“You’re so lucky with your crypto investments.”

Every so often, I’ll think back to this comment an acquaintance made earlier this year.

I hadn’t seen them in many years, and they gave me this reply after asking me whether I’m still investing in digital assets.

It’s disappointing when people call it “luck” in this space.

Yes, there are elements of that at play, but nowadays, it’s far from good fortune.

Besides a group of memecoin millionaires that have essentially gambled on DOGE, SHIB, PEPE, BONK and other coins/tokens over the years, for the most part, it’s little to do with luck.

Many people began to take an interest in Bitcoin, Ethereum, XRP, Litecoin and some altcoins around 2017, when mainstream (and social) media coverage ramped up.

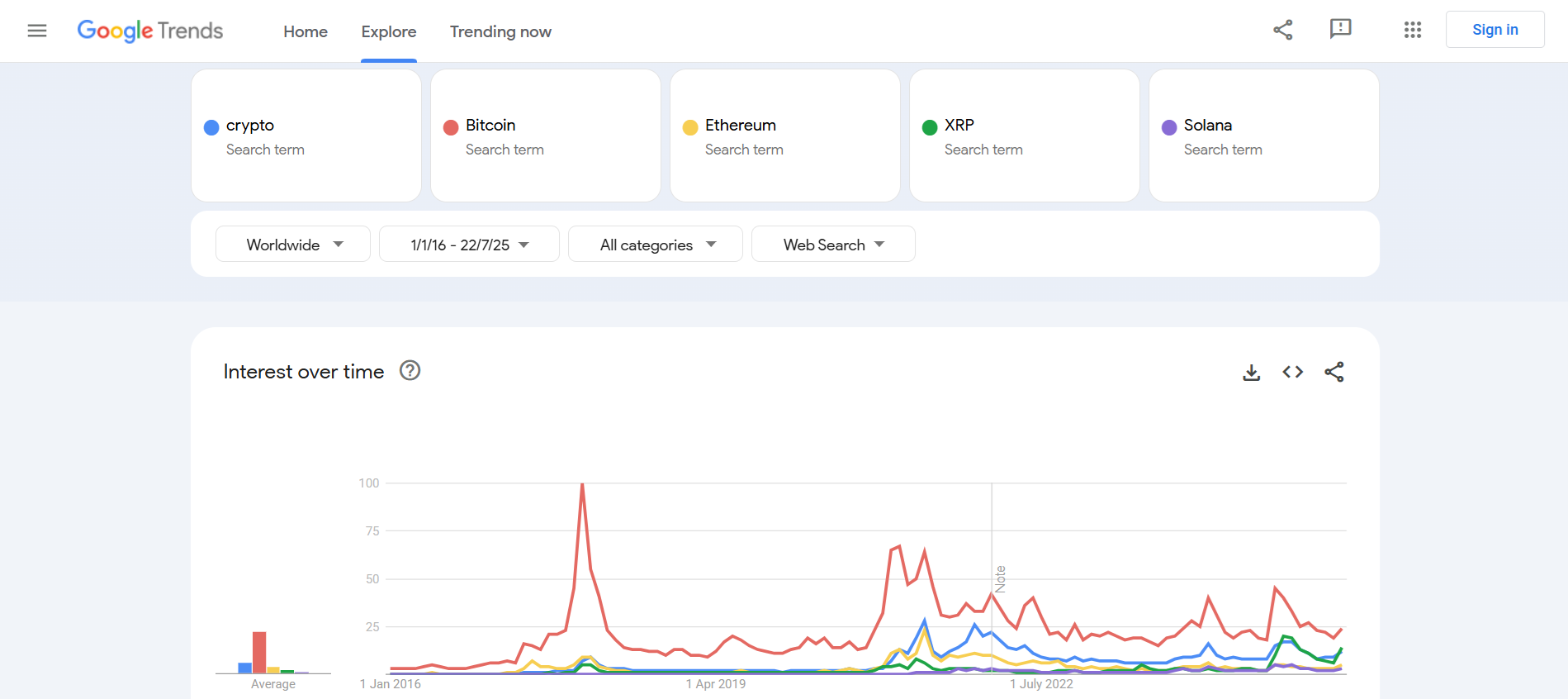

The bull run in the second half of 2017 remains the most popular period in this space, as indicated by Google Trends data.

Source: Google Trends data, 2016 to 22 July 2025.

Despite Bitcoin’s price now sitting six times higher (at $121,000) than its December 2017 peak of just under $20,000, there’s relatively little interest.

If you’ve managed to weather multiple storms, i.e., the brutal and prolonged bear markets between 2018 and mid-2020, followed by late 2022 to 2023, and you’re still here, you should be proud of yourself.

If you haven’t made an effort to learn about Bitcoin and promising altcoins in the space and still haven’t gotten some skin in the game after years, I can’t help you.

Long gone are the days when Bitcoin and various altcoins were seen as get-rich-quick schemes.

Rather, it’s more of a slow(er) burn, one that still has the rollercoaster ride linked to it.

Yet, many dare to attribute our success in Bitcoin to luck when, in fact, it has involved thousands of hours of remaining informed about news, partnerships, gradual improvements to its blockchain, and other developments over the years.

I can’t speak for everyone, but many of us actively involved in this asset class can relate.

Even if you were fortunate to discover Bitcoin very early, it still takes plenty of mental fortitude to sit on your holdings for so many years without selling.

————————————————————————————————————————

Many people, particularly older individuals who are less familiar with digital assets and blockchain technology, often misunderstand that most laypeople are struggling to make ends meet, especially in recent years due to cost-of-living and inflationary pressures.

Geopolitical tensions and an increasingly polarised society don’t help the precarious situation.

Investing is no longer just a luxury; it has become a necessity. Rather, it’s a necessity.

Case in point: Housing in major housing markets.

In Sydney, Australia, house prices hit a median of AUD 1.44 million ($945,000) in January and show little signs of slowing down, particularly once interest rates drop significantly again.

For the USA, if you’re not bringing in over $200,000* household income annually in various Californian cities, New York, Boulder, Honolulu, Seattle, etc., good luck living comfortably in these places.

*More like above $370,000 household income for San Francisco, LA, Santa Cruz and even higher for San Jose.

What percentage of American households make over $200,000 per year?

12.66% nationwide.

The four highest states and districts are Washington D.C. (25.6%), Massachusetts (21.1%), New Jersey (20.7%) and California (19.4%).

For almost all of the United States, the median household income is less than $100,000, with the lowest being in Mississippi, West Virginia, and Arkansas, each below $60,000 per year.

Unless you’ve inherited property or have wealthy relatives, one’s income isn’t gonna cut it.

For most of us, you’ll need to start becoming savvy at investing to supplement your income if you want to eventually own a “good” house without being burdened by various types of debt.

————————————————————————————————————————–

Logical responses would be to upskill and earn more, or to relocate elsewhere with cheaper housing.

While both are sensible suggestions, this is easier said than done.

Relocating isn’t always practical, despite being easier nowadays in a highly connected world with a wealth of comprehensive services to help people make such a transition.

For many, this often comes with its psychological challenges that can’t be easily quantified, but I digress.

As per getting a “better job”, the reality is that all cities and towns need cleaners, service workers and other professions typically associated with the working class, thus, lower wages.

For them to break into the housing market, they’d have to work over 70 hours a week, unless they start investing aggressively from a young age.

We should all be more ambitious and strategic about how we spend our time; however, consistently putting in long hours each week can eventually take a toll on both our mental and physical well-being.

But many people haven’t put aside enough money from their teens to their early 30s, so they have to make up for lost time.

What’s been the best way to do this over the past 10 years? Crypto, notably Bitcoin.

Source: Charlie Bilello on X. Note: Since July 11, BTC has now overtaken gold as the top performer of 2025 year-to-date.

None of the traditional investment vehicles has come close to BTC in terms of cumulative and annualised gains.

With the rise of AI disrupting many sectors (and creating some new job opportunities), there has never been a more crucial time to find the most effective ways to invest your money, i.e., make it work for you.

Considering the significant discrepancy between the median household income and median house prices in the USA, which, I admit, varies greatly depending on one’s state, the good old days of a family relying on a single income are long gone.

Heck, in many cases, two full-time incomes won’t even cut it.

People who don’t see the merits of investments that not only outpace inflation but also manage to outperform house prices are either naïve, way too risk-averse, or don’t need the money.

Concluding thoughts

Whether or not you love your job and adore the idea of a 9-5, life (eventually) throws all sorts of curveballs at us, especially when a partner and kids are involved, not to mention challenges that come with ageing.

One phrase that has stuck with me over the years is:

“Failing to plan is a plan to fail.”

To what extent are you proactive vs reactive?

Also, remember that assistance schemes such as social security payments, subsidised healthcare, and education, which many developed countries have enjoyed over the decades, might not be as commonplace or as effective as they once were.

As governments become increasingly cash-strapped due to burgeoning debts, I’ve learned the importance of taking personal responsibility, as much as possible, and the need to prepare for uncertain times.

To what extent this involves Bitcoin or another cryptocurrency is up to you. Ultimately, it’s your money, so you need to be at peace with your decision – hopefully, a well-informed one with a clear strategy.

What percentage of your overall portfolio is in Bitcoin/crypto?

Affiliate link

If you’d like to purchase a Trezor product, please use the following link to help support my channel. I receive a small commission per sale at no additional cost.

https://affil.trezor.io/aff_c?offer_id=169&aff_id=35611

You might also be interested in these stories:

https://cryptowithlorenzo.medium.com/these-crypto-scams-are-becoming-more-sophisticated-40f35dc6e657

https://medium.com/@cryptowithlorenzo/its-not-too-late-to-own-at-least-half-a-bitcoin-eba7ac43a21c

https://cryptowithlorenzo.medium.com/bitcoin-is-going-to-zero-5562122f5481

Disclaimers

- This blog post is for informational purposes only. It is not financial, legal, or investment advice. You are ultimately responsible for your decisions.

- My opinions in this piece may not reflect those of any news outlet, person, organisation, or entity listed here.

- Please do sufficient research before investing in any cryptocurrency assets, staking, NFTs, or other products associated with this space.

Featured image by oatawa at Shutterstock.