Some good intentions but a superficial and unrealistic approach.

TL;DR — Greenpeace, in collaboration with an artist, produced an installation, the “Skull of Satoshi”, as part of the “Change the Code, Not the Climate” campaign to get multiple stakeholders to work together to move Bitcoin away from proof-of-work (mining) and like Ethereum, adopt a proof-of-stake (staking system).

I cover why this is unlikely to occur and instead argue that more emphasis should be on accelerating the movement to ~100% “clean-energy” uptake, better use of waste heat from ASIC miners, implementing other efficiencies (e.g. novel cooling technologies for miners), and pushing to boost recycling of valuable materials from discarded mining equipment.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Bitcoin uses as much energy as Austria, Portugal, Norway, Switzerland and …(insert country).

This is the frequent comparison between Bitcoin and multiple individual countries across various media sources.

Besides this, there is a movement from various environmentalists/climate activists to get Bitcoin to emulate Ethereum and move to a proof-of-stake (PoS) chain.

“Changing Bitcoin’s code is going to take teamwork. We need everyone involved, from companies and government officials to crypto enthusiasts and climate activists…”

Rolf Skar, Special Projects Manager, Greenpeace USA

Despite some good intentions, particularly in addressing the e-waste generated from Bitcoin mining (something that more people should focus on, more than its energy demands), in my opinion, environmentalists’ efforts on this matter are futile.

Why? Because it is one thing to have ideas (PoW à PoS for Bitcoin) that could theoretically work, but, in reality, they’re much harder to carry out than many expect.

By the time a blueprint was to be put in place to carry out this change, it would not be fully executed by at least 2030 if the Ethereum Merge was anything to go by.

However, this is still wishful thinking, as you will see later.

Before diving into why such a move is unlikely, here is the first claim I saw on the campaign’s About page that I want to challenge.

“We know a basic software code change would reduce Bitcoin’s energy use by 99.9%. If only 30 people — the key miners, exchanges, and core developers who build and contribute to Bitcoin’s code — agreed to reinvent proof-of-work mining or move to a low-energy protocol, Bitcoin would stop polluting the planet. So why isn’t Bitcoin changing its code?”

Clean Up Bitcoin (Change the Code, Not the Climate)

A “basic” code change and just 30 “people”?

To say this is basic misleads the public about the complexity of implementing this fundamental change to the network.

As crypto as a whole is still poorly understood by the general public, comments like this one don’t help.

If this is “basic”, why did Ethereum’s move to the Beacon Chain (i.e., the beginning of PoS on Ethereum) take many years?

Why? Because it’s far from basic and much more complicated than people think. Years of rigorous testing, fixing bugs, and ensuring that the system functions as best as possible without significant glitches…these things take time and a f&*k load of commitment, expertise and perseverance.

As per “30 individuals”, I am highly sceptical about this number, despite a handful of prominent players in Bitcoin, tech and business realms. Even then, successfully bringing out an effective code without compromising the oldest and largest blockchain (based on its circulating market cap) is extremely challenging.

I understand the logic and intentions behind this campaign. However, by going through the entire rigmarole (insane amounts of time, effort and money) of this PoW à PoS transition on Bitcoin, it would be better to focus on reducing CO2 emissions and e-waste with the current system.

In this article, I will cover why I doubt moving Bitcoin to PoS is realistic and a swathe of solutions that will help Bitcoin reduce its environmental footprint whilst remaining a PoW blockchain.

— Satoshi Nakamoto designed Bitcoin to be immutable, thus reiterating the difficulty involved in trying to change this complex system — a well-functioning, decentralised one that has stood the test of time, unlike the plethora of blockchains and protocols that have come and gone.

“The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.”

Satoshi Nakamoto (Bitcoin Whitepaper), 2008.

Redoing PoW for Bitcoin is not impossible, but it is now reaching the point (or possibly surpassed already) that it is becoming increasingly unfeasible and less practical than the alternatives I will explore in this piece.

— Energy intensity is not the issue here. Instead, the matter to be addressed is CO2 emissions and pollutants released from ineffective and dirty power plants and outdated technologies.

It’s important to look at this from a global perspective.

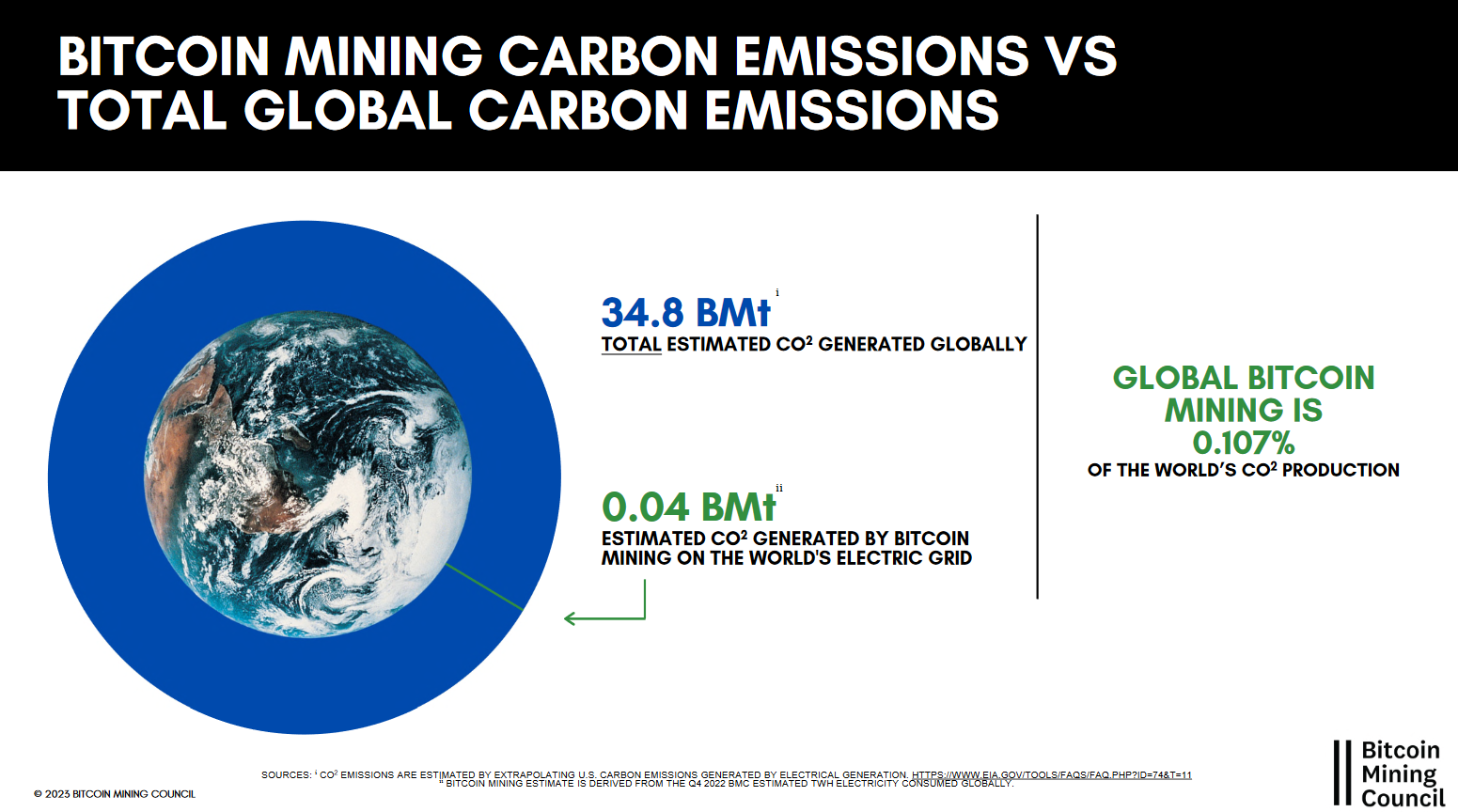

Do you know what percentage of CO2 emissions are caused by Bitcoin mining?

0.1–0.9%, depending on your sources.

This is still a sliver on a pie chart, even at the upper estimate (say, 9x the width of the green line in the figure below).

Source: Bitcoin Mining Council 2023 (Global Bitcoin Mining Data Review Q4 2022) January 2023, slide 6).

Even when factoring in Bitcoin vs global energy usage (in terawatt hours, TWh), it is still at 0.17%.

Another stat I came across is a September 2022 White House report about crypto assets. On Page 6, it mentions:

“Global electricity generation for the crypto-assets with the largest market capitalizations resulted in a combined 140 ± 30 million metric tons of carbon dioxide per year (Mt CO2/y), or about 0.3% of global annual GHG emissions.”

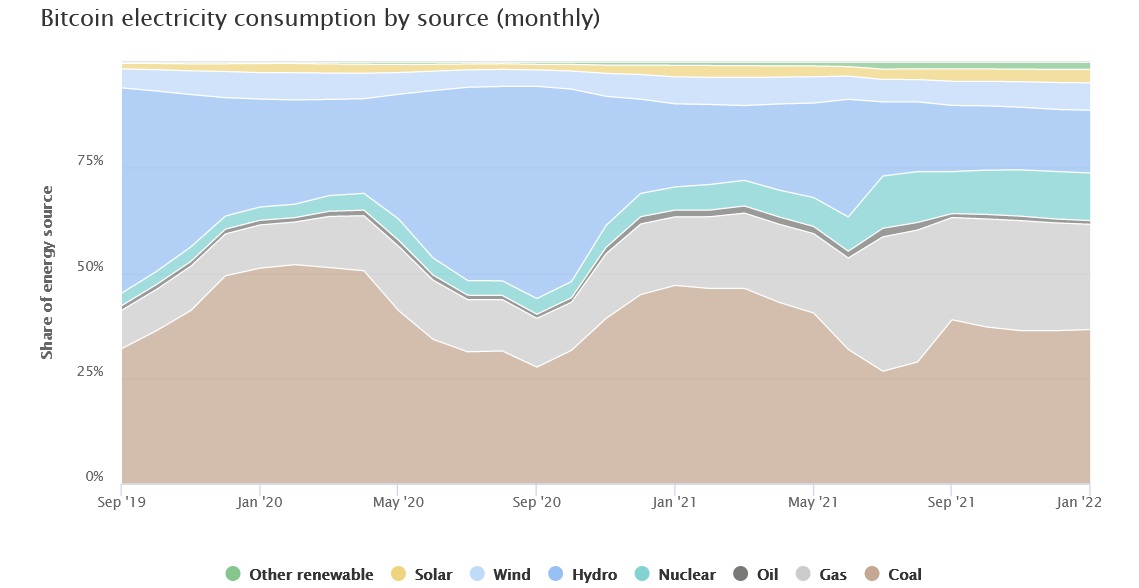

Besides CO2-e emissions, let’s have a look at various energy sources used in Bitcoin mining over the years.

Cambridge Bitcoin Electricity Consumption Index. Cambridge Centre for Alternative Finance © 2023. CC BY-NC-SA 4.0 licence.

I will admit that the share of renewable energy in Bitcoin mining (as per the chart above) peaked in September 2020, based on the above chart.

What led to this? The cause of significant fluctuations in 2019 and 2020 hydroelectricity is attributed to the regular monsoon season in Sichuan. A key reason why this has struggled to recover is China’s central government cracking down on domestic businesses using crypto (May 2021) and a blanket ban* (including BTC mining) from September of that year.

*Despite this being made “illegal”, Bitcoin mining still (reportedly) operates underground in China, which doesn’t surprise me.

However, suppose we were to extrapolate from the point of this “ban”. In that case, other renewables and nuclear are gradually making up for this shortfall. I expect this trend to continue as many renewables become more economically viable and efficient (more on this later).

Now, it’s one thing for a company to claim that they are using x percentage of a particular energy source, but how can we verify this?

Blockchain technology has a role to play in this too.

Organisations such as Energy Web evaluate renewable energy certificates (RECs) and Guarantees of Origin (i.e., which power source was used to provide electricity) and are working on a certification system to determine how “sustainable” Bitcoin miners are. This will be a valuable resource for multiple stakeholders to see how trustworthy a company’s “green” claims are, what the power sources are and real-time monitoring.

Crypto Watch February 2023 — Energy Web Token (EWT)

A 50–100x powerhouse in the making.medium.com

Blockchain technology makes this possible and will become easier to determine as multiple protocols and blockchains continue improving.

— How will Bitcoin miners be compensated for any hypothetical move to proof-of-stake (PoS), as Ethereum did last year?

Let’s face it, operators that have forked out vast sums of money on Bitcoin mining and related equipment (e.g., cooling setups for ASIC miners) would want to (rather should) be financially compensated for any systemic overhaul to Bitcoin mining.

Why would they need to be? Because if Bitcoin were to move from mining to staking whilst not rendering these ASIC miners completely obsolete, it would significantly devalue them and lead to major financial losses.

This hardware is designed specifically for mining digital assets from certain networks with significant computing-power requirements (well beyond CPUs and GPUs).

Different types are programmed to mine crypto assets under a specific hashing algorithm: SHA-256 for Bitcoin, Bitcoin Cash (BCH) and related digital assets. Other units are produced for Ethash: historically Ethereum (before it moved to PoS), but nowadays, they’re used for Ethereum Classic and others that utilise Ethash.

Other types exist, but SHA-256, Ethash and Scrypt (the latter used for Litecoin and Dogecoin) are three of the most common ones.

There is no way that individuals and large entities, solely or predominantly focused on BTC mining, would take this lying down; if this were to occur, I expect people to move to another fork of Bitcoin or even add another one to the dozens that already exist; BCH would be the most plausible option.

In other words, if you believe that they will acquiesce and accept that this is “for the common good”, then I think you’re naïve (to put it politely).

— Even if there were enough support from multiple stakeholders directly and indirectly involved in Bitcoin, this would take several years, perhaps up to a decade, to plausibly carry out a colossal task.

Bitcoin has existed longer than Ethereum (2009 vs 2015 launch dates, respectively) and still maintains PoW. As a result, you cannot assume that Bitcoin shifting to a PoS (or similar) system will take as much time as Ethereum to execute this move.

Instead, to reiterate, expect even more time for this.

— Bitcoin’s energy requirements relate to the network’s hash rate, which, in turn, correlates to its blockchain’s overall security.

This is one of the most misunderstood aspects of Bitcoin.

Not enough people realise that this constantly growing hash rate (in very simple terms, this is computer power to run a blockchain network) makes Bitcoin more secure.

How? It increases the cost of carrying out a 51% attack on its network (i.e., having majority control over it); if this were to occur, it would cause permanent reputational damage to any ecosystem.

To clarify, 51% attacks also exist on PoS chains, as covered in this related piece about Ethereum.

We should also remember that PoS and similar systems — despite the enormous improvement in energy efficiency vs PoW — have their own drawbacks too.

Whilst I acknowledge genuine concerns about the enormous energy needs for Bitcoin mining, this can be justified in many ways, with robust network security being a leading drawcard here.

Nonetheless, I know it is considered blasphemy for eco-warriors. Regardless, many of them conveniently ignore the fact that the majority (or, to use worst-case scenarios, ~40% at present, give or take) of energy used to power Bitcoin mining comes from “sustainable sources”, i.e., renewables and nuclear; yes, nuclear will play a role in this, despite the politics behind this.

Aside from energy usage and CO2 emissions, many people in the West are oblivious to (or conveniently ignore) the importance of a genuinely decentralised cryptocurrency, whereby no government or corporation can f**k with a key aspect of monetary policy (and a major talking point since 2020…inflation).

I guess ignorance is bliss for many, especially for those whereby fiat inflation is still “relatively manageable”.

If more people understood the ramifications of hyperinflation on multiple economies (some of the poorest ones, too), particularly in recent years, some of Bitcoin’s harshest critics would reconsider their antagonistic stance towards it, especially in the digital age.

Moreover, it is a balancing act between addressing environmental impacts on the world and humanitarian issues, particularly for some of the most impoverished people in our world. Anyhow, I digress, and this is a whole article in itself.

Image by rzoze19 on Shutterstock

— Make better use of capturing heat released from Bitcoin miners

In spite of the numerous steps individuals and companies can take to reduce their environmental impact from operating Bitcoin miners, there is still the matter of dealing with waste heat.

So, what is being done to overcome this issue?

With some planning and ingenuity, individuals and businesses have found ways to repurpose heat produced by Bitcoin miners.

Products already exist that can be specifically designed to heat your living space that are quiet and safe enough for continuous exposure in a house (e.g., <40 dB). Heatbit is an innovative Bitcoin miner that doubles (rather triples) as a room heater and air purifier.

OK, so that’s heating a room, but what about water heating? Tresorio, a French-based tech company, has (co-)patented DigHeat and MinIT solutions that allow for Bitcoin mining whilst harnessing the waste heat to be reused; a clever move when considering the energy that would have been otherwise required to operate a standalone water heater, all year round.

An excellent use of copious amounts of heat, but those wanting to completely exploit the full potential of “waste” heat from Bitcoin don’t just stop at that.

What about greenhouses? Well, Bitcoin has a role to play here too.

Bitcoin Bloem is a Dutch company that uses heat from Bitcoin mining equipment to grow flowers.

Moreover, there is one type that comes to mind. Tulips! Not only would it be “not-so-Dutch” of them to grow anything else, but there’s another reason to focus on these.

Back in the 17th Century, tulips were notorious for hitting astronomical prices, albeit temporarily. As a result, many Bitcoin haters/critics liken digital assets to the mania surrounding these flowers back in the (old, old) old days.

I’m sure Greenpeace supporters would appreciate this initiative, with flower power and all that jazz.

As a result, it is only fitting for the company to offer the OG of speculative assets with heat provided by another speculative asset but in digital form…21st-Century style.

Plenty of other companies exist that I have not featured here, and this list will only continue growing as people find innovative solutions to these problems.

— Optimising energy sources for Bitcoin mining under certain conditions: time of day, seasons, geographical locations

Unlike physical mining for precious metals and minerals that have to work with energy sources and other resources in their surrounding area, the beauty of mining Bitcoin and other PoW digital assets is that they can be done anywhere, anytime, and with fewer constraints.

As a result, certain locations have surplus energy at particular times of the year or for given periods owing to favourable weather or geographical conditions. Two notable examples that come to mind include Bitcoin mining during the rainy season in Sichuan, China, and Iceland’s abundance of renewable energy all year round, over 85%.

In countries with over 100% renewable energy, these have provided opportunities for energy-intensive industries (e.g., aluminium smelting in Iceland). Such nations (and more to come in future) can utilise this abundant and continuous stream of reliable, clean energy to entice Bitcoin miners to operate there, thus further increasing RE uptake for Bitcoin miners.

At some point, the amount of energy consumed for crypto mining — let alone across all sectors — becomes irrelevant when nearly 100% is derived from renewables and nuclear; I’m emphasising the former to encourage a strong and reliable mix of options.

Moreover, the World Economic Forum (of all sources) also acknowledges the role of renewables in reducing PoW-blockchain carbon emissions, coinciding with countries weaning off fossil fuels in the coming years.

Image by Anastasiya Shatyrova on Shutterstock

More food for thought

Bitcoin miners opting to reduce their carbon emissions would be predominantly influenced by market-driven choices (i.e., what is most economical, thinking about both the short and long-term), government policies, and a need for greater efficiency with increasing costs down the track, rather than trying to appease climate activists.

Whilst energy intensity is expected to increase in accordance with continual growth in Bitcoin’s hash rate, we also need to factor in/remember that:

- Renewables are forecast to become far more prominent in the overall global energy mix in the coming years due to plummeting costs, enormous R&D, economies of scale and more;

- Nuclear will also play an increasing role in decarbonising various economies to supplement this transition away from fossil fuels (even though Germany has gone the other way);

- Bitcoin mining equipment will become more efficient over time; not just for environmental reasons but more so out of necessity to compensate for an ongoing reduction in mining rewards;

- Technologies such as water cooling and immersion cooling are utilised for greater efficiencies in Bitcoin mining systems, thus contributing to lower emissions per (tera)hash.

As a result, CO2 emissions from Bitcoin transactions and mining will be even lower than now. As these measures and effective solutions for e-waste are implemented, this will effectively silence the loudest critics of PoW cryptos.

To reiterate, all of the steps, as mentioned earlier, combined, will be much better than forcing Bitcoin stakeholders to shift to PoS, particularly when such a move would take several years to deploy effectively with minimal interruption.

If you genuinely want to engage with Bitcoin enthusiasts, aim to find common ground and consider their points of view surrounding what Bitcoin represents, energy generation, environmental matters, etc., would most likely yield more meaningful results than the same old arguments being peddled by Bitcoin sceptics/haters:

- “Criminals use it”;

- “It’s environmentally destructive”;

- ‘’It’s worthless/a scam.”

- A related quote or comment from Warren Buffett, Charlie Munger, Jamie Dimon, Nouriel Roubini, Peter Schiff (the most rational out of these IMO, yet disagree with him regarding BTC) and others.

This extends to multiple issues in society, whereby the left and the right refuse to listen to what the opposite side has to say and repeatedly yell at/mock each other, leading to a lack of meaningful action to resolve various issues, whether this involves Bitcoin in general, the environmental impacts of this industry, or otherwise.

Multiple blockchains exist, and since Ethereum’s transition to PoS, roughly half of the total circulating market cap of crypto is represented by PoS cryptos. Thus, many alternatives to Bitcoin exist, especially if you detest the foundation crypto and its energy-intensive PoW system.

Some concerns surrounding crypto assets are valid, with some of these commentators (see the Roubini hyperlink) about most crypto assets being scams. However, legitimate projects are also out there, and anyone that lumps Bitcoin, Ethereum and other reputable networks into the same category as scams is myopic.

Furthermore, anyone who disregards distributed ledger technology (blockchain, directed acyclic graphs (DAGs), etc.) and thinks it is also useless is just being narrow-minded; dare I say, old-fashioned.

Image by Zapp2Photo on Shutterstock

Anyhow, considering everything mentioned here, this begs the following questions:

- What measures will Bitcoin miners take to reduce the amount of e-waste and boost recycling rates? Who will oversee this?

- Will this information get Bitcoin/crypto haters to reconsider their opposition to PoW digital assets on environmental grounds?

As per the first one, I see some progress being made here, but not enough in the near future to genuinely resolve this growing problem, as processing this requires more funding, and more infrastructure needs to be built to deal with this.

Then again, this problem is not exclusive to Bitcoin; e-waste is a universal problem, and we collectively need to do more to address this for environmental and human health.

Moreover, all stakeholders involved in Bitcoin’s network must also take measures to reduce their CO2 emissions, not just e-waste. However, this needs to be balanced with costs.

Almost everyone will prioritise options that favour their bottom line, which will become increasingly important with the upcoming Bitcoin Block Reward Halving.

Here is the link if you are on a laptop or desktop:

https://www.binance.com/en/activity/referral-entry/CPA?fromActivityPage=true&ref=CPA_002PKBO6IF

Regarding the second question, for the more pragmatic and open-minded people willing to explore solutions to avoid moving Bitcoin from PoW to PoS, perhaps; for others, I doubt they’ll want a bar or it.

Why? Partly because these matters are too abstract for some, they still pretend to know what they’re talking about without sufficient research. For others, don’t let the truth get in the way of a good story…especially when you’re banking on stirring up people’s emotions to help support your cause, albeit one-dimensional.

As I wrap up, as per Greenpeace’s effort with the Change the Code campaign, I would appreciate it if they channelled their energy into other causes, starting with updating their Guide to Greener Electronics, which hasn’t been done in nearly six years.

This would address e-waste across all tech-related consumer goods, creating a more meaningful impact worldwide rather than obsessing over Bitcoin and other PoW cryptos.

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are solely responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your research before investing in any crypto assets, staking, NFTs and other product affiliated with this space.

- For transparency, Bitcoin (BTC) represents about 20% of my crypto portfolio. Having said this, Ethereum (ETH), Cardano (ADA) and PoS cryptos collectively account for most of my crypto holdings. I also invest in CleanSpark (NASDAQ: CLSK), a Bitcoin mining company that sources >90% of its energy requirements from clean sources, such as wind, solar, nuclear and hydro.

P.S. If you think I’m some random crypto enthusiast without a clue about environmental issues, well, FYI, I have a Bachelor of Environmental Science and have worked in a related field for several years, so I am better versed in environmental matters than most people out there, but there is always a lot to learn.

Featured image by corlaffra on Shutterstock.