Providing a solution to a long-standing problem in crypto.

Since the advent of decentralised exchanges (DEXes), we have witnessed major progress in finding ways to directly swap from one token to another on the same chain – notably Ethereum and Binance Chain – rather than taking the additional step to trade the token via ETH, BTC, BNB, USDT or another major digital asset.

However, a major shortfall with these DEXes is the inability to readily swap between cryptos on different chains. For example, switching from an ERC-20 token (i.e., on Ethereum) to BTC usually requires you to use Wrapped Bitcoin (WBTC), an ERC-20 token pegged to BTC instead of the actual coin.

How can we overcome this problem without going through a centralised exchange (CEX) whilst securely carrying out a transaction?

Enter THORChain.

Benefits of THORChain

Like other DeFi protocols, it uses liquidity pools (LPs) – a crowdsourced pool of coins and tokens bound within a smart contract that allows users to trade assets on DEXes without relying on centralised exchanges.

However, THORChain uses an enhanced LP type called continuous liquidity pools. These provide a much more reasonable fee model than conventional DEXes. More information about THORChain’s fees is available here.

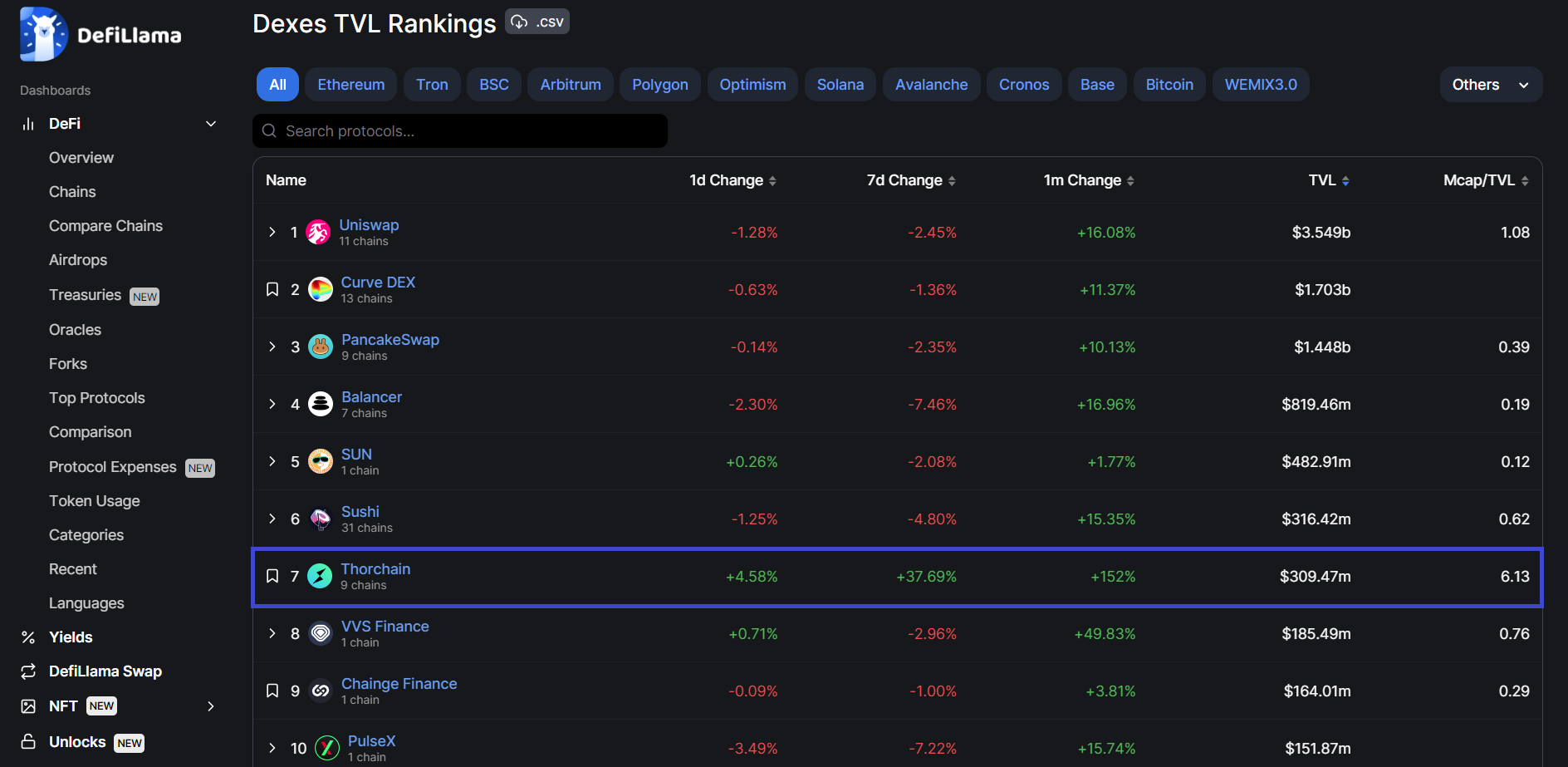

The project offers pools featuring popular assets across multiple blockchains, notably BTC, ETH, USDT, USDC and BNB, alongside other coins and tokens. There is currently $319 million of total value locked (TVL) on THORChain.

For anyone who has dealt with DEXes – particularly during the market-wide bull run and NFT craze in 2021 – you will know that using these services has historically attracted some ridiculous fees. I’m talking about fees over $30, $50, or even hundreds of dollars for just one transaction.

Even though these costs have dropped since then, they are still impractical for anyone wanting to carry out small swaps.

Having to pay several dollars per transaction is chump change for money. Nonetheless, the fees can add up quickly when carrying out dozens/hundreds of daily transactions.

__________________________________________________________________________________

Besides bypassing a CEX, which is what crypto should be about, rather than relying on them for trades, what’s another advantage of using this protocol?

THORChain is decentralized and community-owned, and therefore, all network profits are directly returned to node operators and liquidity providers. Slip-base fees are paid by traders and rewarded to THORChain network participants.

Early adopters and current RUNE holders have capitalised on the opportunities presented by THORChain, helping propel it up the ranks and making it one of the best-performing DEX protocols on a daily, weekly and even monthly basis.

As a result, the token has been a top performer in 2023 (more on this later).

Source: DefiLlama. Snapshot taken on 18 November 2023 at 13:20 AEDT (02:20 UTC).

Partnerships and news

In September, Nine Realms, an institutional partner bringing liquidity to THORChain, published an article about BNB Smart Chain being added to the protocol.

Why is this major news? It opens up many more opportunities for people to trade BNB and its affiliated tokens (BEP-2 and BEP-20).

For context, the BNB Smart Chain has over $3 billion of TVL on its blockchain, with over 660 projects built on it and roughly 948,000 24-hour active users.

On top of this, one of the biggest features to be incorporated into THORChain is lending…which includes BTC lending.

This offers a massive advantage over other DeFi platforms, which generally lack this feature. As BTC accounts for half of the crypto market (in terms of circulating market cap), this opens up many opportunities for anyone looking to avoid using CEXes or other third parties.

Lending has been activated on THORChain. Users can lend their native Layer 1 assets — BTC and ETH — to THORChain and borrow a USD-denominated debt with no liquidations, no interest, and no expiration.

Nine Realms’ Medium post, Aug 21, 2023.

One sure-fire way to significantly boost THORChain’s price is to have a handful of major enterprises outside of the crypto, and blockchain space endorses this DEX and incorporate it into their daily business activities.

More media, gaming, and commerce exposure will help diversify the ecosystem’s partnerships, mostly centred around exchanges, wallets, and community portals.

With the anticipated return of general interest and trillions of dollars flowing back into the crypto market, THORChain, Uniswap, other DEXes, and their corresponding platform tokens will also generate impressive returns for those holding these digital assets, let alone for anyone involved in these ecosystems.

Viking warriors with burning eyes. Generative AI

RUNE tokenomics

RUNE has a total supply of ~484 million tokens, of which ~337.5 million (almost 70%) are currently in circulation.

Its inflation rate is roughly 3.6% per year, which equates to about 12.5 million tokens entering circulation annually.

What’s the purpose of using RUNE for the THORChain network? Its functions include:

– Its role as a settlement asset. I.e., ETH –> BTC via RUNE, without physically needing to trade RUNE to carry out the trade. However, RUNE is not essential to cover transaction fees.

– Protocol security: THORChain runs on proof-of-stake (PoS), thus requiring node operators to commit (bond) RUNE to participate in the network. Moreover, this staked amount is >100% of the secured assets.

– Maintain the network’s incentive system to balance bonded and pooled RUNE. To maintain a safe system, this should represent 67% of bonded RUNE and 33% pooled (staked). When this becomes unbalanced, rewards are automatically adjusted (lowered or increased accordingly) for node operators and stakers until the system returns to a desired state.

Check out ‘Incentive Pendulum’ on THORChain Docs for a detailed written and visual explanation of how this works.

___________________________________________________________________________

Besides RUNE/USD price growth in recent weeks – which has also outperformed BTC, ETH and various altcoins this year – another bullish sign for the token is the enormous growth in 24-hour trading volume.

Per the price chart below, we can see a significantly higher 24H volume in recent times than recorded during the height of the market-wide crypto bull cycle in November 2021.

Source: LiveCoinWatch. Snapshot taken on 18 November 2023, 13:05 AEDT (02:05 UTC).

This, alongside the bullish momentum returning to the crypto market – BTC is at its highest price in over a year – makes me confident about RUNE returning to all-time highs in the coming months. However, this higher trading volume does not guarantee higher prices and could be bearish; I recommend this article from Charles Schwab for useful explanations.

I won’t give any specific dates because it’s just futile and pure speculation; no one knows what will happen to prices for any crypto, let alone any asset.

Final thoughts

RUNE is another mid-cap token with plenty of room for further growth going into 2024. Hopefully, you took my advice* on board when I covered Render Network (RNDR) last month, which has also continued its impressive performance year-to-date.

With the hype surrounding an imminent spot Bitcoin ETF and the upcoming 2024 Bitcoin Block Reward Halving, the bullish sentiment returning to the crypto market should boost the money flowing through the space, helping THORChain grow even bigger and faster.

https://medium.com/p/2c25158339a3

The protocol must continuously innovate and stand out from its competitors as many crypto enthusiasts will gradually turn to micro- and low-cap tokens similar to RUNE to find the next THORChain.

Despite this, I strongly believe that RUNE can continue outperforming BTC, ETH and other large-cap cryptos going into 2024.

RUNE’s recent price performance is a testament to this, with it regularly achieving double-digit % daily growth since last month when the entire market started picking up again.

If you’ve got skin in the game, be prepared to take profits accordingly (have a plan with specific targets). Whether this involves RUNE/USD or crypto, e.g., RUNE/BTC, RUNE/ETH, etc., decide what works best for you.

Consider selling RUNE when there’s a major 24H spike, convert to one of the above crypto pairs, and buy when there’s a dip. However, remember that the token could keep pumping for weeks without a major pullback; Kaspa (KAS) is a case in point.

This analysis is shorter than other posts covering altcoins and tokens with strong growth potential. This is because of the time-sensitive nature of crypto.

I simply want to get the message out there so you can start looking into this asset before the train leaves the station.

I implore you to look into this token and seriously consider it, as it still has plenty of energy behind it.

*Do not FOMO into any digital asset without doing sufficient research about it…and not obtaining information solely from some random shills on Twitter, YouTube, Reddit….myself included. Sometimes, I get it wrong; other times, I guess correctly. Do your due diligence.

Ways to stay in the loop with THORChain

– Official website

– Whitepapers

– X (Twitter)

– Medium blog

– THORChain Foundation

– Discord

– Reddit

– Telegram

– THORChain GitHub repositories

– THORChain Docs

– Staking Rewards – RUNE

See the full list of platforms, outlets, projects and resources relating to THORChain on their Linktree page.

Additional resource

– Check out the ‘THORChain RUNE in 2023’ YouTube video by Dynamic Defi for a great overview of the protocol, including RUNE tokenomics.

Important PSA

For anyone new to crypto, please beware of any tokens that are variants of RUNE or anything resembling the THORChain name. These are likely scams, as with several spin-offs of popular coins and tokens across the crypto market. Always double-check what you’re investing in and (as a bare minimum) do some basic research.

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your research before investing in any crypto assets, staking, NFTs, or other products affiliated with this space.

- RUNE accounts for less than 1% of my crypto portfolio.

- I received no incentive to discuss any of the exchanges listed throughout this article. Moreover, I have no affiliation with any of these companies.

© Crypto with Lorenzo 2023. All rights reserved unless specified otherwise.

Featured image by WindAwake on Shutterstock