With the 2024 Bitcoin Block Reward Halving fast approaching, excitement is building for more altcoins and tokens to outpace potential BTC and ETH gains, going into what should be a bullish year for this asset class.

Let’s review the three altcoins/tokens in the top 100 (based on circulating market cap) that generated the biggest returns on investment in 2023. I will also include some notable mentions towards the end.

Let’s begin.

3) Kaspa (KAS) — 2,050% profit in 2023

Those behind this protocol claim it to be “the fastest, open-source, decentralised & fully scalable Layer-1 in the world.”

Unlike Bitcoin — which relies on the Nakamoto Consensus (NC) algorithm (a type of proof-of-work [i.e., mining] consensus system) — Kaspa adopts another mining-related setup, the GHOSTDAG (Phantom 2.0) mechanism.

Imagine all of the benefits listed above, coupled with the robust security of Bitcoin and Ethereum, not to mention ultra-cheap (0.001 KAS = $0.0001) fees.

If this promising protocol continues to attract talented devs, build its community presence and forge major partnerships, it could eventually give Bitcoin and Ethereum a run for their money, and, above all, continue generating a solid ROI in 2024 and 2025.

It’s a long way to go, but this also presents good opportunities for (relatively) early adopters.

For a comprehensive overview of Kaspa, check out this recent piece:

KAS held the top spot for most of 2023 until a meme coin came along and stole its thunder.

2) Injective Protocol (INJ) — 2,900% profit in 2023

Boasting over 392 million on-chain transactions, 0.8-second block times and transaction fees costing less than a penny, this layer-1 blockchain touts itself as “the blockchain built for finance.”

“Injective is built using the Cosmos SDK and is able to attain instant transaction finality using the Tendermint proof-of-stake consensus framework. In addition, Injective can facilitate fast cross-chain transactions across the largest layer one networks such as Ethereum and Cosmos Hub.”

Injective Docs

Many partnerships and collaborations with this protocol (at least this year) have involved vast interoperability improvements and multiple bridges. Some of these include:

- Partnering with Eclipse to bring Solana apps to Cosmos

- Incorporating Web3 financial information into Google Cloud BigQuery

- Working with Kava to allow stablecoins (especially Tether USDT) to be issued on the Cosmos chain

- Notifi integration to permit Web3 notifications for multiple dApps across Injective

- Raising money through institutional investors, namely Pantera, Mark Cuban, Jump, BH Digital and Cumberland

- In March 2022, they teamed up with Axelar to bring EVM blockchains to the protocol.

INJ’s rise up the crypto ranks has been nothing short of remarkable. INJ started 2023 at $1.27 with a $92.9 million market cap, ranked 170th.

Fast forward 12 months, and it has cemented its spot in the top 50, touching $44 per coin last week, currently sitting at $37/INJ with a $3.14 billion MC, now ranked 29th.

1) Bonk (BONK) — 5,250% profit in 2023

Unless you’ve been living under a rock, I’m almost certain you’ve heard about BONK at least once this year.

This Solana-based meme coin has taken this space by storm and has a fascinating backstory to it…actually, two of them.

1. When Solana was in the dumps — in the depths of the bear market 12–18 months ago as the crypto market tanked and this space copped a hiding from mainstream media because of Terra Luna, FTX, Celsius, 3AC and other high-profile collapses — it offered an incentive to its developers (in LamportDAO) on Christmas Day 2022: A BONK airdrop.

At the time, this would have been chump change, and the asset’s market cap was about $10 million, so no one thought much of it.

It barely moved for most of 2023, as shown in the price chart below.

So far, I’ve covered relevant Solana developers who have benefited from that airdrop. What about us, the average degen?

2. In June 2022, Solana co-founder and CEO Anatoly Yakovenko announced the release of Saga, an Android-based Web-3 Solana smartphone.

To get its users started, each unit comes with free BONK as part of the Saga Rewards program.

You can see where all of this is going…

This was a bold yet ingenious move to launch a product during a major market downtown and marks an incredible turnaround for Saga, which initially struggled to offload these units.

Type in ‘Saga phone’ on eBay, and people are trying to sell these for over 5,000 AUD (roughly $3,400) to cash in on this BONK mania; yes, it is a craze right now, and there’s no other way to describe it.

Here’s an idea: Just buy the crypto that’s pre-loaded onto the wallet (30M BONK, now worth ~US$422), and it will cost you far less than that.

I know that almost no one will pay that amount for a Saga phone, but let’s be honest; we know at least one person will do so.

Anyhow, here we are, 12 months later, and people have made life-changing fortunes from another dog-themed meme coin, this time on Solana’s network.

It has generated ~5,200% (53x) returns in 2023. However, if we extend it by an extra week to include Xmas Day 2022, this reportedly skyrockets up to 16,400% (165x), based on CoinGecko’s reported all-time low of $0.000000086142 on 29 December 2022…assuming you bought and have held on since then.

Strictly speaking, this would be magnitudes higher as BONK’s price has dropped by 55% from its peak two weeks ago.

on

Notable mentions

Tellor (TRB)

Tellor is a decentralised oracle protocol that allows anyone to submit, verify and access the data running through this system.

Its token, Tellor Tributes (TRB), is an Ethereum-based (ERC-20) asset. The token is primarily used for contracts that offer payments to data reporters and for staking to help secure the Tellor network.

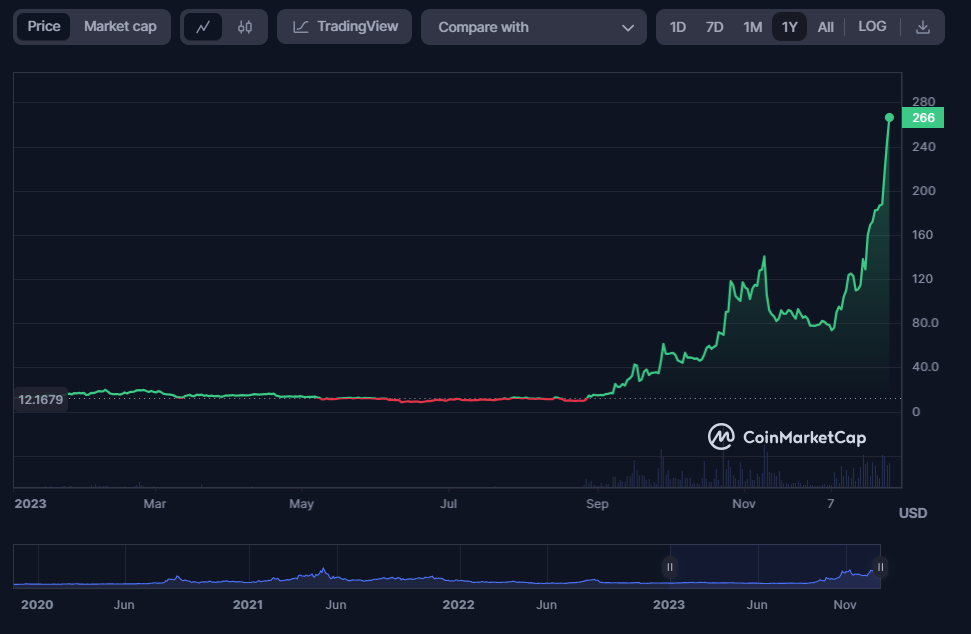

The token yielded approximately 1,800% profit in 2023.

Everything you need to know about TRB staking is available through the Tellor Docs page (see ‘Becoming a Reporter’).

Like BONK, TRB barely moved for most of the year, having experienced most of its rampant growth since September, going from $15 to $266 at present.

Some might say that Tellor will give Chainlink — one of the most established (major) players in the decentralised oracle realm — a solid run for its money as both look to compete for growing market share.

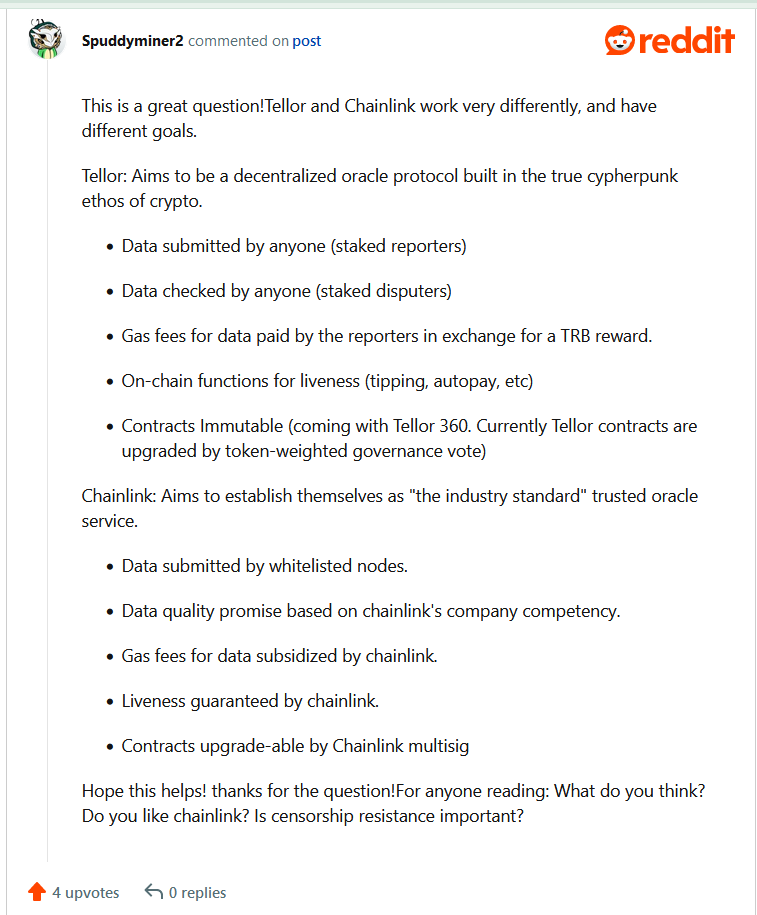

However, per this Reddit post by Spuddyminer2, the Head of Community at Tellor, I found a useful comparison between the two projects. The major differences highlighted lead us to believe that these two platforms will focus on their niches rather than competing with each other.

at

Owing to the significantly smaller market cap than Chainlink ($674M vs $8.6B), I would bank on TRB outperforming LINK. Nonetheless, I expect LINK to do well in the coming years, and I remain a big fan of that project.

As a useful synopsis of Tellor’s activity in 2023, I recommend its 2023 Year in Review via its official blog.

Solana (SOL)

This has been by far the best performer in the top 20, up 900% (10x) in 2023. I wouldn’t be doing the project justice by not giving it a notable mention.

Even though it didn’t make the top-3 list, Solana has pulled off one of the biggest upsets in the crypto space.

What a rollercoaster ride it has had:

— 11 April 2020: ~$0.95

— 1 January 2021: ~$1.70

— 6 November 2021: $260, repenting its all-time high

— 1 January 2022: $170

— 1 January 2023: $10

— 31 December 2023: $101

Hats off to anyone who has held on the entire time, and a special mention to those who loaded your SOL bags while people were panic selling.

How has your preferred crypto performed over the past 12 months? Check out Crypto Bubbles for real-time monitoring of all crypto assets on an hourly, daily, weekly, monthly and yearly timeframe!

Render Network (RNDR)

This grew steadily throughout 2023 — except for a lull in Q3 — generating over 1,000% (11x) gains for its holders.

Rendering complex images comes with cost and energy limitations, leading to an increasing need for cloud-based rendering as an alternative to on-site render farms.

These cloud-based services can be very costly despite the convenience of remotely accessing the required processing power.

This is where Render Network (RN) comes in, with its vision to democratise access to processing power through blockchain technology.

I recommend reading this article for more information about the protocol and its corresponding token.

Final thoughts

Do I believe these digital assets still have much room for growth? Absolutely.

Could they replicate their success in 2023? It is unlikely, mostly owing to a significantly higher market cap and people wanting to chase explosive ROIs.

This is particularly true for BONK and large-cap meme coins (i.e., DOGE and SHIB). While these will ride the wave of a market-wide bull run, many degens will focus on finding that 50, 80, or even 100x gem.

As a result, expect profits from the once small-capped altcoins and tokens to flow into the current micro-caps.

This is one factor at play. Let’s not forget regulatory challenges (e.g., the US SEC, notably Gary Gensler) and their moves, which will most likely spook prospective investors at any sign of a crackdown.

Regarding a potential global recession or other negative macroeconomic circumstances, I doubt The Fed would be raising rates, at least not much higher than now. As this is an election year, Biden and Co. will try their darndest to boost the US economy to get re-elected. I won’t go into politics, but you get the gist.

I will be surprised if Bitcoin doesn’t hit a new all-time high by the end of 2024. If we don’t hit at least $100K by Q3 2024, I think something is seriously wrong.

Considering the crypto space, a $3 trillion market cap by mid-2025 should be a shoo-in, as we hit $2.8 trillion back at the peak in November 2021. For context, we are currently at approximately $1.7T, double where we were 12 months ago.

With over 420 million reported crypto users around the world, I am expecting this to hit the holy grail of one billion users in the next four years (and this, like my other guess presented here, is conservative), owing to software and hardware technological improvements, not to mention lower prices and lower barriers of entry to interact with crypto and blockchain tech.

Strap yourselves in for an eventful 2024, both in the crypto sphere and general.

Happy investing/trading, and I wish you all a Happy New Year 2024.

Lorenzo

P.S. Celestia (TIA) has also been a strong performer this year (up 500%) despite launching just two months ago. Pro-rata would have probably made this list, but it is too early to tell if it can continue this run.

P.P.S. Check out Crypto Bubbles for real-time visualisation of crypto performances at various intervals.

Disclaimers

• N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

• The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

• Please do your research before investing in any crypto assets, staking, NFTs, or other products affiliated with this space.

• Out of these digital assets, I hold RNDR and TRB, which account for less than 1% of my crypto portfolio. I also have SOL, which makes up 3% of my crypto holdings.

• I received no incentive to discuss any of the exchanges listed throughout this article. Moreover, I have no affiliation with any of these entities.

Featured image credits

- Background image by zaie on Freepik

- BONK logo by Akif CUBUK on Shutterstock

- INJ logo by Injective Protocol (brand assets)

- Kaspa logo by Kaspa (media kit)