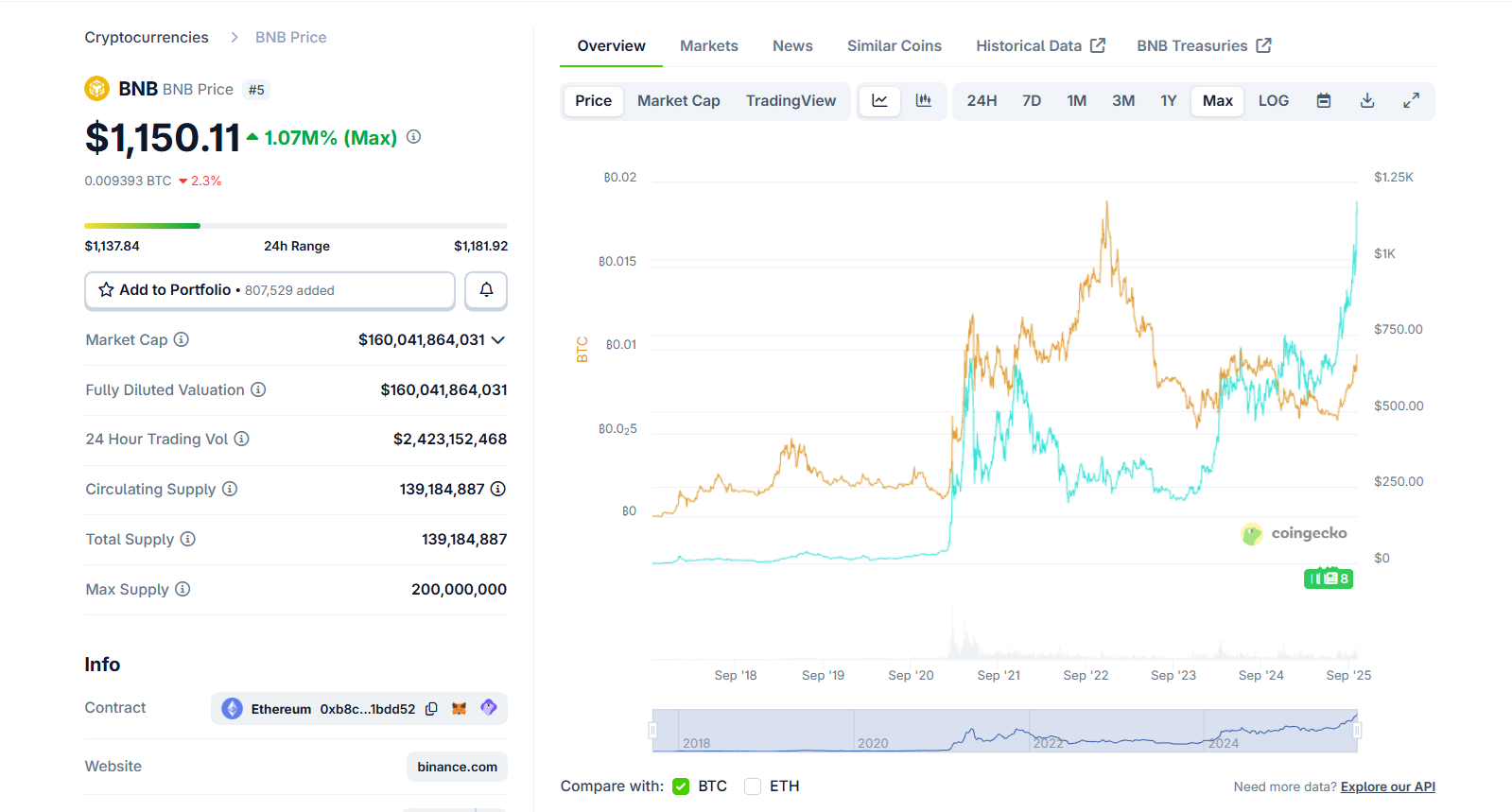

BNB is continuing its price-discovery mode, setting a new all-time high several times a week, having smashed through $1,000 last month, and currently trading at $1,150. It surpassed Solana to become the fourth-largest cryptocurrency by circulating market cap.

Despite BNB’s impressive run in recent weeks, it remains well below its all-time high versus BTC, which it reached ₿0.01917 during the November 2021 bull run. Nonetheless, it is rapidly making up ground, racing back towards that figure.

Check out TradingView’s BNB/BTC and BNB/ETH charts (via Binance) for direct links to these trading pairs.

BNB/USD (cyan line) and BNB/BTC (golden) historical price, CoinGecko snapshot, October 5, 2025, at 02:05 UTC.

Today, we’ll look at some of the reasons why BNB has been surging, from partnerships to network improvements and bullish sentiment returning to many altcoins.

News and a huge partnership

Last month, Binance announced a massive collaboration with Franklin Templeton, which is looking to tokenise securities using Binance’s well-established infrastructure and client base.

“By working with Binance, we can harness tokenization to bring institutional-grade solutions like our Benji Technology Platform to a wider set of investors and help bridge the worlds of traditional and decentralized finance.”

Sandy Kaul, EVP, Head of Innovation at Franklin Templeton. Press release, September 10, 2025.

BNB is one of many large-cap altcoins in line to potentially receive a spot ETF. Companies such as VanEck and Rex Shares/Osprey have submitted filings to the US SEC, with a decision expected by Q1 next year, possibly by year’s end.

We’re seeing a flurry of spot ETF applications being filed with the US SEC, not just for altcoins, but even tech stocks and (2x, 3x) leverage versions of these, further boosting interest in crypto and related stocks.

Regarding the BNB Chain, an announcement was made on its official website regarding the May hard fork, Maxwell.

This set of upgrades reduces the network’s generation time from 1.5 to 0.75 seconds, accelerates block synchronisation across nodes, and facilitates easier communication between validators. This was a further speed improvement after the deployment of the Lorentz Upgrade in April.

It’s boring info for some, but it’s important news when considering the bigger picture for BNB Chain in the coming years, especially for medium- to long-term BNB holders.

Alluding to technical analysis, a potentially bullish trend for the BNB/USD pair is the recent golden cross for the 50- and 200-day moving averages.

This suggests that short-term momentum is shifting bullish relative to the long-term trend, which many traders believe could signal the start of a bullish trend. More information about this and BNB is available through these posts.

An expanding network

A glance at DefiLlama statistics reveals promising signs for this blockchain.

BNB Chain (which is occasionally referred to by its old name, the Binance Smart Chain [BSC]) has outperformed Bitcoin, Ethereum and Solana in terms of TVL growth over the past month. This ecosystem also leads the other in terms of 24-hour DEX volume.

Much of the impressive performance over the past 30 days is attributed to Aster, a decentralised perpetual exchange primarily running on BNB Chain. It has recorded a 570% increase in TVL over the past month, now at $2.35 billion.

Another protocol that mostly runs on BNB Chain is ZEROBASE CeDeFi, a protocol that combines elements of centralised and decentralised finance. This has generated a whopping 1,100% growth in TVL over the past two weeks, currently sitting at $526 million.

Other projects featured on DefiLlama and data from DappRadar also reinforce impressive growth across the BNB Chain over the years.

Massive increases in network activity for these BNB Chain systems indirectly benefit BNB holders.

How? BNB has various functions, one of which includes serving as a gas token to cover transaction fees. More activity leads to more gas (BNB) used, translating to a higher rate of coin burning.

Furthermore, heightened interest in these BNB Chain projects also increases the coin’s demand, which in turn drives up the price.

32 coin burns and counting

Since October 2017, the BNB Foundation has burnt hundreds of thousands, up to 2.5 million BNB coins every quarter.

This is a supplementary burn mechanism to the one I briefly covered earlier, which functions independently of the real-time burn setup. The quarterly version is a programmed one based on the average BNB price at the time of the burn and the number of blocks produced within the BNB Chain.

Starting with a total supply of 200 million coins, BNB’s circulating (and total) supply is currently around 139 million.

The ultimate goal is to continue permanently burning coins until the total supply reaches 100 million.

The last coin burn on BNB Chain took place on July 10, marking the 32nd event to date, with the next one scheduled for the coming days.

Visit BNBBurn.info for real-time stats.

Additional thoughts

It has been a remarkable story, marked by the extraordinary price performance which began as an ERC-20 token named Binance Coin until its rebrand to BNB (officially, Build’N’Build) in February 2022.

Launching at $0.10, few people expected this to hit $100, let alone $1,000.

It’s been an even strategy for the most part if you’ve held since the beginning with the intention of eventually converting profits into BTC; for the best-performing altcoins in recent years, it’s been a solid approach by investors who’ve managed to get 100, 200 or 400x from low-cap altcoins to then convert them into tens of millions of satoshis, on route to 1 BTC.

Regardless of your intentions, I look forward to seeing BNB continue its ascent towards $1,500, possibly $2,000 by the cycle’s peak, especially if a Q4 pump pans out as expected.

In summary, a combination of increased adoption, a major collaboration with Franklin Templeton, network upgrades and the continuation of this bull cycle are collectively contributing to BNB’s strong price gains.

Do you see BNB as a good blue-chip crypto to hold, or would you rather focus on Solana or other L1s? Comment below.

P.S. Bitcoin just hit a new ATH of $125,000, and many altcoins are also performing well! Another 25-basis-point cut later this month by the Fed will only add to the bullish sentiment.

Affiliate links

If you’d like to purchase a Ledger or Trezor product, please use the following link to help support my channel. I receive a small commission per sale at no additional cost.

https://shop.ledger.com/?r=a1b3ac23d773

https://affil.trezor.io/aff_c?offer_id=169&aff_id=35611

Kraken

You might also be interested in these stories:

https://medium.com/@cryptowithlorenzo/bitcoin-is-going-to-zero-5562122f5481

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for your investments.

- My opinions in this piece may not reflect those of any news outlet, person, organisation, or other entity listed here.

- Please do your due diligence before investing in any crypto assets, staking, NFTs, or other products associated with this space.

- Information is correct at the time of writing.

- BNB accounts for about 0.5% of my portfolio.

Image by ddRender at Shutterstock