FTX’s demise is a reminder of ‘Not your keys, not your crypto.

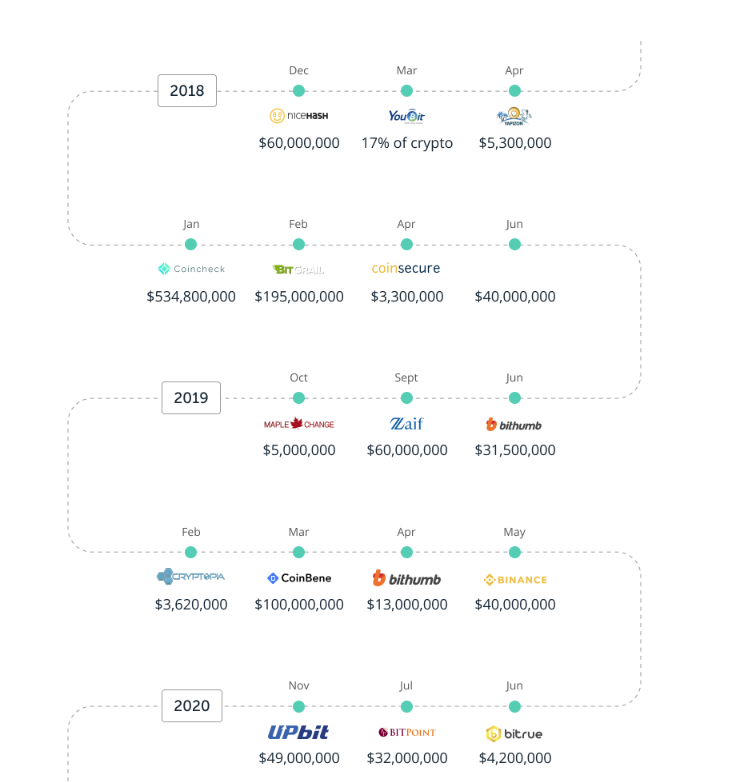

Staggering amounts of crypto have been stolen from exchanges since Bitcoin’s inception more than ten years ago, equating to billions of dollars to date.

Bear in mind that this is just the amount that hackers have stolen. It does not include money lost from certain exchanges that have collapsed due to dodgy operations, bankruptcy, or otherwise.

Before continuing, some might wonder, what does ‘not your keys, not your crypto’ even mean?

In simple terms, it refers to you having control of the private keys: the unique code required to access your wallet that only you (or, if applicable, another trusted person) should have.

As the name implies, no one else should have access to this wallet.

These wallets are called non-custodial (NC) instead of custodial wallets.

The latter refers to centralised crypto exchanges or similar third parties you entrust to manage (custody) your crypto assets.

Doing this offers the convenience of not having to purchase, set up, periodically update and secure your hardware wallet (or similar NC option).

Despite this convenience, you are at the mercy of an exchange’s security measures or lack thereof.

The image below is a stark reminder of why you should prioritise NC wallets over exchanges.

Summary of recent hacks on various crypto exchanges. The original source covers hacks dating back to 2011. Link contains 2022 updated info. Source: Ledger.

Some free trustworthy options (Exodus, Atomic and Guarda) come to mind, which can be used via your laptop or cell/mobile phone, but I will expand on these options in a future article.

Today I will explore some popular hardware wallets and focus on two of the most popular choices on the market, which have dominated the space for several years now, Ledger and Trezor.

Photo by regularguy.eth on Unsplash

Ledger

The world’s most popular brand of hardware wallets, Ledger, has been in the game since 2014, boasting more than four million customers to date.

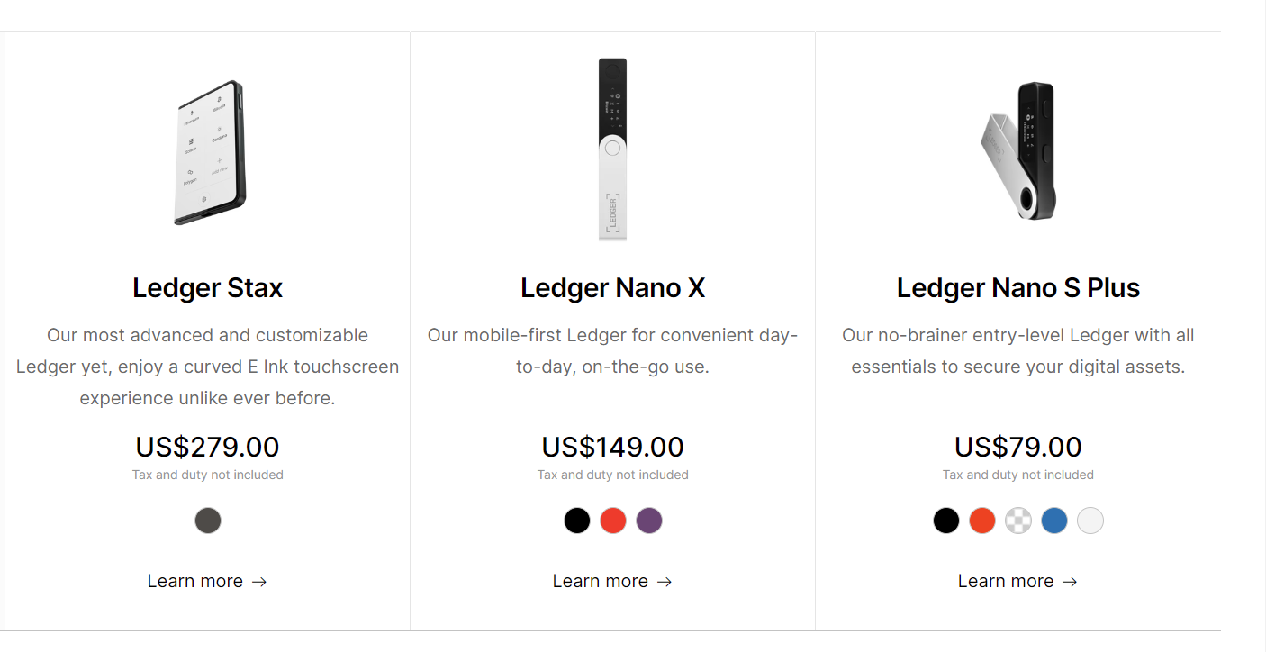

Its two popular models are the Nano S Plus and Nano X, with Bluetooth connectivity and an incorporated battery, unlike the S Plus. The upcoming Stax model will be released shortly (more on that later).

Regardless, both are great options, and Ledger’s in-house app, Ledger Live, is one of the most comprehensive and convenient programs to manage your crypto assets, NFTs, and much more.

Their wallets support thousands of crypto assets across hundreds of blockchains, covering all effective options. Additionally, more crypto assets are becoming integrated into Ledger Live over time, avoiding going through a separate wallet (e.g., Yoroi or Daedalus, as was the case for Cardano ADA up until recently).

Their devices are simple and durable, and Ledger Live’s UI is clean and sleek.

Things to consider before buying Ledger devices

I have had positive experiences, but I want to address two concerns.

Firstly, Ledger wallets are run by closed-source firmware; thus, they cannot be independently tested to check for bugs/vulnerabilities.

To date, I have not experienced any issues. If there were to be a major issue (nothing yet), I doubt the millions of customers possessing a Ledger device would be so forgiving.

Given the anticipated increase in crypto regulations, I doubt they would get away with a systemic failure such as all devices ceasing to work, hacks, or otherwise.

As per the second issue, Ledger customer information has been leaked in two data breaches between 2020 and 2021. The company made a press release outlining the situation and responding to the first one.

To clarify, no hardware wallets were compromised, and users’ crypto assets are still safe.

Data breaches have affected a plethora of companies, and this is not to say that Ledger customer data will become compromised again.

Instead, it is a timely reminder to release as little personal information as possible on the Internet. Check out various ways to keep your crypto and overall details safe so that you’re equipped to deal with potential hacks.

Price comparison of various Ledger wallets. Source: Ledger.

Pricing

The Ledger Nano S Plus is competitively priced and a great option for beginners that do not require Bluetooth connectivity and an external battery (going via the USB is still convenient enough, at least for most people).

I have attached the cost comparison of these devices and their relevant specs, available here in multiple currencies.

Based on my pricing available in AUD, the X is almost double the Nano S Plus. As both devices store up to 100 apps simultaneously (remember that ETH and all ERC-20 tokens operate under the one Ethereum app), the entry-level choice should suffice unless you insist on Bluetooth connectivity for your mobile/cell phone.

According to the specs shown on the official website, both devices have precisely the same security features and identical screen sizes.

Trezor

Photo by regularguy.eth on Unsplash

With nearly ten years of experience in the game, Trezor launched the world’s first hardware wallet, the Trezor Model One, in 2014, followed by the more advanced Model T (above) in 2018.

Both models cover various blockchains, coins and tokens, and Satoshi Labs; the company behind said devices, is (gradually) expanding its range of compatible assets.

The Model T allows users to utilise Shamir backup, having multiple recovery seeds (random set of words in a specific order, used to access your hardware wallet as a backup) as opposed to one location, which is more common than Shamir at present.

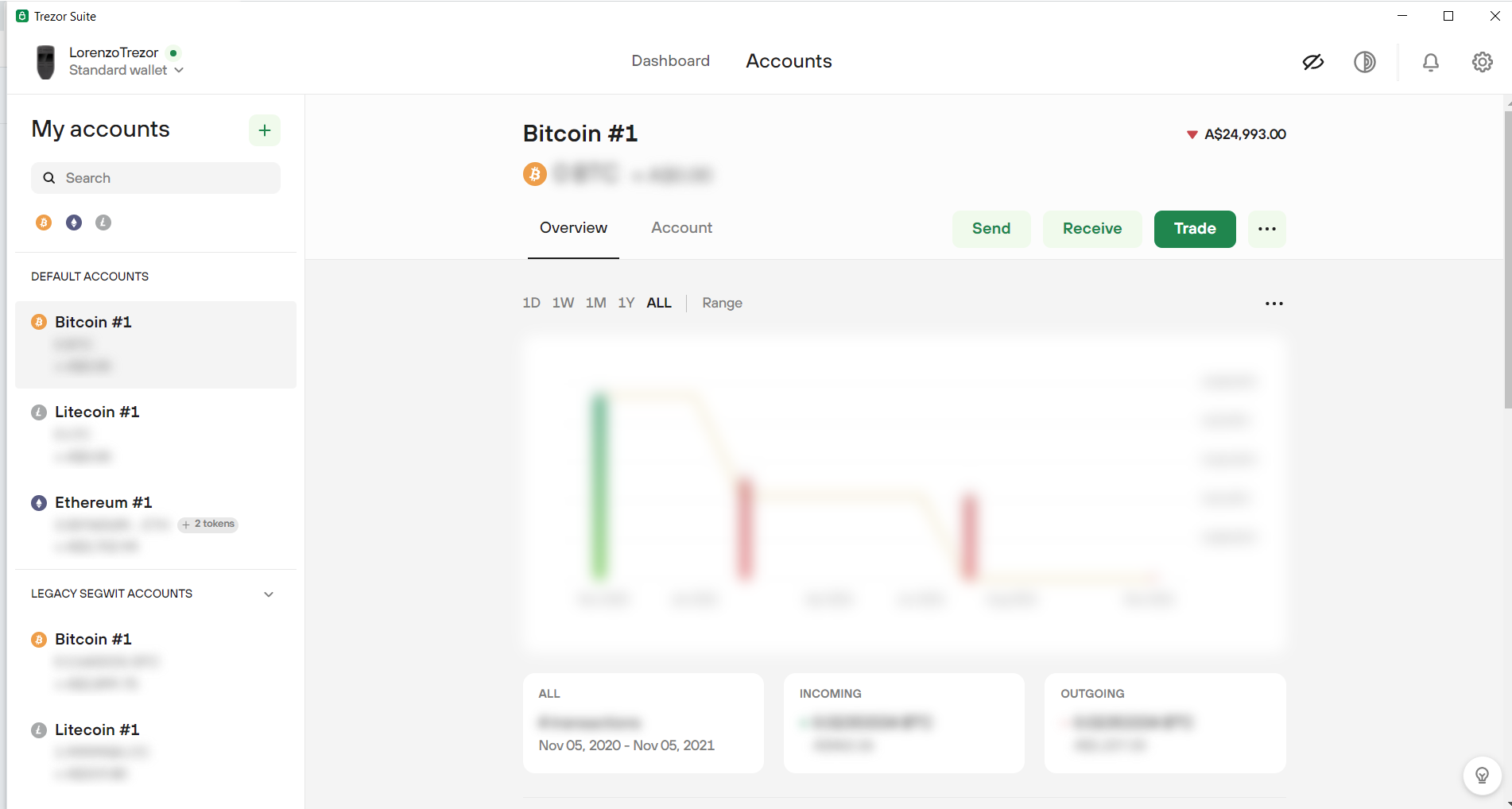

The wallet’s in-house app, Trezor Suite, works well overall and is continually improving. However, the annoying thing is that, unlike Ledger, you need to have your Trezor device connected each time to view your updated balance and navigate through the app.

Similar to Ledger, these devices allow you to securely buy, sell, trade and stake cryptocurrencies, maintaining full control of the private keys at all times.

In terms of upholding privacy for its customers, it has done a better job than Ledger in maintaining the security of its clients’ user data. Moreover, Trezor anonymises customer information after 90 days from purchase.

A screenshot of the Trezor Suite dashboard (with discreet mode activated). More basic than Ledger Live, though still adequate for many crypto users).

Pricing

The Model One is slightly cheaper than Ledger’s equivalent, which could be more appealing for casual crypto holders or those wanting to focus on a small range of coins and tokens.

However, the Model T is over three times more expensive than its budget-friendly alternative. Despite this, the former accommodates a larger coloured screen, Shamir backup, support for more crypto assets, including staking options for popular coins such as ADA and XTZ (though nothing yet for ETH, unfortunately) and more.

A useful side-by-side comparison of the two wallets is available here.

Better choice overall: Ledger

A major difference between Ledger and Trezor devices is the range of blockchains supported on each device. Ledger wins this in terms of convenience, whereby either the Nano S Plus or X allow buying, sending, exchanging and staking thousands of coins.

On the other hand, Trezor devices can vary greatly in terms of supported assets. For example, their entry-level One is incompatible with XRP, ADA, BNB, XTZ and other major cryptos (and their respective networks). Thus, you would need to get the more expensive T, which is about double the Ledger Nano S Plus price.

Whilst all reputable hardware wallets do a great job at keeping your crypto safe from digital attacks, someone trying to tamper with the device physically is another factor to consider.

From my understanding, the microcontroller chip in each Ledger device (not present in Trezor devices) overcomes this concern. More on that here.

Last week, Ledger announced the launch of its new, state-of-the-art hardware wallet, Ledger Stax, available from March 2023.

I would not be surprised if Trezor or other providers were to follow this trend of producing hardware wallets (with much larger screens than current models) to accommodate NFTs and other features in the space that would benefit from this more prominent display.

Other options on the market

The two wallets mentioned above are the most renowned, but several alternatives exist.

As I have never used one of these, I cannot speak (from personal experience) about whether these are suitable for your needs. Thus, please do your due diligence before purchasing any hardware wallet.

— BitBox02 by Shift Crypto: Swiss-made, open-source hardware wallet that contains a secure chip. It is best suited for BTC, ETH/ERC-20 tokens and LTC.

Here is an excellent table comparison between Bitbox02, Ledger Nano X and Trezor Model T.

— Ellipal: Hong Kong-based company with their respective Titan and Titan Mini wallets.

— KeepKey, which operates in tandem with the open-source ShapeShift platform. It only supports a handful of crypto assets, though this could change over time.

— Finney, by Sirin Labs: Claims to be the world’s first blockchain smartphone, with the “cold storage” crypto wallet incorporated into the device.

— CoolWallet: This credit-card-sized wallet appears to be one of the market’s most convenient yet secure options. An ideal offline wallet for those of you who prefer mobile wallets.

CoolWallet offers the S and Pro with related bundle packs.

In summary

If you are willing to purchase a device from either company and are serious about holding large amounts of crypto assets for extensive periods, then try one of each.

I would refrain from holding your digital assets on just one hardware wallet. However, if you decide this, I suggest investing in a highly robust stainless-steel capsule or cassette (Cryptosteel comes to mind) to keep an additional copy of your recovery seed.

Nonetheless, these above-said devices generally provide greater security and autonomy than going via a crypto exchange.

I recently covered the more reputable choices in this article if you prefer to go through a centralised exchange.

Disclaimers

None of this is paid advertising, and I have received no payments from any abovementioned companies to discuss this. To provide a wholly impartial analysis here, I have refrained from using any affiliate links.

None of this is financial advice, and I am not a financial advisor. Please do adequate research before investing in any crypto assets, NFTs and any product affiliated with this space.

If you enjoyed this article, I recommend following my Medium page for regular reports about crypto assets, blockchain technology and more. You can also check out my publication, Crypto Insights AU. Thanks for your support.