I’ll believe it when I see it.

Who predicted this?

Jurrien Timmer, Director of Global Macro at Fidelity Investments – one of the largest asset managers in the world, mentioned in 2021 that Bitcoin could reach $1 billion by 2038. At the same time, he also forecast BTC to hit $100,000 sometime in 2023.

This relates to his demand model coupled with the Bitcoin stock-to-flow model (more on this later) and how it relates to Metcalfe’s Law. According to Wikipedia (CC BY 4.0), this is the financial value or influence of a telecommunications network is proportional to the square of the number of connected users of the system (n2)

Why am I mentioning this now? I listened to a podcast episode released earlier this week featuring the incredible price prediction. So, I thought it would be worth exploring this idea.

“I have a supply model and a demand model, and the next and last time that those two models intersect is at around $100,000 in a couple of years.”

Jurrien Timmer, Interview with CNBC, 13 October 2021

If there’s one Bitcoin chart (and acronym) to remember….

It is definitely this one.

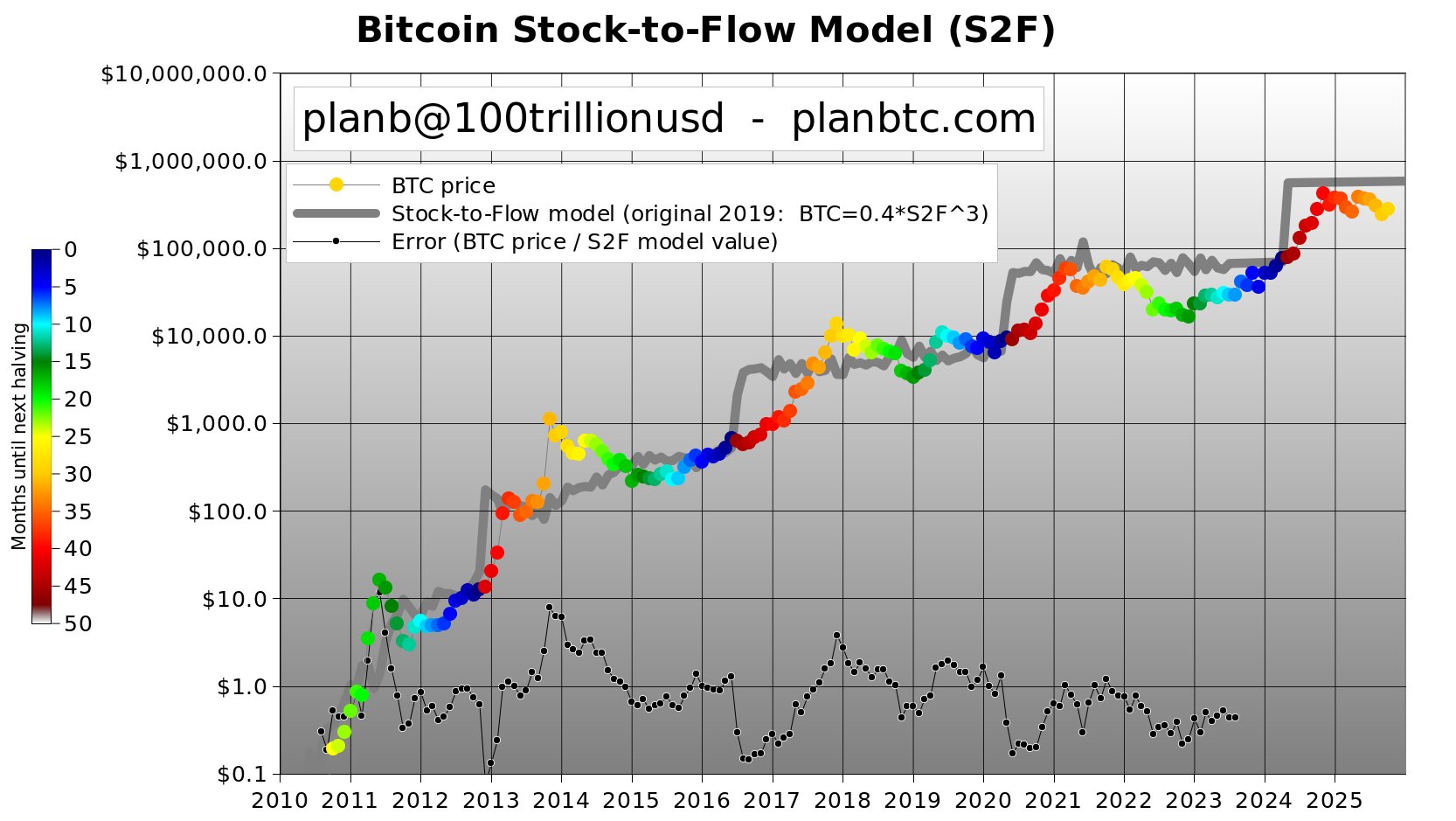

Bitcoin’s Stock-to-flow chart (BTC S2F).

It was invented by PlanB, a former institutional investor who proposed the concept in March 2019 in his article ‘Modelling Bitcoin Value with Scarcity’.

He is a fond believer in the idea of Bitcoin hitting a 100 trillion USD ($100,000,000,000,000) market cap at some point in the future.

Here is one of his latest graphs on X (formerly Twitter).

Chart by PlanB on X (Twitter)

Two major takeaways from this chart are:

1) Pay attention to the BTC/USD price in the lead-up to and shortly after each Bitcoin Block Reward Halving event, with the next one expected in April 2024.

2) Do not underestimate Bitcoin’s logarithmic price growth. In 2012, how many people thought Bitcoin could ever hit $1,000?

How could we get to $1B per BTC?

A combination of factors will most likely propel the coin’s price to these ambitious targets. Some of these include:

– The collapse of various fiat currencies worldwide, many of which are already crumbling due to out-of-control inflation

– Bitcoin’s increasing scarcity, courtesy of each halving event that occurs roughly every four years

– Transfer of wealth from physical gold – with an estimated value of $12.8 trillion – to Bitcoin, often dubbed “digital gold”

– Inherited assets being passed down from older generations, with some of the funds being liquidated and converted into digital assets

– Growing global GDP

– Ongoing economic uncertainly around the world, with people losing faith in major currencies, e.g., the USD, EUR, GBP

– Rapidly increasing adoption of cryptocurrencies, particularly Bitcoin. This coincides with a strong growth of distributed ledger technology (e.g., blockchain) being utilised across multiple facets of our society

– Seeking a censorship-resistant, decentralised alternative to the incumbent system, particularly with high levels of surveillance

Accounting for these factors (and this is not the complete list) makes the bold Bitcoin targets look more realistic and not so farfetched after all.

Moreover, comments from Michael Saylor, CEO of MicroStrategy, which owns a whopping 152,800 BTC (~$3.9 billion); Jack Dorsey; Larry Fink, BlackRock CEO; and other high-profile people add to the bullish sentiment.

Final thoughts

$1 million per coin is plausible, provided that the protocol maintains robust metrics, future-proofs itself from multiple hacking attempts, and has continuously increased adoption and greater acceptance from governments and institutions.

$10 million is worth believing in; $100 million is really pushing it…

But $1 billion per BTC? To say that is a stretch is an understatement.

That would represent a 40,000x from where we are today, with a market cap of over $1.93 quadrillion ($1,930,000,000,000,000). This figure also accounts for an additional 300,000 BTC to enter circulation in the next 20 years.

It is a colossal amount of money to put into just one protocol.

Let’s not forget that there will (most likely) also be other networks besides the pioneering blockchain, which will most likely have a market cap in the trillions.

Yes, the Bitcoin maxis are rolling their eyes, but most would agree that there will be at least one other active distributed-ledger system.

Look, if it ever hit one of the abovementioned milestones, I’d be a very happy man, I won’t lie. However, I will take this one step at a time and make small amounts of profit along the way.

Whilst prices are relatively subdued, consider this period a suitable buying opportunity, assuming that the BTC/USD pans out more or less as PlanB forecasted.

Of course, no one can predict the future, but I don’t expect Bitcoin’s incredible performance to stop anytime soon.

Yes, relatively speaking, it won’t be as profitable as the good old days (pre-2017), but potential gains from BTC, ETH and other digital assets will be nothing to scoff at.

Asset Class Returns since 2011… pic.twitter.com/zZowZcAsTH

— Charlie Bilello (@charliebilello) July 15, 2023

Source: Charlie Bilello on X (Twitter)

If history were to repeat, 2024 and 2025 would be bullish years for BTC, returning to a possible bear market in 2026. Then again, past performance is no guarantee of future results.

How likely are the previously mentioned BTC targets in your eyes?

Disclaimers

- N.B. None of this is financial or tax advice; I am neither a financial advisor nor a taxation lawyer. You are ultimately responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your own research before investing in any crypto assets, staking, NFTs and other products affiliated with this space.

- For transparency, Bitcoin (BTC) represents about 25% of my crypto portfolio.

Featured image by Morrowind on Shutterstock