Non-custodial vs Custodial Crypto Wallets

Which type is better for managing your digital assets?

With the growing interest in the digital asset space and an increasing number of wallets being created (more than 82 million wallet users just for Bitcoin to date) comes a higher demand for multiple forms of crypto wallets. These can be classified into two broad categories, non-custodial and custodial wallets.

In this article, I will provide a run-down of what these are and identify some of the main pros and cons associated with each type.

Non-custodial wallets (NCWs)

NCWs provide users with full control over the private keys and recovery seed (i.e., backup 12, 20 or 24-word combination) that you use to access crypto assets. These come in multiple forms, most of which include:

– Hardware wallets — physical devices, notably Ledger, Trezor, Bitbox and Ellipal, though other companies also produce forms of NCWs with their own benefits.

— Software (desktop and mobile) wallets — Providers such as Exodus, MetaMask, Atomic Wallet and Guarda have around for several years now and have gradually expanded their list of supported assets and related services as the entire space evolves. I am most familiar with Exodus, though the others are also highly regarded by many users in the space.

The aforesaid crypto wallets can also be broken down into blockchain-specific wallets, such as Electrum for Bitcoin; MEW for Ethereum and ERC-20 tokens; Daedalus for Cardano and its tokens, and so on.

— Keystore files, which uses a password to keep private keys safe. However, weak passwords and poor online security could risk these keys being revealed to hackers. More information about these available here.

— Paper wallets: More common once upon a time, I do not consider these to be an efficient way to store private keys, particularly with the range of other NCWs available. However, if you follow all of the correct precautions, then they could be suitable. Nonetheless, I see them as somewhat archaic (in the brief existence of crypto assets).

Photo by rc.xyz NFT gallery on Unsplash

Blockchain expert and tech entrepreneur Andreas Antonopoulos also covered a video explaining his reluctance to use such wallets anymore.

Overall, the major drawcard for NCWs is that they offer maximum security from a range of online threats. Over the years, more options have emerged and each one has gradually improved, in terms of functionality, pricing and convenience.

Responsibilities involving NCWs

As part of maintaining full control over your digital assets, there is also the duty to maintain security measures and remain alert at all times. Some measure you can take include:

— Carrying out the frequent recommended software updates and firmware upgrades for your physical devices, or the platform you are using when operating your NC wallet;

— be aware of dusting attacks, which relate to miniscule amounts of crypto (“dust”) that arrive into your account from unknown sources. To clarify, dust that remains from frequent trades on your account that you conduct is normal; be cautious of dust arriving into your wallet out of the blue.

— Using the in-house application corresponding to a given hardware wallet to ensure that you receive the most suitable upgrades and customer support when required.

— If you lose or damage your private keys and recovery seed, your funds can be permanently gone. One of the most famous cases relating to this involves a Welsh man who discarded an old hard drive containing the private keys for 8,000 Bitcoins back in 2013, currently worth ~$171 million. Just imagine how many pizzas he could have bought with that many BTC today.

Never underestimate the value of your crypto…unless if its Terra Classic, even then, miracles can happen down the track.

— Keeping your device and recovery seed in a safe place and protected from the elements. I expand on this in a related piece.

Users who hold non-custodial wallets should be mindful of suspicious micro payments that could come across as such attacks. By trading/converting this tiny amount, hackers (let alone anyone) can monitor any movements of funds from one wallet to another, which will generate public keys on a given blockchain every time a transaction is carried out.

Custodial wallets

These involve relying on third-parties (usually centralised crypto exchanges) to manage your digital assets. Some of the most popular options out there include Binance, Coinbase, Kraken and Gemini. However, more than 500 reported exchanges exist, each with their own combination of trading pairs, forms of security measures, services offered and more. I have covered some of my preferred options in a separate article, but have included this category in the latter part of this piece as I do not recommend using custodial wallets to store the majority of your crypto. Instead, I would preference NCWs, notably with the assortment of choices at your disposal.

Some food for thought when using custodial wallets:

— Numerous instances of exchange outages, or plans to halt withdrawals or deposits, in some instances, due to poor financial management of a particular exchange. Outages are more likely to occur during times of extreme price volatility, with many users wanting to simultaneously access their accounts to deposit, withdraw or trade assets.

— Hacked exchanges or hot wallets in general: You are at the mercy of an exchange’s security measures, or lack thereof. It is worth taking a few minutes to explore what actions a particular exchange is taking to safeguard your digital funds. From my experience, they have been fairly good. However, never take just one person’s word for something, especially when it comes to crypto.

Ledger has provided a list of major exchange hacks that have occurred in recent years, both big and small, reiterating the benefit of NCWs when they are used responsibly (based on the above recommendations).

Photo by Dylan Calluy on Unsplash

For some balance, ironically, Ledger was involved a major data breach in 2020 (with a corresponding response here), though this has no impact on one’s private keys or crypto assets, and does not mean NCWs are at risk of losing funds; to reiterate, this had to do with a Ledger database, not private keys.

— Exchanges suddenly blocking users: This could come down to poorly-operated exchanges (what I touched on in the first point), missing funds, or government censorship (the latter predominantly applies to authoritarian regimes). In the case of burdensome government restrictions, I am not attributing blame to exchanges here. Rather, it is a timely reminder that regulated crypto exchanges are at the mercy of policymakers in certain jurisdictions; in certain instances, these laws pertain to specific states in a country, such as New York State. Having an NCW circumvents these issue, and offers the liberty to migrate funds from your NCW to any permitted exchange.

Due to these concerns, if you were to use an exchange, I would recommend storing only a small proportion of your crypto holdings on any one of these. If you plan to dabble in crypto and only hold a negligible amount of that, then an exchange might be suitable. Do bear in mind that certain altcoins can skyrocket in price and your miniscule amount might turn into several thousand dollars (or more). It is worth questioning how comfortable you feel holding x amount of funds on an exchange, and perhaps consider an exit strategy at that point as well.

With the vast swathe of crypto exchanges currently available across the world, it is imperative that you do your own research prior to signing up and using one of these. Some things to consider include:

— Is this a regulated crypto exchange that has been registered with related authorities around the world, especially in the US, Canada, UK, EU, etc.?

— What reviews have people given this exchange, particularly over the past 12 months? Which sited did you use to obtain this information?

— Have there been previous hacks linked to one of these services? Were users’ funds stolen and (if so), did the exchange provide full coverage for these losses?

— How is the customer-service experience based on feedback from other clients?

— Does it have two-factor authentication (2FA)? What type of 2FA is used: Google Authenticator, SMS, security key?

— Have there been a few or even various instances of outages when trying to access these exchanges?

— Have these exchanges registered their businesses with related government regulatory bodies to legally operate and custody funds for their clients?

In summary

Since the advent of Bitcoin in 2009, there is a countless number of ways to store the private keys to access your crypto. There are good, mediocre and terrible selections associated with both categories of wallets covered in this article. Whist I have my preferences, please do your due diligence and take some time to ascertain what works well for you.

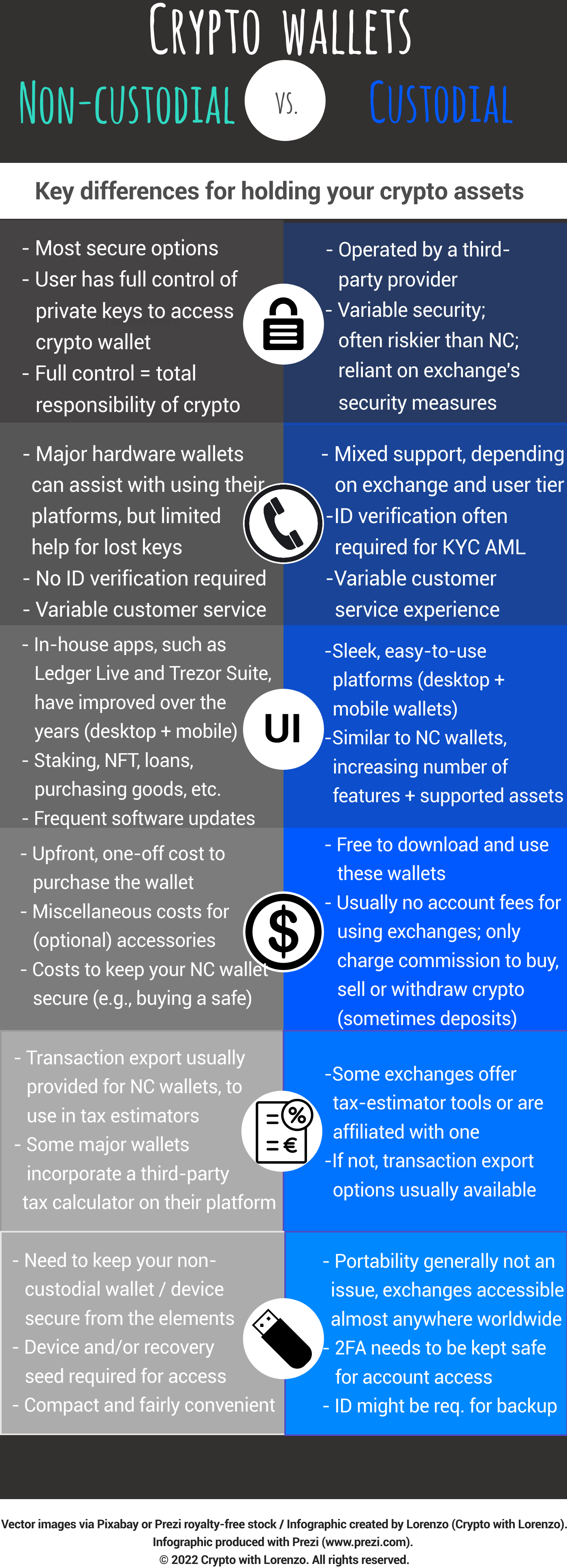

As a useful summary, here is a visual comparison between the two categories covered today.

Thanks for reading. Happy crypto investing and/or trading.

Lorenzo

If you enjoyed this article, I recommend following my Medium page for regular articles pertaining to crypto assets, blockchain technology and more. Feel free to check out my publication as well, Crypto Insights AU. Thanks for your support.

Disclaimers

None of this is financial advice and I am not a financial advisor. It is a mixture of news and opinions from either myself or the links provided. Please do your own research prior to investing in any crypto assets, let alone any product affiliated with this space.

Before anyone jumps to conclusions, no, none of this is paid advertising, and I have not included referral links to any of the products listed above. I have identified the products associated with the abovementioned companies as being legitimate, though I implore you to do your own independent and sufficient research before signing up to using or purchasing any of their services.

Featured image: Two examples of hardware wallets. Photo by regularguy.eth on Unsplash.

Wow Thanks for this post i find it hard to get great details out there when it comes to this blog posts thank for the content website

Wow Thanks for this information i find it hard to come up with good quality particulars out there when it comes to this content appreciate for the post website

This is a really clear post. As someone who manages content, I found this extremely applicable. If you’re interested, I recently wrote something related on my site too. Keep up the great work!