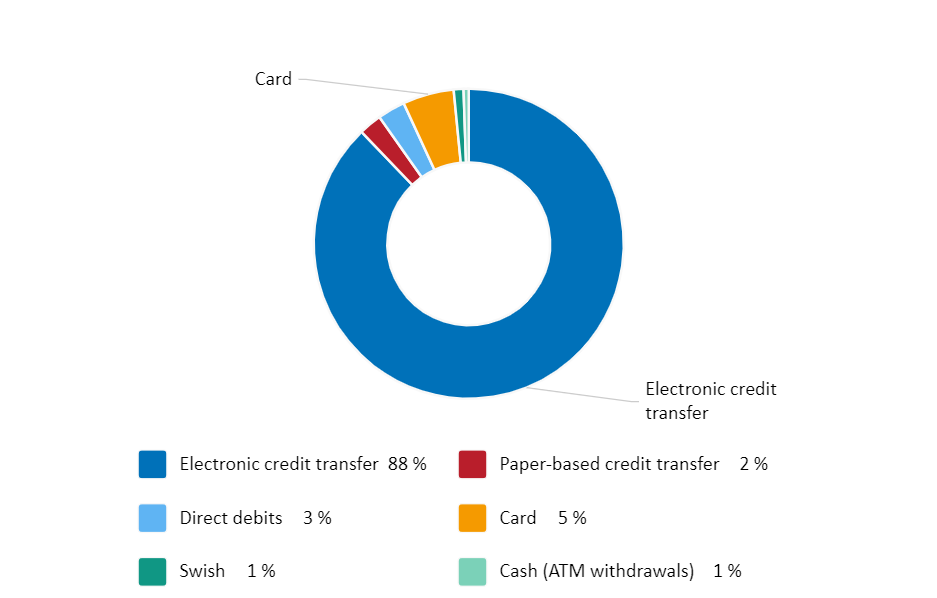

In the USA, cash payments accounted for 30% of overall transaction value in 2017 (1), down from 33% in 2015. In the Euro area, cash is still the dominant payment form at points-of-sale (POSs) in retailers for the vast majority of its member states (2). In contrast, cash payments in Sweden, one of the world’s most cashless nations, now represent less than one per cent of total value (3) (Figure 1). Moreover, the increasing interest and prevalence of cryptocurrencies globally adds another element to this continued interest digital payments, notably in the coming years.

Figure 1: The value of various payments methods for transactions conducted in Sweden in 2018. Less than 1% of this is represented by cash.

Source: The Riksbank

In this article, I will explore the matter of less privacy in a world where cash, the most-established system of paying for goods and service in a private manner, is continuously becoming a rarer site (especially during global pandemics), whilst simultaneously adopting convenient and affordable digital-payment methods. Enter privacy-enabled cryptocurrencies a.k.a. privacy coins.

Two of the most well-established privacy-enabled crypto assets are Monero (XMR) and Zcash (ZEC), with circulating market-caps of roughly $2.29 billion and $700 million accordingly.* DASH is another cryptocurrency that has historically been regarded as a privacy coin. However, several sources (4,5,6) detail why many question their (and in some cases, ZEC’s [7]) claimed privacy features. Numerous privacy coins exist today, with additional information about them here.

The requirement for privacy in an increasingly cashless society

Firstly, I recognise the need for debit and credit cards in our world for improved convenience, tracking one’s spending (both pros and cons) and for greater productivity, in tandem with combatting corruption (8). In spite of this, I believe that major retailers have an obligation to accept physical cash, at least under certain conditions (i.e. offering a sufficient number of checkouts per store.

However, forcing people to use cashless options is one of many aspects of society is another example of gradually eroding our civil liberties. There is a noticeable trend of disproportionately high amounts of unbanked and underbanked people of non-white ethnicity in the USA (9) that should have been addressed a long time ago. The last thing marginalised groups need is to be excluded from purchasing items that many others can readily buy.

There is a plethora of articles on the Internet covering the increasing push for physical shops/stores to only accept card payments. To date, there are still many alternatives to the increasing number of cashless vendors, but the advent of COVID-19 situation has overall accelerated this transition to make cash redundant, rendering it more difficult for those seeking a convenient, privacy-focused alternative when purchasing everyday goods or services.

Hitherto, only a handful of credit providers (10) that I am aware of have allowed for the creation of single-use credit cards for those seeking privacy when transacting online. This already indicates that a certain percentage of people (albeit a tiny amount) would demand a digital payment-system that would ensure privacy and go out of their way to have this choice. For the record, I have never used one of these before and am not promoting them; just simply informing you.

Why several people still prefer cash

For numerous reasons (11), legitimate and otherwise, many still opt for banknotes and coins. Elderly people, those who may require extra assistance and some immigrants (particularly new arrivals) represent some consumers who benefit from cash payments (12). Individuals should have the right to purchase goods and services through bricks-and-mortar retailers and at market stalls without having to pay by card.

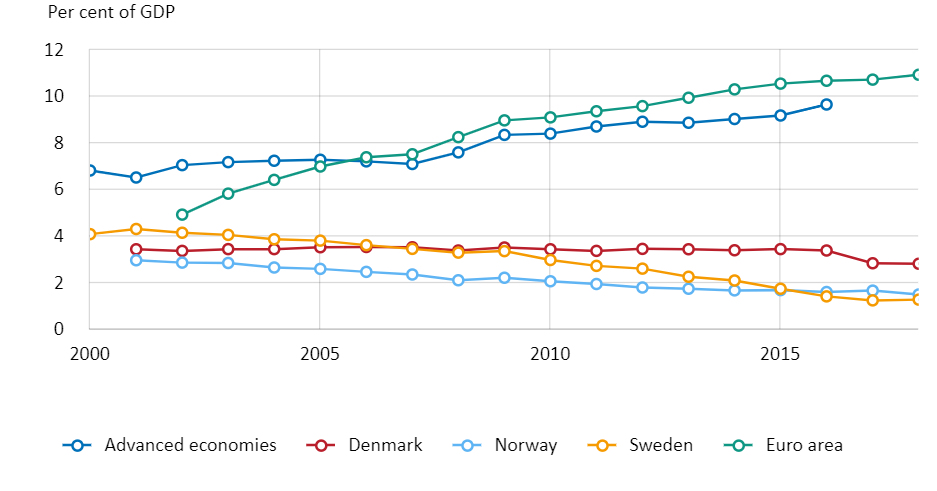

Another factor to address is that whilst many countries, especially in the developed world are increasingly carrying out non-cash payments, generally speaking, cash is proportionately more dominant across poorer/developing nations throughout the world (13) compared to their wealthier counterparts. However, in Europe, there are mixed trends in relation to cash to GDP ratios: In Scandinavia it is falling, whereas in the Euro area and other advanced economies, it is growing (Figure 2).

Figure 2: Cash to GDP volumes across various countries/areas. Scandinavian nations are defying the trend of several other advanced economies, particularly throughout Europe.

Source: BIS and ECB, via The Riksbank (reference #12).

By the same token, there have been numerous instances of major companies (and even national governments) getting hacked. Identify theft in the USA affects approximately 1 in 16 people (14). Despite a vast swathe of robust security measures implemented by debit/credit-card providers, the risk is always there. Additionally, there would always a cohort of the population that would feel apprehensive due to the risk of identity theft, especially with more sophisticated attacked from malicious actors.

On the contrary, there is a varied risk that cash can be stolen and would be very difficult to recoup in that event, unlike protection for lost funds due to fraudulent activity with credit cards.

Government regulations and privacy-coin usage

Monero has particularly provoked the ire of regulators across the globe, with several governments clamping down on exchanges offering XMR and other privacy coins (15,16,17). Furthermore, the United States Internal Revenue Service (US IRS) is doubling-down on this, offering $625,000 for anyone who is able to successfully decipher the privacy features and code underpinning the Monero blockchain (18).

Notwithstanding this, in recent developments (19), CipherTrace, a cryptocurrency intelligence firm, claims that it can (to a certain extent) trace XMR transactions, potentially compromising XMR’s selling point as a genuine privacy-coin. Nevertheless, the success of its XMR monitoring tool(s) remains to be seen in how many transactions it can decrypt on Monero’s blockchain and how much information they can extract from these.

As the overall cryptocurrency sector is anticipated to continuously grow, governments and their corresponding regulators will ensure that sufficient Know Your Customer and Anti-Money Laundering (KMC AML) requirements are made for regulated exchanges. For crypto assets in general, such regulations are key for mainstream adoption and awareness. However, this could represent a double-edged sword for privacy coins, most likely producing more negative consequences based on many governments’ antagonistic stance towards them rather than benefits.

What future lies ahead for privacy coins and cash?

Utilising privacy coins (or well-functioning privacy features on cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and several other established crypto assets) will become/remain available, albeit in a limited capacity. It is unknown to what extent (or even if) regulators in certain jurisdictions would permit their usage in general society as a replacement to cash.

As I strongly doubt governments would relinquish power/control over financial transactions within their borders, and assume that enough people will demand a cash alternative, I envisage a system of compromise, whereby they will allow people and companies to transact in XMR, ZEC or any other privacy coin, up to a certain dollar (or BTC) value.

Although, depending on the specified figure (e.g. $1000 per private transaction, or BTC equivalent) this could possibly be manipulated so that multiple transactions could be executed in a short period of time. Nonetheless, measures could be applied to counter this.

Some puritans might scoff at my above-mentioned suggestion and accuse me of kowtowing to the government for even proposing such an idea. To counter this, it is naïve to think that there will be no regulation whatsoever (for privacy features, let alone cryptocurrencies in general) in the future; KYC AML requirements for legitimate exchanges are already widespread as noted above.

I see the merits of KYC AML but am concerned about overburdening cryptocurrency regulations that some countries could apply to their citizens to assert control, especially out of fear of not keeping up with this nascent and dynamic asset class. If excessive, they run the risk of stifling innovation and organic growth within the cryptocurrency space (let alone for other companies in the broader blockchain/distributed-ledger-technology realm).

Nonetheless, reflecting on recent experience with market disruptors in other sectors such as Uber and Airbnb across the world, policymakers across various jurisdictions have opted for a regulated system, as opposed to banning them (though I acknowledge that lawmakers in several nations have chosen the latter). Ultimately, the rational-minded policymakers that opt for sensible regulations will deliver better outcomes for the industries and people involved in cryptocurrencies/DLT technology than countries/states represents by anti-crypto legislators.

By supporting cash-payment options, this is not a matter of appeasing “luddites” or satisfying criminals. Rather, as a matter of principle, there should be an inclusive option (some people in society do not have access to a registered financial institution, thus are not able to pay with a card) and should not be excluded from purchasing goods and services, as I touched on earlier. Alongside this, some individuals may not feel comfortable with their financial institution knowing how much they are spending at a particular store.

If enough people voted with their wallets and intentionally sought merchants that would accept cash payments, I would not be surprised if a range of stores reversed their cash bans, though I would not hold my breath. Perhaps wishful thinking, considering younger, more tech-savvy consumers seldom use cash, in tandem with many benefits for (big) businesses banking on a cashless society to save on overheads (20) i.e. to boost their profits, but never say never.

To summarise, once we have an entire population of people that are competent enough to use digital payments method with ease, then cash will become extinct, or at least irrelevant (21). As for privacy coins, I believe they will play a role (at least to a certain extent) in our society, as people across the globe continue to wean off a cash-payments system and seek a digital alternative. They will neither be banned outright nor fully permitted in mainstream society due to (but not limited to the) aforementioned reasons.

Irrespective of bans, major restrictions, and so on, there will be enough support for privacy-enabled features of cryptocurrencies amongst certain niches that demand anonymity, particularly in an increasingly digital and connected world. Outlawing drugs, weapons and other products/services in our society has not led to their elimination (for better or worse), so I would not hold my breath on governments managing to completely prohibit the use of privacy coins, especially when many of them fail to adequately manage their own country.

P.S. Thank you for reading this, I appreciate it. This is my first article about this topic and will be producing more written content shortly. In the meantime, I have an established YouTube channel, covering a broad range of cryptocurrencies and their related technologies. CCL

References

(1) Andjelic, J 2020, ‘Paper or Plastic? The Definitive List of Cash Versus Credit Card Spending Statistics’, Fortunly, 17 March,

https://fortunly.com/statistics/cash-versus-credit-card-spending-statistics/#gref

(2) Essellink, H & Hernández, L 2017, Occasional Paper Series: The use of cash by households in the euro area, European Central Bank (ECB), №201, (pages 18–19 for related statistics)

https://www.ecb.europa.eu/pub/pdf/scpops/ecb.op201.en.pdf

(3) Sveriges Riksbank 2019, ‘Cash use in constant decline’, 7 November,

https://www.riksbank.se/en-gb/payments–cash/payments-in-sweden/payments-in-sweden-2019/the-payment-market-is-being-digitalised/card-payments-still-dominate/large-payments-take-place-via-transfers/

(4) van Wirdum, A 2018, ‘Battle Of The Privacycoins: Why Dash Is Not Really That Private’, Bitcoin Magazine, 6 September,

https://bitcoinmagazine.com/articles/battle-privacycoins-why-dash-not-really-private

(5) Rothrie, S 2019, ‘A Little Privacy? Coins Zcash And Dash Under Scrutiny’, Crypto Briefing, 1 October,

https://cryptobriefing.com/privacy-coins-zcash-dash-scrutiny/

(6) Reynaldo 2020, “Dash’s privacy service is no better than other cryptocurrencies”, OKEX, 4 August,

https://www.okex.com/academy/zh/2020080400084550590252-2

(7) Gogo, J 2020, ‘Not So Private: 99% of Zcash and Dash Transactions Traceable, Says Chainalysis’, Bitcoin.com, 9 June,

https://news.bitcoin.com/not-so-private-99-of-zcash-and-dash-transactions-traceable-says-chainalysis/

(8) Desai, M 2020, ‘The benefits of a cashless society’, World Economic Forum, 7 January,

https://www.weforum.org/agenda/2020/01/benefits-cashless-society-mobile-payments/

(9) Detrixhe, J 2020, ‘This major issue needs to be resolved before we can become a cashless society’, World Economic Forum, 26 June,

https://www.weforum.org/agenda/2020/06/covid19-digital-cash-payments-government/

(10) Moran, P 2019, ‘A Look At Single-Use Credit Cards’, Investopedia, 25 June,

https://www.investopedia.com/financial-edge/0511/a-look-at-single-use-credit-cards.aspx

(11) Worthington, 2019, ‘Depending on who you are, the benefits of a cashless society are greatly overrated’, The Conversation, 21 March,

https://theconversation.com/depending-on-who-you-are-the-benefits-of-a-cashless-society-are-greatly-overrated-113268

(12) Sveriges Riksbank, 2019, ‘Payments in Sweden 2019: The payment market is being ditigalised’, 7 November

https://www.riksbank.se/en-gb/payments–cash/payments-in-sweden/payments-in-sweden-2019/the-payment-market-is-being-digitalised/cash-use-in-constant-decline/

(13) Migiro, G 2019, ‘Countries Most Reliant on Cash’, World Atlas, 22 July,

https://www.worldatlas.com/articles/countries-most-reliant-on-cash.html

(14) Mercadante, K 2019, ‘The Future of Cash — Will It Disappear Or Become Obsolete?’, Money Under 30, 22 May,

https://www.moneyunder30.com/what-is-the-future-of-cash

(15) Town, S 2020, ‘Australian Crypto Exchanges Forced to Delist Privacy Coins or be Debanked’, Crypto News Australia, 24 August,

https://cryptonews.com.au/australian-crypto-exchanges-forced-to-delist-privacy-coins-or-be-debanked

(16) Seth, S 2019, Japan’s FSA Bans Private Cryptocurrencies, Investopedia, 25 June,

https://www.investopedia.com/news/japans-fsa-bans-private-cryptocurrencies/

(17) McGuire, A 2018, ‘Japan Takes a Hard Line on Privacy Coins, But Can This Ultimately Prevent Cybercrime?’, Irish Tech News, 15 May,

https://irishtechnews.ie/the-real-reason-japan-is-using-crypto-exchanges-to-fight-cybercrime/

(18) Malwa, S 2020, ‘The IRS Is Offering You $625,000 to Crack Monero’, Decrypt, 10 September,

https://decrypt.co/41411/the-irs-is-offering-you-625000-to-crack-monero

(19) Hayward, A 2020, ‘US Homeland Security Can Now Track Privacy Crypto Monero’, 1 September, Decrypt,

https://decrypt.co/40284/us-homeland-security-can-now-track-privacy-crypto-monero

(20) Scott, B 2018, ‘The cashless society is a con — and big finance is behind it’, The Guardian, 19 July,

https://www.theguardian.com/commentisfree/2018/jul/19/cashless-society-con-big-finance-banks-closing-atms

(21) Birch, DGW 2020, ‘Cashless Does Not Mean What You Think It Means’, Forbes, 18 August,

https://www.forbes.com/sites/davidbirch/2020/08/18/cashless-does-not-mean-what-you-think-it-means/#3f40a224b1bf

*Figures as of 16 October 2020. For latest cryptocurrency prices, I recommend visiting www.coinpaprika.com or www.livecoinwatch.com.

Further resources:

https://www.11alive.com/video/news/health/coronavirus/verify-can-government-track-how-you-spend-your-money-with-debit-cards/85-87a01c5a-5ded-4144-9a92-140118381103

https://decrypt.co/40284/us-homeland-security-can-now-track-privacy-crypto-monero

Privacy.com, www.privacy.com

https://coinswitch.co/news/10-best-privacy-coins-in-2020-latest-review

ShapeShift 2020, ‘What are Privacy Coins’, Medium, 28 February,

https://medium.com/shapeshift-stories/what-are-privacy-coins-6df8622ebf76

DISCLAIMER: None of the information in these videos is financial advice. I am not a financial advisor. It is a mixture of information and my insight, and those from the authors listed in this article. Please always do your own research before investing.