Some hidden gems shine in each bull cycle.

It’s no secret that in every bull run, some altcoins appear from out of nowhere to skyrocket into the top 50 cryptos based on market cap, to end up doing a >100x over 12 months.

Today, I will cover some altcoins, mostly low-cap ones (less than $200 million, ideally $100M max) that could 50-100x in the coming years.

Yes, I realise it’s not your 1000x coin/token for you to buy your Lambo, mansion or whatever lavish toy you desire; I am simply opting for an altcoin that could plausibly exceed expectations, even in the short term.

But come on; no one’s gonna complain about any ROI greater than 30x for whatever they invest in.

Before beginning, I will take crypto’s market cap relative to its circulating (not total) supply for clarity and consistency.

There’s a lot of info overall; each crypto identified here is in bold (some of which have corresponding pics) in case you’d like to skip most of the details.

SHPING – Market cap: $8.63M, currently $0.0055, ATH ~$0.10

I first discovered this when I saw it being offered through the Coinbase Earn program, which I recommend participating in to take advantage of distributions of (small amounts of) free crypto.

It is touted as a comprehensive shopping app allowing its app users to compare product prices across some of Australia’s largest retailers to earn SHPING tokens and save dollarydoos at the same time.

Over time, I expect this app to grow in popularity, particularly among savvy shoppers who enjoy collecting rewards points across multiple loyalty programs, with the added benefit of earning crypto tokens (primarily benefiting some of the early adopters of this asset).

Moreover, whether an economy is booming or is in the midst of a recession, supermarkets and other large retailers always tend to cope well (to the dismay of many SMEs, I acknowledge this, though I digress), so I doubt prevailing economic conditions would negatively impact the app’s activity (i.e., weekly or monthly active users).

15x should be comfortably achieved for the next bull run when you look at its all-time high (ATH), and the expectation that Bitcoin will eventually hit $100K or a $10K ETH will propel alts even higher than their top prices to date; yes, I believe a market-wide bull run is a matter of when not if.

I recently downloaded the app and will test it out in the coming weeks; I’ll keep you updated in the comments section.

OriginTrail (TRAC) – Market cap: $84.8M, currently $0.22, ATH ~$3.71

Product traceability, logistics tracking, security audits, sustainable agriculture and verifying credentials using blockchain technology to ensure their authenticity are some of the leading solutions that OriginTrail has deployed and continuously improving to help provide greater efficiencies for various stakeholders across the globe.

These only scratch the surface of what the organisation has achieved to date and what is planned; you only need to look at its comprehensive roadmap with its five eras (similar to Cardano) to see what is in store for its ecosystem. Check OT’s whitepaper for details about its dual-token system and layer 2 solution (OriginTrail DKG).

Another crypto with some similarities (in terms of solutions) is VeChain (VET), which will also do well in the future and benefit from more investment across the crypto space. However, TRAC’s much lower market cap makes 50x minimum much more plausible.

So why do I believe TRAC, VET, or similar assets will do very well in future? Because the use cases, especially those about product traceability (for food, alcohol, vaccines, etc.), verifying credentials (e.g. university degrees, thinking of countries with sub-par record keeping), or confirming the authentication of (luxury) goods to combat counterfeiting, are all possible (and will become mainstream) by utilising blockchain technology.

Powerledger (POWR) – Market cap: $86.2M, currently $0.17, ATH ~$0.94

This Australian-based company offers software solutions for monitoring and trading renewable energy and environmental commodities (the latter through its TraceX marketplace).

Another product it offers is Vision, real-time and transparent tracking of green hydrogen to see if it is derived from renewable energy sources. This traceability (as touched on above with TRAC) of a given good or service along its supply chain will become increasingly relevant with advancements in blockchain technology systems down the track, thus leading to greater consumer demand for this knowledge.

Image by Sanjay kj on Shutterstock 2182376315

I see the massive potential here for a few reasons:

— Greater emphasis placed on renewable energy and other clean forms of energy (I see nuclear playing a role here too, but I digress), and anticipate growth in modular, microgrid systems across communities around the world; these will eventually be a game-changer for towns and small cities in developing countries.

— Distributed ledger technology (DLT) and buzzwords such as “blockchain”, “decentralised”, and “Web3” will become mainstream within ten years, with many related companies thriving as this type of technology become prolific. Whether Powerledger plays a role in this case (under its current name or otherwise) remains to be seen, though I remain optimistic.

— Blockchain technology’s peer-to-peer (P2P) nature will be more efficient than relying on a third party to provide services. Whilst we are not there yet in terms of smart contracts being deployed at scale (quickly, cheaply and efficiently), we will reach a point where it becomes second nature.

Powerledger now allows POWR holders to stake their tokens; more information about the process is in this clear and concise video here.

Bloktopia (BLOK) – Market cap: $42.3M, currently $0.0027, ATH ~$0.177

I am enthusiastic about this project as it is a decentralised metaverse built on Polygon, the leading layer 2 scaling solution compatible with multiple chains, notably Ethereum.

As an acknowledgement of Bitcoin’s contribution to this space, this project contains 21 levels in reference to 21 million BTC.

On its website and through its whitepaper, it covers four fundamental principles:

– Learn: It aims to position itself as a central source of crypto information by allowing and encouraging users to learn in an open and welcoming environment.

Personal thoughts on this: In terms of a “friendly” environment, I want to see what measures are in place to crack down on crypto maxis, haters and general antagonists. I say this as I don’t consider interactions on social media as very respectful and rational, per se.

– Earn revenue in multiple ways, including, but not limited to — passive earning, staking, and ads, much of which could be generated from parcels of digital land in its metaverse.

– Play: Fairly self-explanatory… try not to get addicted; if so, perhaps you should disconnect, at least for a bit.

– Create: You never know what digital masterpiece you could create here and whether you can make it as big as Beeple one day.

Here is the Blocktopia whitepaper if you want a comprehensive yet easy-to-read overview of the network.

Arweave (AR) – Market cap: $447.4M, currently $10.21, ATH ~$88.44

Arweave’s fundamental purpose is to provide users with a decentralised, open-source ledger to permanently store data online, available to everyone online, without being scrubbed or tweaked to suit a particular narrative.

In short, its CEO, Sam Williams, refers to this project as a “global, permanent archive that can’t be censored or altered by any one regime or individual.”

One only needs to look at certain totalitarian regimes of the 20th Century to gauge how powerful information control and propaganda are, though I will refrain from digressing here.

Utilising blockchain technology’s benefits, we have the excellent opportunity to store data across multiple points in a system. However, keeping a colossal amount of historical information will significantly limit the network’s ability to scale effectively.

Thus, Arweave has developed a novel and unique variant of blockchain tech called Blockweave, whereby miners and those who contribute to network hashing are only required to store a portion of the blocks to earn rewards, as opposed to all the data, as this is the case for many blockchains.

Furthermore, their Permaweb has information permanently stored on the Internet; everything you have published is forever available for content creators to access.

No more 404 errors and no more servers required.

A serverless system? Yes, Arweave has been designed to help link those that require web hosting with the average person that can delegate some spare hard-drive space on their computer. As a result, web hosting is significantly cheaper, thus, more efficient overall (with space, energy intensity and less reliance on expensive corporate-run servers).

Without a central point of failure, having something open-source and easy-to-use represents a truly distributed, transparent and universally accessible project.

In terms of spare hard-drive space, there is competition in the form of Filecoin (FIL) and Siacoin (SIA); I am particularly excited about the former, but both should benefit from this as the concept gradually becomes mainstream.

Expect big things from Arweave (AR) and the decentralised data-store space in the coming years.

Mina Protocol (MINA) – Market cap: $663.1M, currently $0.81, ATH ~$187.82

It claims to be the world’s lightest blockchain, emphasising operating this system with just 22kb of data – the same size as about two tweets.

I came across this video from Mina Protocol explaining how they can keep their blockchain compact. Whether you think this figure is BS and too good to be true, you can decide this for yourself.

Ultimately, the proof of the pudding is in the eating, so let’s see how well it can successfully run the same number of dApps as Ethereum, the leading smart contracts platform.

Another highly advantageous feature of this ecosystem is the option for developers to build decentralised applications utilising zero-knowledge proofs (zkApps), which ensures maximum privacy and security for its users.

Besides privacy benefits, developers behind the protocol aim to make network participation as universally accessible as possible, recently launching a Proof of Concept to allow anyone who runs a node, even people who have slow CPUs and low memory-capacity devices.

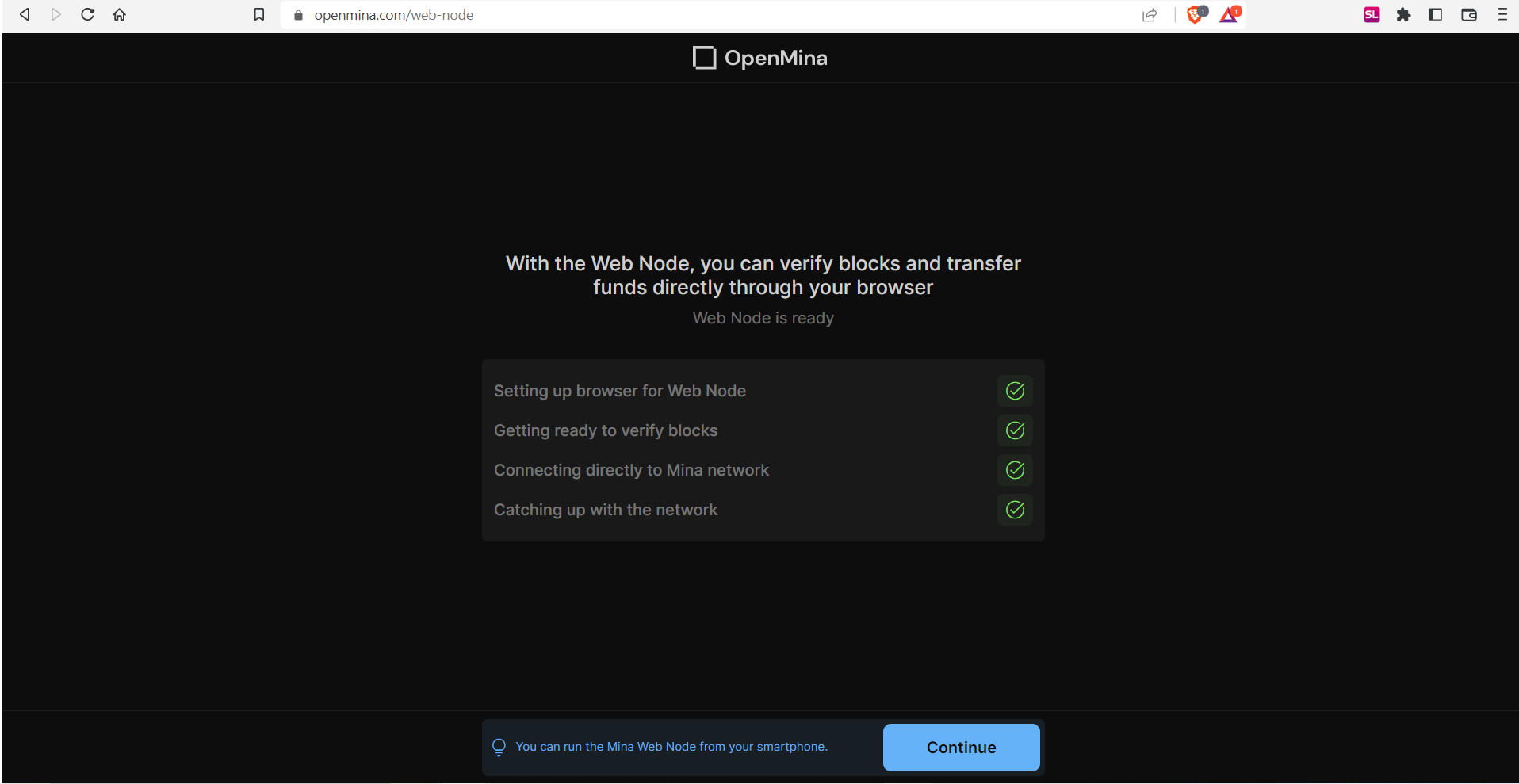

For more information about this proposal and to test it out, check out OpenMina and this corresponding Medium article.

It is incredible how simple and convenient it is to run a Mina Web Node. For any blockchain programmers, you be the judge in terms of how effective this is. Source: OpenMina

As most of us in the space are used to large and well-established blockchains such as Bitcoin and Ethereum, Mina provides something substantially different with its claimed small-sized blockchain, at least what appears to be a lot more compact in the networks mentioned above.

There could (and likely will, in my opinion) come to a point where Ethereum will be able to scale so effectively and rapidly deploy smart contracts and transactions (incorporating ZK-rollups) for less than a penny that this could make Mina redundant.

I am not saying that it will happen, nor do I wish this, though there is always this risk, considering the intense competition within the crypto/DLT space and vast commercial emphasis on Ethereum.

Floki (FLOKI) – Market cap: $447.4M, currently $0.000025, ATH ~$0.000348

This one is a bizarre choice, I know. However, I am throwing in a meme coin, as a few of these tend to do ridiculously well during a significant bull run – DOGE and SHIB are notable examples that have hit market caps exceeding $50 billion each during their peaks in 2021, with most of the market setting new all-time highs.

Are meme coins genuinely worth such an enormous amount of money? I highly doubt that, at least not for the foreseeable future, unless the developers behind them create and successfully deploy ground-breaking features that other chains/projects can use.

Image courtesy of Floki (see ‘Brand Assets’)

This one is already down by about 96% from its all-time high, much of its growth being fuelled by ‘The Dogefather’ himself with his affinity for the original meme coin. So, if one were to rely on its past performance, and if the entire crypto market were to go beyond $3T again, then FLOKI could comfortably 25x, or even 50x…though I am not holding my breath.

STEPN (GMT) – Market cap: ~$328 M, currently ~$0.55, ATH $4.18

This Solana-based, Web3 lifestyle and fitness app rewards users for various forms of exercise; walking, jogging or running are all included, so this applies to everyone, regardless of how much of a fitness fanatic you are.

Besides the healthy lifestyle aspect of it, STEPN also Game-Fi and Social-Fi aspects, allowing you to earn other tokens through activity and obtain customisable NFT sneakers, amongst other things.

Logo courtesy of STEPN (media kit)

Logo courtesy of STEPN (media kit)

According to its roadmap, we should see the launch of its Web3 social product, and the devs behind STEPN have been developing the crypto project for over a year now, adding new features along the way.

I am still new to this, but I have seen major crypto commentators speak about this (Lark Davis and Altcoin Daily come to mind), so I will keep an eye on this.

Anything that encourages physical activity and rewards users along the way with crypto is a win-win and helps promote the benefits of such digital assets, especially with these move-to-earn utility tokens.

Livepeer (LPT) – Market cap: ~$175.2M, currently ~$7.21, ATH $98.35

Livepeer is building a decentralised, open-source live streaming video network, aiming to provide a more cost-effective and efficient alternative to the centralised systems we have today.

According to its whitepaper, whilst LPT is the network’s token, ETH is utilised for broadcasting video to its network. Various devices or data points (nodes) that offer bandwidth and process videos earn ETH fees as a reward.

Source: Livepeer brand kit

Their whitepaper also identifies threats to the network (DDoS, Useless or Self-dealing Transcoder, Chain Reorg, etc.). It goes into sufficient detail about planned measures to address and mitigate these risks.

Besides its role as the general protocol token, LPT is also used for staking rewards (fairly generous ones, from what I’ve seen). If you’re interested, I came across an LPT-staking video tutorial from last year.

As an additional form of passive income, Livepeer allows users to earn ETH and LPT by transcoding video (going from one format to another) while mining crypto with your GPU; more information about this here.

Strictly speaking, the protocol is semi-centralised, as Livepeer Inc., the primary entity behind it, is gradually setting up the network to become completely decentralised.

This phenomenon is common in the space, with various blockchains having key companies/organisations that initially have more influence over a network than others (at least initially) as a system transitions to something genuinely decentralised. These things take time and are not straightforward (thinking of IOTA and Coordicide as an example.

Wildcards/Honourable mentions

Optimism (OP) – Market cap: ~$459.6M, currently ~$2.14, ATH $2.54

An up-and-coming L2 for Ethereum, Optimism has featured prominently across Twitter and YouTube crypto communities. It has recently been working its way up the list of top 100 cryptos.

When crypto and NFT markets regain popularity, L2s, above all, fully compatible with the Ethereum Virtual Machine (EVM) such as Optimism, are set to have a significant year ahead, playing a pivotal role in faster and significantly cheaper transactions.

Less network congestion and transaction fees costing pennies will help the overall space grow and stave off much negative criticism Ethereum attracted, particularly throughout 2021 and early last year.

Whilst Polygon (MATIC) is a prominent example of a successful L2 on Ethereum, many investors will be turning to other L2s to seek something even more profitable, with just as much potential as MATIC.

Source: Optimism’s Github page

Shiba Inu (SHIB) – Market cap: ~$6.9B, currently ~$0.000012, ATH $0.000089

I know this one is somewhat farfetched, and some might say borderline bizarre when you consider its market cap. However, there is a fundamental difference here: it’s encouraging users to burn their SHIB tokens and receive rewards in another token. Whatever is sent to the token-burn address can never be re-accessed.

The SHIB Burn Tracker, Shibburn and Shiba Burn provide all the information relating to token burns and general ecosystem news.

There is a massive hype surrounding Shibarium, the ecosystem’s native layer-2 scaling solution (a way to carry out many more transactions whilst freeing up the main blockchain).

Between NFTs, staking, a decentralised exchange, a planned metaverse, and its enormous cult-like following, I anticipate plenty of activity in the ecosystem for years to come. Whether it goes beyond its reputation as a meme coin or can genuinely be a go-to for NFTs, its metaverse and other entertainment, this remains to be seen. Nonetheless, I’d feel inclined to buy some SHIB “just in case”.

People can laugh as much as they want, but let’s not forget that DOGE did 250x its price over 12 months (May 2020 to May 2021).

Photo by Minh Pham on Unsplash

Illuvium (ILV) – Market cap: ~$422.6M, currently ~$66.15, ATH $1,908

Another Metaverse-related crypto asset, this runs on the Ethereum network and has a solid community of nearly 370,000 followers on Twitter.

A key aspect of their game is Overworld, with seven different areas to explore and many unique creatures to interact with.

Image by Satheesh Sankarans on Shutterstock

Once again, I envisage this will skyrocket in price with any wave of hype surrounding the metaverse, coupled with a general market-wide bull run. Using the latter, it reached roughly 25x. For context, it reportedly hit $2,868/ILV amid the 2021 bull run (though I have also seen a more conservative yet impressive figure of $1,908 per token).

Of course, there are two flaws in my argument. Firstly, past performance is no guarantee of future results. Secondly, there is greater competition in the space. Another project with a lower market cap could garner more attention amongst those hellbent on wanting crypto that could do 300x, 500x…or even 1000x because, you know, greed, speculation and general human nature.

As you’ve probably gathered, I admit that I am not a gamer and have not used anything related to the metaverse. However, I have friends (and acquaintances) that are into this and realise the gaming industry is colossal, thus, has a lot of investment potential.

Despite any reservations I may have, with a market cap of roughly $150 million, Ethereum improvements (which will indirectly benefit ILV and other ERC-20 tokens), alongside an overall bull market, I see significant potential to do well in future.

https://indianexpress.com/article/technology/crypto/heres-how-shiba-inus-new-burning-mechanism-will-reward-shib-members-7888486/

Aave (AAVE) – Market cap: ~$1.18B, currently ~$83.23, ATH ~$663 (1 Feb 2023 data)

I first got into Aave in 2017 and have seen it morph over the years and change names along the way: ETHLend à Lend à Aave. It has come a long way from running solely on its launch network, Ethereum, to operating on several leading blockchains.

Whilst I don’t see this doing a 60, 80 or even 100x, at least not for many years, if anything, I believe AAVE will go beyond its all-time high of just under $630 back in May 2021 (it currently sits at $87).

Why do I assume this? Two main reasons:

– Its latest market version (#3) now includes support for Arbitrum, Harmony, Optimism blockchain and Fantom’s distributed ledger, adding to Aave’s compatibility with Ethereum, Polygon and Avalanche in its previous version. Support for many more blockchains will further boost the protocol’s total value locked (TVL).

– Its appeal to anyone seeking to borrow or lend crypto via an automated market maker (AMM)’s community-funded liquidity pool, bypassing the need to go through a conventional exchange platform. As the crypto market continues to mature, Aave expands its list of supported networks (more than 10 in the next year or two, I imagine), and more individuals take an interest in borrowing and lending crypto; Aave and similar reputable protocols will thrive.

Binance affiliate link. I receive a small commission from each successful referral.

Here is the link if you are on a laptop or desktop:

https://www.binance.com/en/activity/referral-entry/CPA?fromActivityPage=true&ref=CPA_002PKBO6IF

Kusama (KSM) – Polkadot’s testnet will probably do well as Polkadot is expected to thrive in the coming years.

Chiliz (CHZ) – I have seen this mentioned a lot, and I believe this coin (and related blockchain) will perform well in the coming years. I have included this here as it is the only crypto on this list focusing on sports-fan engagement, a huge industry worldwide.

ImmutableX (IMX): Another L2 scaling platform with good potential in the medium to long term.

Concluding thoughts

With over 22,000 recorded cryptos (and most likely counting), finding a shortlist of small-cap altcoins that could plausibly generate insane returns (and justify their presence here) inevitably leads to many other great digital assets not making the cut here.

This space is very dynamic, and a couple of new significant partnerships or successful network upgrades for a given project and/or its digital asset could cause its price to skyrocket; consider how MANA and SAND prices spiked in October and November 2021 after Meta announced its plans to focus on the Metaverse (legs for its characters would be nice, but that’s a different story…they’re getting there).

When BTC and ETH surge, altcoins, particularly small to mid-cap ones, go ballistic. Do not underestimate insane price growth of certain altcoins during a bull run, mainly as they have historically set new records (all-time highs) each time, factoring in the overall crypto market cap over the years.

For perspective, all of these altcoins (combined) account for less than 5% of my crypto portfolio, and these should not account for the majority of your portfolio either. For every success story about the crypto millionaires who picked a 500x to 1000x gem, some invested heavily into these alts and lost it all.

Whilst you should not get too ahead of yourself, it is equally naïve and short-sighted not to give any of these a go; this 50-second video says it all.

Disclaimers

None of this is financial advice, and I am not a financial advisor.

The opinions expressed within this piece are my own and might not reflect those behind any project listed here.

Please do sufficient research before investing in any crypto assets, staking, NFTs and other product affiliated with this space.

I hold a small amount of most of these cryptos, collectively accounting for about 2-3% of my overall crypto portfolio.

I received no incentive from companies or entities listed throughout this article to discuss their product. An exception is a Coinbase referral link if you want to get some free crypto and then participate in their Earn program, whereby I get some commission from this.

Price data obtained 30-31 January 2023 (unless specified otherwise), with rounding used for brevity.

If you enjoyed this article, I recommend following my Medium page for regular reports about crypto assets, blockchain technology, and more. Feel free to check out my publication as well, Crypto Insights AU.

Thanks for your support.

Featured image acknowledgements:

Thumbnail text: ‘Blade Runner Font’ by Phil Steinschneider via Da Font.

Main image by Pairach Ch on Shutterstock.

It’s not dull when you write about it.. out of every blog about this, yours is worth reading.