On the cusp of US regulatory clarity and massive price movements

I know it is a peculiar decision to list a top-10 crypto (by market cap) here in my monthly Crypto Watch series. However, you will understand why XRP should be on your radar by the end of this piece.

Before beginning, I will cover both Ripple Labs Inc. (“Ripple”) and XRP, as they are closely linked, albeit separate. To clarify, you will still see the crypto (XRP) being incorrectly referred to as Ripple, but these names both refer to the same XRP digital asset.

What is XRP?

It is the native coin of the decentralised, permissionless (public), open-source XRP Ledger.

Established in 2011 by Jed McCaleb, Arthur Britto and David Schwartz – the latter is still actively involved in the project as Ripple’s Chief Technology Officer (CTO) – XRP, alongside Bitcoin and Litecoin, are the only three legacy coins to have stood the test of time and remain in the top 20.

Ripple has historically held most of the total (100-billion) XRP in an escrow. However, since 2017, the entity has been releasing up to one billion coins per month back into the market for purchase by the general public…with crypto whales snapping up large amounts.

“We’ll use Escrow to establish 55 contracts of 1 billion XRP each that will expire on the first day of every month from months 0 to 54. As each contract expires, the XRP will become available for Ripple’s use…We’ll then return whatever is unused at the end of each month to the back of the escrow queue.”

Brad Garlinghouse via Ripple Insights

Ripple has used this setup deliberately to avoid unexpectedly flooding the market with its XRP in one hit. This automated monthly process lets the general community know what to expect and when.

SEC Lawsuit and Hinman Speech documents

The XRP community has had to deal with the consequences of the ongoing Ripple vs SEC lawsuit, which began in December 2020.

What is this all about? The SEC alleges that Ripple raised over $1.3 billion via an “unregistered, ongoing asset securities offering”.

In other words, the SEC argues that XRP is a security, whereas Ripple has repeatedly claimed otherwise.

There is a plethora of recent (2023) resources arguing why XRP is not a security, which I have included here FRYP. For brevity, much of this relates to classifications based on assets deemed “investment contracts” under the SEC’s Howey Test.

It’s been a drawn-out process, testing the patience of XRP holders and Ripple.

However, there is a silver lining to all of this. One of the most promising signs of a (somewhat) favourable outcome for the crypto company is the content within the Hinman Speech documents from 2018, named after William (Bill) Hinman, the former Director of the SEC’s Division of Corporation Finance.

Originally scheduled for release on 6 June (i.e., tomorrow), this has now been pushed back a week to 13 June.

The US SEC was adamant in withholding the contents of the above-mentioned document from being publicly released (i.e., sealed). Still, Judge Annalisa Torres denied their request, a small win for Ripple, at least for now.

Why is this significant? Back in January 2021, Stuart Alderoty, Chief Legal Officer @ Ripple, informed the public (via a Twitter thread) that they put in a Freedom of Information Act surrounding the US SEC’s ruling on ETH.

We also filed a Freedom of Information Act request asking how the SEC determined ETH evolved from a security to not a security. No explanation or guidance was given why. We’re simply asking for the rules to be 1. stated clearly 2. applied consistently. 3/5

— Stuart Alderoty (@s_alderoty) January 29, 2021

Whilst there is an assurance from SEC Chair Gary Gensler about Bitcoin being a commodity, not a security, altcoins (in this case, XRP) are still yet to discover where they sit in the eyes of US regulators; Ethereum’s classification is still yet TBC, but the following comments from Hinman, also back in 2018 provide optimism for those banking on it being classified a commodity.

“And putting aside the fundraising that accompanied the creation of Ether, based on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions.”

William Hinman, 2018

Why does the security vs commodity classification matter? It ultimately boils down to regulatory clarity for all stakeholders affiliated with the broad range of crypto assets.

This uncertainty keeps several retail and institutional investors from investing in XRP. Moreover, Ripple’s initial public offering (IPO) plans are still on hold while awaiting the lawsuit verdict.

Image by danielo on Shutterstock

$250 million acquisition and Bitstamp shareholdings

This regulatory limbo in the US has led to Ripple re-evaluating its focus (at least in the interim) on forging new partnerships elsewhere, in both established and emerging economies.

One of the largest announcements as of late is the acquisition of a Swiss-based crypto custody startup, Metaco, for $250 million. This was announced by the company earlier this month in a press release.

“Through the strength of our balance sheet and financial position, Ripple will continue pressing our advantage in the areas critical to crypto infrastructure. Bringing on Metaco is monumental for our growing product suite and expanding global footprint.”

Brad Garlinghouse, Ripple CEO

It is an encouraging sign for Ripple to gain a foothold in the European market as part of its expansion outside the US. Collaborating with a Swiss firm taps into the enormous potential of crypto/blockchain based in Zug, a.k.a. “Crypto Valley”, an affluent low-tax haven.

Adding to Ripple’s growth strategy beyond North America is buying shares of Bitstamp, one of the oldest European crypto exchanges (since 2011), boasting more than four million clients on their platform.

CBDCs and Ripple

As part of its objective to become a major player in the real-time gross-settlement system industry, Ripple is preparing itself to play a pivotal role in the uptake of central bank digital currencies (CBDCs) worldwide.

As of May 2023, major developed economies such as China, India, France and Canada, with Nigeria being one of the largest developing nations to trial its CBDC, the eNaira.

Ripple’s Central Bank Digital Currency Platform offers solutions built on private ledgers on decentralised, public (permissionless) XRP Ledger blockchain.

One of the most discussed (I would refrain from saying “highly-anticipated”) CBDC launches is that of Hong Kong — the e-HKD.

In collaboration with the Taiwanese-based Fubon Bank*, Ripple Labs is working with the Hong Kong Monetary Authority to launch a pilot program of their CBDC, the e-HKD. These two are part of 16 companies approved by the HKMA to participate in this e-HKD trial run.

They will play a key role in the settlement of tokenised assets, representing one of the multiple use cases of the e-HKD as identified by the HKMA.

In brief, tokenisation involves splitting an asset into X number of investment units (e.g., 100 individual pieces) to allow for direct ownership of at least 1/100 of a property or an artwork, achieved through smart contracts and blockchain tech.

This opens up many opportunities for tokenised assets, particularly high-value investments such as real estate and art. I will expand on this whole concept in a separate piece.

*Fubon Bank (Hong Kong) Limited is the specific division involved here.

This is a major use case for the crypto company, adding to its increasing range of products for retail and institutional clients. Two notable ones complementing the CBDC solutions include On-Demand Liquidity (ODL) and Liquidity Hub.

Source: Stedas.hr (@stedas). Click here for a clear, full-screen version of this image.

Non-fungible tokens on the XRP Ledger

Proving that it is a one-stop shop for all things crypto and much more than just a payments protocol, XRPL has joined the likes of other leading blockchain platforms in offering users to mint and trade NFTs, even through auctions.

https://xrpl.org/non-fungible-tokens.html

Here is your go-to list for all related content about NFTs on the XRPL.

NFTs on the XRPL are a reality courtesy of the XLS-20 standard.

Besides all this, let’s not forget the other entities offering growing collections of XRP/Ripple-themed “nifties” on the Binance NFT platform, with more to follow shortly.

Adding to the recent enthusiasm about XRP is the Q1 2023 growth in net sales on Ripple and a 34% increase in DEX volume across versus Q4 2022. The full breakdown of network activity and developments on XRPL and Ripple is available in the latter’s Q1 2023 XRP Markets Report.

As per XRP NFTs, I came across this from the report as mentioned earlier:

“Since the mainnet launch of the NFT standard XLS-20 in Q4 2022, over 1.2M NFTs have been minted, making XRP Ledger among the top 10 chains for NFT volume and transactions. In addition, there are now 1,500+ apps/exchanges on the XRPL and 950+ public projects on GitHub related to XRPL.”

Final thoughts

Despite the uncertainty surrounding the lawsuit, the crypto company looks set to remain a dominant force in this sector.

After nearly three years and what will have been at least $200 million in legal fees covered by Ripple by the end of this saga, a ruling by Judge Torres against the firm will not seal its fate, especially outside of the US.

XRP has borne the brunt of this drawn-out litigation, which has resulted in the coin failing to reach its all-time high of roughly $3.70 in January 2018, unlike BTC, ETH, ADA and other large crypto assets that have more than doubled their prices since that December 2017/January 2018 bull run.

However, from an investor’s perspective, this can be considered a valuable opportunity to spend more time accumulating the asset whilst it is relatively cheap. Of course, we can’t conclude that it will mimic other digital assets and return to its ATH, let alone exceed it. As a reminder, past performance does not guarantee future results.

I expect some XRP price movements on the day of the Hinman documents’ release, but the most significant volatility will occur (in my opinion) on the day of the official verdict. Nonetheless, I don’t see this impacting XRP’s long-term prospects, particularly as they increase their global scope.

As a reminder to anyone who supports the USA’s overbearing attitude towards crypto and blockchain entities, they move abroad to more favourable business destinations, not to mention a brain drain and a loss of revenue.

Gemini and Crypto.com have been forging ahead with overseas expansion – in recent days, UAE and Singapore, respectively; in March, Coinbase announced its “Go Broad, Go Deep” initiative across six continents; other exchanges will follow suit.

Ways to stay in the loop with Ripple and XRP

- Official Ripple website and separate XRP page

- Whitepaper

- Ripple Insights – the official blog

- YouTube

- Telegram

- Discord

- Brad Garlinghouse

- David Schwartz

- XRP Ledger page (including Developer Resources)

- XRP Ledger Foundation (an independent, non-profit entity unrelated to Ripple)

- XRP LF GitHub docs

Image by Dang Pham on Shutterstock

Disclaimers

- N.B. None of this is financial or legal advice, and I am neither a financial advisor nor a lawyer. You are solely responsible for crypto investments and how you interpret the information provided in this piece.

- The opinions expressed within this piece are my own and might not reflect those behind any company, organisation or person listed here.

- Please do your research before investing in any crypto assets (including stablecoins), hardware wallets, NFTs and other products affiliated with this space.

- To reiterate, I received no incentive from any person or entity listed throughout this article to discuss their product.

If you enjoyed this article, I recommend following my Medium page for regular reports about crypto assets, blockchain technology, and more. Feel free to check out my publication as well, Crypto Insights AU.

Thanks for your support.

Featured image by BT Side on Shutterstock

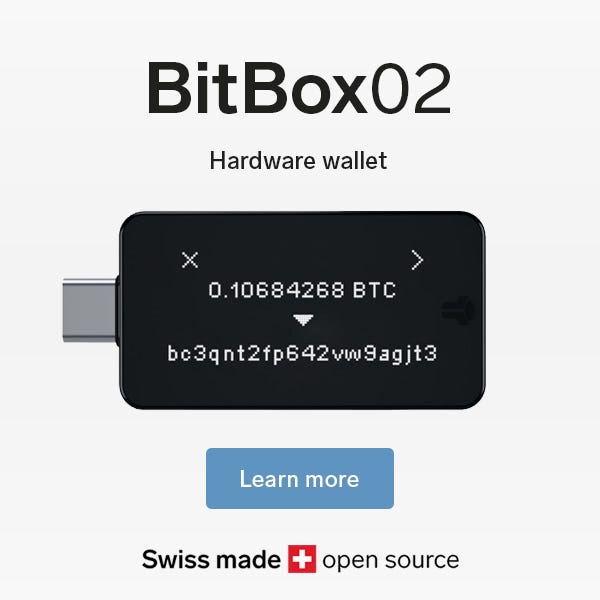

Affiliate link: BitBox02 is a increasingly popular alternative to Ledger and Trezor. This is not paid advertising. However, if you were to buy one of their products via my affiliate link, I receive a small commission at no extra cost to you. Their website also has an excellent side-by-side comparison with the above-mentioned alternatives.