A mid-cap token that is set to shine in the coming years.

Chainlink is a decentralised oracle network (DON) that allows smart contracts across several blockchains to connect with on- and off-chain data and readily connect to a range of distributed networks.

DON is a network maintained by a committee of Chainlink nodes. Rooted in a consensus protocol, it supports any of an unlimited range of oracle functions chosen for deployment by the committee.

Chainlink 2.0 whitepaper, April 2021

It can facilitate connections to multiple APIs and various services through different blockchains – Bitcoin, Ethereum, Cardano and Polygon, to name a few.

Additionally, Chainlink is further enhancing the overall interoperability experience as it continues to improve one of its key products, the Cross-Chain Interoperability Platform (CCIP).

Products and use cases

Chainlink provides autonomous and distributed data feed for weather, sports, a vast swathe of crypto trading data, etc.

This distributed setup avoids a centralised point of failure with many conventional systems. Moreover, as Chainlink operates on Ethereum’s blockchain, it can depend on the security and reliability of the world’s leading smart contracts platform.

Regarding crypto, there are over 720 data feeds covering crypto trading pairs, stablecoin, forex and exchange reserves, to name a few.

Automation

Incorporating a reliable, secure and cost-efficient automated system, in addition to the abovementioned interoperability measures, the protocol’s success will also help Ethereum eventually achieve its status as a world computer.

Chainlink’s autonomous system is designed to readily handle large amounts of transactions on its system via its transaction manager tool.

Moreover, its website claims that it can “scale faster, from zero to millions of transactions”. Note that they didn’t specifically mention “transactions per second”. Having said this, its partnership with Ethereum scaling solution (i.e., a Layer 2), Arbitrum One, will help the decentralised oracle network hit that ambitious 1M TPS benchmark.

Here is a video tutorial from the official Chainlink YouTube channel about how to use Chainlink Automation for smart contracts written in Solidity, one of the main programming languages for Ethereum.

Verifiable Random Function (VRF)

VRF involves using blockchain technology to produce random numbers securely.

Chainlink VRF v2 permits smart contracts to use its type of random number generator without trading off security or utility. Furthermore, it allows users to deploy VRF in two ways: Using its subscription or the direct funding method, which also ties in with transaction costs.

What’s the purpose of VRF? It has applications in various fields, including (but not limited to) lottery systems, NFT minting, escrows, zero-knowledge databases and electronic cash.

A robust VRF system is essential for many of these applications. Imagine how boring a game would be without enough unpredictability or a lottery system that lacks randomness.

A shortcoming of VRF that will become increasingly important to address is its apparent susceptibility to quantum computers. Here is a line from a scientific journal article discussing this matter:

Despite their usefulness, a significant concern regarding the currently deployed VRF solutions is that they are susceptible to attacks by powerful quantum computers.

Buser et al. 2022

Despite this concern, I believe Chainlink Labs, developers and other stakeholders will incorporate quantum-resistant features and future-proof the protocol. This applies to other projects and blockchains, not just Chainlink.

As much of the information about cryptography can be rather abstract – and for brevity – I am merely skimming the surface of VRFs. For more information, I recommend these resources:

– Chainlink’s short video about its VRF scheme;

– A related Wikipedia entry;

– Scientific journal article titled Verifiable Random Functions, co-written by Silvio Micali, the founder of another blockchain project called Algorand.

– This article about Binance Oracle VRFs provides a good overview of VRFs for blockchains.

The collapse of FTX has once again reignited discussions about the importance of Proof of Reserves for centralised exchanges, stablecoin issuers, wrapped token providers (e.g. Bitgo’s Wrapped Bitcoin) and other entities.

This is a useful (I would even say an essential) tool to verify on-, off- and cross-chain reserves for these abovementioned services. Through Chainlink’s PoR, reserves data across all related ledgers are updated in real time.

This allows for accurate information and far greater transparency than conventional systems, particularly the banking sector, with financial institutions operating on fractional reserves across most countries.

If crypto were to establish itself as a reliable alternative, then exchanges, DeFi platforms, and stablecoins issuers should adopt a form of PoR, Chainlink’s version or otherwise.

Here is a comprehensive overview of all reported use cases on Chainlink.

Partnerships and news

Earlier this week, the CCIP went live on Base – the Coinbase-affiliated layer-2 scaling solution for Ethereum – making it the sixth network to connect with the CCIP since its mainnet launch in July.

This allows Chainlink developers to build decentralised applications on the L2 and take advantage of its purported benefits, a “safe, low-cost, developer-friendly way to build on-chain.”

The CCIP is emerging as a leading product to bridge the major gaps between Web2 (i.e., the present-day Internet) and Web3 (decentralised) applications, tokens and other assets or services, not to mention improved interoperability between different blockchains.

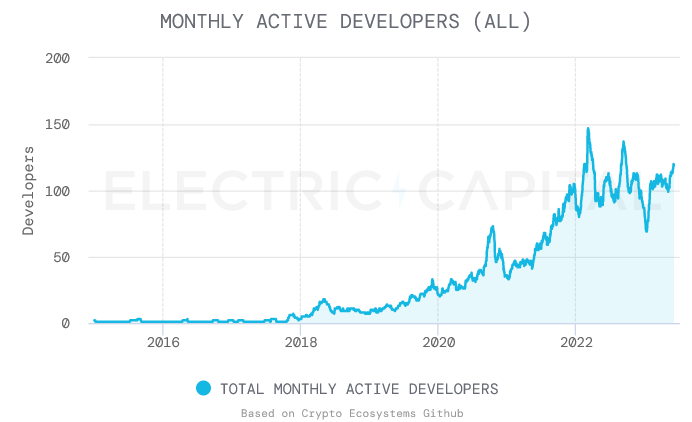

Monthly active developers on Chainlink (till June 1, 2023). Source: Graph by Electric Capital, with data from EC’s Crypto Ecosystems repository on GitHub.

___________________________________________________________________________

Chainlink has also been involved with not one but two tech behemoths.

Let’s start with Google (Alphabet). Chainlink first partnered with it in 2019, when it made BigQuery public datasets available on-chain via one of its smart contracts.

Here is the official announcement on X (Twitter).

Learn how to use Chainlink services to provide data from #BigQuery crypto public datasets on-chain, which helps reduce inefficiencies & enables new on-chain business models to emerge by adding entirely new capabilities to Ethereum smart contracts ↓ https://t.co/yVekclgafQ

— Google Cloud Tech (@GoogleCloudTech) June 13, 2019

Source: @GoogleCloudTech on X (Twitter)

As this is rather abstract – especially for anyone without a computer science background – I will refrain from bombarding you with jargon and excessive details.

I recommend reading the Google Cloud blog post about this partnership. For more info, it provides a comprehensive overview of what it all entails.

Additionally, a former Google CEO, Eric Schmidt, joined Chainlink Labs as a Strategic Advisor in December 2021. His involvement in Chainlink helped boost the number of oracles running on the networks by about 30%*.

In a recent conference (in July), Schmidt mentioned that Chainlink scales better than many other networks that “seem to fall over reasonably quickly”.

It sends a strong message to have the former head of one of the biggest tech companies in the world offering advisory services for Chainlink (Labs) instead of a primary foundation/organisation for a rival blockchain.

*According to The Motley Fool post published on Oct 5, 2022.

___________________________________________________________________________

As per the second tech giant, Amazon Web Services began using the protocol’s features, launching as AWS Chainlink Quickstart in 2021. This allows its operators to have a more streamlined workflow experience and to use Chainlink oracle nodes on AWS to sell real-world information via several blockchain ecosystems.

As the demand for smart contract applications continues to grow, so does the need for reliable and secure oracle solutions like Chainlink. In this regard, deploying Chainlink on AWS can offer several benefits such as scalability, flexibility, and high availability.

TrackIt blog post, May 2023

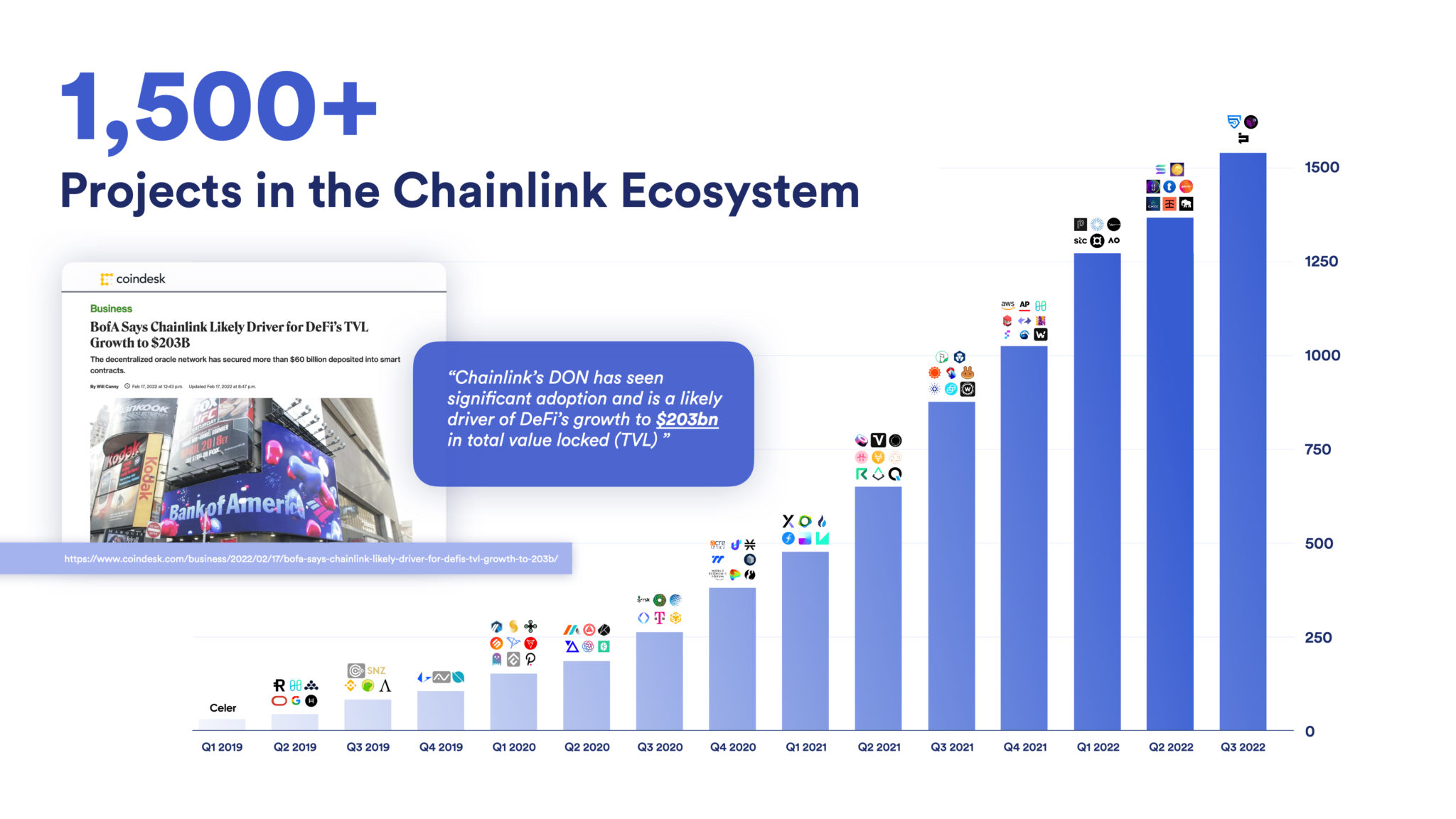

The two have reinforced their alliance since then by having AWS as one of over 1,500 partners across Chainlink’s network through the Chainlink BUILD initiative – a type of Web3 incubator/accelerator tool.

What is Amazon’s role in this? Based on this Chainlink tweet, whoever is accepted into the program can reach out to AWS account reps, access $5,000 in AWS credits and chances to participate in other AWS projects.

___________________________________________________________________________

A popular news story in recent weeks is the business relationship between the decentralised oracle network and ANZ Bank, one of the four largest banks in Australia, which also operates in over 30 markets worldwide.

The financial institution is keen to explore (trial) Chainlink’s massive potential in improving interoperability between different blockchain networks and helping these chains connect with the legacy financial system.

This is a significant move as the other major banks in Australia will closely observe how this all pans out. From here, this could also influence decisions made by other financial institutions across the Asia-Pacific region, but it is too early to tell.

___________________________________________________________________________

One of the many positive signs for Chainlink and its long-term prospects. The general crypto market has dropped, but this protocol has continued to grow. Source: The Chainlink Blog.

Yesterday, I came across this tweet about LINK acting as a proposed universal gas token at some point in the future.

This is a very bold move, considering that Ethereum consistently processes one million transactions daily and is the leading smart contracts platform. Thus, you would (rather, should) need approval from enough stakeholders to go ahead with this idea. Your thoughts?

___________________________________________________________________________

Final thoughts

After doing all this research, I feel more bullish than ever about Chainlink, particularly when balancing products, use cases, collaborations, tokenomics, and community activity across social media.

From a price perspective, LINK is one of the best mid-caps going around, at a fraction of its all-time high (ATH), currently at ~$8/LINK.

I will refrain from giving timeframes for price targets, as I believe anyone who does this is simply taking a wild guess. If I had to take the stab in the dark – using LINK’s current ATH of ~$53 – I reckon $120 during the next bull run is plausible.

This involves factoring in improved tech, more partnerships and greater liquidity across the overall market.

Like several projects in this space, it is still in its infancy and is gradually reaching the point where it can provide many business solutions at scale worldwide.

Thus, it is a slow burn, and like many good things, it’ll take time to get there as it continues to forge new collabs, continuously improve its products and LINK solidifying its spot as a top (20) crypto asset.

I wouldn’t rule out seeing this as a consistent top-10 crypto asset within the coming years, but one step at a time.

Ways to stay in the loop with Chainlink

– Official Chainlink website

– Whitepaper

– Twitter

– Chainlink’s official blog

– YouTube

– Reddit

– Telegram

– Discord

– LINK token contracts

– Sergey Nazarov — Co-Founder of Chainlink (LinkedIn profile)

– Chainlink Labs

– Events calendar

– GitHub docs

Links about other Chainlink collabs (I’ll add to this over time)

https://blockworks.co/news/coinbase-cloud-chainlink-node

https://www.coindesk.com/tech/2021/08/06/chainlink-integrates-weather-data-from-the-google-cloud/

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your research before investing in any crypto assets, staking, NFTs and other products affiliated with this space.

- For transparency, LINK accounts for roughly 2% of my portfolio, but I plan to increase this to 6-8% in the coming months.

Featured image by Gorev Evgenii on Shutterstock.