Could this Ethereum alternative ever hit a $1T market cap?

Cardano’s native crypto, ADA, has had a poor price performance since hitting an all-time high of roughly $3 two years ago.

ADA’s price is currently around $0.25, 12 times lower than the abovementioned ATH. Whilst BTC, ETH, BNB and other crypto assets have also dropped during this period, some might be starting to reconsider their position.

However, there are still positive signs for this top-10 crypto asset.

Despite not being as prolific in the crypto media compared to some other projects, developers and other stakeholders are continuing to build and improve Cardano.

How can we measure this? Cardano’s Weekly Development Reports are one way to ascertain whether the ecosystem is growing, shrinking or stagnant. These updates have been produced since July 2017, featuring a revised format since April 2022 on Essential Cardano.

Where we are now

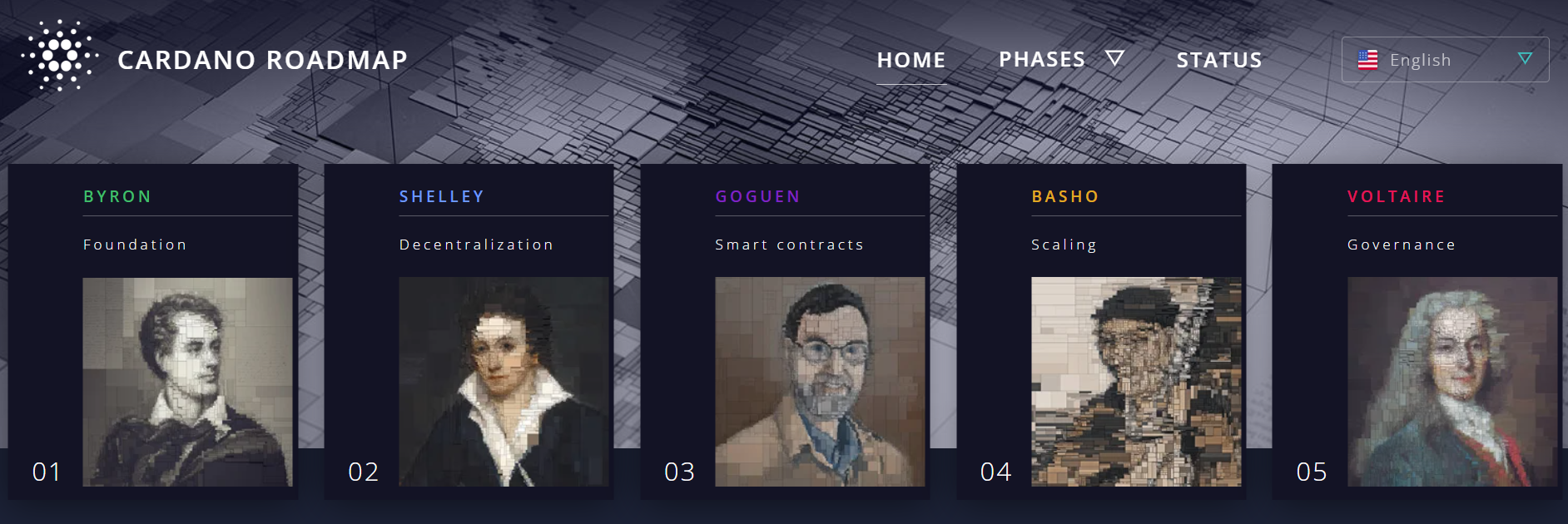

Cardano’s Roadmap provides a useful summary of the five stages of its network’s development over the years – past, present and future.

In September 2021, we witnessed the deployment of the Alonzo Hard Fork, ushering in smart contracts on the ecosystem and leading to the creation of decentralised applications (dapps) on Cardano.

This also signalled the beginning of the (current) Goguen Era. This epoch also marks the addition of several Cardano-native tokens, similar to ERC-20 tokens built on Ethereum.

A subset of these native assets consists of stablecoins, notably the over-collateralised DJED stablecoin, coupled with its SHEN reserve coin.

Cardano’s five epochs. Source: Cardano Roadmap

Basho – Cardano’s next development phase

Whereas previous development eras focused on decentralization and new functionality, Basho is about improving the underlying performance of the Cardano network to better support growth and adoption for applications with high transaction volume.

Cardano Roadmap – Basho

One of the major features in this era will be the execution of Hydra, the protocol’s native layer-2 scaling solution.

With an “aspirational target” of one million transactions per second (TPS) and a settlement time of less than one second (i.e., seconds per transaction), if, or even when Cardano devs manage to pull this off consistently, it will be a game-changer for the network.

I covered my thoughts about this pending upgrade in a separate piece earlier this year.

Alternatively, there is the possibility to boost scalability via a sidechain such as Polygon (MATIC), which is chain-agnostic and, thus, not exclusive to Ethereum.

I know this concept has been discussed for years, but this is nothing new. Ethereum 2.0/The Merge, Lightning Network on Bitcoin, massive scalability on Ethereum and other networks, etc.

These concepts were discussed for years before being fully carried out or are still in the works.

Charles Hoskinson and others behind Cardano that got people enthused about upcoming network upgrades (e.g., Hydra and scalability in general) give those within the community something to look forward to.

And this is a smart approach, as they’ve taken a leaf out of Elon Musk’s marketing strategy.

Ivan Liljequist (Ivan on Tech) explained this in a recent video:

“He (Elon Musk) always speaks about things that may or may not happen ten years from now.”

Ivan on Tech, 17 August 2023

This has helped boost Tesla’s market valuation by creating ongoing hype about its Cyber Truck, self-driving cars, etc.

Now, transfer this to crypto, and you get the point.

Of course, this space has no shortage of competitors (more on this shortly). However, the anticipation of scalability improvements, features like staking and dapps now live on Cardano’s blockchain, and its ongoing community updates keep the community’s hope in the project alive and well.

Does it still have a promising future?

Yes, I believe it does.

First and foremost, Cardano has delivered on many of the things it said it was going to do.

Staking, smart contracts, native tokens, increased utility, consistently high network security, sufficient decentralisation (although there’s always room for improvement), etc.

Here is a relevant post that sums up how this project has silenced many of its detractors over the years.

Post by aTalkingDonkey on Reddit

Of course, it still has a long way to go, and its detractors won’t stop criticising the project anytime soon. Some of it is justified; other times, it is nonsensical anti-Cardano maximalist BS.

Crypto was and will remain tribal, at least for the foreseeable future; anyhow, I digress.

Nonetheless, let’s not discount the progress Cardano and other major blockchains have made in their relatively short existence.

Besides scalability, Cardano also recognises the importance of interoperability with other chains, notably Bitcoin and Ethereum.

Many ecosystems connect with the latter by creating a sidechain with the Ethereum Virtual Machine (EVM).

Last year, Cardano announced the launch of its EVM-compatible sidechain to connect with dapps built on the leading smart-contracts platform seamlessly.

The deployment of the Vasil Hard Fork not only boosts interoperability and faster throughput (i.e., scalability) but also achieves quicker block validation times to enhance the network’s overall performance.

Finally, Vasil optimizes Ouroboros’ Verifiable Random Function (VRF) process. Before Vasil, block validation required two VRF functions in every network hop. Vasil drops one of these functions, resulting in faster block validation and network syncing times overall. Users will experience higher performance without compromising security settings.

Tim Harrison, VP of Community & Ecosystem (Communications) at Input Output Global (IOG)

Despite all of these steps to improve Cardano, much needs to be done to get this to compete with Ethereum or others in this space.

The network reportedly hovers between two and six TPS, although data from Cardanoscan indicate less than one TPS (see ‘transactions in the past 15 days’, and divide by 86,400 à seconds in a day).

However, its Extended Unspent Transaction Output Model (EUTXO) can lead to much better scalability, reportedly “hundreds of transactions” per second.

Nonetheless, this is still a far cry from the Hydra holy grail of one million TPS.

Good things take time, and such upgrades should not be rushed, particularly to maintain high network security and sufficient decentralisation.

Apart from all of this, there are other optimistic Cardano metrics:

– The network has added 250,000 wallets since April, in spite of a lower ADA price

– A continuous increase year-to-date of individual ADA wallets and delegators (over 4.2 million and more than 1.3 million, respectively).

– Over 600 million ADA (roughly US$160 million) in total value locked, which has also been increasing YTD.

– 8.8 million native tokens being built on Cardano’s network and counting.

Additional thoughts

Could it hit a $1 trillion market cap? Yes, perhaps sometime in 2025, but I would say towards the end of this decade.

If Charles Hoskinson’s comments are anything to go by, Cardano will be a slow-burn.

I.e., slow and steady wins the race.

This is a bold move when considering the enormous competition in this sector. Then again, rushed projects are more likely to have (potentially fatal) flaws.

Then again, despite the flurry of network outages in recent years, rival project Solana is still a popular blockchain with plenty of dapps being built on it.

Cardano Foundation, Emurgo and IOHK (IOG), the three entities spearheading the blockchain, will need to maintain their momentum in keeping this project in the top 10 cryptos.

So far, so good, but Cardano fans cannot rest on their laurels. They shouldn’t bank on its strong performance since its inception in 2017, carrying the project into the future without delivering (at least) the majority of what they’ve planned for the future.

Like every other project in the space, it has had its fair share of detractors and will continue having them until it successfully deploys all of the expected upgrades.

Even then, there will still be people who will fight tooth and nail to bring down a rival project, especially when plenty of money and reputations are at stake; all hail the tribal nature of crypto.

This is still a new space with much development required to cater to billions of daily or weekly active users. This applies to all blockchains, not just Cardano.

The next logical question is how much space can accommodate these competing projects.

It is hard to tell, but like technology companies, I doubt there will be just one or two taking over the Internet.

Yes, there will be a few giants down the track, but many will evolve into accommodating a certain niche or be more prominent in particular locations worldwide.

This is a whole different topic of discussion and something that I will elaborate on in future.

In summary, I see Cardano remaining dominant in the coming years; if not top-10, then I am also certain it will stay in the top-20 list of crypto assets by circulating market cap in the medium-to-long term (i.e., going into the 2030s).

At this rate, it would take something catastrophic for the project to vanish into the ether and become the umpteenth digital relic of this space.

Image by Venus78 on Shutterstock

Ways to stay in the loop with Cardano and ADA

– Official website and ADA token

– Cardano docs, including its whitepaper

– Twitter/X

– Cardano forum in over 12 languages

– Reddit

– Telegram

– Discord

– Charles Hoskinson’s YouTube channel

– Creating and managing a stake pool

– Developer Portal and GitHub DP

– Cardano Foundation

– Cardano Foundation GitHub docs

Further reading about EUTXOs

https://docs.cardano.org/learn/eutxo-explainer/

https://forum.cardano.org/t/accounting-models-in-blockchain-utxo-eutxo-and-account-models/98366

https://medium.com/coinmonks/understanding-cardano-extended-utxo-950ae19829cf

https://iohk.io/en/blog/posts/2021/03/11/cardanos-extended-utxo-accounting-model/

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your own research before investing in any crypto assets, staking, NFTs and other products affiliated with this space.

- For transparency, Cardano (ADA) represents about 15% of my crypto portfolio at the time of writing.