It’s not a silver bullet, but it has a key role to play.

The rapid rise of solar PV and wind farms across much of the developed world has contributed to excess power for many grids during the middle of the day.

Whilst this sounds great, it can be problematic due to major or rapid fluctuations in supply. There are many instances of excess amounts of solar or wind power not being harvested without sufficient battery storage, thus going to waste.

What’s one solution to help regulate the load on these grids?

ASIC miners, which are specialised machines required for creating new Bitcoins.

How can ASIC miners help?

Part of this involves boosting demand when it is relatively low and can rapidly scale back operations when renewable energy (RE) supply dwindles, e.g., when the sun isn’t shining or when there’s insufficient wind.

Mining companies need to be strategic about where they build their infrastructure to fully exploit an overabundance of solar arrays, wind turbines or hydroelectric dams. I say “overabundance” as there needs to be a balance between meeting these companies’ requirements and ensuring ample energy supplies for locals and other businesses (more on this later).

Bitcoin has also been cited as being able to help with the management of the electric grid…Miners could make up for unexpected shortfalls in renewable generation by reducing demand, which may be particularly appealing to Texas given its increasing wind portfolio.

There is another factor at play here, which is highly relevant for small-scale (e.g., individual) mining operations with up to a few ASIC miners operating.

Let’s assume a setup where you have an array of solar panels on your property and manage to consistently generate more energy than you use.

Even if you could feed it back into a grid and get paid for this excess through net metering (whereby your utility company agrees to compensate you at X cents per kWh sent back to the grid), sometimes it might make more sense to use the surplus for more Bitcoin mining – especially during sunnier periods of the year – instead of selling it.

In this case, it would be up to you to ascertain whether it is more feasible to use that excess for Bitcoin mining or sell it back to your electricity supplier.

Nonetheless, using efficient, high-quality, well-maintained and durable solar panels that have been properly installed on your rooftop helps boost an area’s share of RE without occupying any additional space that could have been used for other purposes.

The uphill battle for Bitcoin miners – government

One hurdle to overcome here is getting regulators (i.e., government departments) behind the idea of allowing mining farms to operate in areas with plentiful amounts of renewable (or even nuclear) energy, notably when and where there is a consistent oversupply.

Unfortunately, mining firms are at the mercy of local or federal laws, and whoever’s elected will influence how these companies operate within said country.

Digital asset mining also creates uncertainty and risks to local utilities and communities, as mining activity is highly variable and highly mobile.

An excise tax on electricity usage by digital asset miners could reduce mining activity along with its associated environmental impacts and other harms.

US Department of the Treasury report (p. 71), March 2023.

The first sentence is misleading. Whilst mining operations have indeed placed stress on grids – especially at times of overwhelming energy consumption such as during heatwaves – Bitcoin mining farms can rapidly shut down or scale back operations accordingly, which ties in with demand flexibility for electricity, whereby you tweak the demand as much as possible to correspond to variable supply.

Bitcoin miners have sufficient energy consumption data to determine how many kWh of energy they require and at what power rates (kW) during the day. If they were to sufficiently communicate with electricity companies and provide all relevant energy usage data in advance, this would mitigate impacts on electricity grids, thus negating the US Government’s “highly variable” argument.

Policymakers should aim to work with all stakeholders and satisfy everyone’s needs as best as possible through compromise. To ease the burden on an electricity grid, the government could establish rules that require mining firms to source over 70% of their electricity from nuclear and/or renewables.

Moreover, a provision should be in place ensuring that these firms are sourcing X % of energy from newly added renewables rather than taking a large chunk of RE that would have otherwise gone to residential and other commercial usage. This would incentivise miners to establish themselves in locations with an abundance of clean energy at their disposal.

___________________________________________________________________________

It’s a complex situation, but I would rather see some sensible regulations than hefty taxes and major restrictions imposed on Bitcoin mining firms.

It makes it even more difficult for these enterprises when certain members of parliament and ill-informed people still peddle the argument that Bitcoin is a scam, it’s used by criminals (so is cash…), it’s environmentally destructive, etc., using plenty of cherry-picked information to favour their arguments.

In regards to the excise tax, this is a very short-sighted mentality. This proposed tariff would be “equal to 30 per cent of the costs of electricity used in digital asset mining”, as stated in the abovementioned report, which puts miners at a disadvantage, particularly those sourcing the vast majority of energy from clean sources.

The ridiculous thing is that the US Government doesn’t realise that if domestic companies don’t mine Bitcoin, firms in other countries will do it instead (as it is a global network), and ironically, could even be relying on energy that is far more polluting than nuclear or renewables, in nations with weaker environmental regulations.

So, the idea of “associated environmental impacts and other harms” is simply being exported—a classic case of out of sight, out of mind.

___________________________________________________________________________

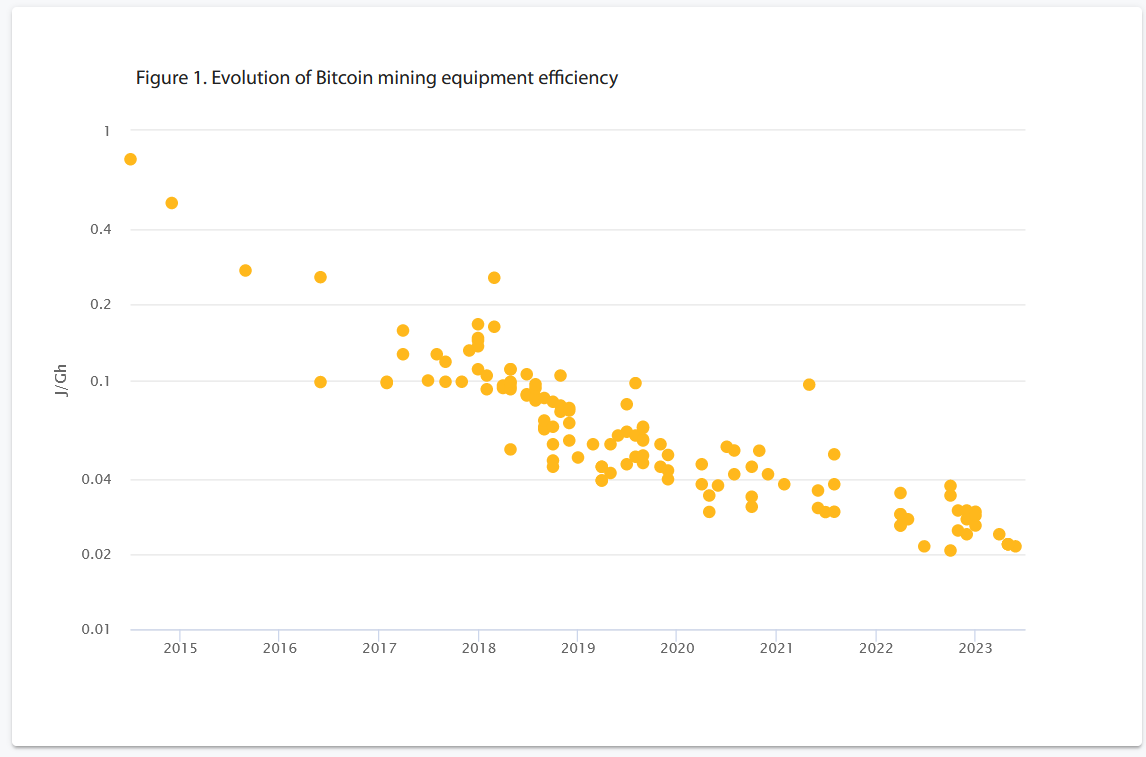

Despite the increasing energy demands to maintain Bitcoin’s network (hash rate), much of the mainstream media will conveniently ignore ASIC miners’ significant energy efficiency gains (as shown below) and the prominence of RE sources.

There is a several-fold decrease in the mean energy consumption rate of ASIC miners, representing an enormous increase in efficiency per Gigahash (GH). If this accounted for CPU and GPU mining pre-2015, we’d be dealing with >10,000x efficiency improvements.

Source: Cambridge Bitcoin Electricity Consumption Index

This is a pivotal moment for cryptocurrencies and the blockchain technology sector, and measures to discourage investment in this industry will ultimately hurt the government via less tax revenue and its citizens through fewer jobs.

To clarify, a lack of regulation here puts ordinary people at a disadvantage, and excessive, punitive laws will unfairly burden responsible miners trying to do the right thing.

Geothermal power and Bitcoin mining

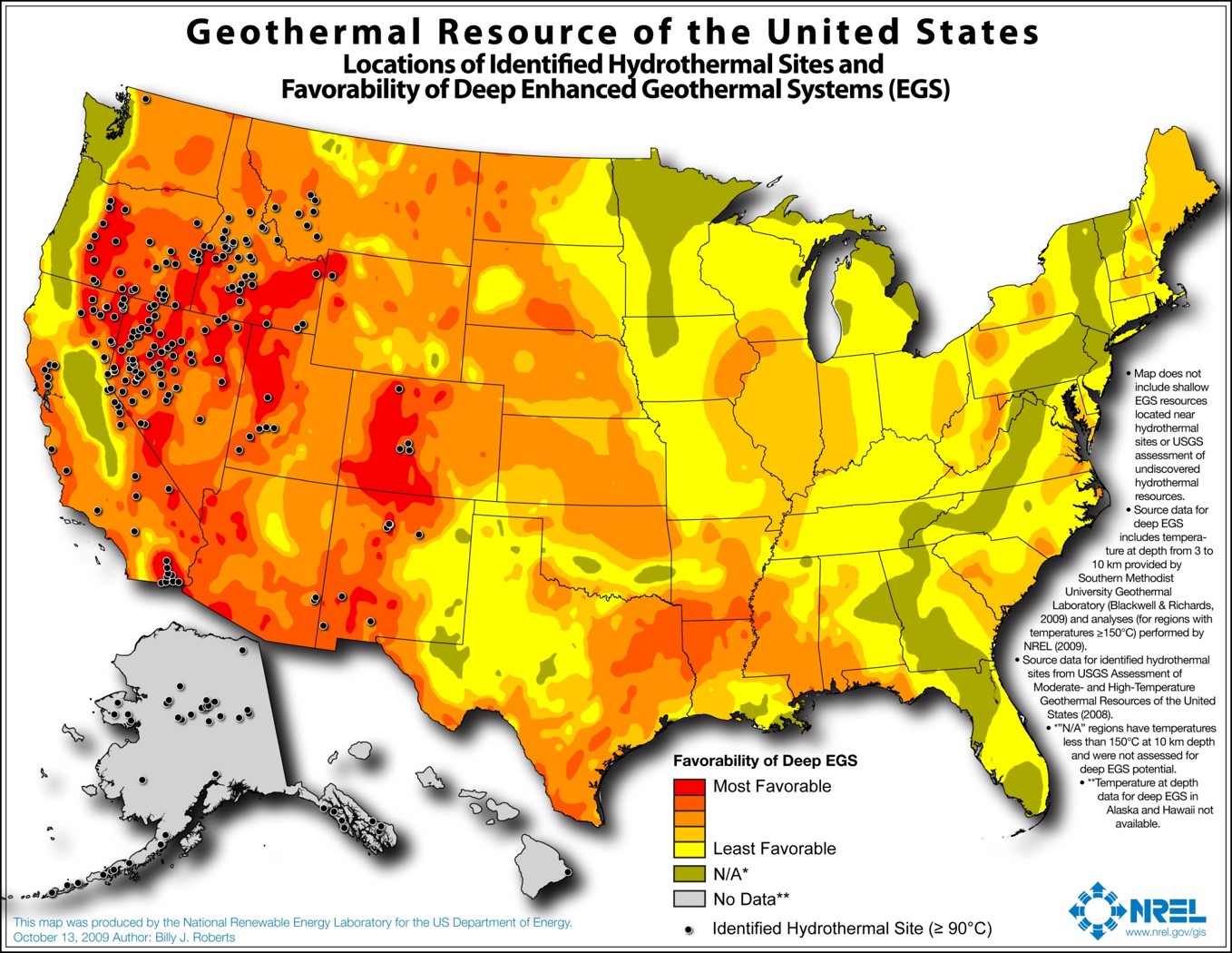

When most people consider RE, they often think of solar (PV and thermal), wind or hydro. However, areas with rich geothermal energy could add to this RE mix, helping Bitcoin miners carry out their operations in locations with cheap and clean(er) power, at least relative to fossil fuels.

Iceland is one of the examples where its abundance of hydro and geothermal power has encouraged Bitcoin mining firms. Unfortunately, in recent times, a period of low levels in the country’s hydro reservoirs has led to a pause on new Bitcoin miners moving there, not to mention reducing energy for other industries, such as aluminium smelters and data centres.

In spite of this, much larger and diverse markets, such as the USA, have significant potential and established geothermal infrastructure to draw miners to certain regions in the country, notably in the western half of the US mainland.

What helps keep costs down and minimise environmental impact is prioritising areas in favourable locations with existing infrastructure.

Source: National Renewable Energy Laboratory, slide 8.

A high-profile example for our industry is what’s happening in El Salvador and its Bitcoin mining initiatives.

Last week, El Salvador announced the launch of their aptly-named Lava Pool, an initiative from Volcano Energy – a public-private entity – and Luxor Technology Corporation to establish a 241 MW renewable-power generation centre in the country involving geothermal, wind and solar energy.

It aims to achieve a Bitcoin hash rate of 1.3 EH/s, eventually making it one of the largest Bitcoin mining pools in the world.

I hope more countries follow suit, as this would help break up the Bitcoin mining dominance, with a handful of entities controlling most of the network’s hash rate.

We’re still testing and installing, but this is officially the first #Bitcoin mining from the #volcanode 🌋

— Nayib Bukele (@nayibbukele) October 1, 2021

As with every energy source, geothermal has financial drawbacks and environmental impacts. Illuminem provides a great overview of the pros and cons of geothermal.

Nuclear power’s role in Bitcoin mining operations

People have their perceptions of nuclear power, but I view it objectively.

Despite the associated radioactive waste, water usage, and significant (albeit rare) nuclear disasters, the reality is that this energy source still plays a major role in sourcing reliable, affordable and clean energy for various highly advanced economies worldwide, including the USA, France, the UK, South Korea, Canada, Sweden and Germany* as notable examples.

Multiple impartial information sources demonstrate that nuclear power generates much fewer CO2-e emissions, accidents and general air pollution per kWh than fossil fuels and some renewables, even when accounting for setting up and decommissioning infrastructure.

There is a strong push for Bitcoin miners to seek cleaner and more affordable energy sources, particularly publicly-listed mining companies that prioritise these greener options. CleanSpark, Riot Platforms, Marathon Digital Holdings and other Bitcoin mining enterprises acknowledge using nuclear power as a portion of their clean energy mix for their mining equipment.

*Its government (regrettably) planned to phase out nuclear plants by the end of 2022, but global events got in the way. More info here.

Image by wacomka on Shutterstock

Additional thoughts

As Bitcoin’s hash rate – the computing power required to maintain a robust and reliable network at all times – increases, so do its energy requirements.

Adding further cost pressures to miners is the recurring block reward halving event, which occurs approximately every four years, with the next one coming in April 2024. These factors will require miners to minimise expenses and implement other efficiency measures as much as possible, with lower energy costs being key here.

A mixture of nuclear power and affordable renewable sources will play a key role in reducing greenhouse gas emissions from this industry – let alone across our entire society – whilst simultaneously offering affordable and reliable energy for Bitcoin miners.

To clarify, I am aware that crypto mining is not exclusive to Bitcoin’s network. Litecoin, Dogecoin, Ethereum Classic and other blockchains also rely on a Proof-of-Work algorithm to maintain their networks. I am focusing on Bitcoin as it accounts for roughly 95% of the market cap of PoW crypto assets combined.

On a concluding note, once we have even cheaper and higher-capacity battery storage – especially with improvements to solid-state batteries (but still years away from reaching mass adoption) – this will further contribute to a higher percentage of RE used in Bitcoin mining, with intermittent RE supply eventually becoming a relic of the past.

The take-home message is that discussions about Bitcoin’s energy intensity will eventually become irrelevant when it becomes almost entirely powered by clean energy.

Yes, it’s energy-intensive, but it’s a relatively small price to pay for a global and truly decentralised network, one that is long overdue.

Related articles and further reading

https://medium.com/crypto-insights-au/why-climate-activists-bitcoin-proposal-won-t-work-509927029a26

https://medium.com/the-capital/no-bitcoin-will-not-move-to-proof-of-stake-483588754116

https://www.eia.gov/energyexplained/geothermal/use-of-geothermal-energy.php

https://www.powermag.com/well-constructed-solution-geothermal-to-power-bitcoin-mining/

https://beincrypto.com/crypto-mining-stabilize-electricity-grids/

https://www.coindesk.com/consensus-magazine/2023/07/25/bitcoin-mining-has-a-superpower/https://www.block.green/miners

https://www.globalxetfs.com/bitcoin-mining-is-set-to-turn-greener/

Disclaimers

- N.B. None of this is financial advice; I am not a financial advisor. You are ultimately responsible for crypto investments, let alone in any asset class.

- The opinions expressed within this piece are my own and might not reflect those behind any news outlet, person, organisation, or otherwise listed here.

- Please do your research before investing in any crypto assets, staking, NFTs and other products affiliated with this space.

- For transparency, Bitcoin (BTC) accounts for roughly 20% of my crypto portfolio. Moreover, I also hold shares in CleanSpark (NASDAQ: CLSK), Iris Energy Limited (NASDAQ: IREN) and Hive Digital Technologies (NASDAQ: HIVE), in descending order.

Featured image by Billion Photos on Shutterstock.