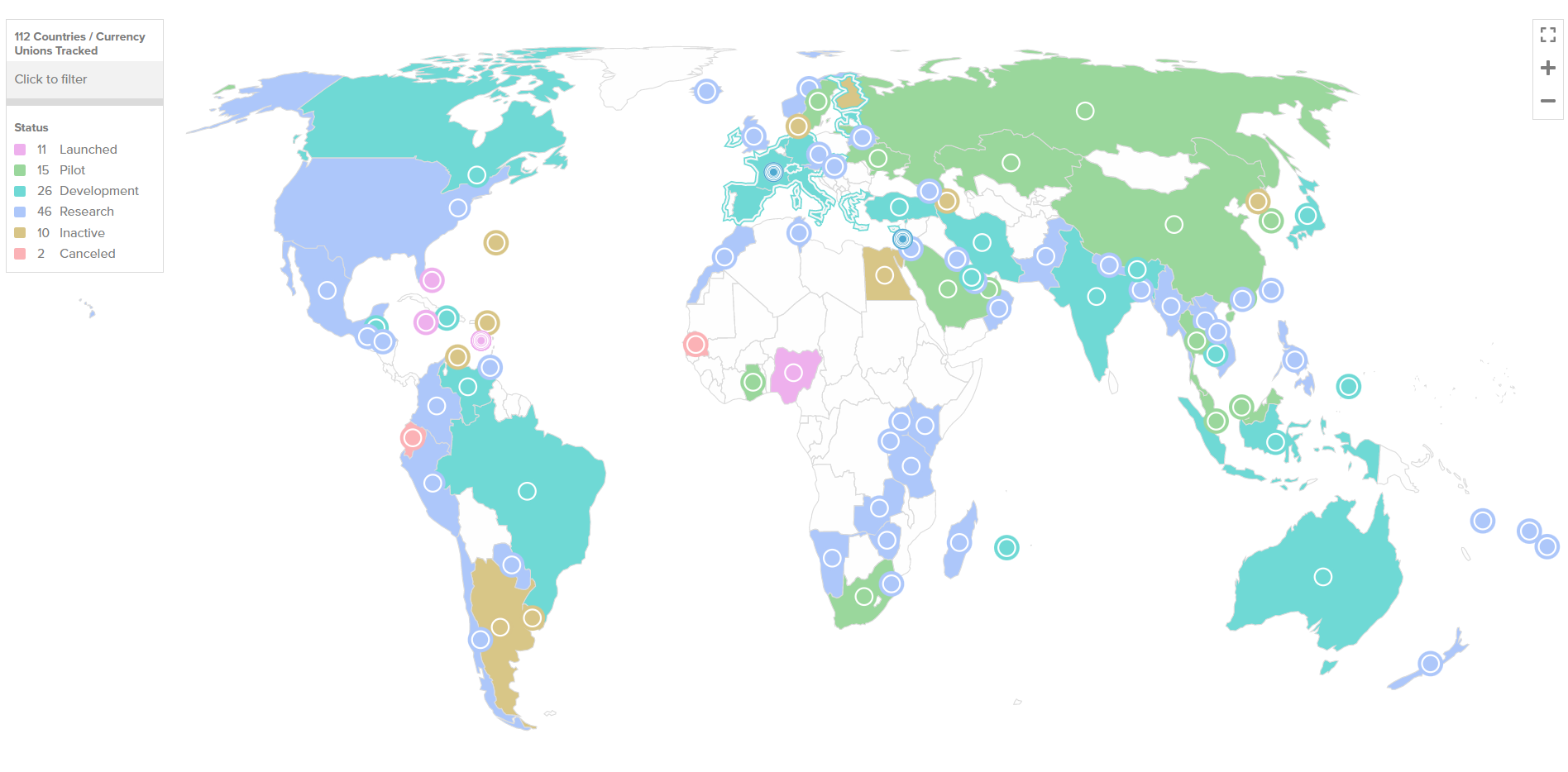

At present, approximately 100 countries/currency unions are interested in (exploring, developing, trialling and/or launching) this form of digital money.

The Bank of International Settlements (BIS) believes that CBDCs, not actual cryptocurrencies such as Bitcoin and Ethereum, will be the dominant player in future monetary systems.

Perhaps this could be the case, especially if enough people embrace the concept, just like the rise of the cashless society.

However, many crypto assets, particularly coins native to blockchains that could become (or even remain) significant participants in the space, will most certainly stand the test of time.

Status of CBDCs across multiple nations worldwide (downloaded on 3 November 2022). Source: Atlantic Council

Proponents of CBDCs acknowledge their merits, such as offering greater transaction efficiency and much faster processing times; utilising established blockchains (such as Ethereum) in tandem with central banks and governments;

On the flip side, there are various concerns and risks with CBDCs, notably privacy issues, cybersecurity risks, and costs to implement these digital assets. All of these have been well documented by numerous sources.

An issue that remains at large is that privacy-enabling measures need to be implemented as a substitute for cash, at least for purchasing everyday items.

Will they? Perhaps, but not without some resistance. Most people (yes, even in democratic countries with advanced economies) have readily relinquished numerous civil liberties in recent decades for greater convenience.

Many governments relish the control and would enjoy the greater tracking of their citizens’ funds that CBDCs have to offer. Furthermore, most people probably would not question the implications of this technological shift, and merely see this as a form of “progress” (open to interpretation).

CBDCs are not cryptocurrencies

Whilst true cryptocurrencies such as Bitcoin, Ethereum and many altcoins could be collectively classified as a type of digital currency, these are fundamentally different to CBDCs.

How? Actual cryptos are not controlled by any central authority, such as a bank or government, unlike the latter.

Governments, many of whom despise what Bitcoin (BTC) represents, only have themselves to blame for the cryptocurrency’s genesis (that subsequently lead to the creation of altcoins).

Why? Satoshi Nakamoto released Bitcoin’s white paper in October 2008, amid the Global Financial Crisis. Thus, the digital asset was created (at least in part) due to the incompetence of the prevailing financial system.

BTC was in the top 10 of largest assets worldwide up until recently, and is still in the top 20, despite a significant market-wide downturn over the past 12 months.

The role of cash in everyday society

In their defence, the cost of money laundering, tax evasion and other illicit activities help them justify their stance for this greater tracking. However, there is an unfair stigma attached to law-abiding citizens who simply prefer to pay with coins and banknotes.

Cash plays its role in society (particularly for privacy, controlling one’s spending and inclusivity), and enough individuals will demand a digital alternative to it if were no longer accepted in future.

Despite articles such as Cash ‘will be obsolete by 2030’ and the more recent Brits predict a cashless society by 2030, I believe this is wishful thinking, as the demand is still there for cash, and will be until a privacy-focused digital alternative is offered.

Ramifications of CBDCs on crypto assets in future

I envisage a system whereby both CBDCs and cryptocurrencies will coexist, even with bans or strict regulations in certain parts of the world (one major nation comes to mind).

Across the Western world, I expect enough people to drive adequate demand for Bitcoin for it to stay (at the very least) relevant daily. Moreover, I would still advocate for other cryptocurrencies (even semi-centralised ones) than government-controlled digital currencies.

I expect CBDCs to operate alongside true cryptocurrencies, as the former does not replace the innovations underpinning distributed ledger technology (DLT), the basis of all crypto assets (most of which use blockchain technology).

There will be enough demand by discerning tech enthusiasts and those who prefer to support digital assets not affiliated with any central authority, to ensure the long-term viability of true crypto assets.

One of the significant aspects of DLT to keep an eye on is smart contracts (SCs): programs or transactions that self-execute once certain conditions are met. This aspect of DLT is one of the biggest selling points for various blockchain protocols, notably Ethereum, BNB Chain, Cardano and other platforms.

Many CBDCs will most likely opt to use multiple SC platforms for efficient operations; I expect the aforementioned ones to play a role in this, but other up-and-coming SC ecosystems will most likely be involved in CBDCs, to a varying degree.

Concluding thoughts

To reiterate, CBDCs should not replace true cryptocurrencies. Rather, I see them as a useful complement to them.

I welcome faster and cheaper cross-border payments, which, with all due respect, can be achieved with multiple crypto assets; XRP is a stand-out in this category.

However, to reiterate, CBDCs still fail to resolve the issue of having a currency that is controlled by a central government. Inflation rates (particularly in recent years) have devalued native currencies by a considerable amount.

I question whether CBDCs can adequately resolve a government’s fiscal incompetence. As such, true cryptocurrencies, devoid of government control (as per their inflation rate/issuance), should remain available for general usage.

Whether or not a sovereign state decides to legally adopt crypto as legal tender (e.g., El Salvador and the Central African Republic for Bitcoin), I remain neutral on that, though I acknowledge its merits.

However, I disagree with the idea of nations actively banning or significantly restricting crypto within their borders. They have something to hide from their citizens and/or see true cryptocurrencies as a threat; a compelling sign that crypto assets are here to disrupt the status quo, for better or worse (I believe for the better).

Disclaimers

None of this is financial advice and I am not a financial advisor.

This piece contains a mixture of news and opinions from either myself or the sources contained herein. Please do your research before investing in any crypto assets, NFTs and any product affiliated with this space.

If you enjoyed this article, I recommend following my Medium page for regular articles about crypto assets, blockchain technology and more. Feel free to check out my publication as well, Crypto Insights AU.

Thanks for your support.

Featured image by Panchenko Vladimir via Shutterstock

Affiliate link: BitBox02 is an increasingly popular alternative to Ledger and Trezor hardware wallets.

By using the affiliate link when you click the image below, I receive a small commission for any sales at no extra cost. Cheers.