Pay a fraction of the cost and buy, sell or swap tokens at a much faster speed.

You search for a micro-cap to buy and have no luck on your preferred exchange.

It’s an ERC-20, i.e. one that runs on Ethereum. Off you go to a DEX that’s compatible with the network.

As you prepare to swap from ETH to this ERC-20 token, up comes the transaction (including the gas) fee:

$15…and you’re only after about $100 worth of this micro-cap.

This can’t be right. Let’s try a different exchange…$17 fee.

OK, here we go again with these high fees on Ethereum.

Fortunately, there are two popular solutions: Polygon PoS and (to a lesser extent) BNB Chain.

Just two? Don’t worry, I didn’t forget the third option: Layer-2s (L2s). I will touch on these later and share a separate article covering these in further detail.

Yes, some of you already knew this. Still, most people trying to buy these tokens felt obliged to pay exorbitant fees when transacting directly on the Ethereum blockchain, thinking they had no alternative.

Just my thoughts as I speak from experience.

How does this work on Polygon PoS?

The network – formerly known as Matic and usually referred to as just Polygon – was launched on Ethereum and has been designed to work on the latter since the beginning.

Even though it became a side chain and functions independently, it still deals with these Ethereum-related assets.

The average cost of a Polygon transaction is $0.015 (assuming a MATIC price of $0.90); for context, it is currently at $0.78 per token). On the other hand, Ethereum reportedly has fees starting at $1.50, though this will probably be different when you check the stats.

Polygon even claims to offer ~10,000x cheaper transaction costs than Ethereum.

In reality, additional costs are involved for buying, selling, or converting ERC-20 tokens when going through a DEX. Even a few trades can add up; that’s money that could have been put towards the crypto asset.

We’ve only covered the costs so far; let’s not forget that transaction speeds also make a big difference, particularly when conducting hundreds of trades daily.

The last thing you want is to have a trade stuck in a mempool.

What about BNB Chain?

Formerly known as Binance Smart Chain, BNB Chain is an Ethereum-compatible chain via the Ethereum Virtual Machine (EVM). Due to this, you can readily purchase many (but not all) ERC-20 tokens on BNB Chain with a different contract address.

Whilst it is faster and leads to cheaper transactions than Ethereum, it is less decentralised than the leading smart contracts platform. This is straight from the horse’s mouth:

“Currently, there are 21 validators on the testnet and 56 validators on the mainnet. Validators are selected every 24 hours. Anyone can become a candidate for the validator.”

BNB Chain Documentation > BSC Validator FAQs

How do you find contract address details?

The most convenient starting point is through a price-tracking website, e.g. CoinGecko, CoinMarketCap, LiveCoinWatch, etc.

Clicking on a crypto asset will tell you the relevant contract address(es).

Some only have one; others have multiple options.

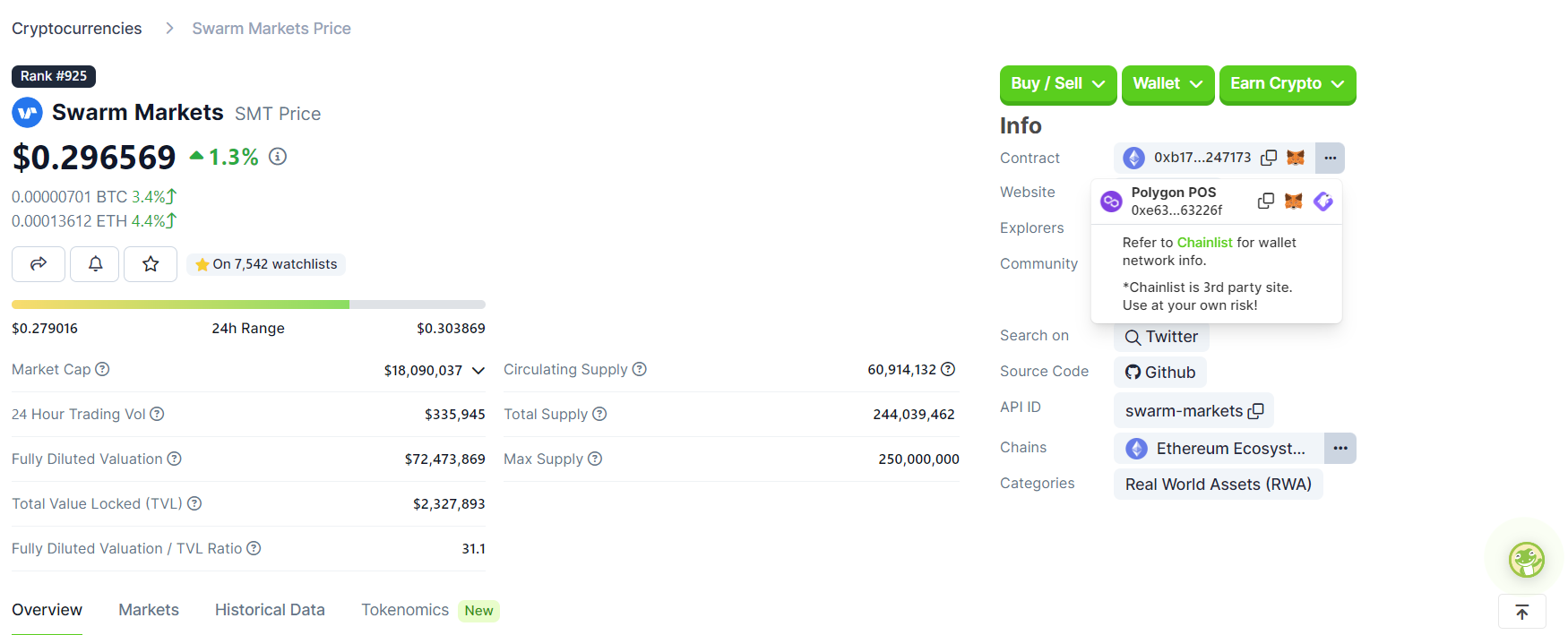

Here is an example of what I am referring to:

Pressing the … by the contract info will provide you with the list of related addresses and corresponding networks. Source: CoinGecko

Layer-2 scaling solutions (L2s)

These operate on top of a base chain (layer 1), with Ethereum being the most prominent example. They help free up the L1 by processing some of the transactions, thus reducing network congestion, which would have otherwise caused a significant spike in network fees.

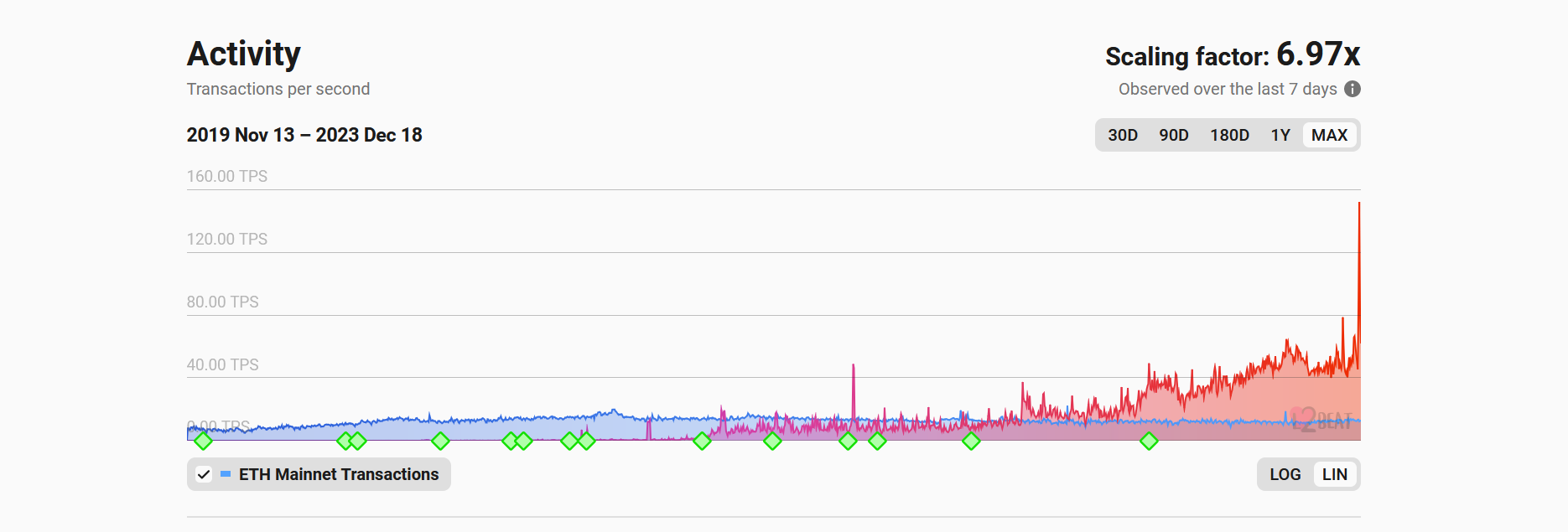

L2s are yet to realise their full potential, and they’re not as simple for beginners…at least not yet, but they are all making progress, as shown in the graph below.

Green diamonds represent major L2 milestones. Click this link to access the interactive chart. Source: L2Beat.

L2s are (collectively) doing the heavy lifting for Ethereum, hopefully avoiding a repeat of 2021, where we witnessed DEXes charging hundreds of dollars per transaction during peak activity.

Hence, I doubt we’ll see extended periods of exorbitant transactions in the next bull run, provided that L2s continue to handle a higher throughput (transaction per second) alongside Ethereum rollups becoming more prominent in the coming months and years.

Here’s the article I alluded to earlier. I will make a step-by-step guide shortly, detailing the best way(s) to use common L2s for cheaper and faster Ethereum transactions. In the meantime, I recommend this resource from the official website about bridging tokens to L2s.

Food for thought – IMPORTANT

Even though it is convenient to deal with ERC-20 (and tokens running on other Ethereum-related standards) on Polygon, BNB Chain or any other EVM-compatible chain (Avalanche is emerging as a popular alternative, where devs can mint ERC-20 tokens on its C-Chain), there is a catch.

What happens if you want to use these assets purchased on Polygon or BNB Chain directly on Ethereum’s blockchain?

In this case, you’d need to use a Polygon ⇔ Ethereum bridge. A common one is through the zkEVM Solution via the Polygon Wallet.

Here are the popular BNB Chain ⇔ Ethereum bridges.

Don’t just take my word for it. Metamask – one of the most renowned non-custodial Ethereum wallets – provides this summary:

“Don’t use MetaMask with any addresses that don’t use the Ethereum format, either when sending or receiving. This is in addition to the fact you should never send tokens straight from one network to another without bridging. (There are some cases where you won’t lose them, but in most scenarios, you will.)”

Here is another source covering this matter with a similar message.

I get this is not for everyone, so if you want to avoid taking these extra steps, your best bet is to look for these tokens on a centralised exchange and transfer them to your preferred non-custodial wallet during quieter times of the day, with up to 75% lower fees than peak periods.

To track this, I recommend Etherscan’s Gas Price Heatmap for gas-fee trends over the past seven days.

In conclusion, you need to weigh up the cost of convenience for ensuring your ERC-20 tokens remain safe by going directly on Ethereum’s network versus an EVM-compatible one.

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Always confirm the contract address and check at least two sources when dealing with lesser-known tokens. It is common to have micro-caps with an identical token name despite being two separate things.

- Please do your research before investing in any crypto assets, staking, NFTs, or other products affiliated with this space.

- For transparency, Ethereum (ETH) accounts for roughly 25% of my crypto portfolio, and ERC-20 tokens collectively comprise an extra 12-15%.

Image by sukrit3d on Shutterstock