It’s that time again as we wind up another wild year, both in the crypto sphere and in general.

If you’re looking for gift ideas for a loved one and don’t want to resort to an ordinary gift card, I have not one but two options you can explore.

1) A Bitcoin (BTC) gift card

This is the most convenient way for the recipient to get their hands on some crypto without going through the entire process of registering an account, depositing funds, etc.

Yes, in 2023, most reputable vendors would need to use a form of payment that can trace the buyer’s identity. However, I have never purchased a Bitcoin gift card, so I cannot speak from experience.

Regardless, pre-loading a gift card with X amount of satoshis will help your friend or family member begin their Bitcoin/crypto journey. Even though they could use it as a temporary “wallet” without redeeming the card’s code immediately, I wouldn’t advise this in case the email account linked to the card gets hacked.

Your best bet is to transfer the BTC to a non-custodial wallet sooner rather than later. As a bare minimum, you can send it to a reputable crypto exchange, provided it is regulated and you only deal with small amounts.

2) Buying a hardware wallet

I am in two minds about this, as it depends on how tech-savvy the recipient is.

The last thing you want is for them to put it away in a cupboard without it ever being activated and having BTC or crypto managed.

Quick side notes: Some people online have suggested setting up a non-custodial wallet for free with the recovery seed. This could be useful, as it is a free option that can be safe. However, it’s not a great present if it’s considered too much of a hassle for someone prioritising convenience.

I have also seen a suggestion for a paper wallet. These could work, but it’s a rather old method and not the best choice in 2023.

Yes, these non-custodial wallets have come a long way in terms of functionality, user-friendliness, and a far greater variety than just a few years ago. However, some people immediately baulk at using one of these.

One minute later, they give up and say it’s too hard, much like many Apple fans who (almost) immediately complain about using Android OS. Alas.

Depending on how much you are willing to spend, your best bet (i.e., for whoever’s receiving the present) is to buy a hardware wallet and a BTC gift card.

From there, spend the arvo (afternoon) with them to set up a wallet on their behalf and give him a quick and simple overview of what Bitcoin is and why it is important, especially with ridiculous inflation in recent years (or even hyperinflation that still exists around the world).

Hopefully, they prepare a warm and hearty meal and don’t leave you going back home empty-handed; I’ll gladly take a bottle of red on my way back if offered.

What’s the “life-changing” aspect of this?

In recent years, BTC, ETH and other digital assets have outshone even the best-performing tech stocks.

Asset Class Returns since 2011… pic.twitter.com/zZowZcAsTH

— Charlie Bilello (@charliebilello) July 15, 2023

Source: Charlie Bilello on X (Twitter)

.

N.B. BTC year-to-date is up by ~140%, even more than the 89% up to 14 July, as displayed in Bilello’s chart.

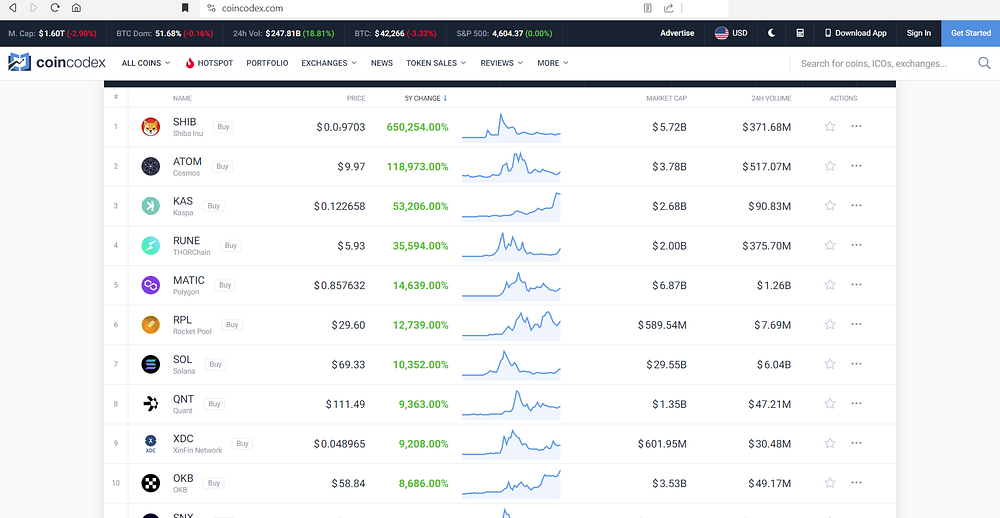

I know the second image with the so-called “s#!tcoins” will trigger Bitcoin maxis, but I don’t care. I’m here to promote the space at large, not just one asset, despite it being numero uno.

You get the gist. BTC and various altcoins/tokens have blown the competition out of the water.

Giving BTC (or whatever crypto you prefer) to someone could create that spark for them to take an active interest in this space.

If you were to pass on a card containing access to ETH, XRP or another altcoin, then you’ve selected an option that is more likely to succeed…or just play it safe and buy BTC, at least to begin with.

Before you beat me to it, yes, it is highly unlikely that BTC, ETH and most digital assets will replicate this incredible growth in just a few years.

Who’s to say that buying some crypto now won’t significantly accelerate one’s path to financial freedom?

However, out of all the presents you can offer someone, this is more meaningful and beneficial than many other goods provided to people at Christmas.

At least you know this won’t be re-gifted….well, anyone sensible will understand.

Final thoughts

Once you’ve prioritised aiming to get the bare essentials needed for a comfortable, safe and dignified life, you should aim to have at least 1% of your net worth in Bitcoin, and that’s being very conservative.

Yes, I get that many people are doing it tough, and their priorities lie (at the very least) in surviving, whether you love.

There’s an inconvenient truth most ordinary people (i.e., the plebs and even cashed-up boomers who refuse to touch BTC/crypto) refuse to accept:

Billions of people in the poorest regions around the world have been refused access to many financial services that we (in developed nations) take for granted.

In many cases, it’s by no fault of their own, at least not at an individual or community level. Rather, it’s because of corrupt leaders and atrocious economic management that ultimately shafts their country’s citizens.

Besides all this, millions of people in our neck of the woods still cannot access many conventional financial services. So, such issues are not exclusive to poorer regions.

You think Bitcoin is volatile? That it could never replace fiat currencies? Well, how about living in a nation/region where inflation rates are in the double digits, some of which have exceeded 100% p.a. in recent years — Zimbabwe, Venezuela and Argentina, to name a few?

Turkey, Iran, South Sudan, Sudan, Liberia, and many others have problematic inflation rates, collectively affecting hundreds of millions of individuals.

Still unconvinced? Check out Sofi’s Worst Cases of Hyperinflation Throughout History, current inflation rates worldwide, watch a handful of videos covering the everyday plight of people trying to live off their terrible currency, and then come back to me and say BTC is still an unsuitable alternative…

To end this on a positive note, your gift can make a lasting difference to someone or even a charity that focuses on a cause close to your heart. For the latter, if they don’t already accept BTC donations, ask them when they’d consider accepting them.

I hope all goes well with your investments and you have time to unwind and prepare for a new year.

Happy investing.

Disclaimers

• N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

• The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

• Please do your research before investing in any crypto assets, staking, NFTs or other products affiliated with this space.

• For transparency, Bitcoin (BTC) and Ethereum (ETH) each account for roughly 25% of my crypto portfolio.