Project info | Airdrop details | Marketplaces & exchanges | Future of L2s

One of the most hyped token launches this year has finally arrived. Arbitrum, a layer-2 scaling solution on Ethereum, announced the native token, ARB, had its long-awaited airdrop on March 23.

Why all of this excitement with Arbitrum? It currently has $2.1 billion of total value locked (TVL), the fourth-highest amount out of all blockchains, and more than double one of its L2 competitors, Optimism.

Its main purpose is to provide scaling solutions for Ethereum. Using Arbitrum chains, you can use the leading smart-contracts platform to interact with a vast swathe of Web3 apps, run smart contracts, and so on, in a much cheaper and quicker manner than going directly through Ethereum at present.

As ARB is an ERC-20 governance token, it is fully compatible with Ethereum and its Virtual Machine (EVM): A cloud-based, decentralised computer that acts as the backbone for running all smart-contract code on Ethereum’s network.

The latest iteration of Arbitrum is Nitro, its second-generation L2 optimistic rollup — running transactions off the main/base chain, e.g. Ethereum, subsequently broadcasting these data back to the mainnet for cheaper and quicker transactions.

Arbitrum and Optimism have been two of the most discussed L2s in recent months. The latter’s native asset, OP, which launched last June, is already up by more than 50% versus Bitcoin, Ethereum and various altcoins year-to-date (YTD) and over 160% YTD compared to the USD.

ARB airdrop key points + token overview

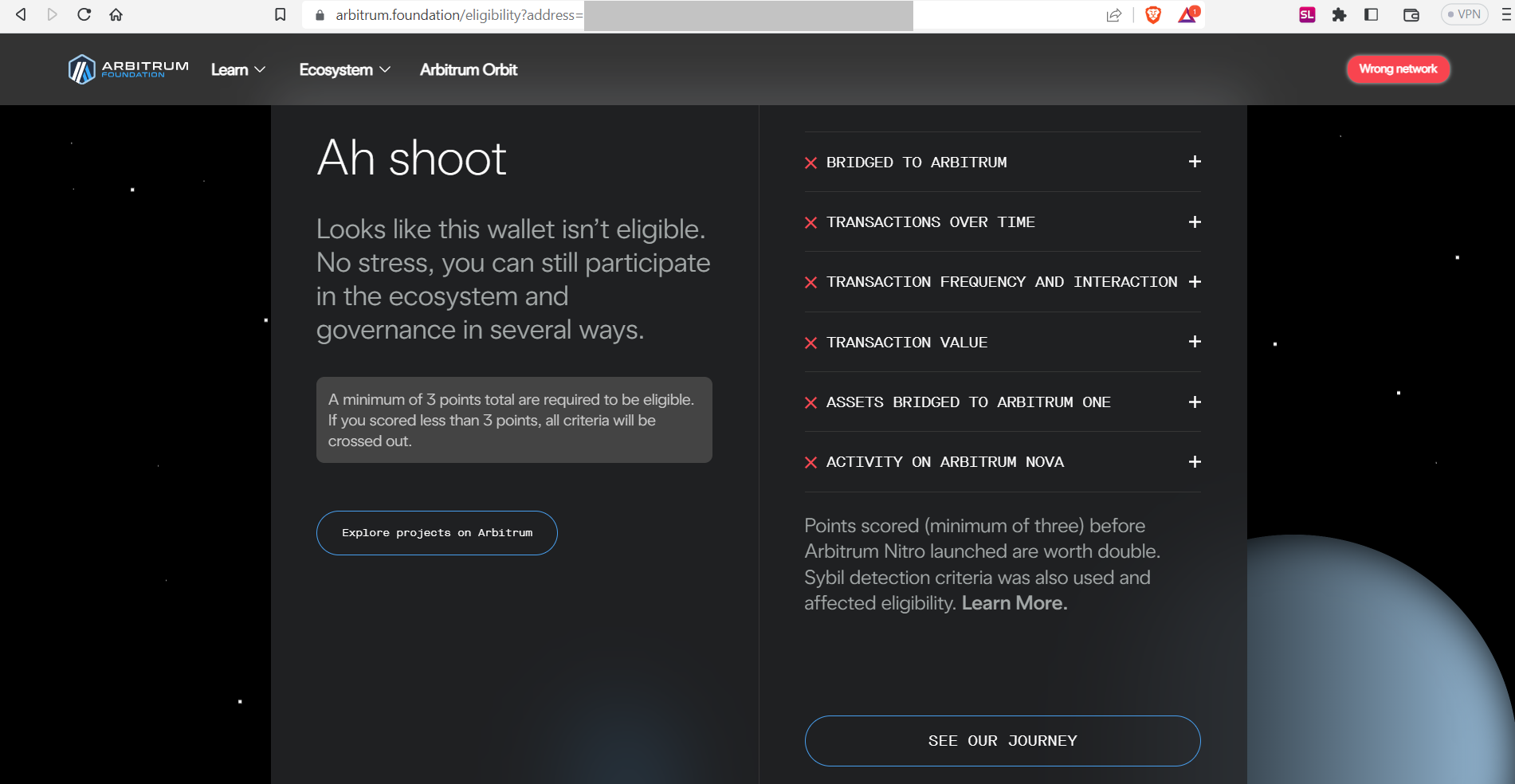

Those who had sufficiently used Arbitrum’s One or Nova networks before March 23 (see image below) are more likely to be eligible for an ARB airdrop (a distribution of free crypto, usually if you meet certain conditions).

Eligibility criteria for the ARB airdrop (image provided by author).

Eligibility criteria for the ARB airdrop (image provided by author).

At the time of writing, you will have another six months to claim your free ARB if you satisfy at least three of the points listed in the above image. Comprehensive details about this airdrop can be found in the Arbitrum DAO Governance Docs.

N.B. Only use the official website (or any site Arbitrum Foundation suggests) when interacting with the network or token.

Check out Ivan on Tech’s video with his overview of the ARB airdrop and thoughts about short and long-term price movement expectations based on recent token launches with other projects in the space.

ARB has a circulating market cap of ~$1.6 billion at $1.26 per token. There are 1.275 billion tokens in circulation, with a total supply of 10 billion.

ARB marketplaces, trading pairs and liquidity

Despite launching as a top-50 crypto (based on circulating market cap), it will still take a while for various marketplaces to list ARB, both big and small.

As more centralised exchanges and DEXes list the token and allow for more trading pairs with fiat currencies and crypto assets, this will significantly expand its reach to a broader audience of prospective investors and traders. As a result, this should inject more overall liquidity into the market and boost trading volumes linked to ARB.

For an updated list of trading pairs, volumes and crypto marketplaces that offer ARB, let alone general crypto stats, I use live data from CoinMarketCap, CoinGecko and LiveCoinWatch.

Image by Ebru-Omer on Shutterstock

Future of L2s and Arbitrum (ARB)

Several others exist besides Arbitrum and Optimism to assist Ethereum with scalability, not to mention some L2s can operate on (and will eventually be compatible with) other layer-1 (base) blockchains.

With over ten separate L2 projects working on significantly improving Ethereum scalability, a key question is how many will remain relevant.

I would say at least four of these will emerge as major L2 players in the coming years.

Why? We know that crypto is here to stay, and Ethereum is poised to remain a dominant player in terms of smart contracts platforms.

Before L2s became mainstream in this space, Ethereum transactions were incredibly expensive; users forked out dozens, if not hundreds, of dollars of ETH gas fees per transaction amid the 2021 bull run, particularly with the NFT craze during that period.

Moreover, ETH transactions per second (i.e., throughput) on its main chain remain very slow (~12 tps), at least compared to payment networks such as Visa, Mastercard and American Express. In all fairness, many reputable and secure blockchains struggle with a scalability, decentralisation and security catch-22 (see ‘blockchain trilemma’).

As many crypto enthusiasts expect Ethereum to remain a dominant player in this sector for years (possibly decades), its network will need to be equipped to handle tens, if not hundreds, of thousands of transactions per second, with fees of 1-2 cents at most.

Thus, the infrastructure to help deal with both throughput and finality (seconds per transaction) must be set up now.

Expanding on security, Arbitrum announced its partnership with Blowfish, an entity that provides additional safety for Web3 wallets across multiple chains, not just Ethereum; more details on this collaboration are in the tweet below.

Blowfish is launching @arbitrum support today!

We are excited to expand our protection for Web3 users against crypto-native scams & fraud 🔍

If you use Arbitrum, stay safe by downloading our security extension: https://t.co/KCIaNQf8hl

What does this extension do? pic.twitter.com/X27etPOzD0

— Blowfish (@blowfishxyz) March 24, 2023

Some of you will note that I have not yet mentioned Polygon (PoS). Whilst it is commonly regarded as an L2, strictly speaking, Polygon PoS is considered a side chain with a separate system to Ethereum, albeit fully compatible with the latter; more information about L2 vs side chains is available here.

There are many Ethereum network upgrades in the works that I have not yet or barely touched on — rollups, sidechains, sharding and zero-knowledge proofs (ZK-proofs), to name a few. I will expand on these concepts in a future piece about Ethereum (most likely later this year).

Layer-3 technology

Whilst L2s are a major step in the right direction for accommodating more and cheaper transactions per second, there is also the matter of easily communicating between different layers and systems (cross-chain interoperability).

This is where Arbitrum’s layer-3 solutions come into the mix. Besides interoperability, L3s can be implemented in a permissionless manner. This bypasses the need for any prior authorisation or endorsement that would otherwise be required for L2s (which, for Arbitrum, go through its DAO).

L3s are not exclusive to Arbitrum — Interledger, IBC Protocol, ICON and Quant exist for various distributed ledger networks (Ripple and Cosmos blockchains for the first two on the list).

Here is the link if you are on a laptop or desktop:

https://www.binance.com/en/activity/referral-entry/CPA?fromActivityPage=true&ref=CPA_002PKBO6IF

Ways to keep in touch with Arbitrum

– Official website

– Arbitrum Nitro whitepaper by Offchain Labs

– Twitter (and a separate Arbitrum Developers page)

– Discord

– Medium blog

– Telegram

If you enjoyed this article, I recommend following my Medium page for regular reports about crypto assets, blockchain technology, and more. Feel free to check out my publication as well, Crypto Insights AU.

Thanks for your support.

Disclaimers

-N.B. None of this is financial or legal advice, and I am neither a financial advisor nor a lawyer. You are solely responsible for crypto investments and how you interpret the information provided in this piece.

-The opinions expressed within this piece are my own and might not reflect those behind Arbitrum or any entity featured here.

-Please do your research prior to investing in any cryptos, staking, NFTs and other product affiliated with this space.

– Statistics and prices included herein are correct at the time of writing (March 24) and are based on the included links/sources.

– ARB accounts for less than 1% of my overall crypto portfolio, so life will go on even if it goes down to zero.

– I received no incentive from companies or entities listed throughout this article to discuss their product.

Featured image by CryptoFX on Shutterstock