the coming months as competing projects make further improvements and capture more of the L2 market share.

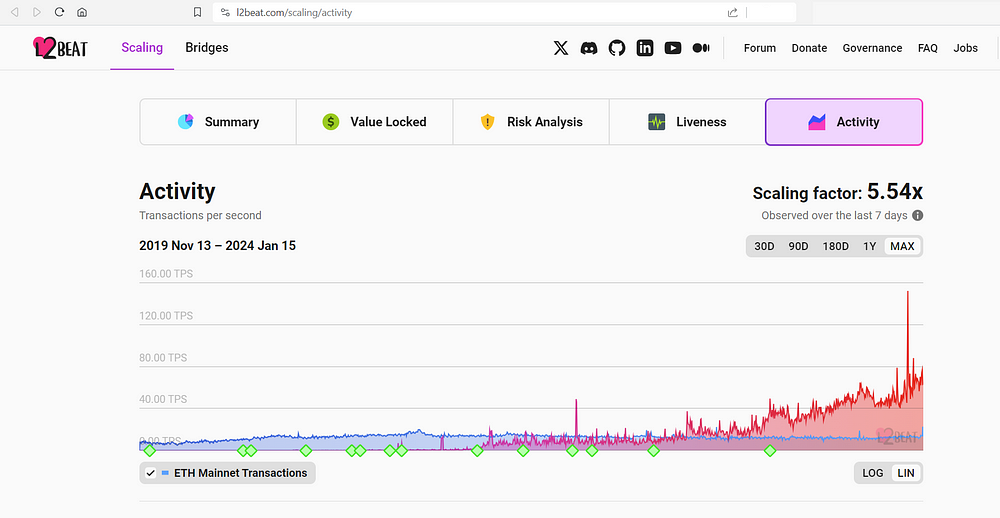

Notice how these L2s collectively offered little improvement in throughput (transactions per second) during that 2021 bull run, leading to astronomical ETH fees, particularly on DEXes and anyone wanting to buy, sell or flip NFTs.

By this year’s end, I expect the scaling factor to get above 10x. With the Ethereum mainnet processing roughly 15 TPS (more like 10–12), the network, including help from L2s, should be aiming for at least 150 TPS by the end of this year.

2) Helium Network (HNT) — Market cap: ~$1.18B, currently $7.38, ATH ~$55

Helium bypasses the inefficiencies of complex, conventional network infrastructure by opting for its low-power, wide-range network (LoRaWAN).

Owing to its long-range capability and cost-effectiveness, LoRa is particularly useful in smart cities and the Internet of Things (IoT) concept: Hundreds of millions of low-power devices and sensors across a city continuously interact with each other.

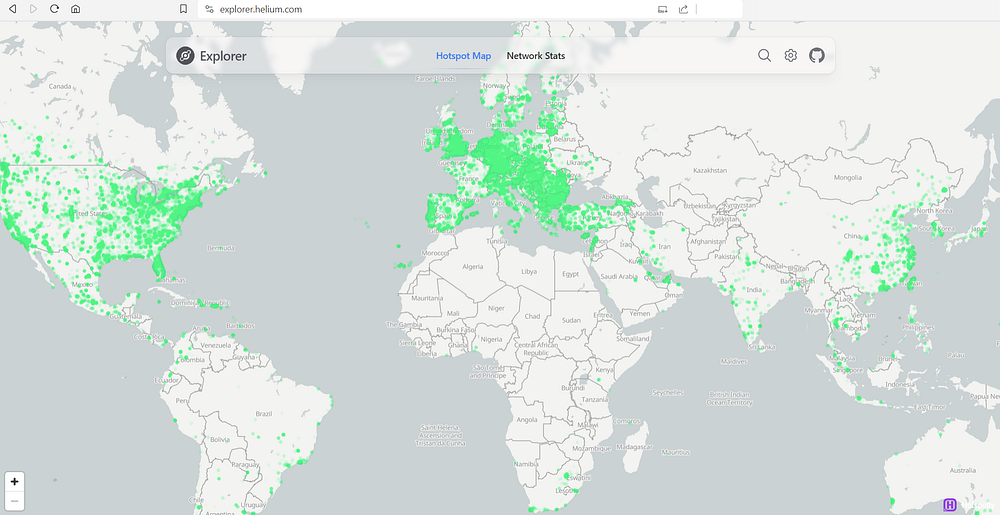

. Snapshot taken on 14 January 2024 at 13:15 AEDT.

Notice the vast areas and several countries — notably across Africa, South America and much of Asia- still lacking this HN connectivity.

This is a blessing in many ways, as it presents enormous growth potential for the network. The regions currently lacking this infrastructure will be some of the biggest beneficiaries of this novel technology, as these cover billions of people worldwide.

This ties in with the broader phenomenon of “leapfrogging”, whereby developing countries (notably China and India) have avoided a lot of the expensive, less-efficient poles and wires required for telecommunications networks (that much of the developed world went through) and instead went straight to wireless technologies, e.g., mobile/cell phones, 4G, 5G, etc.

I expect this leapfrogging to occur with decentralised energy grids as well, as a component of IoT, whereby blockchain tech will play a key role in this moving forward.

Back to HN, one of the latest use cases is SenseCore, a software solution that improves leak detection and water conservation in plumbing systems.

In tandem with The Kraken — a non-invasive, clamp-on ultrasonic flow meter — it allows live monitoring of water flow data without relying on a plumber to install similar devices, thus significantly reducing costs.

Not only is this saving money (that could be invested in BTC and crypto), but it is also preventing millions of Litres of precious water from going to waste.

Check out this Medium blog post to learn more about this product and Helium Network’s role in it.

Another related piece of news is HN’s migration to Solana’s blockchain, which was finalised in April last year. The main motivations for this included quicker transaction speeds, greater utility, and the need to maintain its existing layer-1 Helium blockchain.

There was a period when I would have been reluctant to proceed with such a move. However, to Solana’s defence, its uptime has improved considerably over the past 18 months.

How does HNT work?

“To acquire Data Credits, network users convert HNT or obtain them from an HNT owner. Any HNT converted to Data Credits is permanently removed (“burned”) from the circulating supply.”

Helium Network > Token

As a result, HNT has a max supply of 223 million.

How can you earn HNT? As stated in HN’s whitepaper:

“Miners earn tokens for providing network coverage, and miners earn fees from transactions, and for validating the integrity of the Helium network.”

It is worth noting that HNT adopts a “burn-and-mint equilibrium”, which means secondary (and in this case, tertiary) tokens are created to compensate for the main (HNT) tokens being burnt.

IOT and MOBILE tokens are issued for this network due to HNT being removed from circulation. These produce non-transferable data credits and transmit information from devices using Helium Network involving various use cases.

3) Fetch.AI — Market cap: ~$719M, currently $0.69, ATH $1.17

The first of the AI-related cryptos on today’s list, Fetch.AI aims to help entities adapt their existing systems to be AI-ready without changing their current APIs.

Last month, Fetch.AI announced a noteworthy collaboration with SingularityNET, a Cardano-based AI-/AGI-related protocol I covered in a March blog post.

Developers will be able to access the necessary tools to construct more reliable and reasoning-capable LLMs through Fetch.ai’s DeltaV interface and SingularityNET’s AI APIs.

Fetch.AI official press release, 14 December 2023

Fetch.AI claims to be the “first open network for AI Agents.”

These are modular building blocks programmed to carry out specific tasks, designed to streamline various activities and improve our everyday lives.

For example, Fetch.AI’s DeltaV product allows you to quickly and easily book a service on your behalf without making an online booking directly through a website.

Fetch.AI demonstrates how this product works in this short video. Specifying a budget and date and informing it what service you need will automatically find a provider that best matches your criteria. Once confirmed, it logs this entry on your device’s calendar/diary immediately.

at

Its native token, FET, and other AI-/AGI-themed protocols/ tokens skyrocketed in popularity shortly after the launch of OpenAI’s ChatGPT in November 2022.

Even though FET hit its ATH before ChatGPT’s launch, which was predominantly driven by a market-wide pump in 2021, I am expecting the combination of AI hype and another crypto-wide bull run to send FET well above its ATH in the next 12–18 months.

4) Optimism — Market cap: ~$3.35B, currently $3.51, ATH $4.13

Like Arbitrum, this is another L2 scaling solution and its native asset, OP, was released last year, shortly after the protocol’s launch a few months earlier.

This L2 is another type of optimistic rollup, which allows for cheaper scalability than another popular category, Zero-Knowledge (ZK) Rollups, which are preferred for speed, security and privacy features.

As such, optimistic rollups are (currently) more ideal for DeFi than the ZK equivalent. However, each comes with its own set of pros and cons.

Immutable and Nervos, two other crypto projects, provide excellent overviews of these categories.

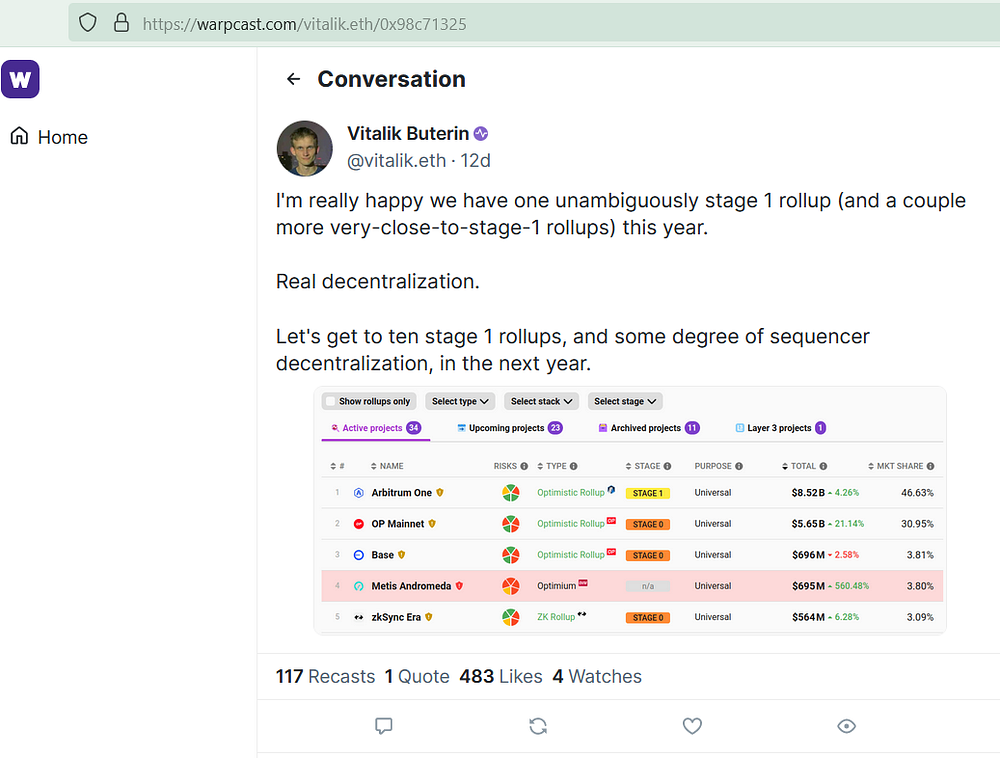

Two weeks ago, Vitalik Buterin posted about the hopes of getting to at least ten stage-1 rollups in 2024.

Vitalik Buterin (@vitalik.eth)

at

. Click

to learn more about L2 Beats’ rollup stage criteria.

Optimism has solid prospects for years, even when Ethereum can achieve over 100,000 TPS on its mainnet.

Why is this? Optimism, Arbitrum and other L2s will likely pick up much of the slack until Ethereum fully deploys its scalability upgrades through Danksharding. A basic iteration of this, Proto-Danksharding, is forecast to arrive sometime this year.

Danksharding is how Ethereum becomes a truly scalable blockchain, but there are several protocol upgrades required to get there. Proto-Danksharding is an intermediate step along the way. Both aim to make transactions on Layer 2 as cheap as possible for users and should scale Ethereum to >100,000 transactions per second.

Full Danksharding is several years away. However, Proto-Danksharding should arrive relatively soon.

Ethereum > Danksharding

Alongside this, if Ethereum were ever to become a global computer, I envisage L2s playing a role in helping the network run, albeit to a lesser extent, even as a backup system in case the base chain cannot scale due to technical issues.

5) Render Network (RNDR) — Market cap: ~$1.44B, currently $3.83, ATH $9.03

I have written a piece dedicated to this project and its token, which is available here.

For my regular readers, you might think I am simply repeating this out of convenience.

Rest assured that is not the case. Its price has nearly doubled in less than three months, thus making the list based on merit price performance since 2022 and what it is trying to achieve by making decentralised GPU rendering power more accessible to everyone.

From a price perspective, it was one of the best-performing assets in 2023, appreciating by roughly 900% by the end of it.

Its relatively low market cap still entices many people seeking a potential 20x. If this were to occur, it would be attributed to protocol upgrades, new partnerships and (to a varying degree) piggybacking off Bitcoin’s success post-halving, as is often the case with altcoins during a massive bull market.

6) Akash Network (AKT) — Market cap: ~$650M, currently $2.88, ATH ~$8.08

Akash Network offers an open-source (Apache 2.0 Licensed) Supercloud, allowing people to buy and sell computing resources securely and productively.

What stood out for the network in 2023 was the major move to open-source Akash Network’s entire codebase, alongside its establishment of an open structure for community participation akin to a decentralised autonomous organisation (DAO).

This is according to a recent blog post (I strongly recommend this) from Zach Horn, Content Marketing Associate at Overclock Labs, the creator of Akash Network and Akash Network AI.

“You will own your cloud, and you will be happy.”

Akash Network

Another positive move by Akash Network was its upgrade to Mainnet 6, which permitted NVIDIA and AMD GPUs to work in this ecosystem.

It was a wise move, particularly in response to the GPU shortages in recent years. Despite this matter being mostly resolved, the shortage still has ramifications across the tech industry.

How does its token tie into all of this? AKT is used for governance and to store and exchange value on its network. It’s also used to help secure the protocol via staking rewards.

Another improvement in the works is AKT 2.0, which will provide further incentives for people to utilise this token for overall network growth and development. Check out this GitHub entry regarding the Akash Network Economics 2.0 Proposal and related roadmap.

In terms of market pairs, AKT is only listed on one major exchange, Kraken. I see opportunities for significant price growth if AKT trading pairs were to be added to Binance, Coinbase, Bybit and other markets.

Yet, these listings only go so far in helping propel altcoin and token prices. Thus, further network improvements and new partnerships will be key.

7) Bounce (AUCTION) — Market cap: ~$182M, currently ~$28, ATH $70.56

Starting as an Auction-as-a-Service platform, Bounce (a.k.a. Bounce Finance) has branched out into three other categories:

— Bounce Bitcoin — A ready-to-use (plug-and-play) Bitcoin L2 service.

One of the biggest developments for this is BounceBit, its BTC staking chain product.

It adds another option for people to earn passive income from their BTC holders on top of other strategies I have previously discussed.

Two days ago, Bounce announced its partnership with SatoshiVM, a Bitcoin ZK Rollup L2 that uses native BTC gas for transactions. Its native token, SAVM, will be available on Bounce Launchpad starting 19 January.

The LP Revenue Offering model allows people to earn continuous income through the protocol by auctioning off the fee production from AUCTION’s automated market maker (AMM) liquidity pool, thus incentivising ongoing participation.

Bounce Brand (@bounce_finance)

on

— Bounce Box — An upcoming DeFi service.

This project has a well-established presence on this platform under the latter name, which makes a difference when considering its relatively low market cap and that it is still outside the top 200.

The fact that they are branching out into different sectors is a promising sign, although some would argue that they could spread themselves too thin.

It is wise to diversify here, provided they attract more talent for each division and constantly improve each service.

This is a major opportunity, particularly for a 20–30x by the end of next year.

It has a very high security score on DEX Tools and Moralis Money, 99/100 and 97/100, respectively, alongside strong performances across several metrics (net experienced buyers, number of wallets, buy/sell ratio, etc.) I see this is a reliable choice moving forward.

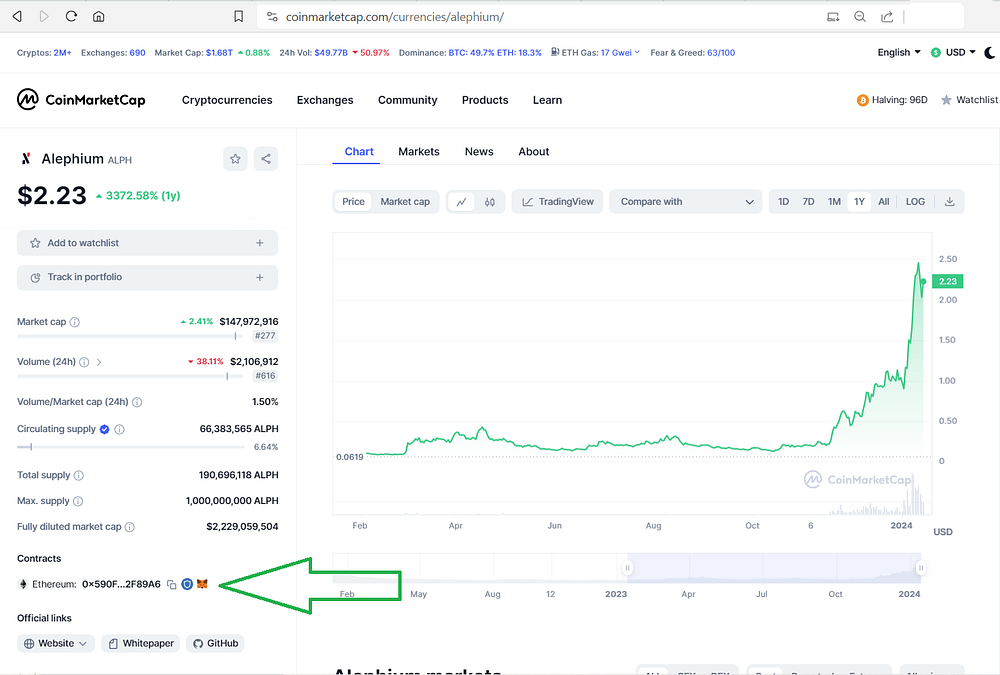

8) Alephium (ALPH) — Circulating market cap: ~$149M, currently $2.24, ATH ~$2.98

Alephium is an L1 that has adopted “Proof-of-Less-Work”, which claims to be 87% more efficient than the Proof-of-Work consensus algorithm used for Bitcoin, Bitcoin Cash, Litecoin and Dogecoin, to name a few blockchains.

The concept was proposed by Cheng Wang (who is also the Alephium founder) in their December 2019 post on the ETH Research website. The author has also elaborated on this by producing the PoLW research paper and whitepaper, FYRP.

Since then, Alephium has been one of the few (perhaps the only) mainstream/emerging blockchain project(s) to embrace this idea.

Alephium also merges the conventional unspent transaction output (UTXO) model — for Bitcoin, Litecoin and other blockchains — with a more developer-friendly account model to produce a stateful UTXO system.

As energy-efficient yet decentralised and secure blockchains are highly sought after in this space, it will be interesting to see how well the network scales and functions overall as it onboards many more users in the coming years.

For most projects, the trend has been to adopt proof-of-stake as a more efficient alternative to PoW, so let’s see how Alephium’s PoLW works.

If ALPH continues its impressive form in 2024, I am banking on some explosive gains in 2024. Why? One of the major reasons is the lack of listings on major exchanges, unlike others with a similar market cap.

To date, no Binance, Coinbase, Kraken, Bybit, OKX, KuCoin, nada. Once the token gets listed on (some of) these, I expect an enormous liquidity boost that often comes with extra listings and dozens of new trading pairs.

To play devil’s advocate, some would focus on ALPH’s fully diluted market cap (which would be the case if all tokens were in circulation) of $2.182 billion rather than its CMC. Compared to other blockchains, this is uncommon.

However, I admit there is a several-fold discrepancy between the two. There’s a clear reason for this: Mining rewards.

ALPH’s tokenomics page mentions that 86% of tokens will be assigned for mining rewards over the next ~80 years. On top of this, small amounts of ALPH (i.e., transaction fees) are burned per block.

Even when accounting for mining rewards, this token could plausibly do another 25–30x in the next 12–18 months — which it managed to achieve in 2023 — especially with its low circulating market cap.

Before moving along, this system and its token should not be confused with Aleph.im (ALEPH). Despite having a very similar name, it is an unrelated network.

Moreover, to ensure that you are purchasing the right asset — especially for lesser-known assets, check the listed contract address on your crypto price-tracking website (e.g. CoinMarketCap) corresponds to what you have on block explorers such as Etherscan or, for tokens on other networks, BscScan, Cardanoscan, etc.

Alephium dApps can be accessed through Ethereum via Wrapped ALPH and the Alephium Bridge.

. Snapshot taken on 14 Jan 2024.

9) The Graph (GRT) — Market cap: ~$1.56B, currently $0.17, ATH $2.87

at

The Graph is a network that allows anyone to build faster without relying on a data server or needing to develop their own indexing infrastructure.

You can build dApps and retrieve blockchain data from around the world using this protocol through its subgraphs, i.e., open APIs. These obtain blockchain data, process it and cache it for simple querying through GraphQL.

In November, The Graph Foundation unveiled its revamped roadmap to accommodate the rapid growth of large language model (LLM) applications, new query languages, UX enhancements, new chain integrations and other features since its previous version in May 2022.

Additionally, the Foundation produced a 2023 recap covering major network milestones, stats, updates and performance improvements for the protocol. Some of these include:

— One trillion queries (and counting) on its hosted service

— Allowing users to move subgraphs and delegated GRT from its system (run on Ethereum) to Arbitrum One

— progress on Substreams — robust blockchain indexing software designed for this network

— Queries on The Graph increased ~40% quarter over quarter (QoQ) from Q2 to Q3 2023

— the growth of relevant community DAOs such as GraphAdvocates, BuildersDAO and InfraDAO.

at

10) Pancake Swap (CAKE) — Market cap: ~$725M, currently $2.96, ATH ~$44

at

The leading decentralised exchange (DEX) on BNB Chain, I expect a substantial boost in activity on PancakeSwap as the bull market restarts for various altcoins and tokens.

This DEX has established itself as a major player and has remained dominant since launching in September 2020. According to CoinGecko data, it (Version 3) is the third-largest DEX by trading volume, with $465 million of transactions in the past 24 hours.

Starting as a DEX for BEP20 (BNB Chain) tokens, it has expanded to include Ethereum, Polygon zkEVM and multiple L2s. Moreover, it allows people to earn CAKE through various staking options, yield farming, and access to its gaming and lottery marketplace and NFT platform, all under the same app.

What’s CAKE’s role in this DEX? It is the primary token for governance, staking, liquidity, gaming, NFTs, trading, farming and other uses on PancakeSwap. This post and the corresponding infographic give you the full run-down.

CAKE has a net emission rate (tokens produced — tokens burned) of roughly 39,200 CAKE daily, whereby 100% of scheduled to be destroyed are sent to the related burn address every week. This ties in with CAKE’s max supply, now capped at 750 million.

To learn more about CAKE tokenomics, including a visual summary displaying the, visit the PancakeSwap docs page > CAKE Tokenomics.

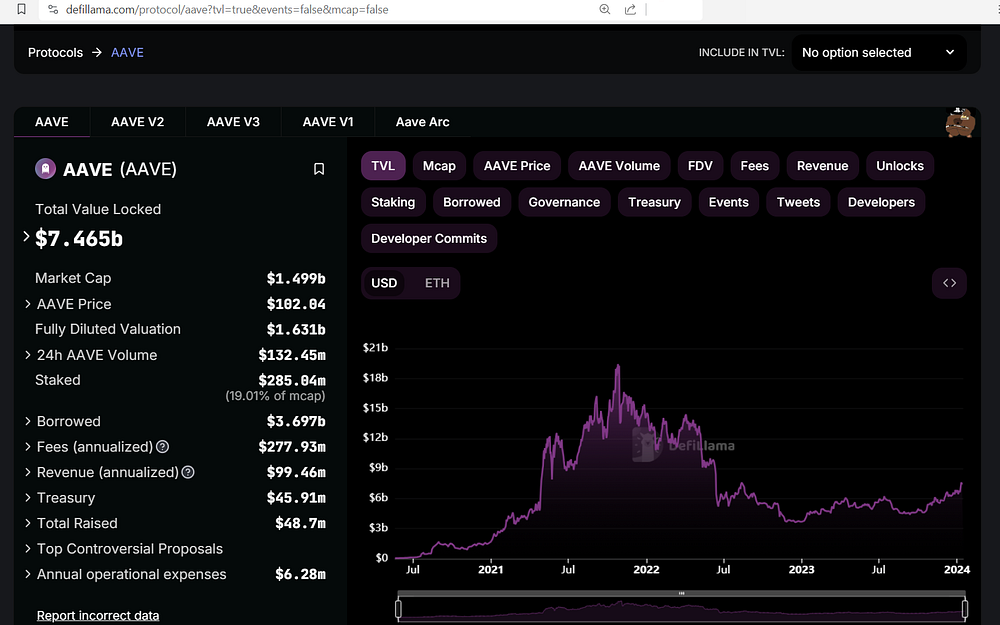

11) Aave (AAVE) — Market cap: ~$1.55B, currently $106, ATH ~$661

Wrapping up with one of the most established altcoins and tokens on this list, Aave launched as Lend (LEND) in 2017, rebranding and starting its token migration in October 2020.

Aave is a decentralised, non-custodial lending protocol allowing anyone to borrow a vast range of digital assets.

Like many other platforms and tokens, it launched on Ethereum but has continued incorporating new chains into its network. These include Ethereum, Polygon, Avalanche, Gnosis and a range of L2s.

. Snapshot taken on 16 January 2024.

Its official website claims that over $10.5 billion of liquidity is locked in AAVE across eight networks and 15 markets.

I expect its TVL to fly past its previous ATH of roughly $20B (per the above chart) as funds pour into the space again, re-igniting a keen interest in lending and borrowing crypto assets.

As it has further expanded its compatibility with even more chains since its ATH nearly three years ago, I expect even more money to be locked into this system.

The platform is available in different iterations — Versions 1, 2 and 3. According to an Aave Docs entry, the latter offers improved capital efficiencies, greater security and cross-chain functionality whilst allowing for high decentralisation.

Despite featuring this towards the end, it is worth paying attention to AAVE and is proving to be a good long-term hold, especially amongst DeFi assets.

Notable mentions

Injective Protocol (INJ)

Many partnerships and collaborations with this layer-1 cross-chain interoperability platform (at least those last year) have involved vast interoperability improvements and multiple bridges. Some of these include:

- Partnering with Eclipse to bring Solana apps to Cosmos

- Incorporating Web3 financial information into Google Cloud BigQuery

- Working with Kava to allow stablecoins (especially Tether USDT) to be issued on the Cosmos chain

- Notifi integration to permit Web3 notifications for multiple dApps across Injective

- Raising money through institutional investors, namely Pantera, Mark Cuban, Jump, BH Digital and Cumberland

- In March 2022, they teamed up with Axelar to bring EVM blockchains to the protocol.

INJ’s rise up the crypto ranks has been nothing short of remarkable. INJ started 2023 at $1.27 with a $92.9 million market cap, ranked 170th.

Fast forward 12 months, and it has cemented its spot in the top 50, touching $44 per coin a few weeks ago, currently sitting at $40/INJ with a $3.4 billion MC, now ranked 25th.

I contemplated featuring this in the main list, but the other cryptos mentioned above present better opportunities to deliver stronger ROIs. It could prove me wrong and emulate this success.

Nonetheless, INJ is worthy of a mention. It had an incredible run in 2023, was the second-best performing crypto asset in the top 100 based on CMC, and generated a 2,900% profit last year.

Stacks (STX)

I have decided to include Stacks here as, in all fairness, I included the project and crypto in last year’s version of this article.

Stacks permits smart contracts and decentralised apps to operate on the Bitcoin blockchain. This is achieved using the Stacks layer’s consensus protocol, Proof of Transfer (PoX), which reclaims energy from the Proof-of-Work (PoW) system used by Bitcoin’s blockchain.

As a result, you can have smart contracts on a truly decentralised and highly secure network such as Bitcoin.

What’s the STX token’s role in this network? It is designed to cover transaction fees when using Stacks apps, which, in turn, incentivise miners who maintain and update the network. More details are available here, including the latest list of reputable STX exchanges.

Livepeer (LPT)

Touted as an open video structure platform for live and on-demand content, it aims to position itself as an alternative to centralised video streaming services.

Besides the viewers and LPT investors, the network consists of three major stakeholders:

— Developers

— Orchestrators are involved in running Livepeer nodes and transcoding videos using GPUs. In turn, these participants get LPT broadcasting fees and network rewards

— Delegators who stake LPT to secure the network and obtain rewards. They are also eligible for a portion of the abovementioned incentives.

From an investor perspective, Grayscale — a notable digital fund manager — helped raise the LPT profile by establishing its Livepeer Trust in 2021. As of 12 January, it holds ~$4.9 million in tokens.

If Grayscale continues accumulating LPT or maintains its share at the very least, I expect other digital fund managers also to consider gaining exposure to this. However, it is too early to tell.

Even though past performance is no guarantee of future results, LPT has a good chance of pumping with the rest of the market in the coming months, considering it is about 10x from its ATH of $99 set in November 2021 amid the peak of the market-wide bull cycle.

Additional thoughts

There is another one that comes to mind, one that is popular for people who like to win money by predicting outcomes. It is not allowed to operate in many countries, although you can use a VPN to circumvent this.

To avoid having this article being reported or demonetised, I will refrain from mentioning its full name — Rol#*&t.

As this market is conducive to risk-taking, I expect this to increase in popularity again, along with related projects and their respective tokens.

With your preferred crypto assets, remaining informed (at least occasionally) about how they’re all faring is important as this space is very dynamic.

Even though most digital assets will pump amid a bull run, some will substantially outperform others, partly due to securing massive commercial or government partnerships.

Your favourite coin or token could flourish for a while, only to have a rival steal its thunder and outcompete it by offering a superior product.

There will be many altcoins and tokens that will exceed expectations in an upcoming bull run, getting that extra rocket fuel on top of the energy generated from announcements surrounding major network upgrades, collaborations, exchange listings, etc.

However, don’t forget to take profits along the way, whether it involves converting one of these digital assets to BTC, ETH or a large-cap altcoin/token or cashing out in fiat.

As we saw last week with POWR, the token was on an absolute tear for three to four consecutive long green candles, only to erase all those profits in less than two hours. It has since failed to bounce back, not even to half of its local peak.

. Snapshot taken on 11 January 2024.

Could you handle this roller-coaster ride if an asset you invested in were to replicate this?

For the record, I am still bullish on this POWR in the long term. I considered featuring this above, but the others are worth more attention, at least for now.

Remember, short- to medium-term performance does not dictate how well (or poorly) it will do in the coming years.

In conclusion, these assets comprise less than 6% of my total crypto portfolio. This market is highly speculative, and the assets listed throughout this take that to the next level. Invest only what you can afford (and are willing) to lose.

Disclaimers and context

- N.B. None of this is financial advice; I am not a financial advisor. You are solely responsible for crypto investments, let alone those in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any entity listed here.

- Just because a crypto is well below its ATH, there is no guarantee that it will eclipse it, let alone return to that number.

- Please do your research before investing in any crypto assets, staking, NFTs, or other products affiliated with this space.

- For transparency, at present, I hold all of these assets except for FET.

- I obtained most of the relevant data between 13 and 16 January 2024.

- I received no incentive from companies or entities listed throughout this article to discuss their product.