What You Need to Know About Ethereum’s Shanghai Upgrade

Last year’s Ethereum Merge led to a massive network upgrade, migrating the leading smart-contracts platform to a more energy-efficient Proof-of-Stake system.

For many individual users, the biggest benefit was earning ETH staking rewards just by holding ETH; no mining machines required and no complicated or time-consuming steps to follow, depending on your staking method.

So far, so good. However, there was a caveat with this whole process.

Both your initial stake and subsequent rewards are still locked.

For some, it has been over a year since the beginning of the staking process. To be fair, it was made clear from the outset that your ETH would be indefinitely locked.

Yes, I know there are a few ways around this (just for the rewards), but most do not have this option and will have to wait until Ethereum permits un-staking and withdrawals.

Enter the Shanghai Hard Fork.

Slated for launch in March, this significant upgrade, including the Ethereum Improvement Proposal (EIP)–4895 finally allow people to access their initial stake and rewards.

I found this approach of locking up rewards somewhat bizarre, considering that other PoS blockchains such as Cardano, BNB, Tezos, Polkadot and others all allow stakers to readily unstake and access their funds (yes, Polkadot has a 28-day unbonding/unstaking period, but at least there is a specified timeframe here).

Besides the withdrawal functionality, this hard fork will also feature EIP-4844, i.e., the aptly-named ‘Proto-Danksharding’ (who came up with this name?), which will free up add more space to blocks of data on Ethereum’s blockchain and further help reduce gas fees.

The range of EIPs to be deployed as part of the upgrade will help Ethereum’s scalability and performance; more on that here.

on

What impact will this have on ETH’s price?

I anticipate some volatility in the short term, with a cohort of ETH stakers willing to cash out their rewards or trade ETH into other cryptos. For context, a whopping ~$21.7 billion is being staked, representing roughly 14% of the coin’s circulating supply.

Having said this, I doubt there will be a noteworthy sell-off once the coins are unlocked following the hard fork. If so, many people would be keen to snap up some ETH, especially with it being continuously burnt, thus deflating the supply.

Some crypto media sources are exploring a plausible sell-off of Ether, so you be the judge and be prepared accordingly.

A metric to factor in when considering a crypto’s price movements is overall exchange reserves; less crypto on an exchange means less available liquidity for trading, thus affecting an asset’s volatility. This is just one of many signals, yet monitoring this is worthwhile.

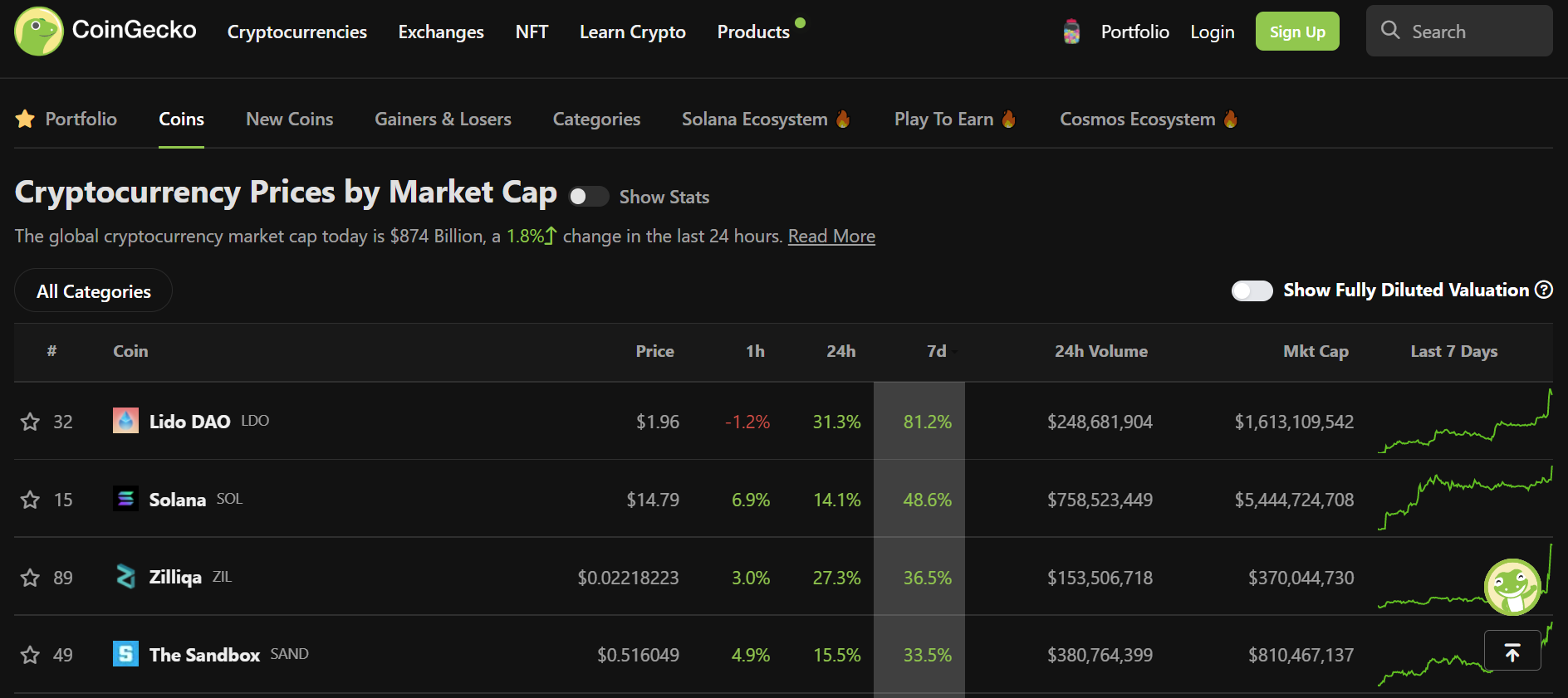

I expect more bullish movements for tokens associated with staking pools such as Lido DAO (LDO) and Rocket Pool (RPL), which have been performing well over the past seven days, particularly the former.

Before concluding, I admit that I ignored ETH technical analysis, which I generally omit from my pieces, as I am neither experienced nor even that interested in TA. However, you can check out Trading View or your preferred platform if this is important.

None of this is financial advice, and I am not a financial advisor.

This piece contains news and opinions from either myself or the sources mentioned here. Please do sufficient research before investing in any crypto assets, NFTs and any product affiliated with this space.

If you enjoyed this article, I recommend following my Medium page for regular reports about crypto assets, blockchain technology, and more. Feel free to check out my publication as well, Crypto Insights AU.

Thanks for your support.