How to approach all of this as a noob.

You’ve decided to take the plunge after years of Bitcoin/crypto enthusiasts convincing you to start buying up some digital assets (and inevitably, those talking about NFTs too, but that’s a whole different topic).

With over 22,000 coins and tokens recorded to date, at least according to the crypto price-tracker CoinMarketCap, all of these videos and articles about 50x, 100x, 200x cryptos, and so on, where on Earth do you begin?

A lot of info here, so focus on the content in bold, italics or both throughout the article to get the gist of this.

What should you buy?

As this is tailored for beginners, I will keep this as simple as possible.

Before I continue, cryptocurrency, crypto, and crypto assets all refer to the same thing, but different commentators and influencers use some terms more than others in this space.

Without further ado, here is my allocation.

– Ethereum: 40-45%

– Bitcoin: 40%

– Cardano 15-20%

Yes, just three cryptos. I know; I have defied convention and suggested something other than the two most popular options.

People will tell me off for even suggesting a third or fourth option here for beginners. Fair enough. However, I don’t see the harm in proposing an alternative (just one FFS, so I doubt it will be a mental overload for rookies).

I think there’s consensus among most seasoned crypto investors: The vast majority should be split between the top two.

Why these options?

Ethereum

The leading smart-contracts platform and altcoin still play second fiddle to Bitcoin and BTC, respectively. Regardless of whether or not ETH overtakes BTC, expect it to have a massive presence in the coming years (more on this shortly).

Its most significant event over the last 12 months was The Merge, the second stage of the broader upgrade referred to as Ethereum 2.0. The Merge marked the complete transition of Ethereum’s network from Proof-of-Work (PoW), which involves mining, like Bitcoin and Dogecoin), to Proof-of-Stake (PoS) for running its network.

Ethereum PoS is 30,000 times (yes, you read this correctly) more energy-efficient than ETH mining before moving to PoS, not to mention generally more universally accessible for crypto holders that use this technology.

Whenever a crypto-hating eco-warrior mentions crypto is terrible for the environment, tell them to read updated data, not from 12-18 months ago (or more).

Image by increation87 on Shutterstock.

Words cannot describe the weight of carrying out such a monumental task of transitioning an entire distributed network (several years of information all connected in a specific sequence) to a new system (PoW -> PoS).

After years of testing and discussions, the Ethereum developers finally pulled it off.

I recommend this explanation from the official Ethereum website, which covers The Merge marking the shift to this new PoS chain called Beacon Chain.

So why do I recommend buying Ethereum, rather, its native coin, ETH, a.k.a. Ether?

Check out the Enterprise Ethereum Alliance to help you gauge how much interest and collaboration there is between various stakeholders actively involved in the world’s largest smart platform.

Once you realise how many projects/protocols are built and run on this blockchain and how much money is involved here, you will understand why so much emphasis is placed on Ethereum.

Whilst the return on investment (ROI) for anyone beginning to invest in Ethereum will not be as significant as some other crypto assets (i.e., the relatively riskier ones), many still expect big things for ETH and the Ethereum blockchain in the coming years.

Bitcoin

The foundation crypto needs no intro. It has stood the test of time since its inception in January 2009, and despite talk over the years about another crypto asset trying to dethrone it in nearly 15 years, no one has managed to do so (Ethereum has come close, but no cigar…yet).

Its truly decentralised nature, excellent network security, anonymous founder(s), capped supply, declining inflation rate every 3.5 – 4 years (see Bitcoin Block Reward Halving), and countries accepting BTC as legal tender are some reasons why people believe so strongly in this digital asset.

I see it taking two potential routes: an alternative/supplement to gold as a store of value or a payment method. Either way, I expect it to remain relevant for years, despite having “died” over 470 times (and counting).

Several sceptics have repeatedly cited the massive energy requirements for Bitcoin mining, with is continuously increasing (with the benefit of having a more secure network as it grows), essentially making it harder for a single entity to have majority control over it.

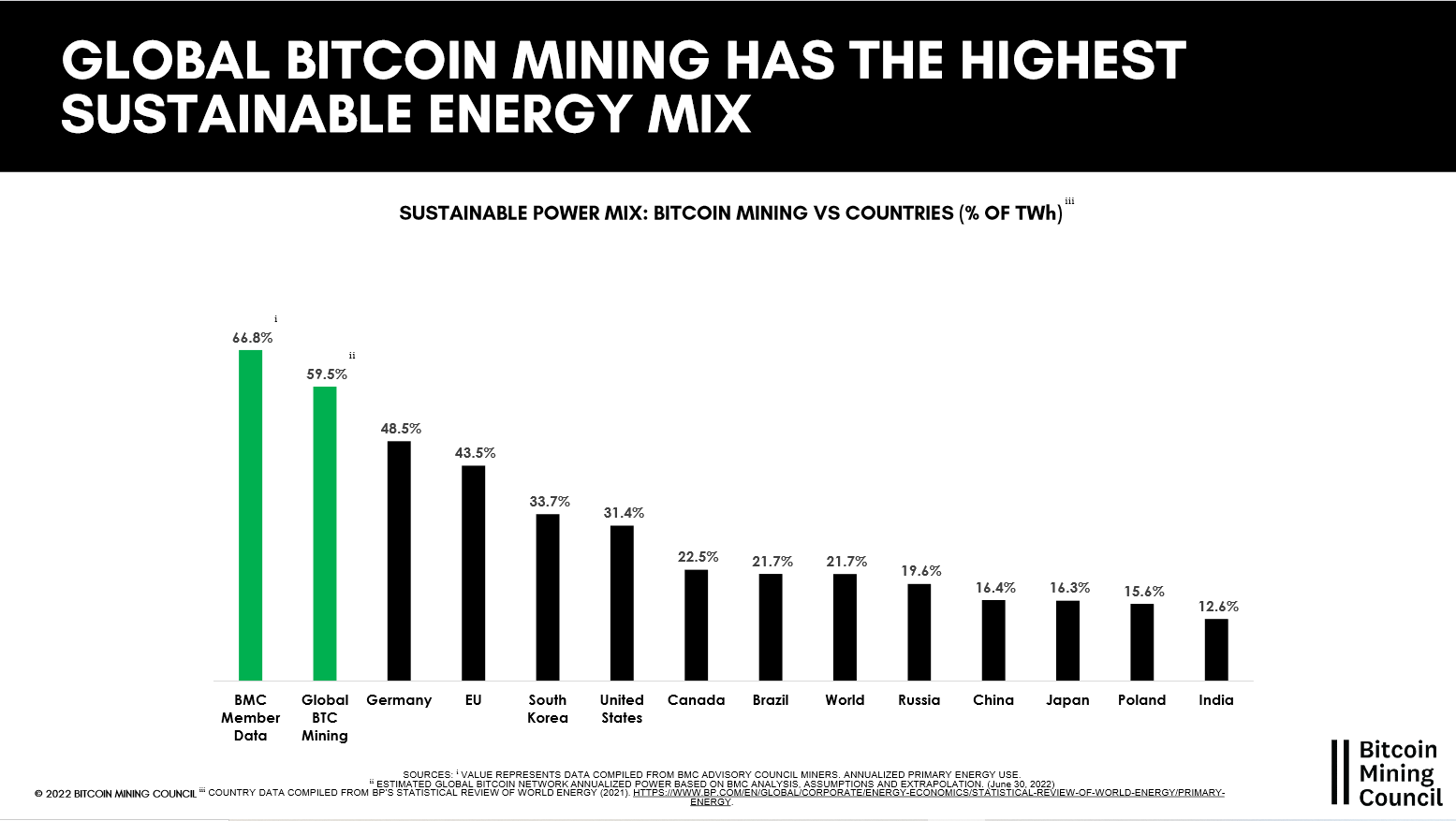

However, in spite of the general increase in global energy consumption, numerous critics conveniently disregard the fact that nearly 59.5% (July 2022 figures, see below) of Bitcoin mining is derived from sustainable sources.

Source: Bitcoin Mining Council’s Global Bitcoin Mining Data Review July 2022

What is “sustainable energy”? Whilst there was no specific information in a related BMC press release, US-based Bitcoin miner, CleanSpark, refers to their sustainable energy mix as including nuclear, hydroelectric, solar and wind; let’s not forget finding ways to utilise waste energy for Bitcoin mining as well.

I hope to see this 59.5% -> 90% nuclear/renewables mix by 2030 to quell the argument that Bitcoin is bad for the environment.

Touching on its network security, independent blockchain and Bitcoin expert Andreas Antonopoulos provides insights into why attacking Bitcoin is highly unlikely and difficult to sustain, even for nation-states attempting to do this, thus reinforcing how robust and adaptable the network is.

Despite being slow (in terms of Bitcoin transactions per second), at some point, I expect the Lightning Network, an additional layer on top of Bitcoin’s blockchain for swift and cheap transactions, to be fully functioning in the coming years. Anything to speed up a blockchain will be a massive improvement from the seven transactions per second right now.

Remember, the Internet in its early days was very slow, basic and limited in its use cases. Crypto is going through similar teething problems, but it will get there with time.

Cardano

Touted as a competitor to Ethereum (a so-called “Ethereum killer”; it’s a cringy term, I know), Cardano and its native coin, ADA, launched onto the scene in late 2017 and has built a massive following of over 1.3 million on Twitter.

Source: Cardano brand assets

Why am I particularly excited about Cardano? It regularly boasts significant developer activity and consistently features in the Top 10 list of Weekly Github Activity, one of several metrics to help investors determine which blockchains are getting lots of attention.

People used to criticise the network for lacking the ability to run decentralised apps (dApps), which was an issue up until the launch of the Alonzo hard fork last September. Since then, multiple projects have been running on Cardano, although still behind Ethereum.

Furthermore, Cardano is the second-most popular blockchain to earn staking rewards (that you get for using your crypto to help run the network), with Ethereum in the top spot. Cardano has a highly decentralised staking system, allowing you to earn ADA and withdraw it at any time easily; it is even simpler than what we have with Ethereum.

Here is a helpful beginner’s guide for Cardano if you want to learn more about it.

If you want to delve deeper into Cardano, I recommend reading its roadmap to understand what is earmarked for this ecosystem in the coming years.

Wildcard: Polygon (MATIC)

Perhaps too soon to include here for beginners, though it is worthy of a mention.

This blockchain is designed to help Ethereum successfully run many more transactions and greatly reduce the cost of doing so by storing their information on a secondary chain (e.g., Polygon) to minimise network congestion on Ethereum. This is called scalability.

Across the Internet, you will see information about Polygon as part of a group of related cryptos called layer 2s (L2s); more info about these here.

Polygon also aims to improve Ethereum’s connectivity and communication with other blockchains. This is called interoperability.

For an excellent, easy-to-read overview of this, check out Polygon’s lightpaper to learn more about scalability, interoperability, and other benefits they want to bring to Ethereum and other blockchains.

To clarify, the lightpaper is a simpler summary of a project’s whitepaper (this is Polygon’s one for comparison). As you can see, the latter is full of jargon and tailored towards advanced users, blockchain developers, programmers and other professionals/enthusiasts seeking extensive information.

Despite my experience in the space, I still prefer lightpapers as I’d choose brevity and more visual information than lengthy paragraphs full of technical vocabulary. Whilst many do, all projects should offer both lightpapers and whitepapers if they are serious about attracting stakeholders from different backgrounds.

Image by Lucas Agr on Shutterstock

How much should I invest?

Whilst this is not financial advice, and I cannot speak for everyone, this is how most other rational people in the space would approach this:

– Never invest more than you can afford to and are willing to lose;

– Take profits along the way, ideally as the market starts pumping and a wave of ordinary people is beginning to pour into the space.

Why do I say “as it starts pumping”? To clarify, take some profits as you go, but consider increasing that as the market gets out of hand; sooner or later, there will be a dump, so always be prepared.

Conversely, bear markets are often even better buying opportunities, but picking these good ops usually comes with time as you gain experience with crypto assets.

– Don’t put all your eggs in one basket, as is the case for other investment classes. I don’t care what maxis think, and I highly doubt there will be ONLY one project to rule them all, especially in a space with decentralisation as a core theme.

– Do your own research and due diligence before blindly throwing money into a project. Just because a partner, friend, colleague, or some random profited off anything mentioned here or an altcoin (any crypto other than Bitcoin), this does not guarantee that you will also benefit.

– Understand who manages your crypto assets: You can self-custody (where you have complete control) or go through an exchange, like a crypto bank that looks after your funds.

As a word of warning, whilst several exchanges are legitimate, numerous exchanges are duds, and one only needs to look at FTX’s collapse to see why you must be careful about whom you choose.

I wrote a separate piece covering some more reputable choices, but do not rely solely on this; seek other opinions before proceeding.

– Refrain from keeping your crypto in just one place, particularly on an exchange. If you want to invest large amounts, consider getting a hardware wallet.

Additional food for thought

Straight away, I know people who vouch for other altcoins will be disappointed that I have not featured many other great projects.

I agree; others should have been listed here, including some low to mid-cap altcoins that will do well in the coming years.

So why have I left them out? This comes down to not promoting an assortment of significantly riskier altcoins than what I have featured here.

In other words, I consider the crypto assets mentioned above to be “less risky”.

“Less-risky” cryptos? It’s an oxymoron, I know. Considering the information in each section above per crypto, not to mention tens or hundreds of billions of dollars behind these well-established protocols, there are compelling reasons to focus on these, especially for anyone new to this asset class.

Any sensible and intelligent crypto commentator should suggest and prioritise reputable options rather than no-name digital assets that COULD 100x, 200x, etc.

Why? Because selecting options that are more likely to be trustworthy and have built a reputation over time makes it less likely for people to fall victim to complete rug-pulls, scandals or anything else tarnishing the entire space. In turn, this would make people more likely to participate in the space if there were crackdowns on bad actors.

Of course, this is wishful thinking, as many average people get too greedy, become delusional, and have unrealistic expectations of ROIs in crypto, at least in 2023; my friends, 2017 has come and gone.

I speak from experience and learned from my mistakes as a beginner. The last thing I want is for others to suffer the same fate when markets crash and panic sets in.

For those of you that are new to the space and are interested in seriously investing in crypto and any public companies behind these or blockchain technology in general, this piece might interest you. Nonetheless, I would still prioritise BTC, ETH, and ADA and look into MATIC.

Before I forget, here are important points to remember as beginners (take note, ladies and gents):

– Be wary of anyone promising specific annual yields/return on investing in a crypto, particularly for vague digital assets/blockchains. There are no guaranteed returns in crypto.

– Bitcoin Cash is not Bitcoin, Ethereum Classic is not Ethereum, and so on; scream and cry till the cows come home, but they’re not the same.

– Steer clear of unscrupulous evil degenerates that are really pushing a crypto and very in-your-face about it.

– Avoid pumps and dumps (unless you prefer an ONS, that’s a different kettle of fish).

– Don’t let crypto consume your mind and take over your life…at least not initially.

– Only day-trade crypto IF you understand the cryptos involved AND have plenty of experience with day trading. If you insist on it, then only start with a demo account and learn about it first before diving into the deep end.

Were, are and will remain the two heavyweights of the space (for the foreseeable future).

Source: Wit Olszewski on Shutterstock

To play devil’s advocate, you may ask, why not just one cryptocurrency?

Well, of course, you could, but I hate promoting this ‘maxi’ mentality that I have witnessed over the years— literally obsessing over one crypto and disparaging any other project or person supporting it; if you hear the term ‘Bitcoin maxi’, this is what it means. In an upcoming piece, I will expand on maximalists in this space (not just for Bitcoin).

Besides this, it goes against the old age of not putting all of your eggs in one basket. Crypto should only account for a small portion of your net worth, at least to begin with. Don’t be one of those noobs who invests their life savings into it, especially if you haven’t gained enough knowledge and experience about what crypto entails, how market cycles work, their utility, etc.

On the flip side, don’t be one who refuses to invest a single cent into this asset class, only to cry like a petulant child and be bitter for missing out on potentially massive ROIs in the future.

Following the suggestions and advice I have provided will help you approach crypto investing with a much clearer and more rational mindset, reducing the risk of you having a bad experience overall.

Happy crypto investing. If you want more info or to share your thoughts, leave a comment.

Disclaimers

None of this is financial advice, and I am not a financial advisor. You are responsible for your investment choices.

The opinions expressed within this piece are my own and might not reflect those behind any project listed here.

Please do sufficient research before investing in any crypto assets, staking, NFTs and other product affiliated with this space.

BTC, ETH and ADA are some of the most extensive holdings in my crypto portfolio, so I am practicing what I preach.

I received no incentive from companies or entities listed throughout this article to feature their product.

Price statistics were obtained on 9 and 10 January 2023 unless specified otherwise.

If you enjoyed this article, I recommend following my Medium page for regular reports about crypto assets, blockchain technology, and more. Feel free to check out my publication as well, Crypto Insights AU.

Thanks for your support.

Cover image by Anutr Yossundara on Shutterstock.